Ace Tips About Detailed Trial Balance

Thus, the general ledger may be several hundred pages long, while the trial balance covers only a few pages.

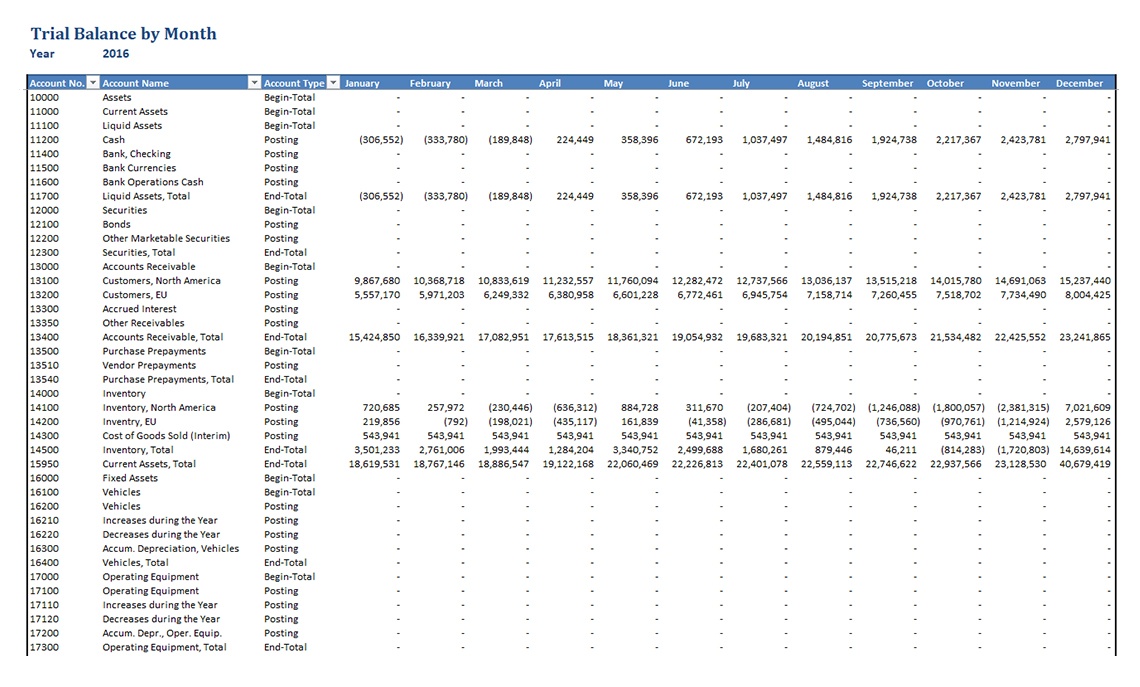

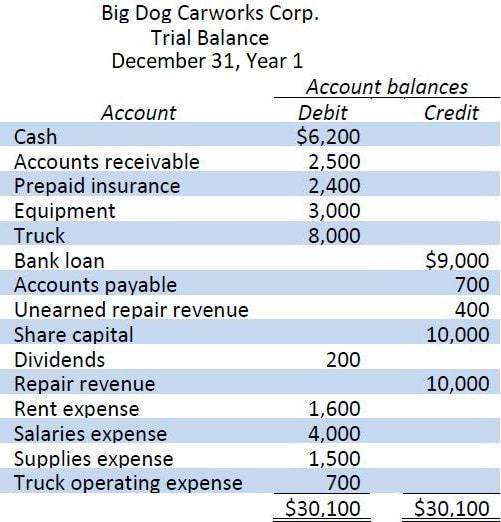

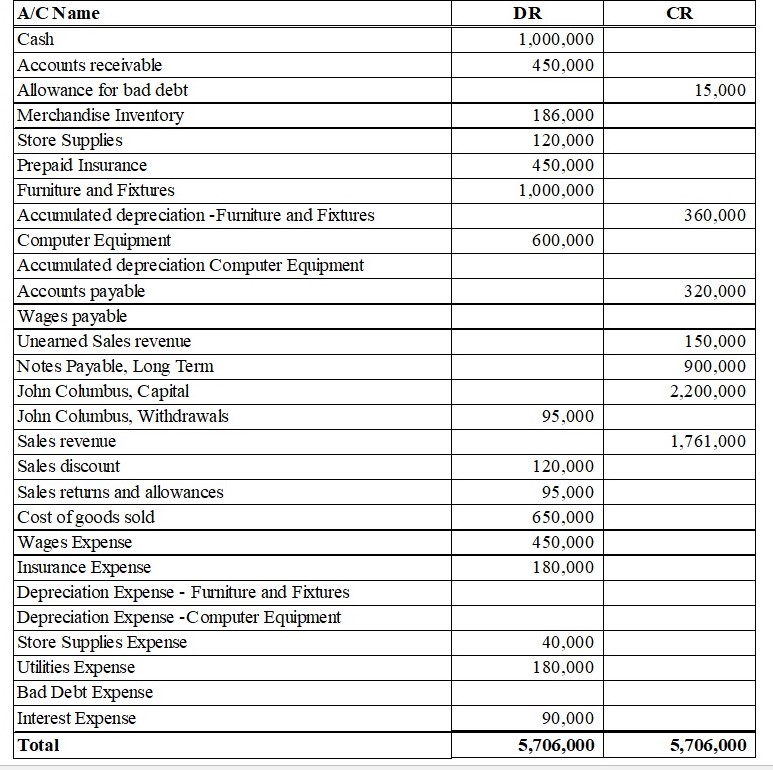

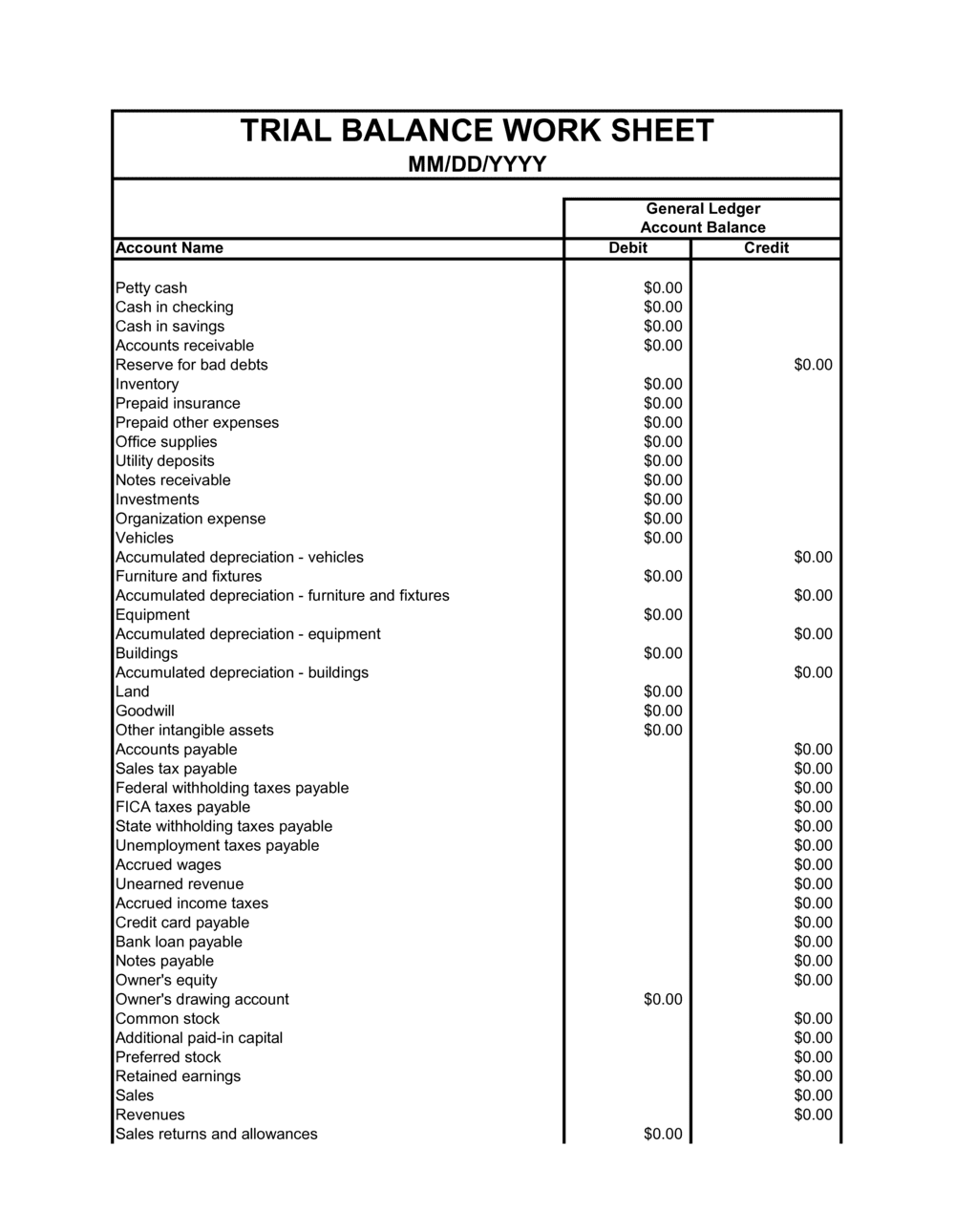

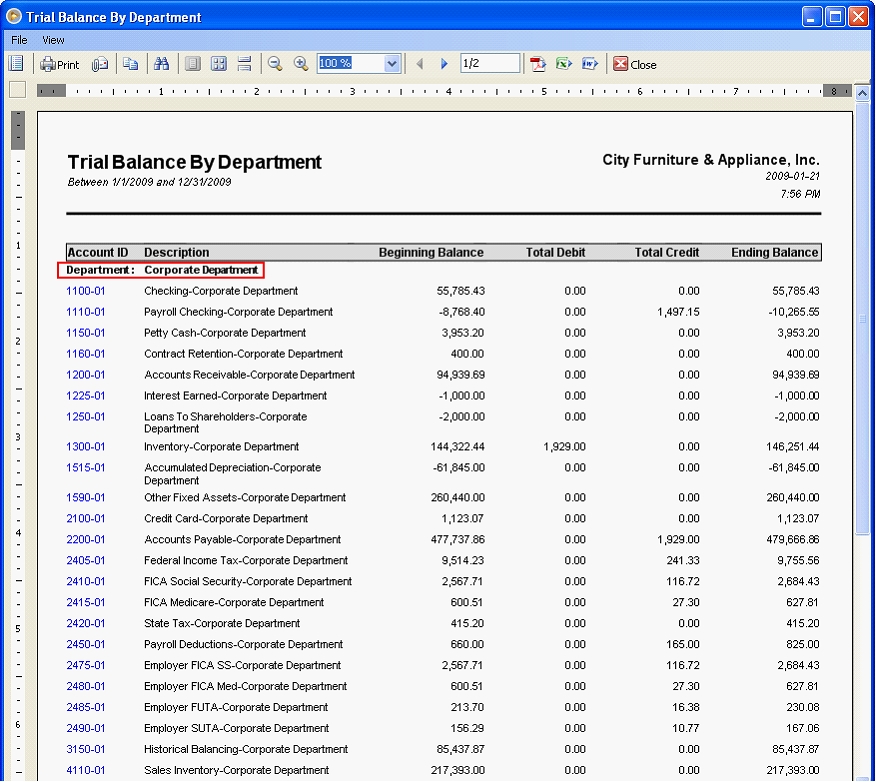

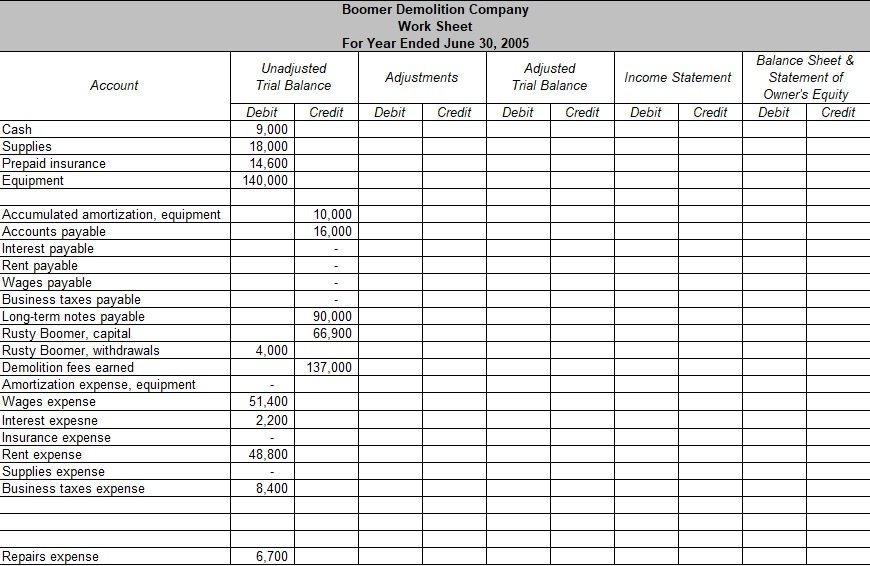

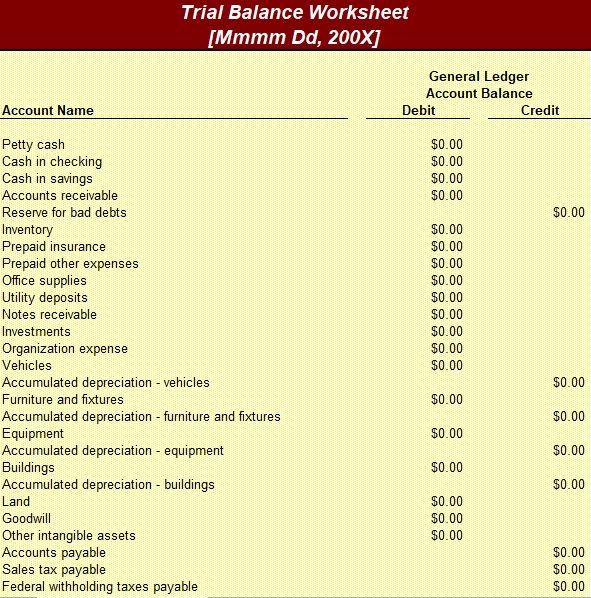

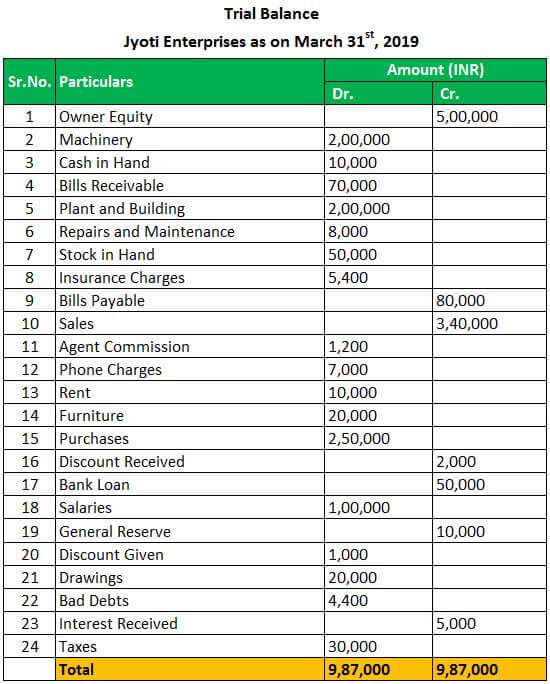

Detailed trial balance. The purpose of a trial balance is to verify that the sum of debits equals the sum of credits, not to report account balances. Trial balance has a tabular format that shows details of all ledger balances in one place. Let me show you how:

