Best Tips About Comprehensive Income In Accounting

Comprehensive income includes net income and oci.

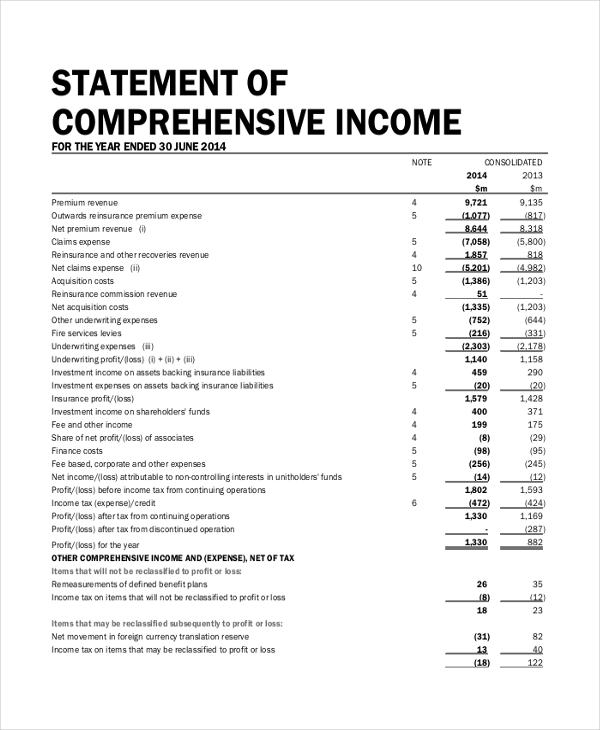

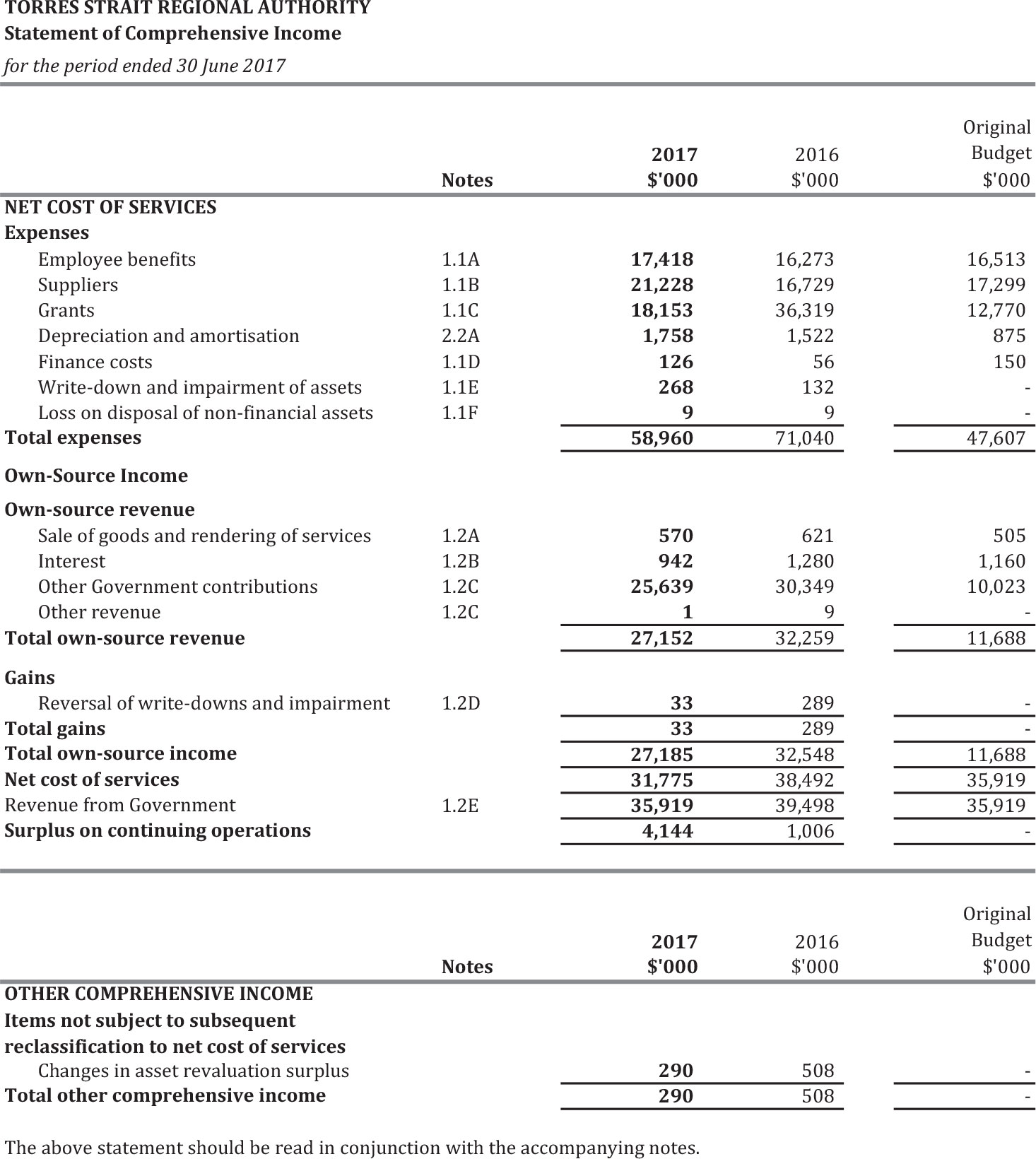

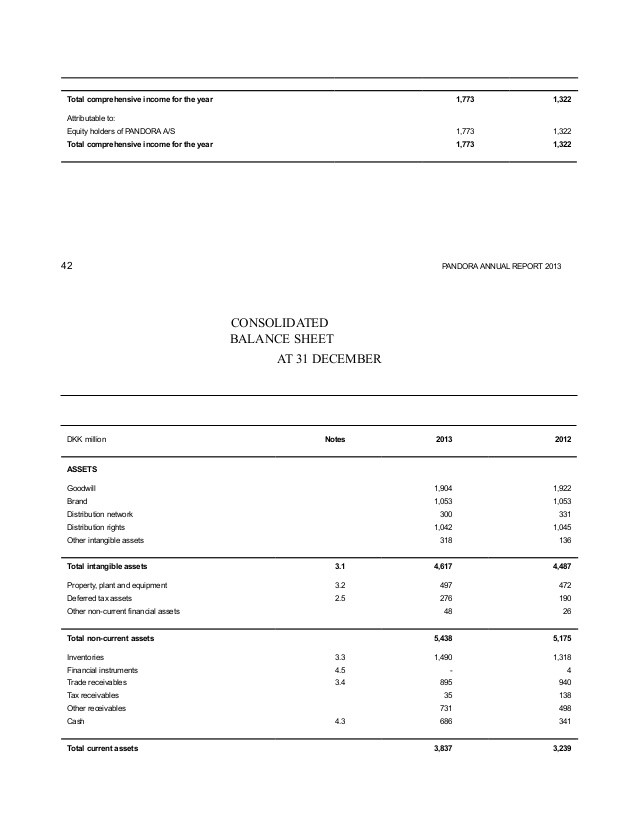

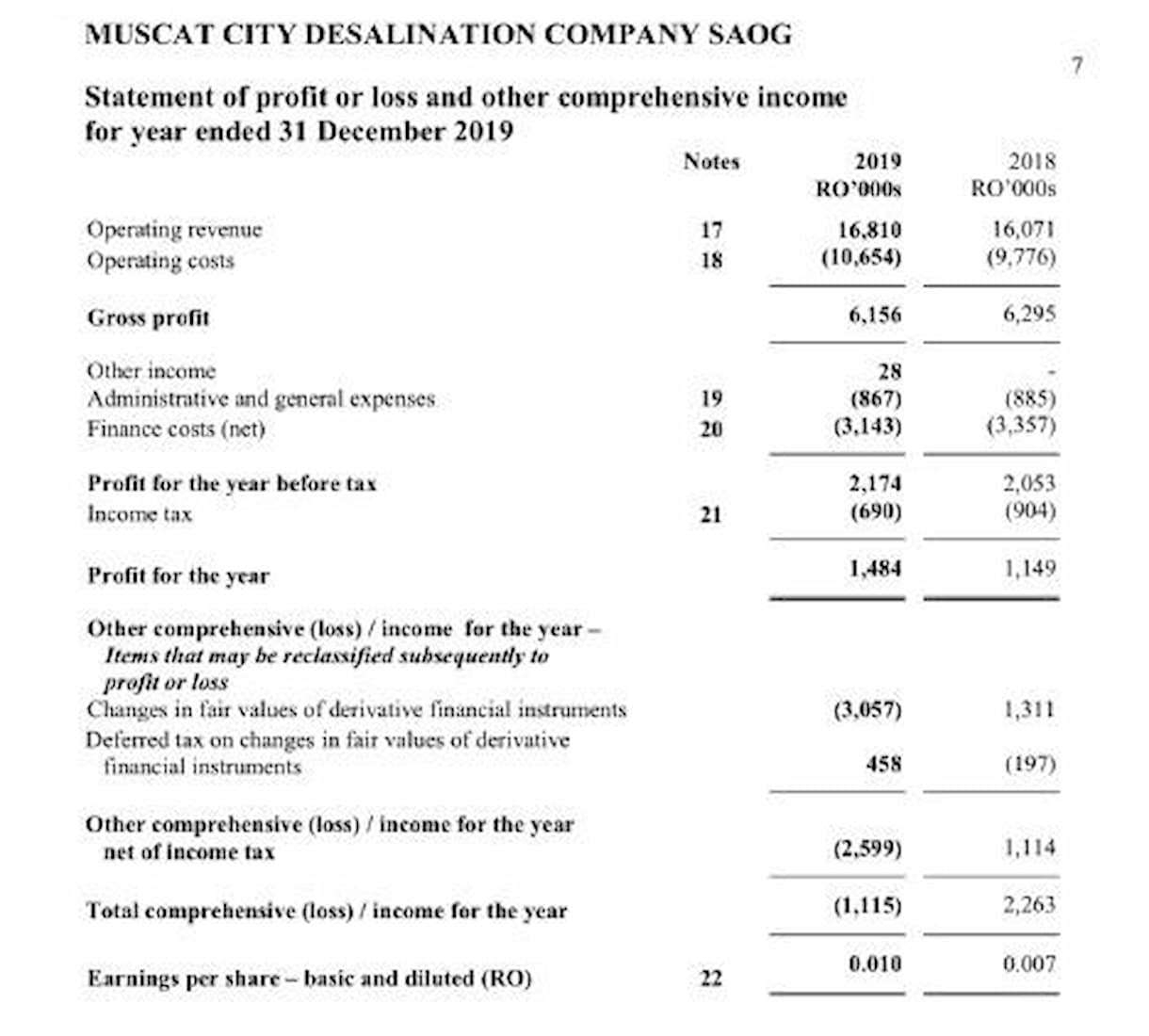

Comprehensive income in accounting. The financial accounting standards board (fasb) has continued to emphasize a financial measure called other comprehensive income (oci) as a valuable financial analysis tool. It includes all changes in equity during a period except those resulting from investments by owners. The statement should be classified and aggregated in a manner that makes it understandable and comparable.

Incomes and expenses as stated earlier in level two of this accounting tutorials. The video also demonstrates the three different ways firms can present comp. Knowing these figures allows a company to measure changes in the businesses it has interests in.

