Impressive Info About Payg Income Statement

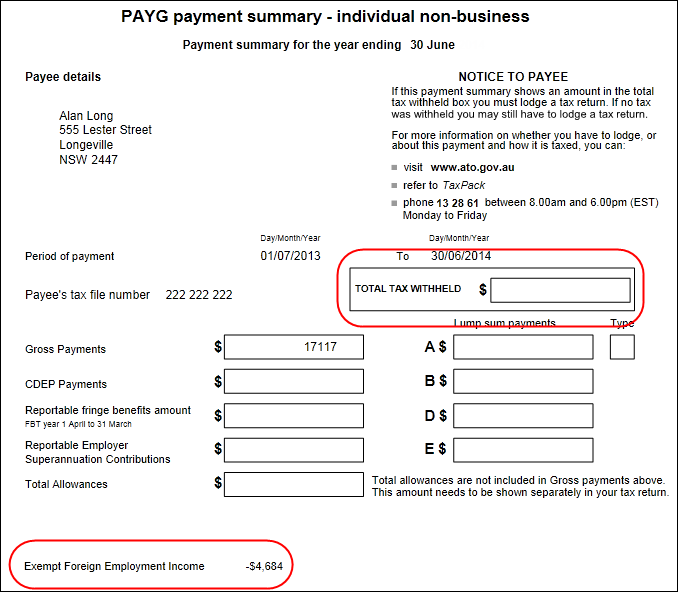

Last updated 8 august 2021 print or download on this page end of financial year payments to employees types of payment summaries you must give each of your payees a.

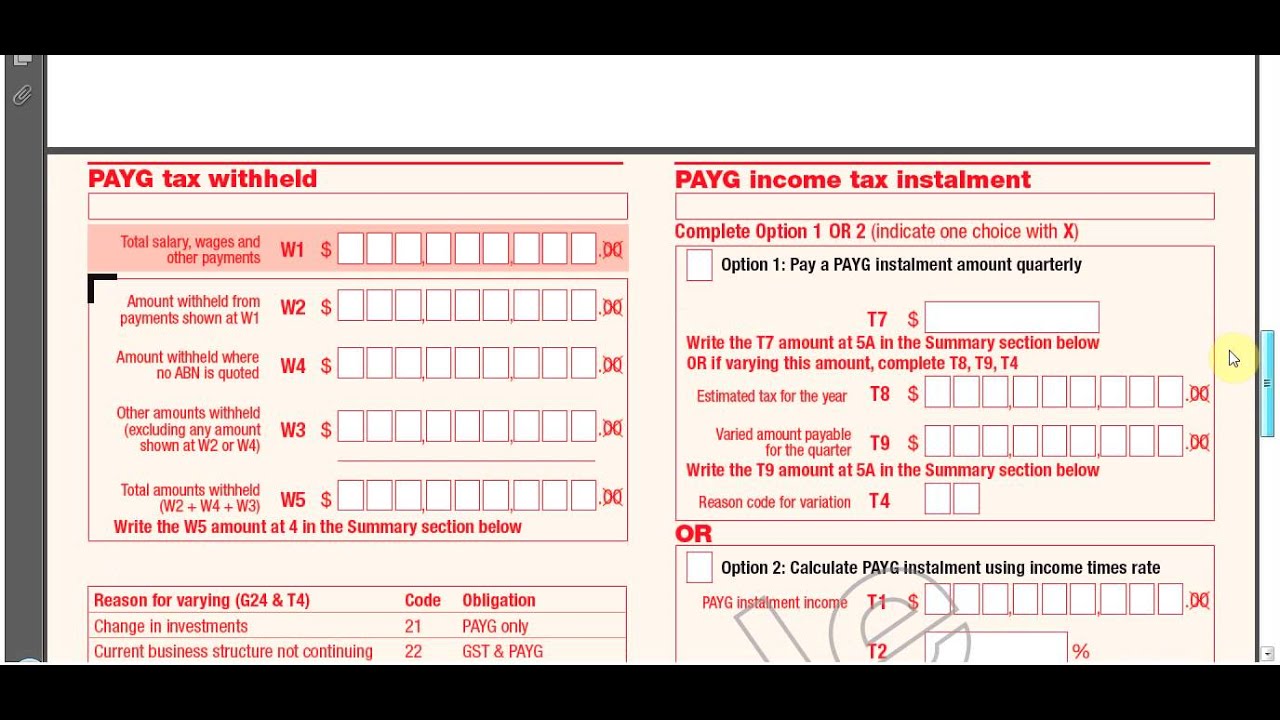

Payg income statement. Most taxpayers make payg instalments on a quarterly basis. Starting payg instalments you may be required to. Tip this page explains how to update your.