The trial balance is an accounting report that lists the ending balance in each general ledger account. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. 2.2 define, explain, and provide examples of current and noncurrent assets, current and noncurrent liabilities, equity, revenues, and expenses;

Trump was penalized $355 million, plus millions more in interest, and banned for three years from serving in any top roles at a new. 14, 2024 3:16 pm pt. For transaction details, the report includes the following information in the columns:

The balances are usually listed to achieve equal. 10.9% with placebo) and fever (6.4% vs. Although a trial balance may equal the debits and credits, it does not mean the figures are correct.

The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains,. Credits and debits to each account from transactions during the accounting period. The dates of the accounting period.

Embark on a journey to understand trial balance, a fundamental concept in accounting. While there isn't a specific report to show both the beginning and closing balance, you can run the transaction detail by account. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that should equal each other.

A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. This statement comprises two columns: 2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate;

This means that it states the total for each asset, liability, equity, revenue, expense, gain, and loss account. Go to the reports menu. Judge arthur f.

The trial balance is a bookkeeping or accounting report in which the balances of all the general ledger accounts of the organization are listed in separate credit and debit account columns. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. The trial balance format is easy to read because of its clean layout.

Trial balance and balance sheet detail reports will show the beginning balance of each account. The general ledger contains the detailed transactions comprising all accounts, while the trial balance only contains the ending balance in each of those accounts. A trial balance includes the figures from the profit and loss (income statement) and the balance sheet financial statements.