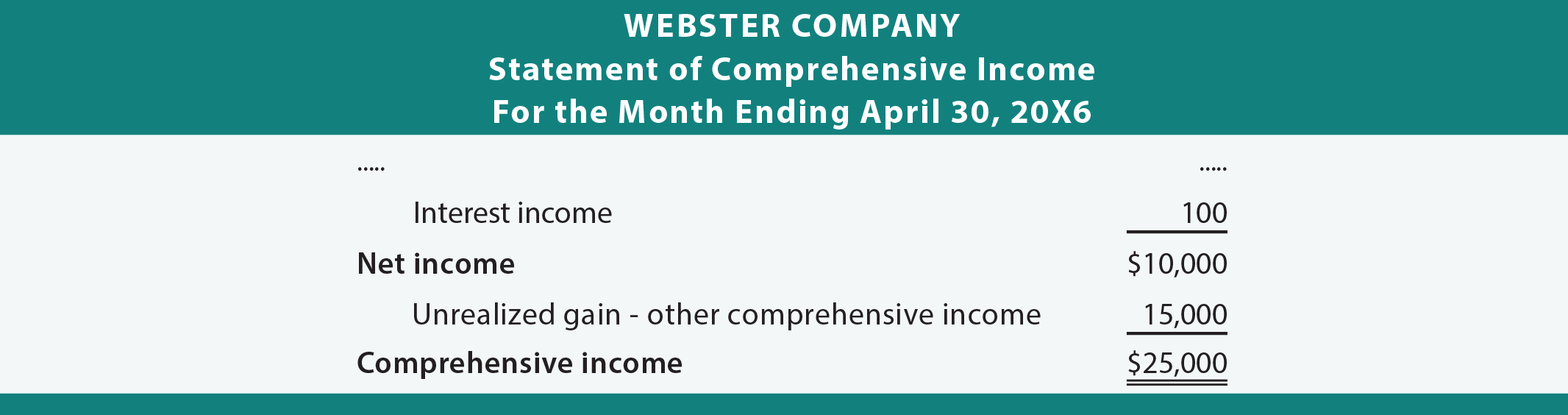

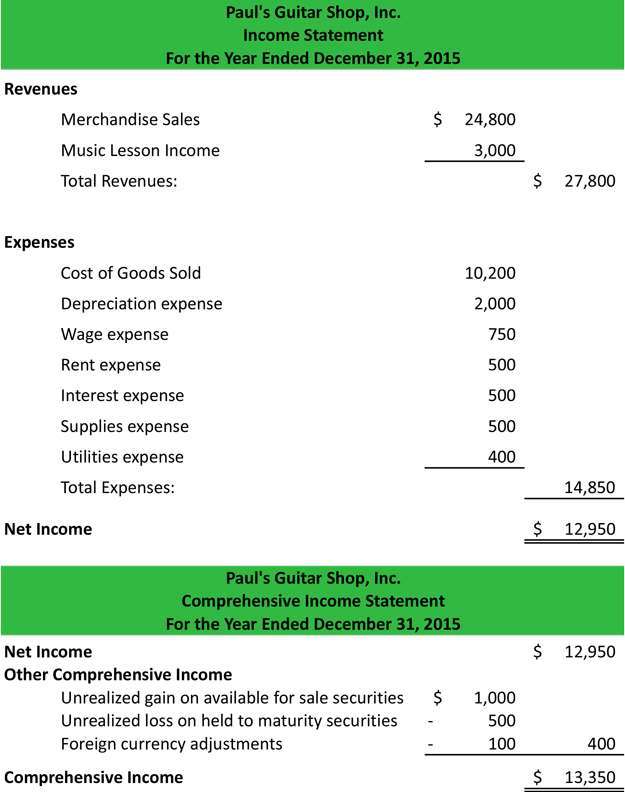

In other words, it includes all revenues, gains, expenses, and losses incurred during a period as well as unrealized gains and losses during an accounting period. It includes net income and unrealized income. It accompanies an organization’s income statement, and is intended to present a more complete picture of.

