Inspirating Info About Investment Account In Balance Sheet

A firm invests for the long term to help them sustain profits now and into the future.

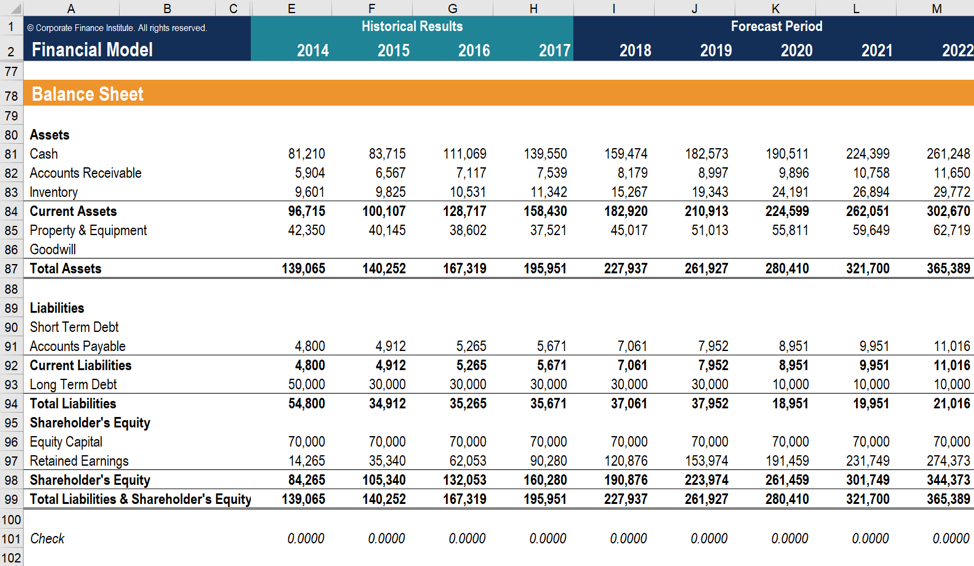

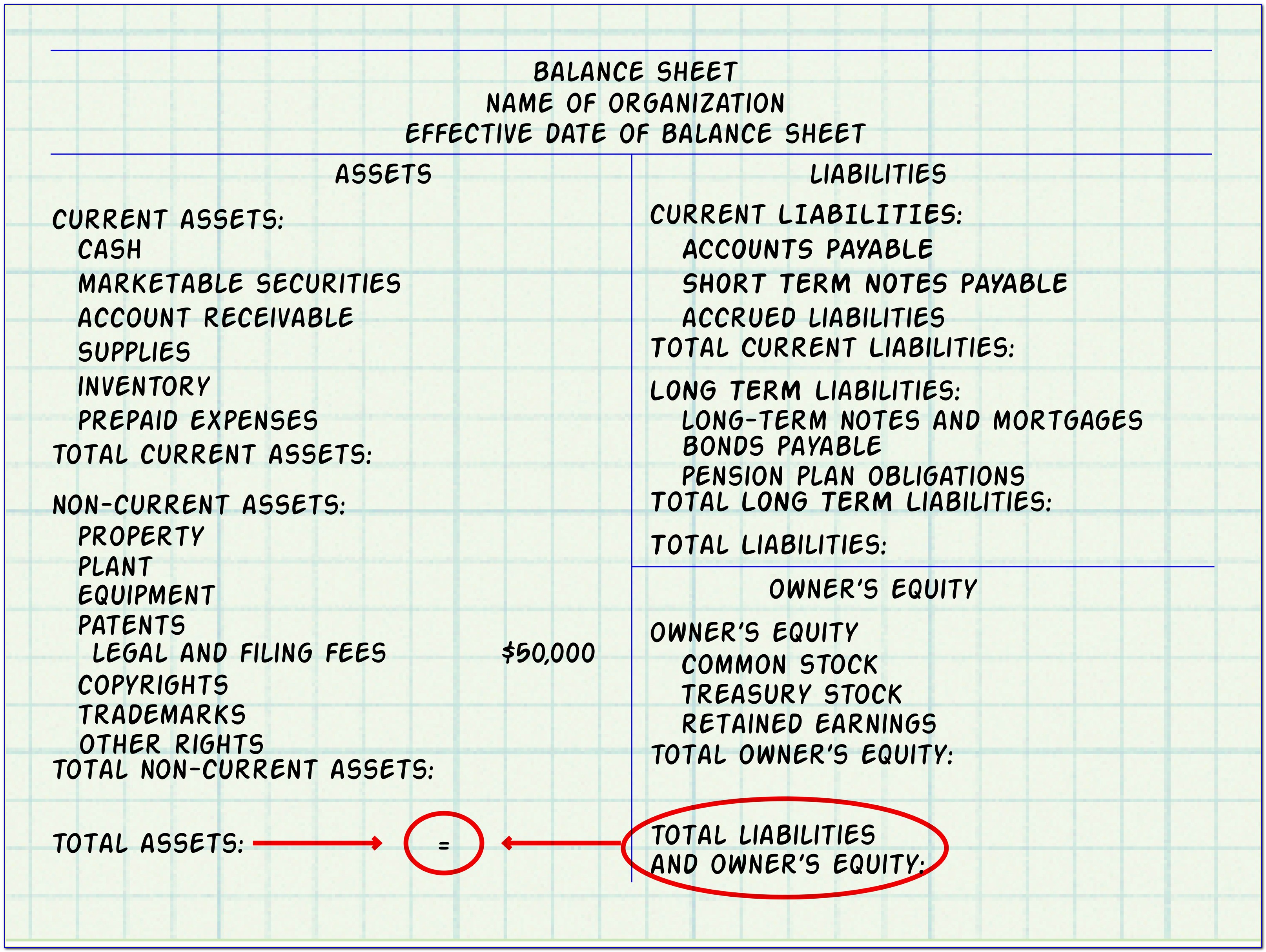

Investment account in balance sheet. The balance sheet is based on the fundamental equation: Investments in excess of 50 percent. Company liabilities go on the other side of the equals sign.