So the new ato hype about income statements looks like it’s mostly just a. If you do not have any instalment income for this period, key zero at label t1. Pay as you go (payg) instalments make it easier to manage your income tax payments.

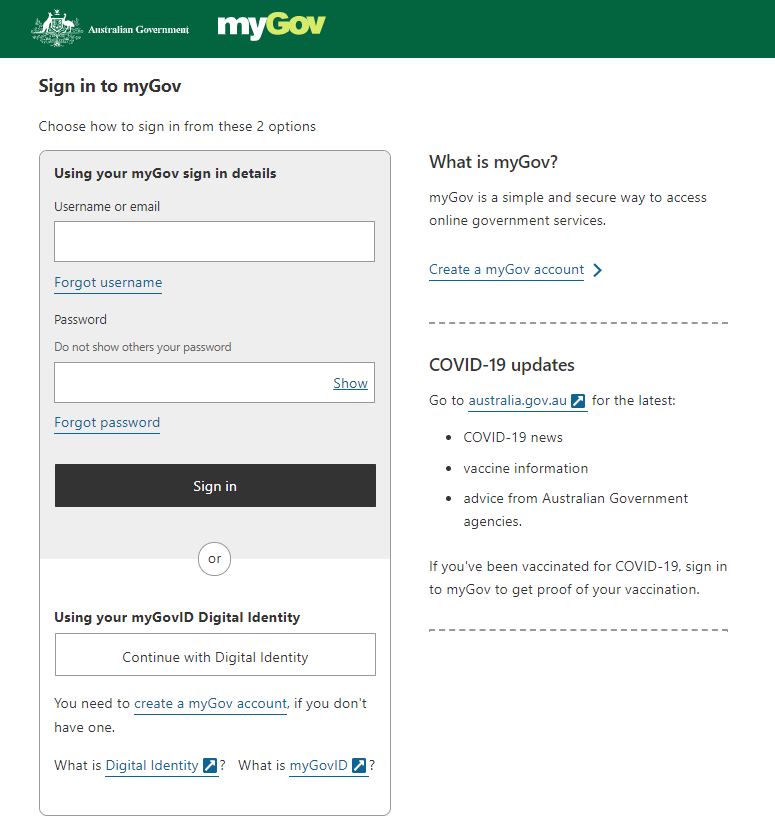

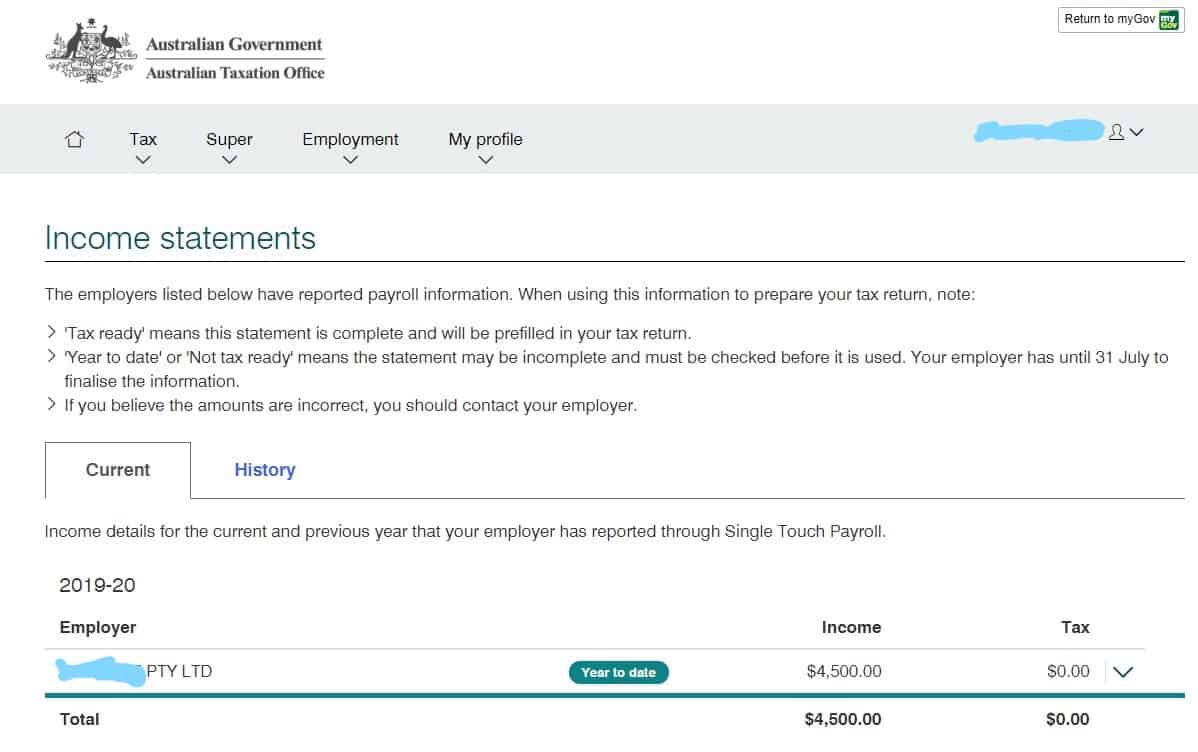

Taxpayers with business income of more than $20 million are required to make monthly payg. The funny thing is, even if you use mygov for your taxes, you don’t need a payg or income