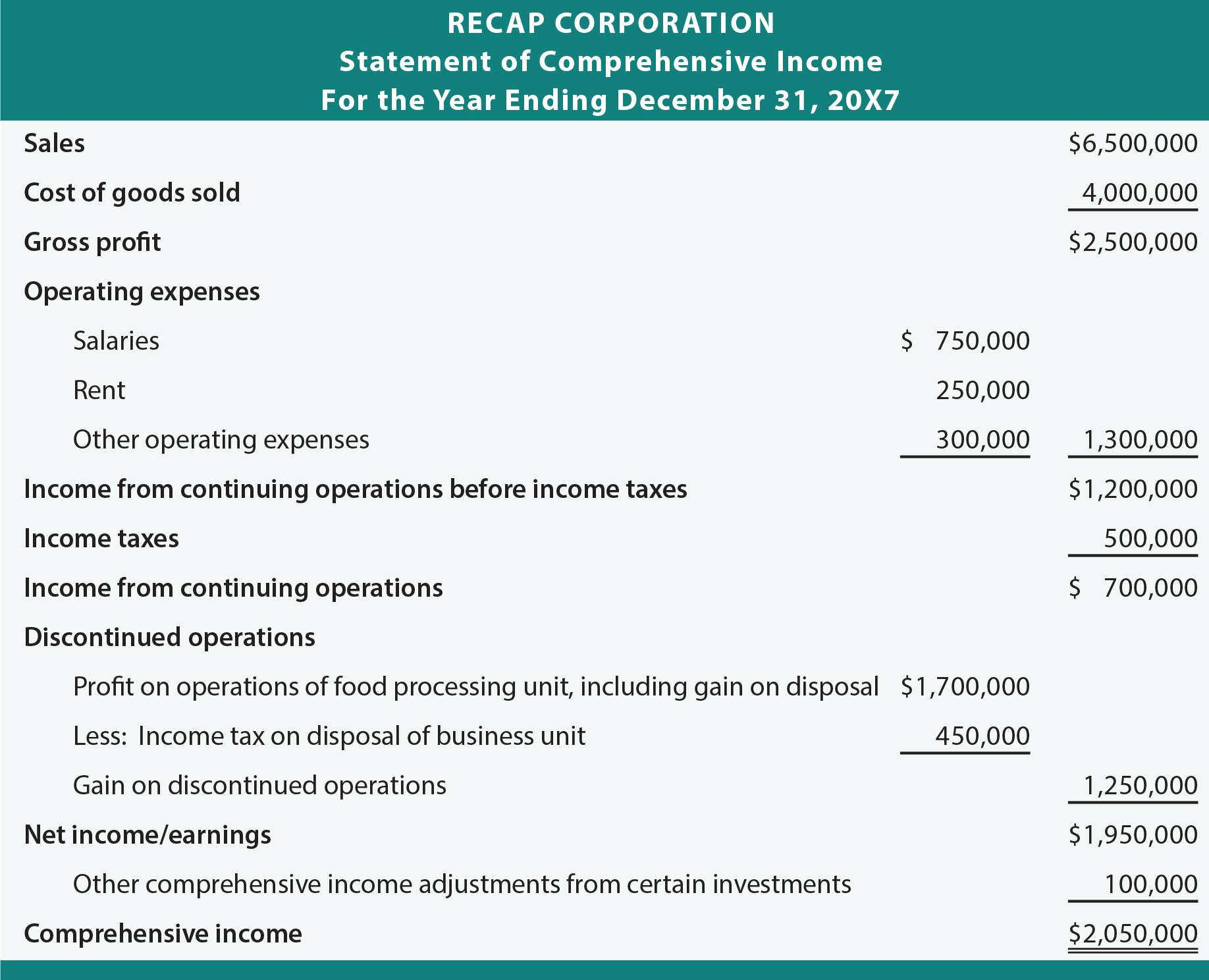

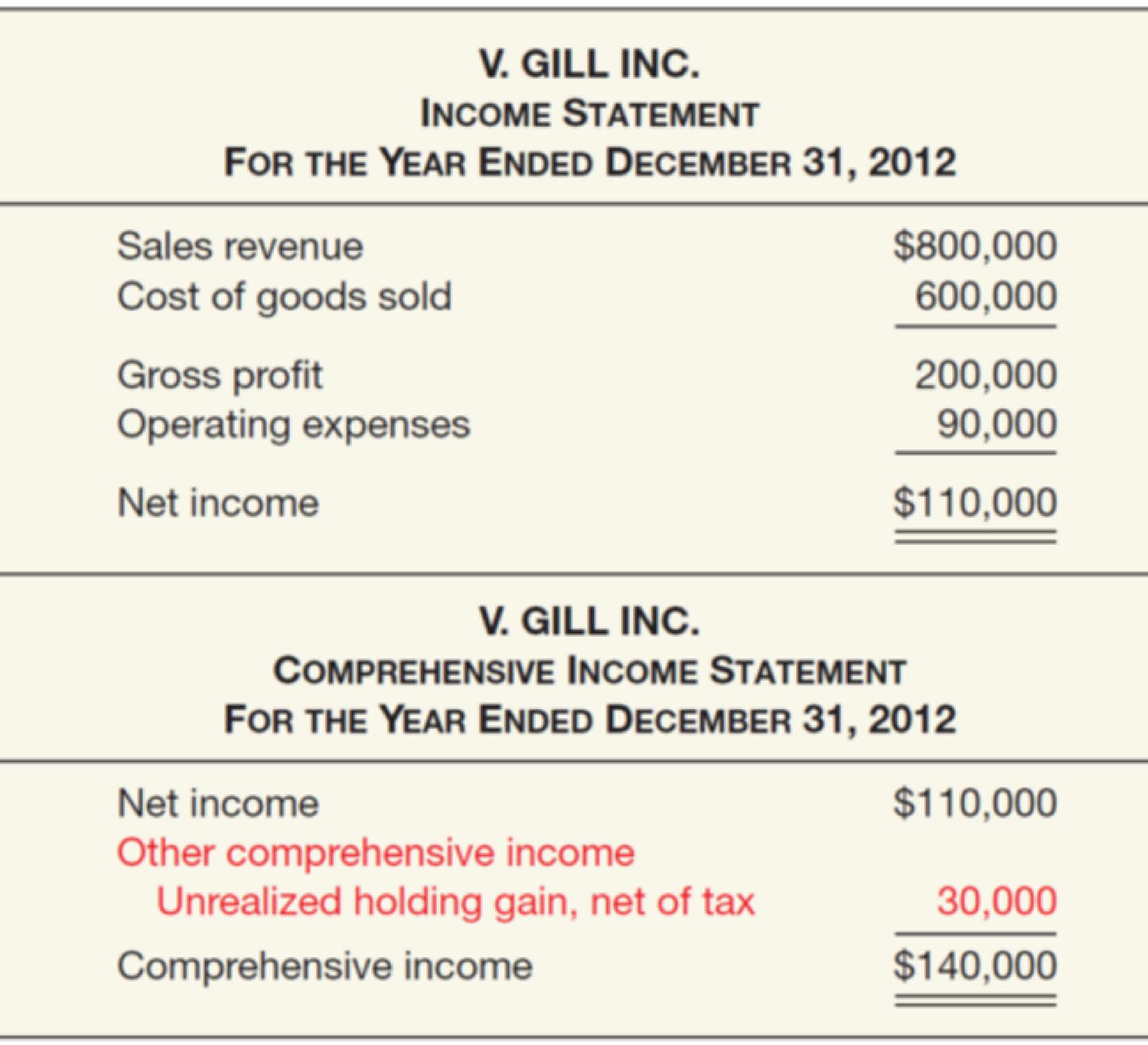

Net income or net loss (the details of which are reported on the corporation's income statement ), plus. The term comprehensive income consists of 1) a corporation's net income (which is detailed on the corporation's income statement), and 2) a few additional items which make up what is known as other comprehensive income. Module 5—statement of comprehensive income and income statement ifrs®foundation supporting material for the ifrs for smes®standard including the full text of section 5 statement of comprehensive income and income statement of theifrs for smes standard issued by the international accounting standards board in october.