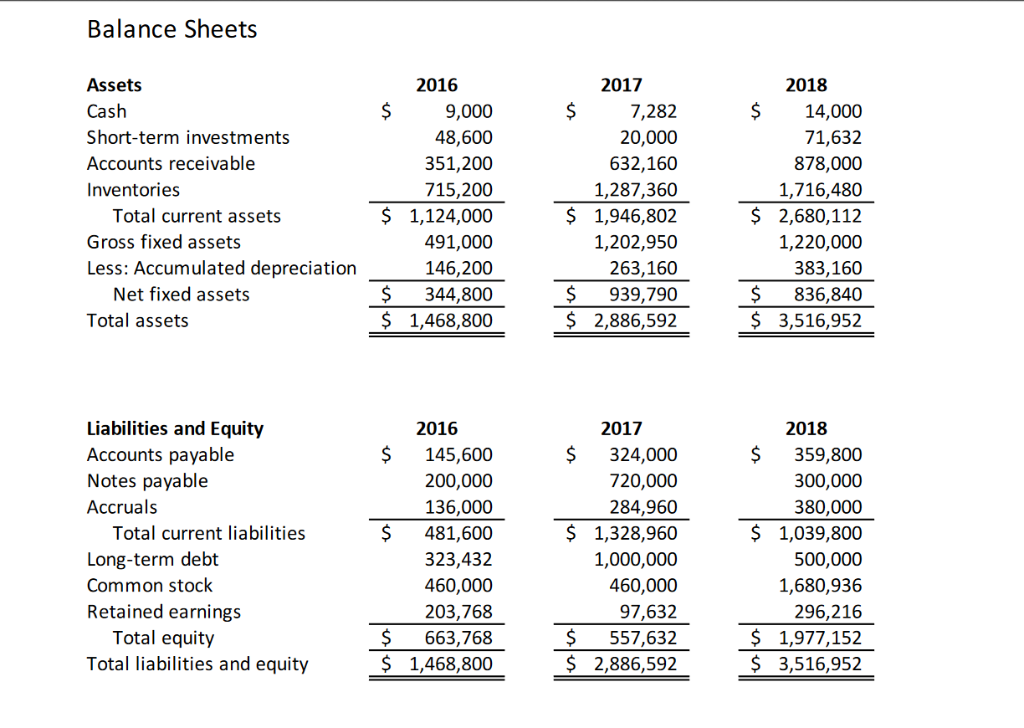

Speaking to hindustan times, the oyo founder said that he aims to increase transparency regarding investments in the show. On the other hand, current assets are often liquid assets. A balance sheet provides a snapshot of a company’s financial performance at a given point in time.

