Cool Tips About Liabilities Of Balance Sheet

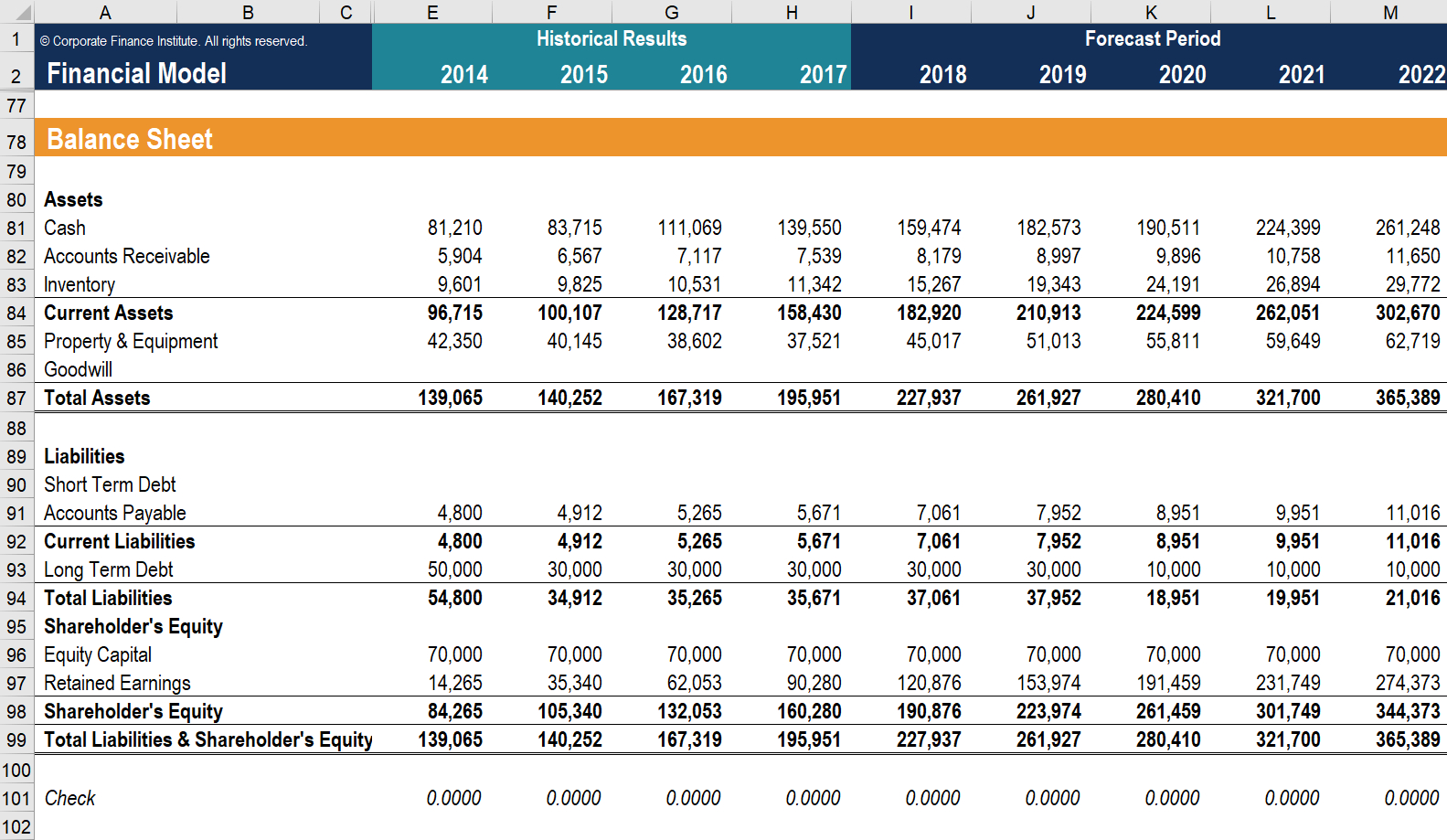

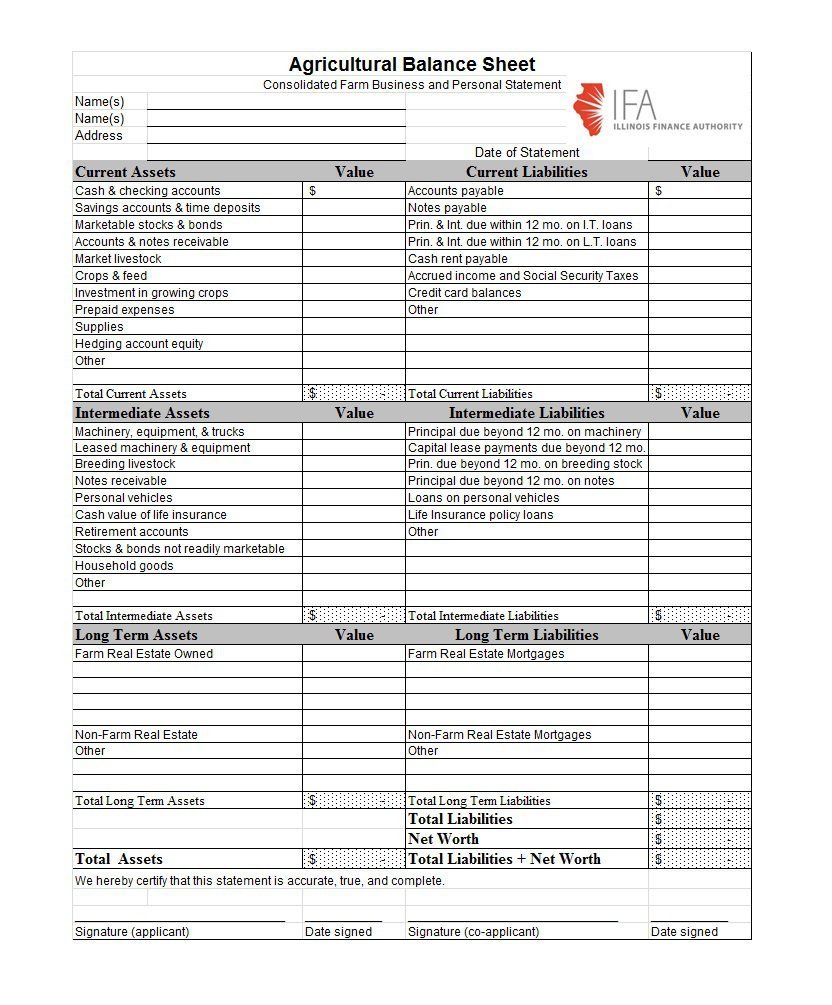

It records the assets and liabilities of the business at the end of the accounting period after the preparation of trading and profit and loss accounts.

