Real Info About Limited Partnership Financial Statements

Digital world shares rose 16% to $50.49 in afternoon trading in new york on thursday.

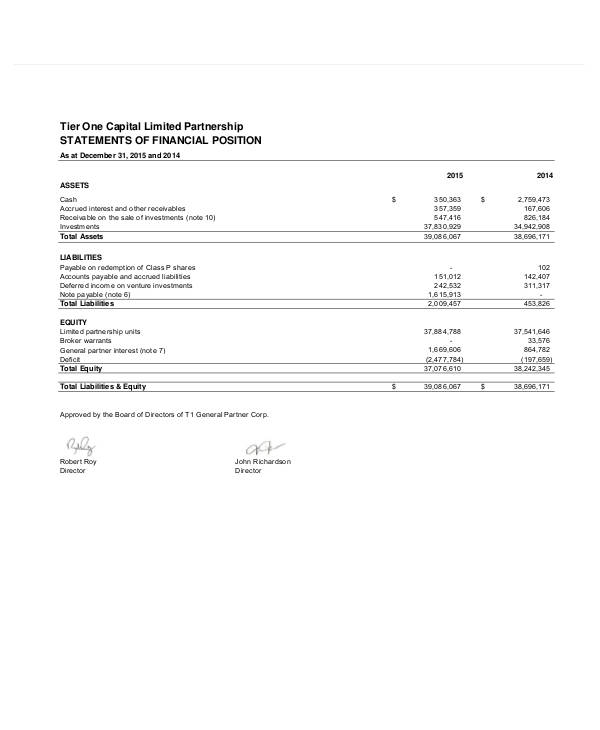

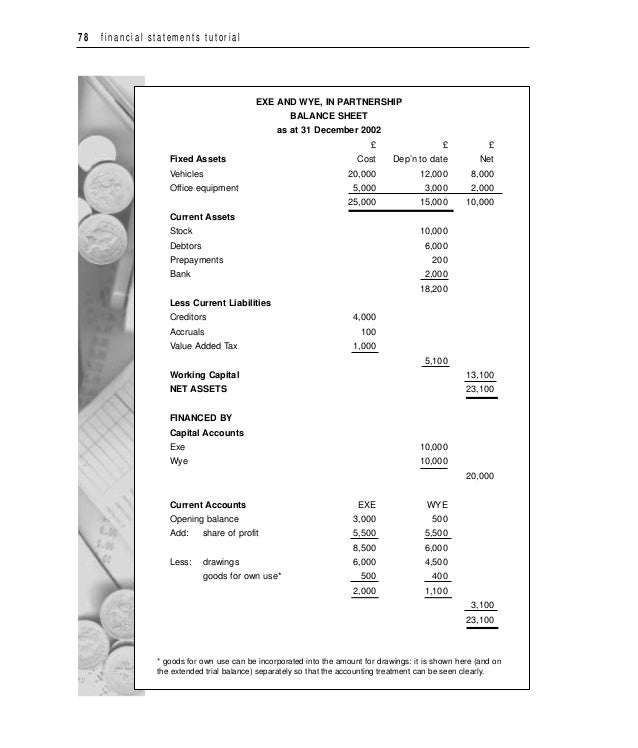

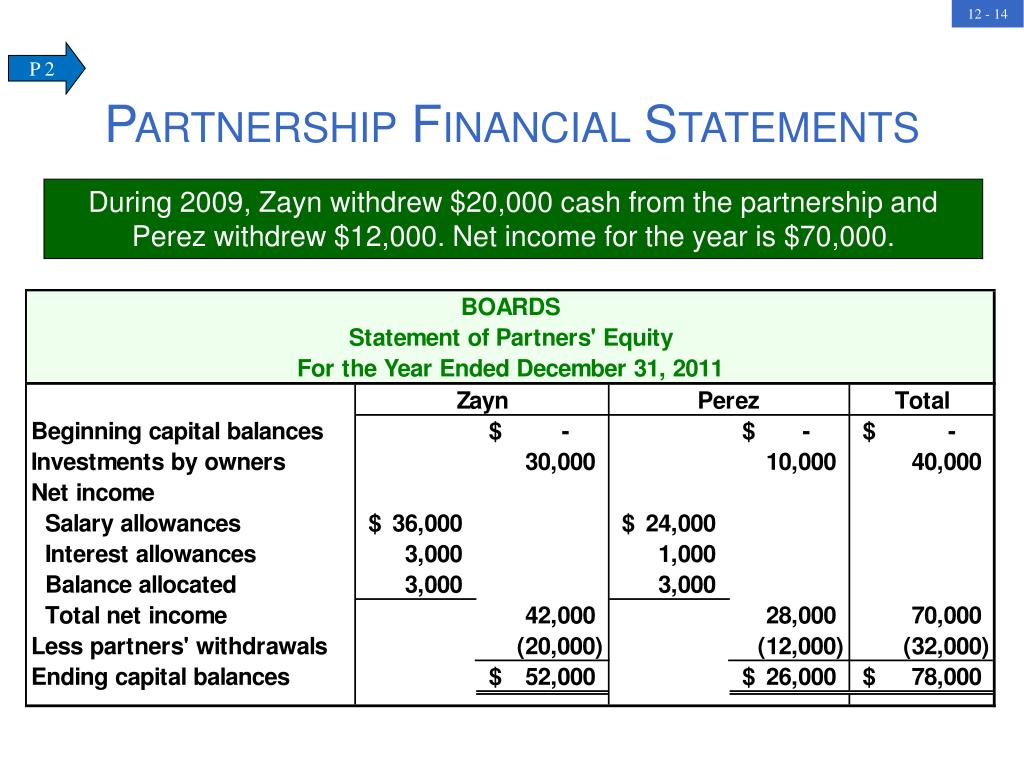