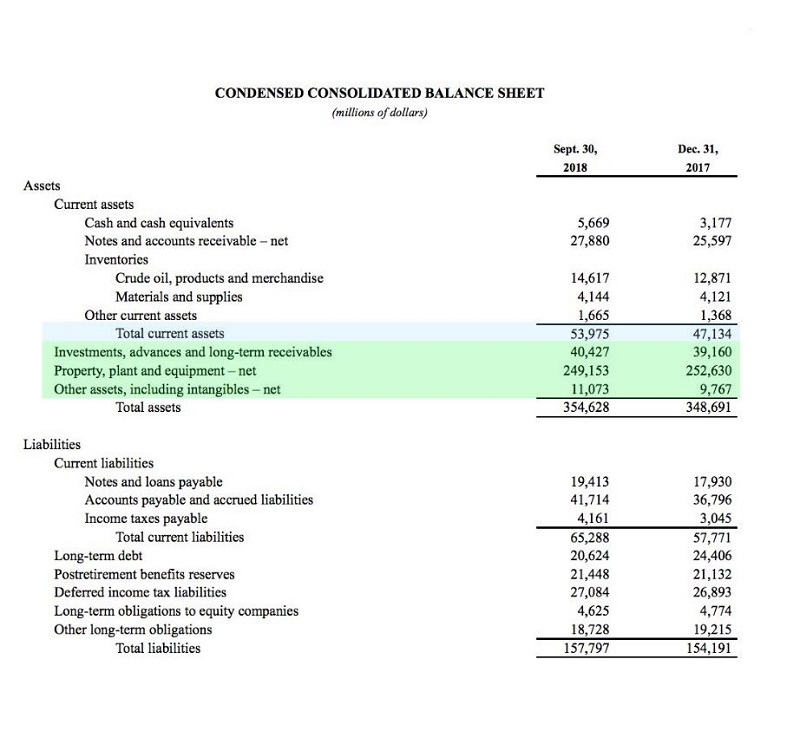

Assets = liabilities + shareholder equity. Conceptually, the assets of a company (i.e. The initial recognition of nci occurs during the purchase accounting proscribed by asc 805 when the fair value of the purchased assets and liabilities and the fair.

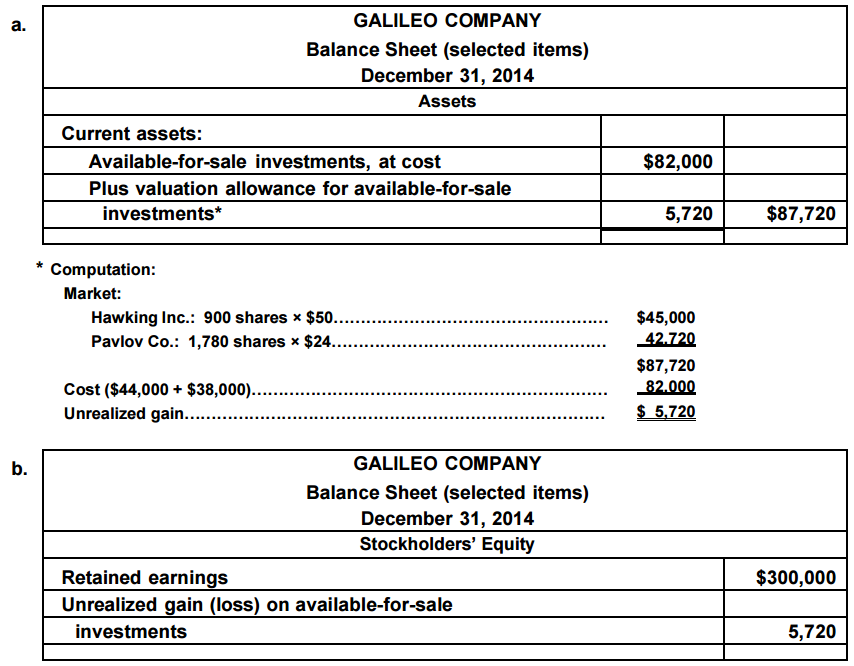

The equity method of accounting should generally be used when an investment results in a 20% to 50% stake in another company, unless it can be clearly shown that the investment doesn't result. Dividends earned from the investment are recorded as income in profit and loss account and are accounted for in the calculation of tax. For example, if company a acquires a 5% stake in company b by buying 1,000,000 equity shares @ us$ 5 each, then the investment cost of us$ 5,000,000 is recorded as an investment in company a’s balance sheet.