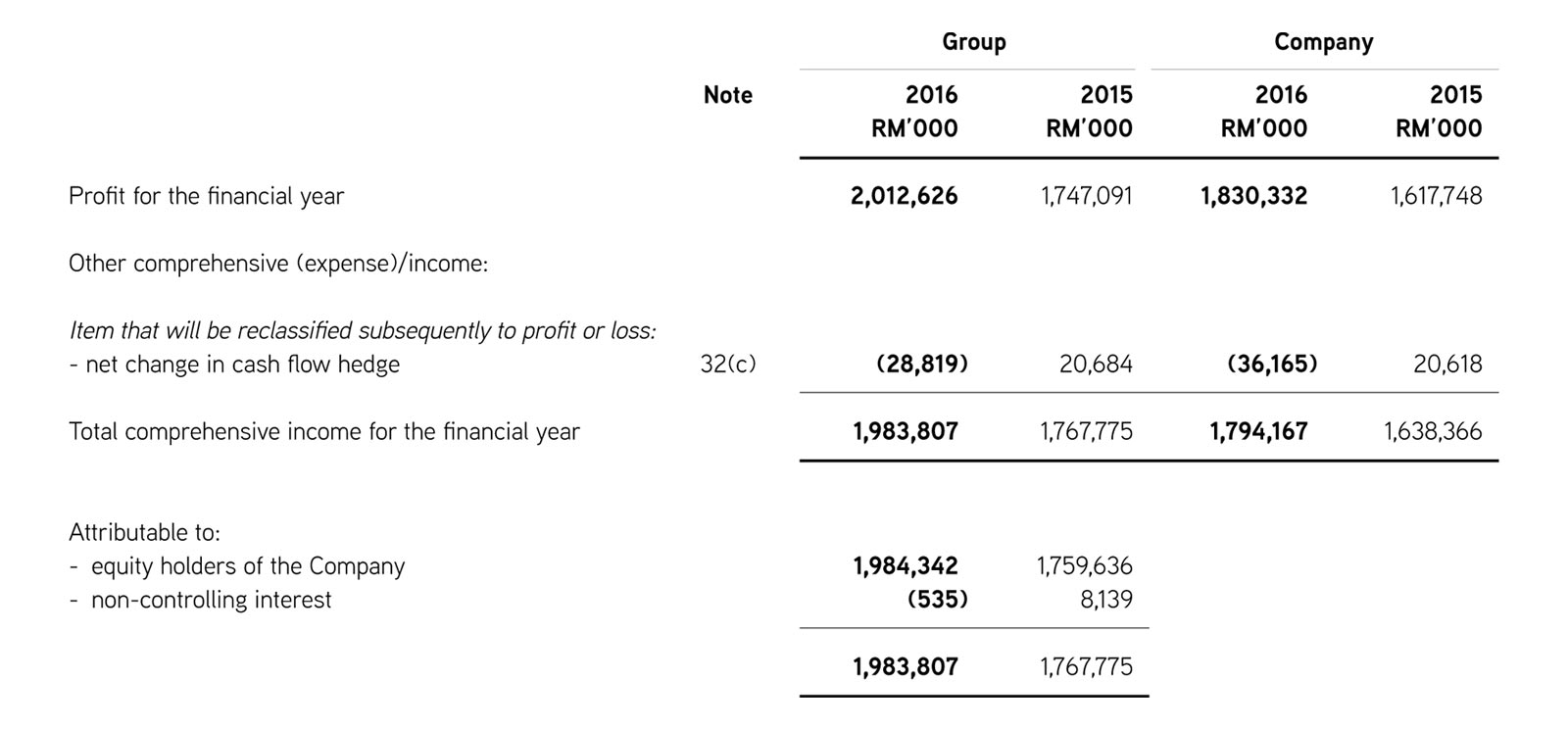

Comprehensive income is a concept in accounting that refers to the change in a company’s equity during a period, resulting from transactions and events outside of the company’s ordinary operations. Comprehensive income for a corporation is the combination of the following amounts which occurred during a specified period of time such as a year, quarter, month, etc.: The “other comprehensive income (oci)” line item is recorded on the shareholders’ equity section of the balance sheet and consists of a company’s unrealized revenues, expenses, gains, and losses.

This change is comprised of net income or net loss , and other comprehensive income. Unfortunately, net income only accounts for the earned income and incurred expenses. It summarizes all the sources of revenue and expenses, including taxes and interest charges.

It includes all changes in equity during a period except those resulting from investments by owners and distributions to owners. Comprehensive income is the profit or loss in a company’s investments during a specific time period. Written by caroline grimm in intermediate accounting.

The change in equity (net assets) of a business entity during a period from transactions and other events and circumstances from nonowner sources. The statement of comprehensive income contains those revenue and expense items that have not yet been realized. In business accounting, other comprehensive income (oci) includes revenues, expenses, gains, and losses that have yet to be realized and are excluded from net income on an income statement.

A more complete view of a company's income and revenues is shown by comprehensive income. This would include unrealized gains and losses on securities that are available for sale, foreign currency adjustments, as well as changes to certain pension benefit obligations. Oci consists of revenues, expenses, gains, and losses to be included in comprehensive income but excluded from net income.

Definition of comprehensive income. This video explains the concept of comprehensive income in financial accounting. These amounts cannot be included on a company’s income statement because the investments are still in play.