Perfect Info About Bonds In Cash Flow Statement

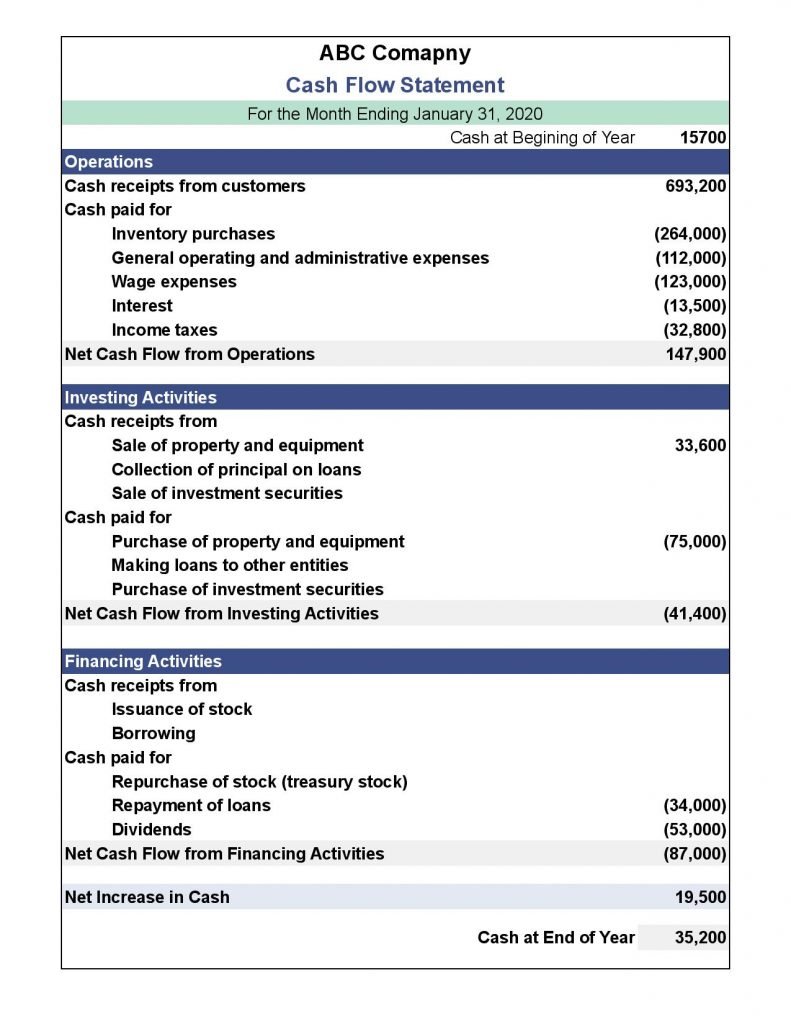

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company.

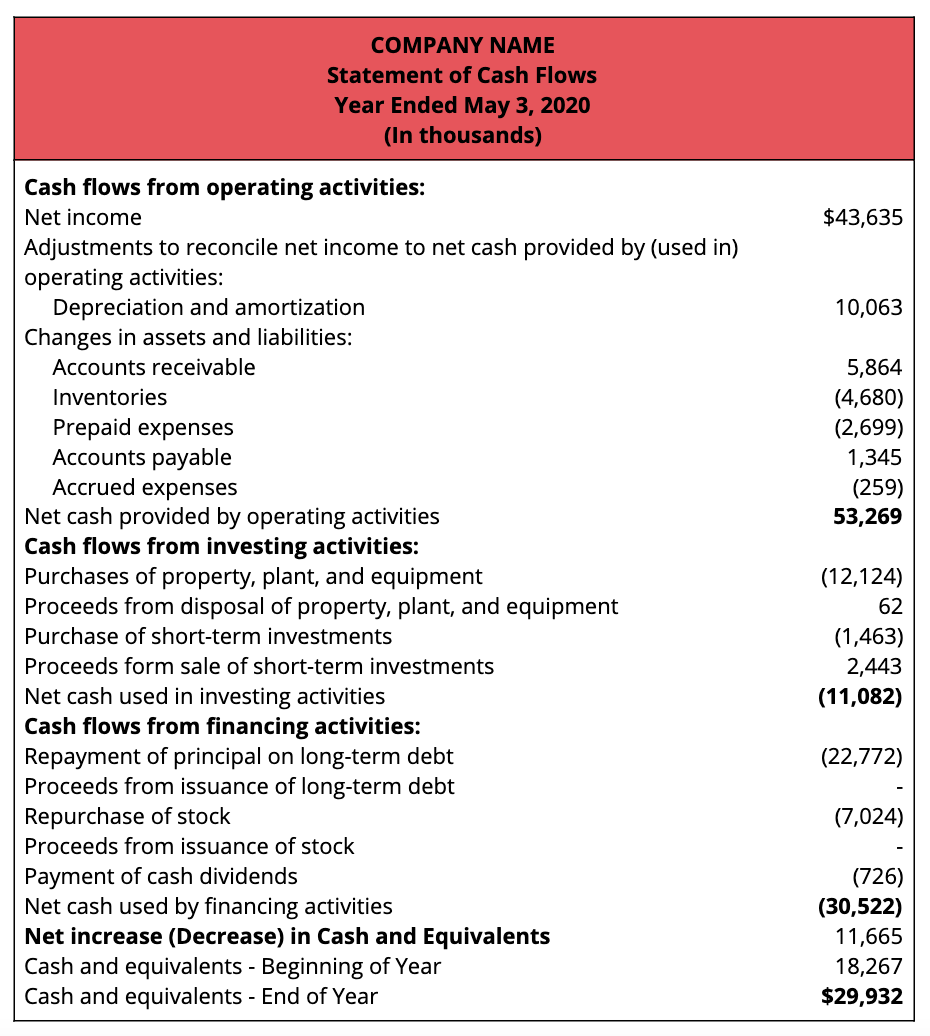

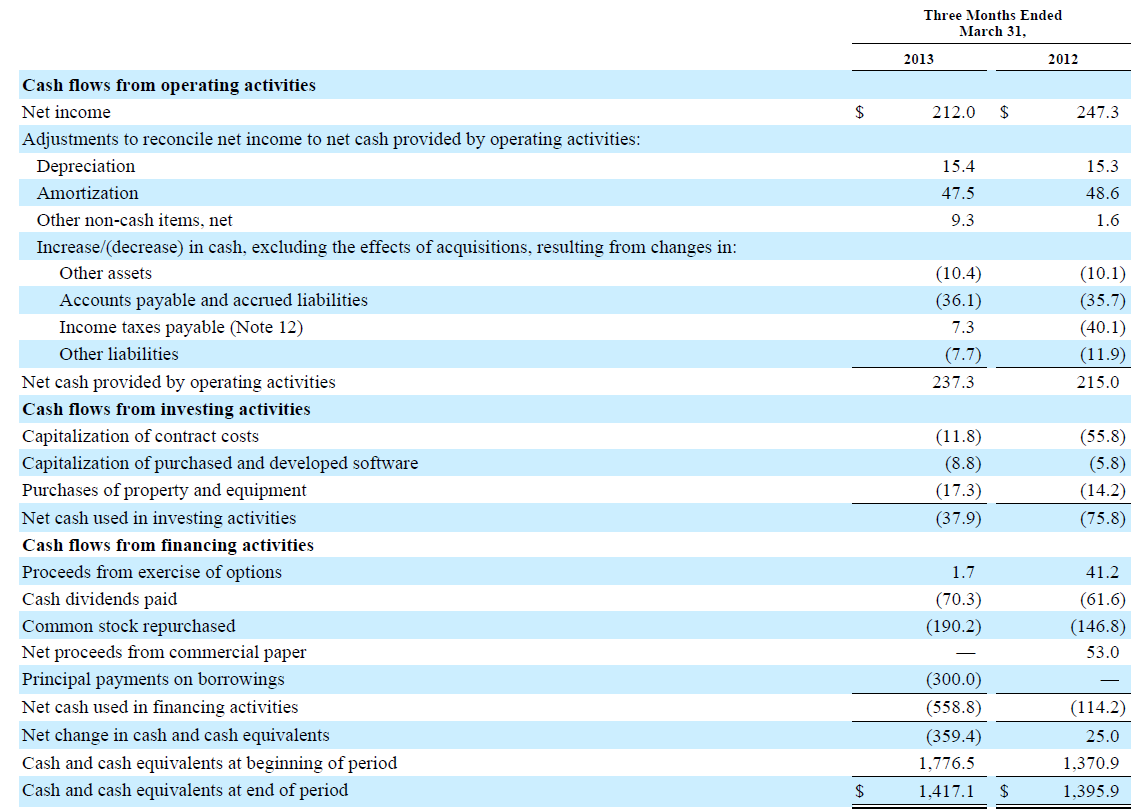

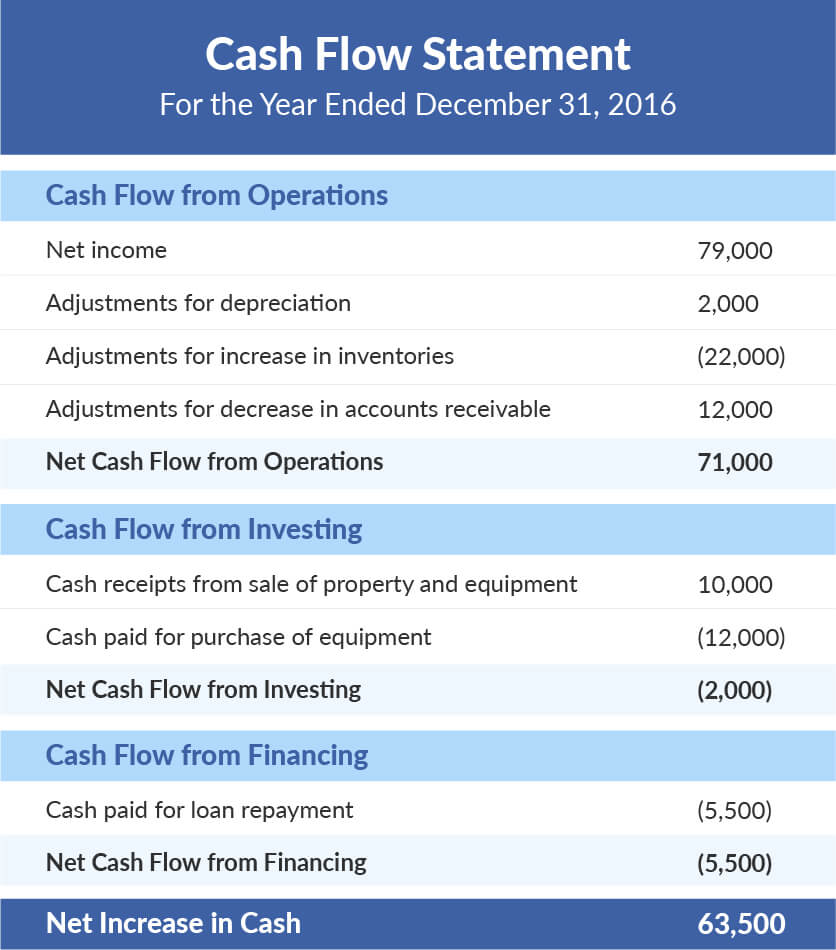

Bonds in cash flow statement. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). A cash flow statement, also known as the statement of cash flows, is a financial statement that shows the flow of cash into and out of your business during a specific period of time. Cash flow from financing (cff) activities is a category in a company’s cash flow statement that accounts for external activities that allow a firm to raise.

Cash flow from financing activities: Identify the structure and key elements of the statement of cash flows. Sec approves n200bn ava infrastructure fund the securities and exchange commission has approved.

Sap s/4hana cloud for finance. The final financial statement is the statement of cash flows. Assume that on january 1, 19x1, debtor corporation issues 13% bonded debt with a face value of $100,000 and a 10 year maturity for $110,000 cash, or at a $10,000 premium.

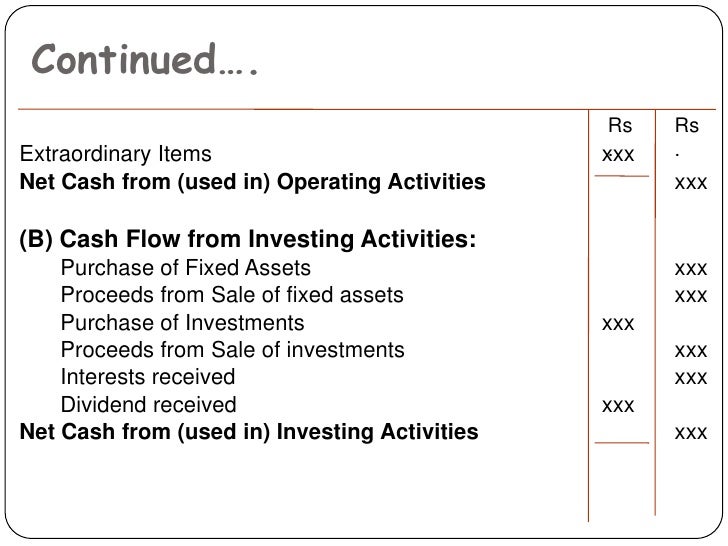

However, the income statement, retained earnings statement, and balance sheet do not directly track or report the flow of cash. The cfs measures how well a. The statement of cash flows is prepared by following these steps:

The presentation in the cash flow statement of bonds issued at a premium is considered within the context of another simple example, as follows. | accounting & bookkeeping | cash flow by john cromwell bond activity should be reported on the cash flow statement from the security’s issuance to its eventual settlement date. Begin with net income from the income statement.

There were inflows of $16.1 billion to stocks, and $11.6 billion to bonds, compared to outflows of $18.4 billion from cash, the most in eight weeks, bofa said in its weekly roundup of fund flows. Free cash flow eur 423 million; Cash flows from operating activities, cash flows from investing activities, cash flows from financing activities, reconciling the increase in cash from the scf with the change in cash reported on the balance sheet, supplemental information part 3

Statement of cash flows page id managers, investors, and lenders are particularly interested in the availability of cash, where it comes from, and what it is used for in a business. When a company issues bonds, it receives finance. The cash flow statement looks at the inflow and outflow of cash within a company.

At the end of the maturity date, the issuer has to use cash to settle with bondholders. Innovation rate increased to 20%; Income statement and free cash flow.

This report shows how much cash a company receives and spends on operating, investing, and financing activities. Sap s/4hana cloud for finance. The repayment of bonds means companies decrease their cash and cash equivalent balances.

Free cash flow eur 423 million; Bonds payable are the financial instrument that company uses to issue to get cash from investors. How is bonds payable presented on the cash flow statement?