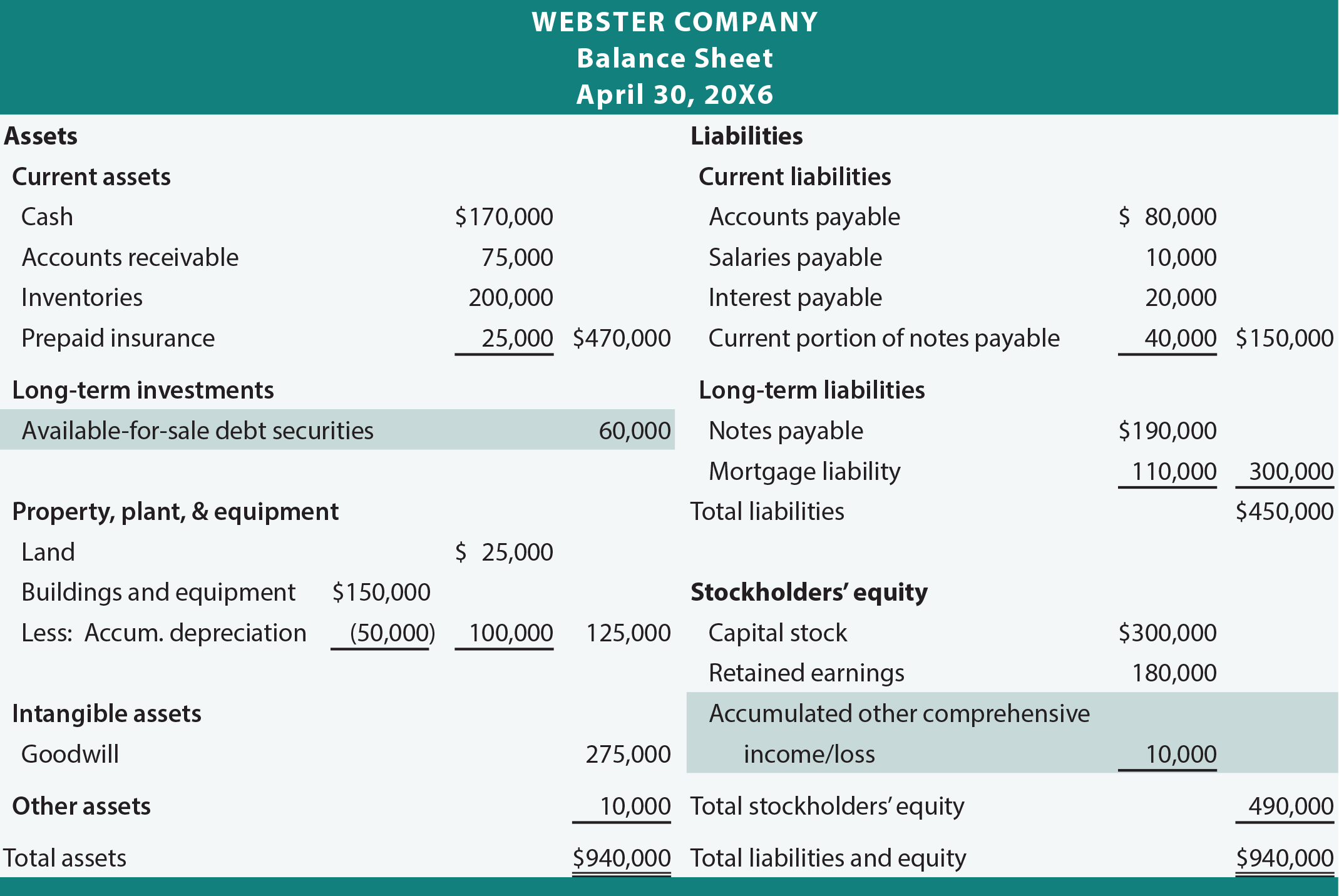

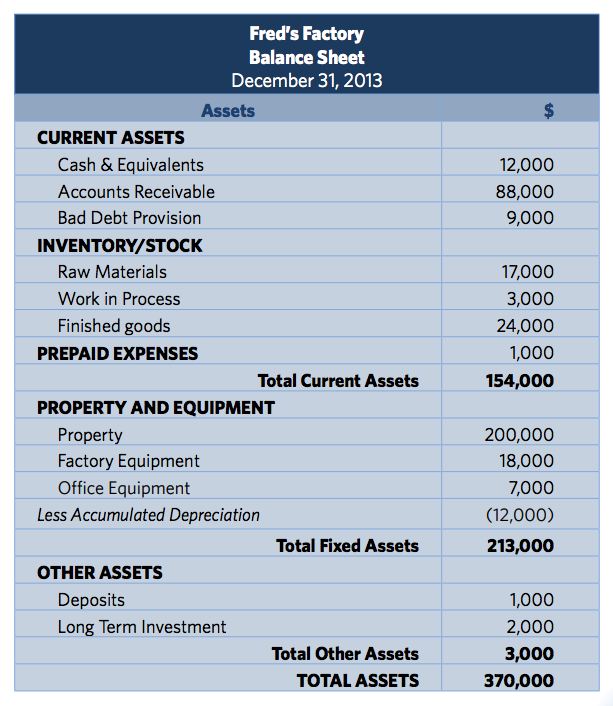

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. The balance sheet is a reflection of the assets owned and the liabilities owed by a company at a certain point in time. It is critical to make sure that there is a very high level of detailing.

Depending on these factors, the following types of accounting may apply: The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. D/e = total liabilities / total shareholders' equity = $152,969 / 83,253 = 1.84.

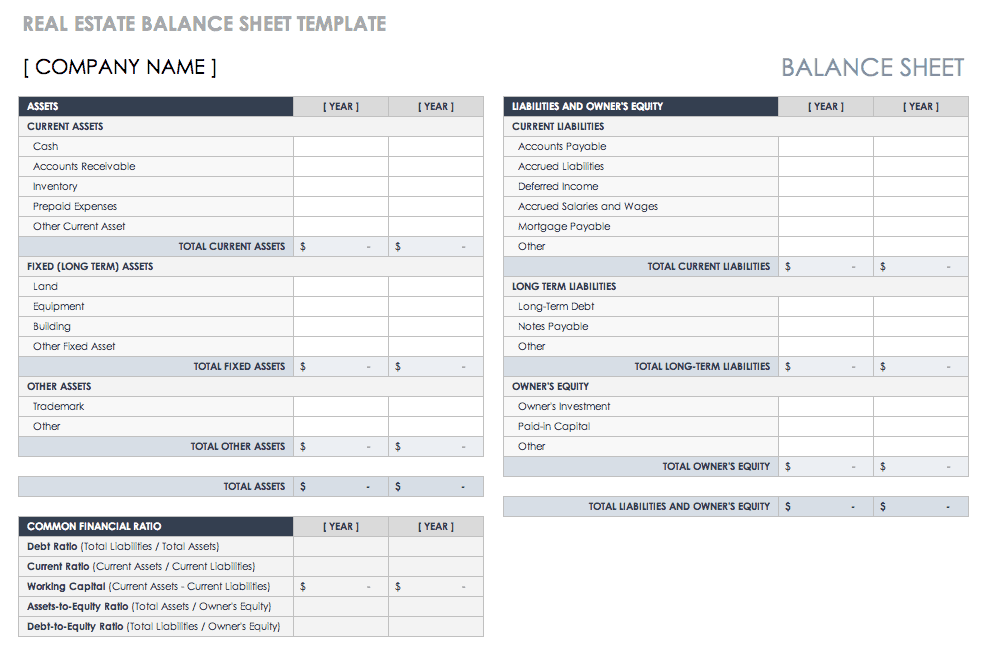

Cash in the bank, inventory, accounts receivable and investments all go on the balance sheet as assets. Use these balance sheet templates as financial statements to keep tabs on your assets (what you own) and liabilities (what you owe) to determine your equity. A balance sheet covers a company’s assets as defined by.

It details a company’s assets and liabilities, along with the value of its stock. Get free smartsheet templates. They include loans you have to pay back, wages.

Assets = liabilities + owners’ equity. The basic formula used to analyze a balance sheet is: Balance sheets are typically prepared and distributed monthly or quarterly depending on the.

Classification, valuation debt investments and equity investments recorded using the cost method are classified as trading securities, available‐for‐sale securities, or, in the case of debt investments, held‐to‐maturity securities. Assets = liabilities + equity. The strength of a company's balance sheet can be evaluated by three.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)