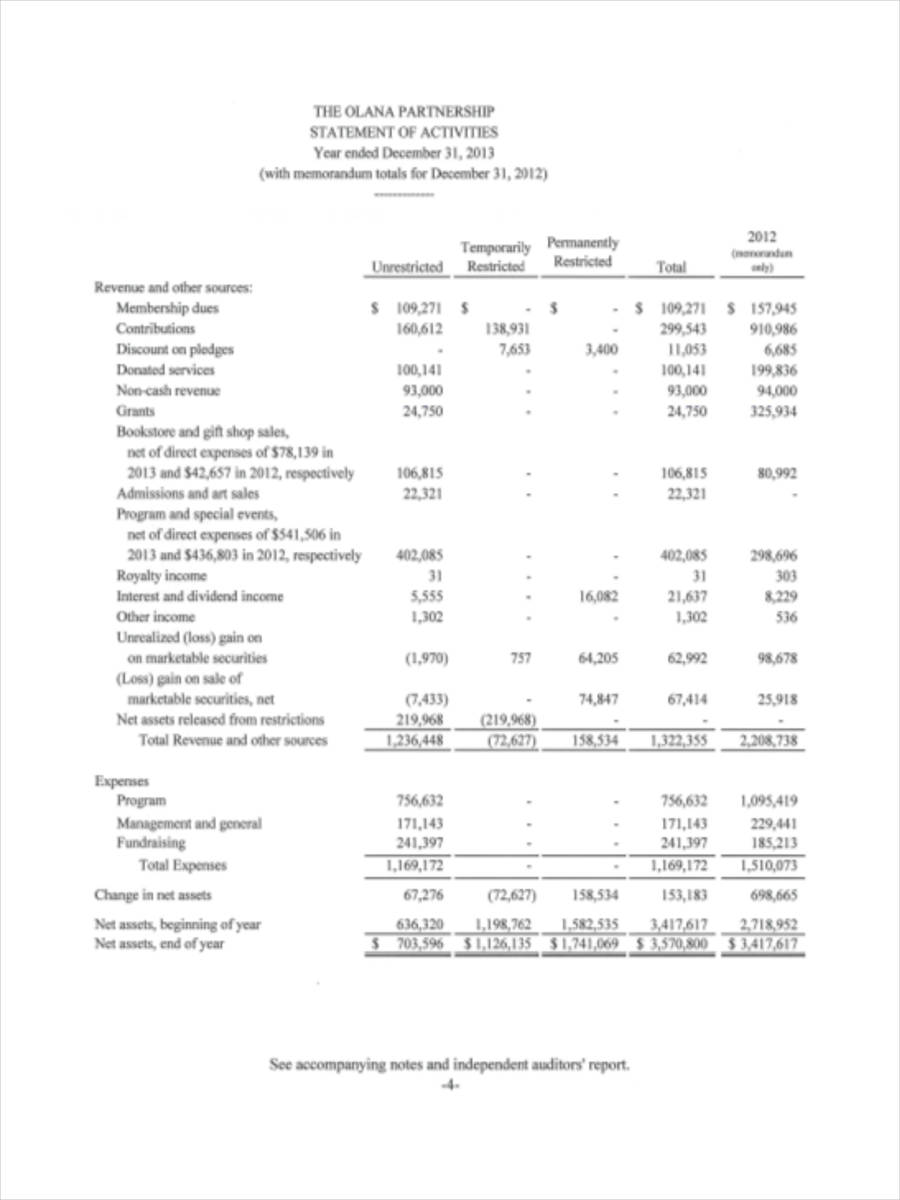

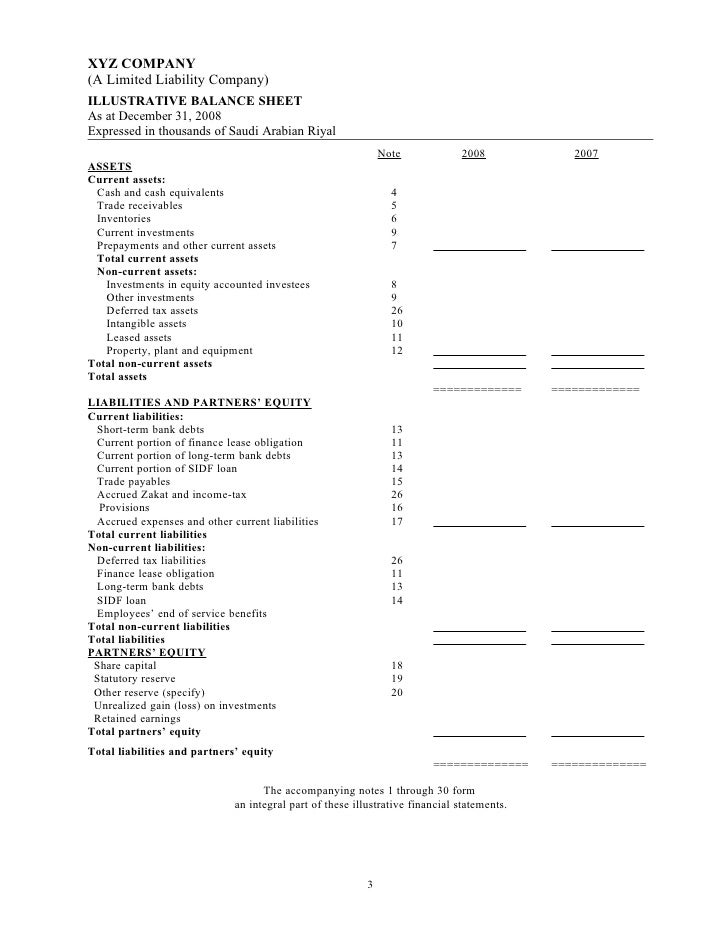

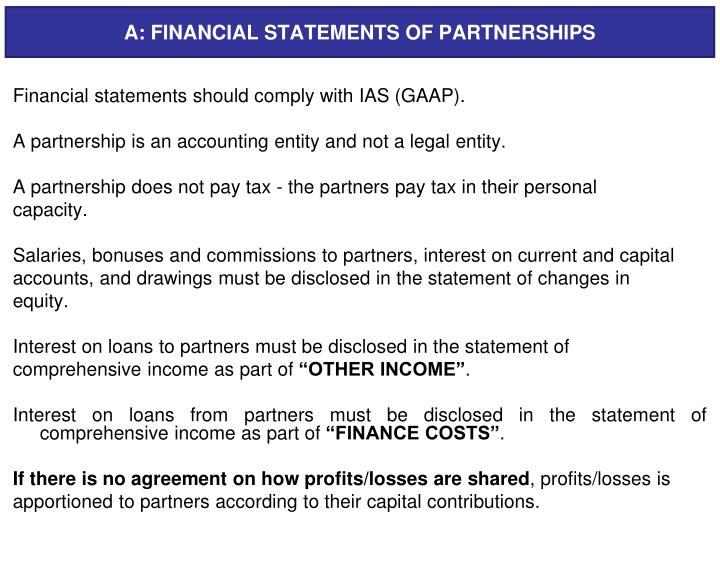

Limited partnership financial statements. A limited partnership (lp)—not to be confused with a limited liability partnership (llp)—is a business owned by two or more parties. Statement of changes in partners’ capital year ended december 31, 20xx general partner limited. As fiduciaries, limited partners (lps) require a basic level of financial details to inform and guide their boards, trustees, portfolio managers, and risk departments.