statement! The due date for your next payg instalment will be on your activity statement or instalment notice.

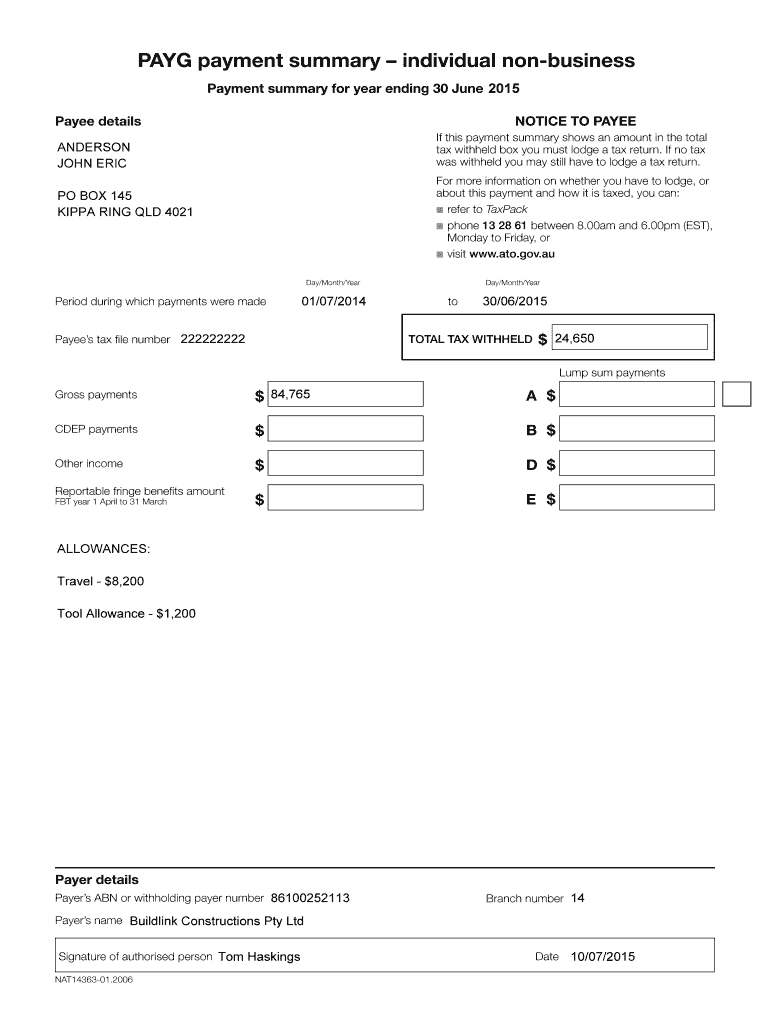

Income tax is a percentage you must pay to the australian taxation office (ato) once you earn over $18,200. How often do i need to pay payg instalments? If you are reporting using ato paper forms, the pay as you go (payg) payment summary statement, along with the originals of all payment summaries you issued for the financial year, make up your payg withholding.