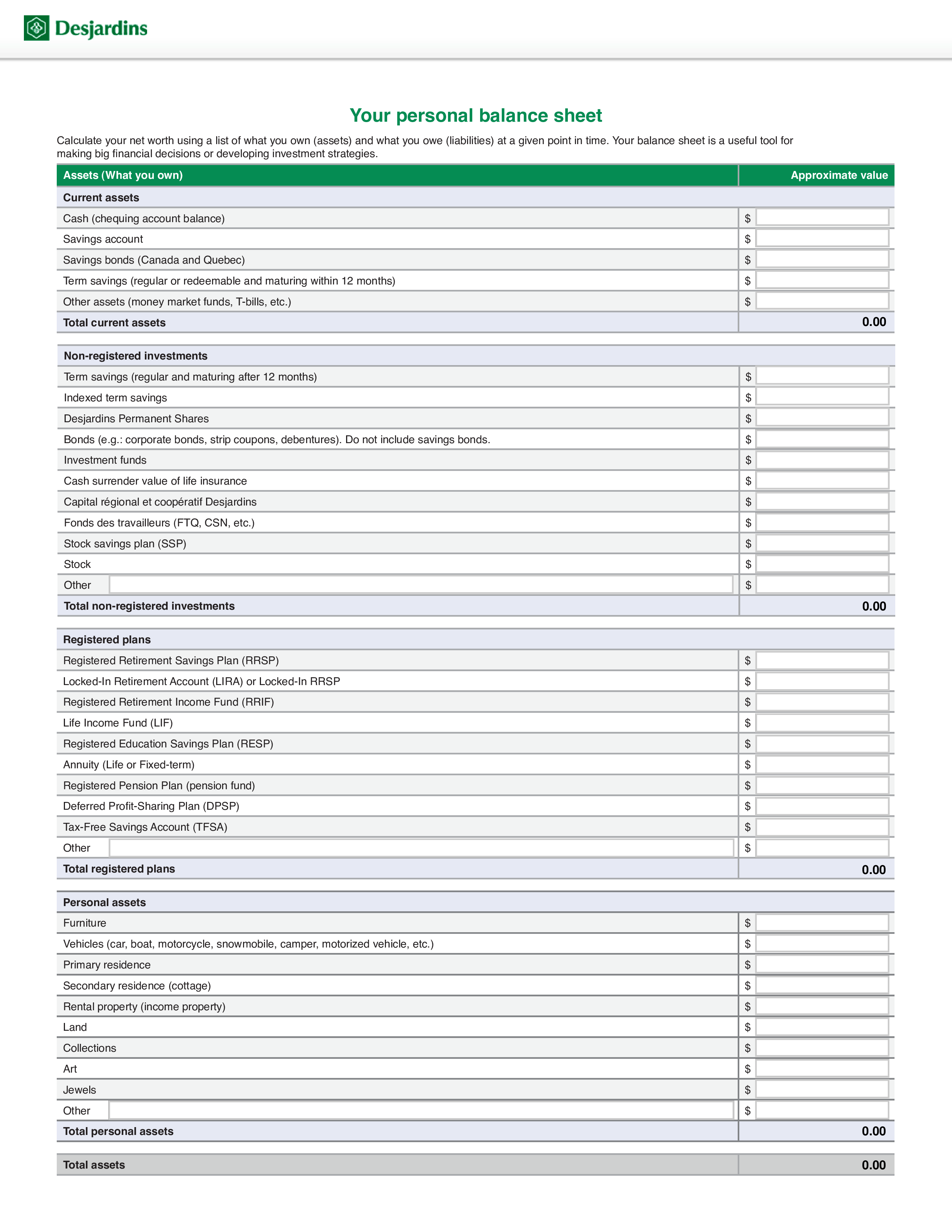

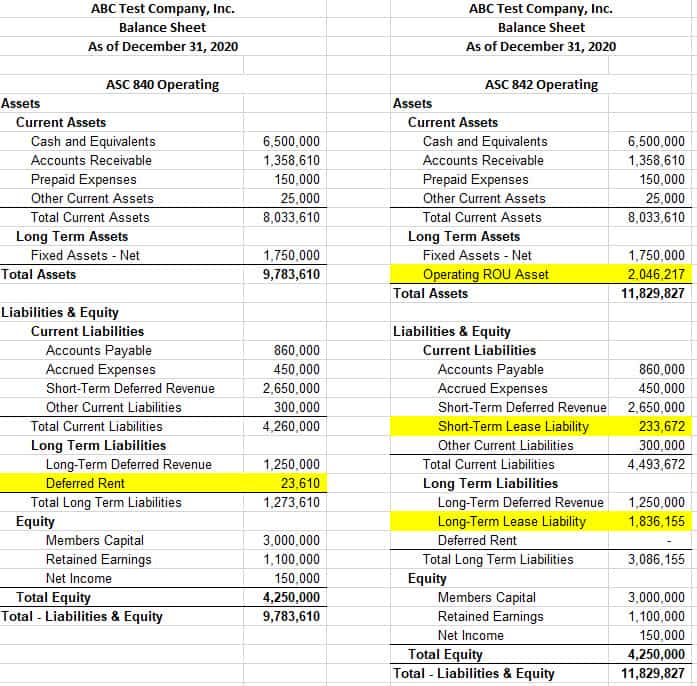

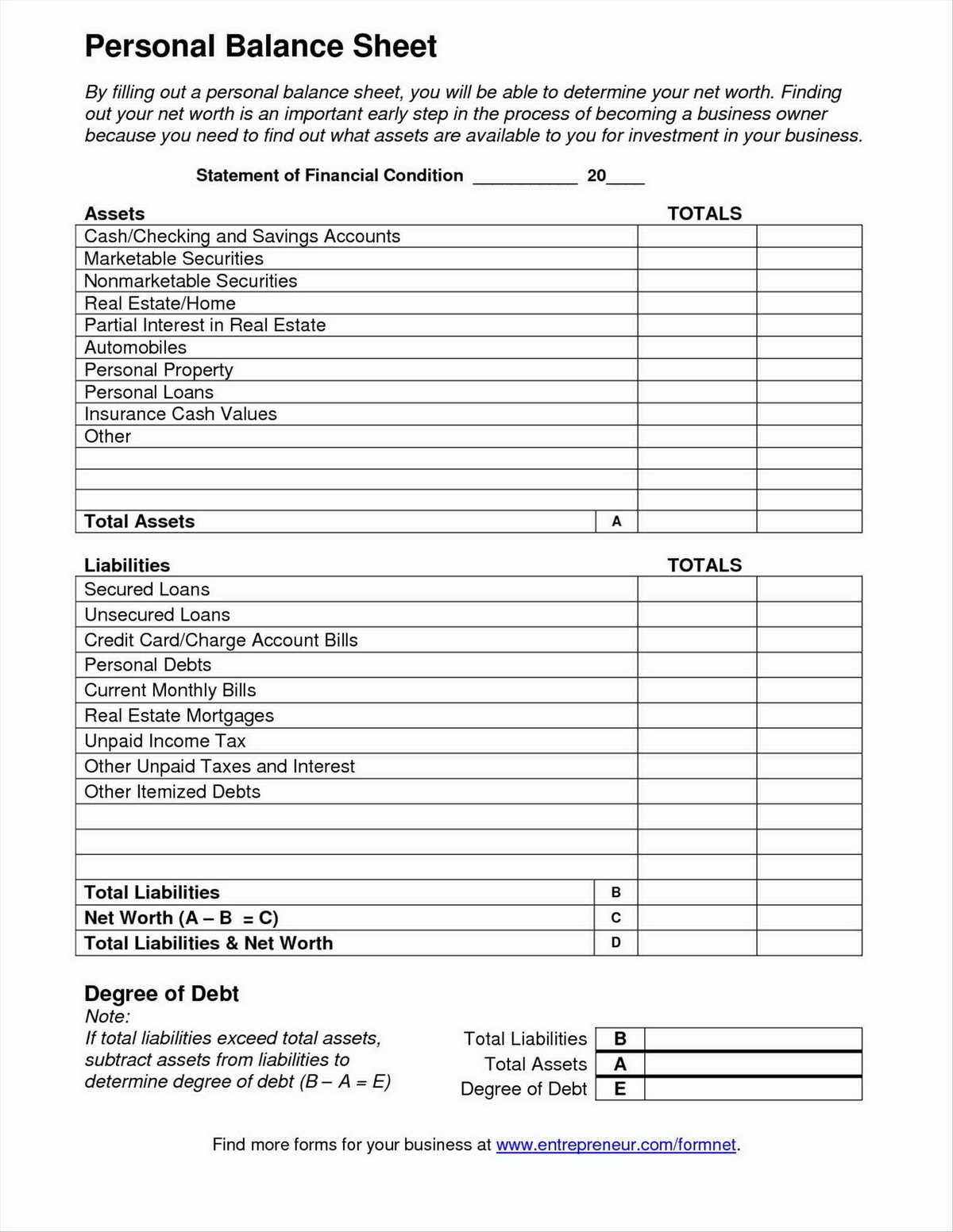

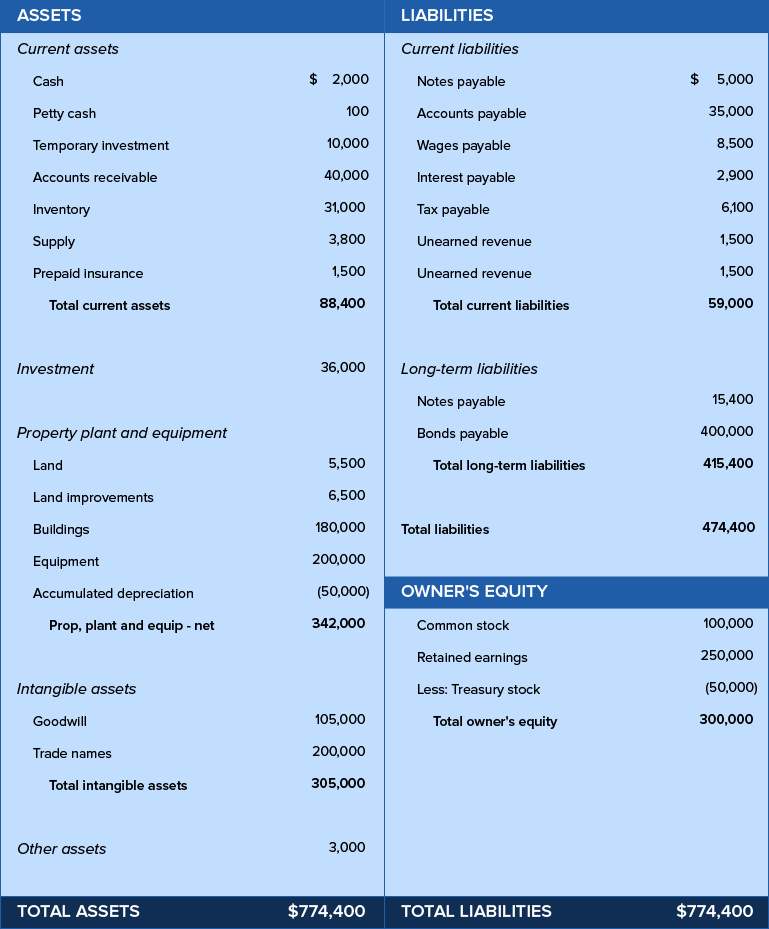

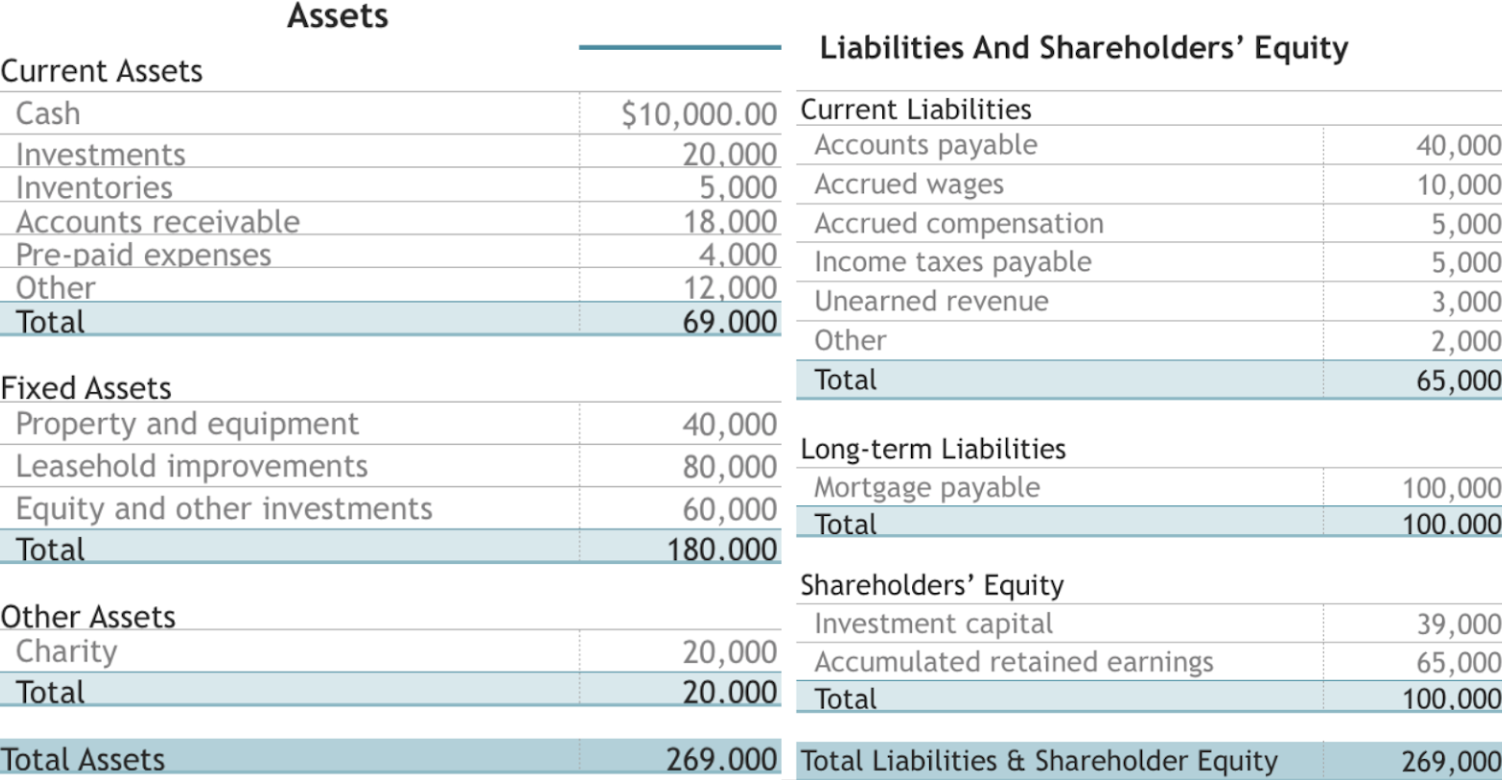

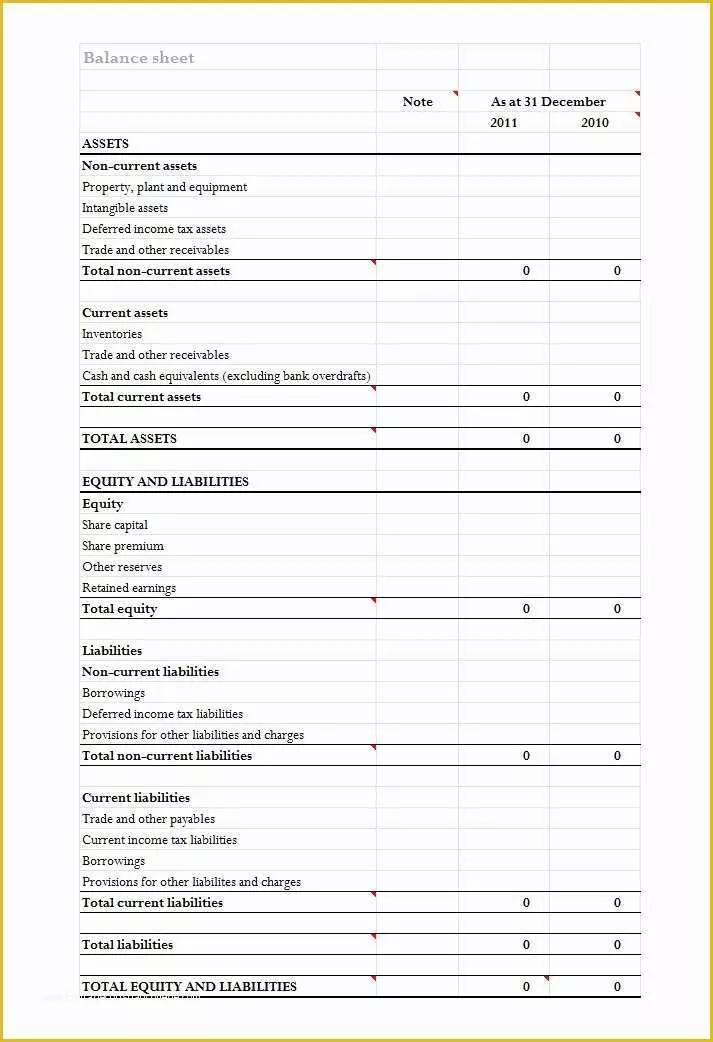

Liabilities of balance sheet. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Balance sheet time periods when investors ask for a balance sheet, they want to make. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company.

This is the total of the two principal payments due after december 31, 2023 (the payments due on december 31, 2024 and december 31, 2025). Shareholders’ equity is the difference between a. Assets are everything that a business owns and can use to pay its debts.

You can learn about the health of a business by looking at its balance sheet. When settled, an entity will have an economic outflow. This chapter looks at a government's balance sheet, showing the various types of assets and liabilities it contains.

Just as assets are categorized as current or noncurrent, liabilities are categorized as current liabilities or noncurrent liabilities. When balance sheet is prepared, the liabilities section is presented first and owners’ equity section is presented later. The balance sheet is a statement that shows the financial position of the business.

With liabilities, this is obvious—you owe loans to a bank, or. Past events or transactions result in liabilities. A company's balance sheet, also known as a statement of financial position, reveals the firm's assets, liabilities, and owners' equity (net worth).

This accounting equation is the key to the balance sheet: The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. The balance sheet includes things owned (assets) and things owed (liabilities).

Liability is an obligation between one party and another not yet completed or paid for in full. Your balance sheet consists of two main categories: This is a list of what the company owes.

It can also be referred to as a statement of net worth or a statement of financial position. The two sides must balance—hence the name “balance sheet.” This is a list of what the company owes.

Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity. Assets = liabilities + owner’s equity. Balance sheets provide the basis for.

The balance sheet equation. The company is legally responsible for such transactions or events. Liabilities are debts you owe to other parties, including other businesses or the government.