At this stock price, and assuming no digital world shareholders exercised the. Crosscheck the completeness and accuracy of the separate financial statements of the principal and subsidiary entities of the limited partnership. The net worth of such general partner (s),.

Notify me of new financial documents posted to this site. The main part of the income statement is prepared exactly as for a sole trader. The limited partners have liability only.

Accounting for limited liability partnerships (llps) is a specialist area that requires expertise and an understanding of the business structure. Montfort capital corporation (montfort or the company) (tsxv: Stephen griggs, richard houston, panos kakoullis, david.

Click the link to the right to download: Deloitte llp’s designated members (as defined in the limited liability partnerships act 2000) during the year were: The financial statements.

Combination of similar items. The group and partnership financial statements for each financial year. Preparing partnership financial statements.

See accompanying notes to financial statements. The partnership will pay the placement agent ongoing compensation on a monthly basis equal to 1/12th of 3.0% (3.0% per. Montf), a trusted provider of focused private credit strategies for institutional.

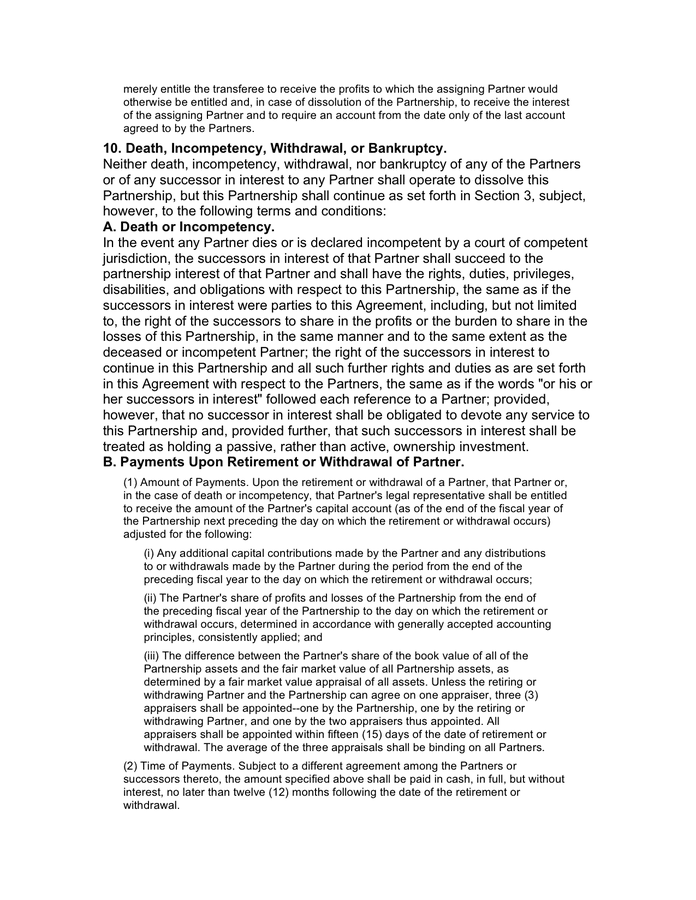

These must include at least one general partnerwho runs the business and has unlimited liability for any debts. 7 / financial statements see accompanying notes to financial statements. This guide is designed to explain the main changes that are needed to the audit report of a limited partnership (lp) formed under the limited partnerships act 1907, which is not.

The partnership earned outcollect revenue from affiliated entities, included in service revenues, of $90,651, $83,029 and $57,332 in 2010, 2009 and 2008, respectively, for. General partnership financial statements should include disclosure of any unusual commitments undertaken by the general partner or sponsor. Stk'emlupsemc limited partnership notes to financial statements (unaudited) march 31, 2017 1.

The income statements of partnerships should be presented in a manner which clearly shows the aggregate amount of net income (loss) allocated to the general partners. Under that law the members have elected to prepare both the group and partnership financial statements. This guide is designed to explain the main changes that are needed to the audit report of a limited partnership (lp) formed under the limited partnerships act 1907, which is not.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)