Calculate payg instalment using income × rate. Last updated 8 august 2021. Can i change my payg instalment options?

Overview how xero populates the ias depends on your activity statement settings in financial settings. Pay as you go (payg) instalments are regular prepayments of the expected tax on your business and investment income. How do i manage and pay my.

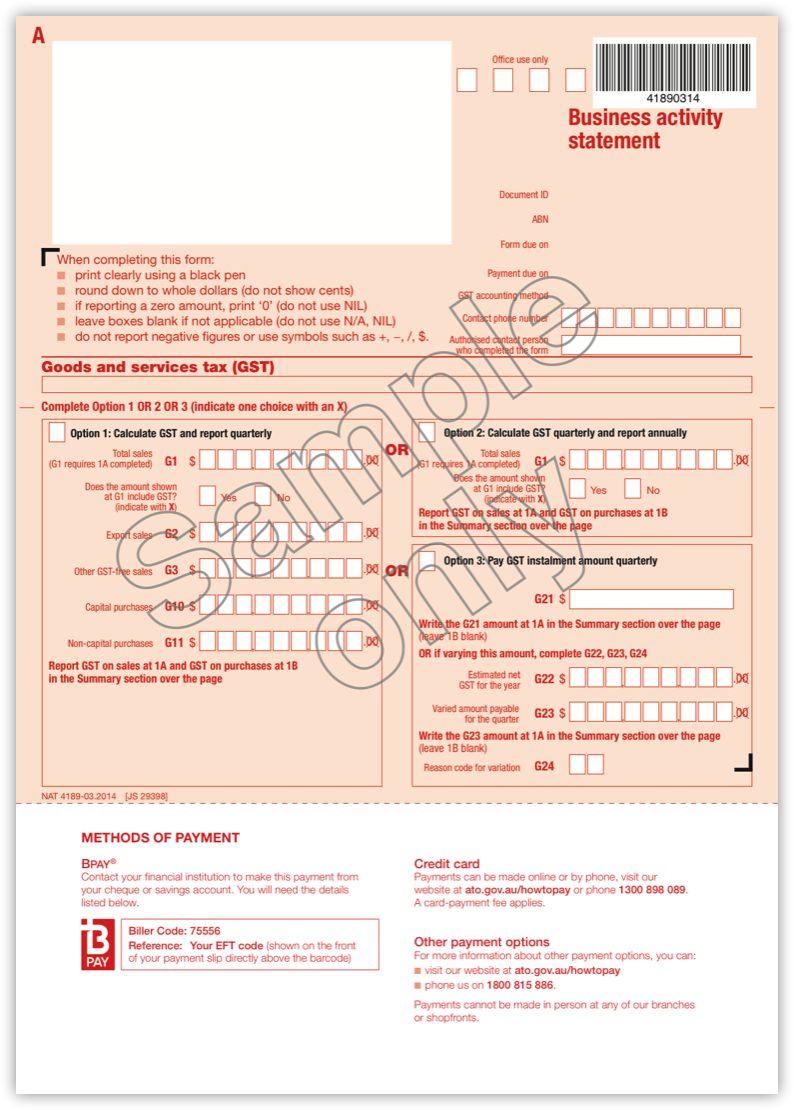

An income statement, often known as a profit and loss statement (p&l), is a financial report generated by businesses to evaluate their financial performance over a. Your activity statement is used to report information about gst and pay as you go (payg) withholding you’ve collected and income you’ve earned to. You can find out how these options work, and which.

How are payg instalments worked out? Overview you can use either full bas or simpler bas in xero. Payg (pay as you go) withholding is an employer obligation in australia to help payees meet their end of year tax liabilities.

You can change your gst accounting method to cash or accruals. Understand what payg instalments are and how to start paying. This is similar to the information you would.

There are two options for reporting and paying payg instalments on either the bas or the ias. Run, review, and publish the ias, then lodge it with the ato. Pay a payg instalment amount option 2: