Ideal Info About Social Income Statement

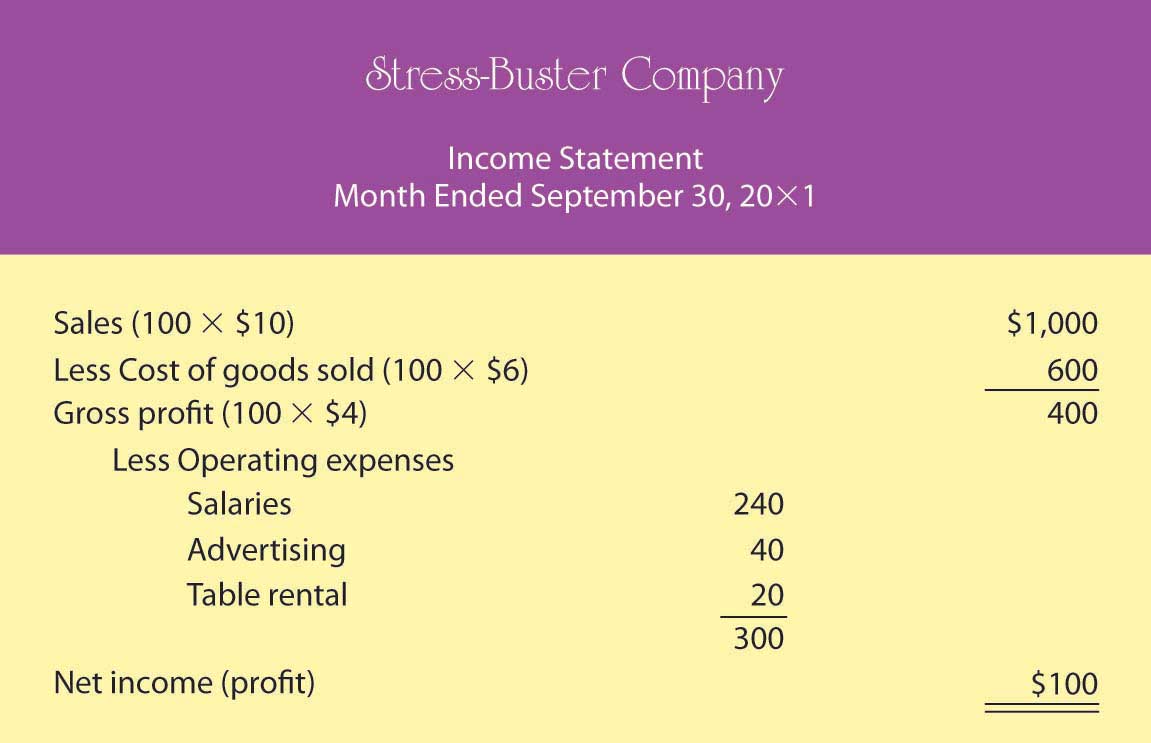

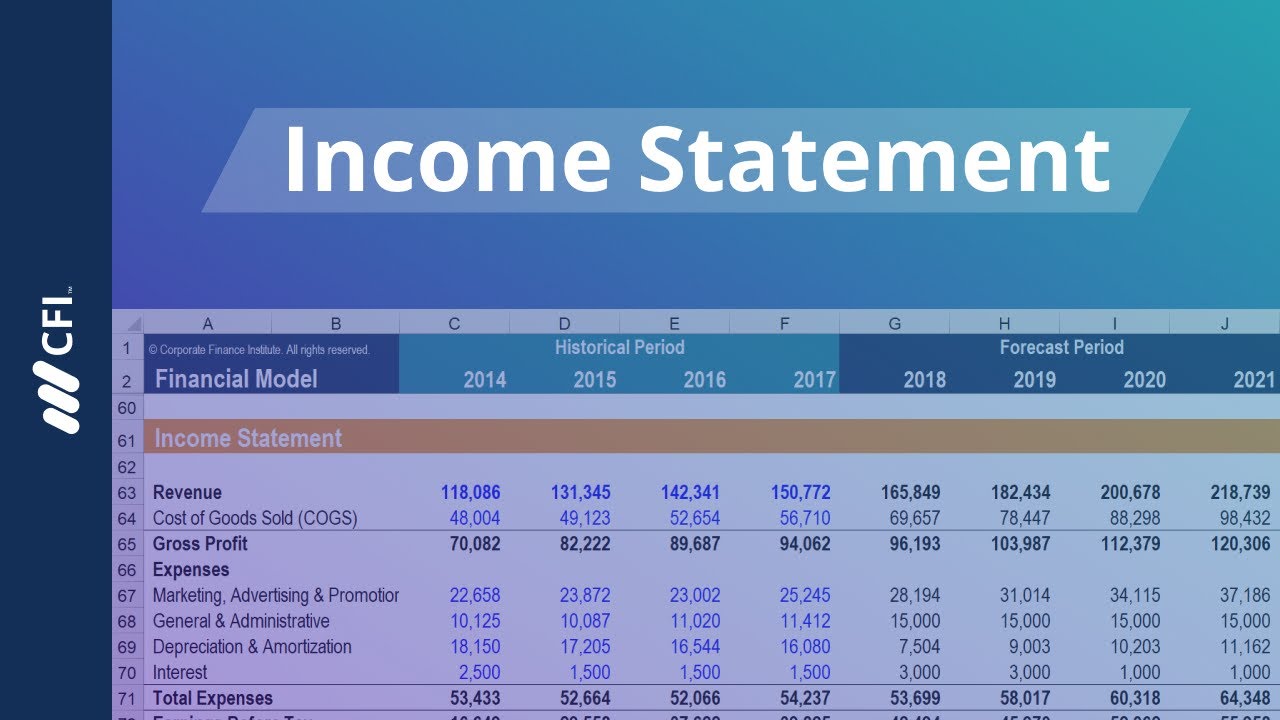

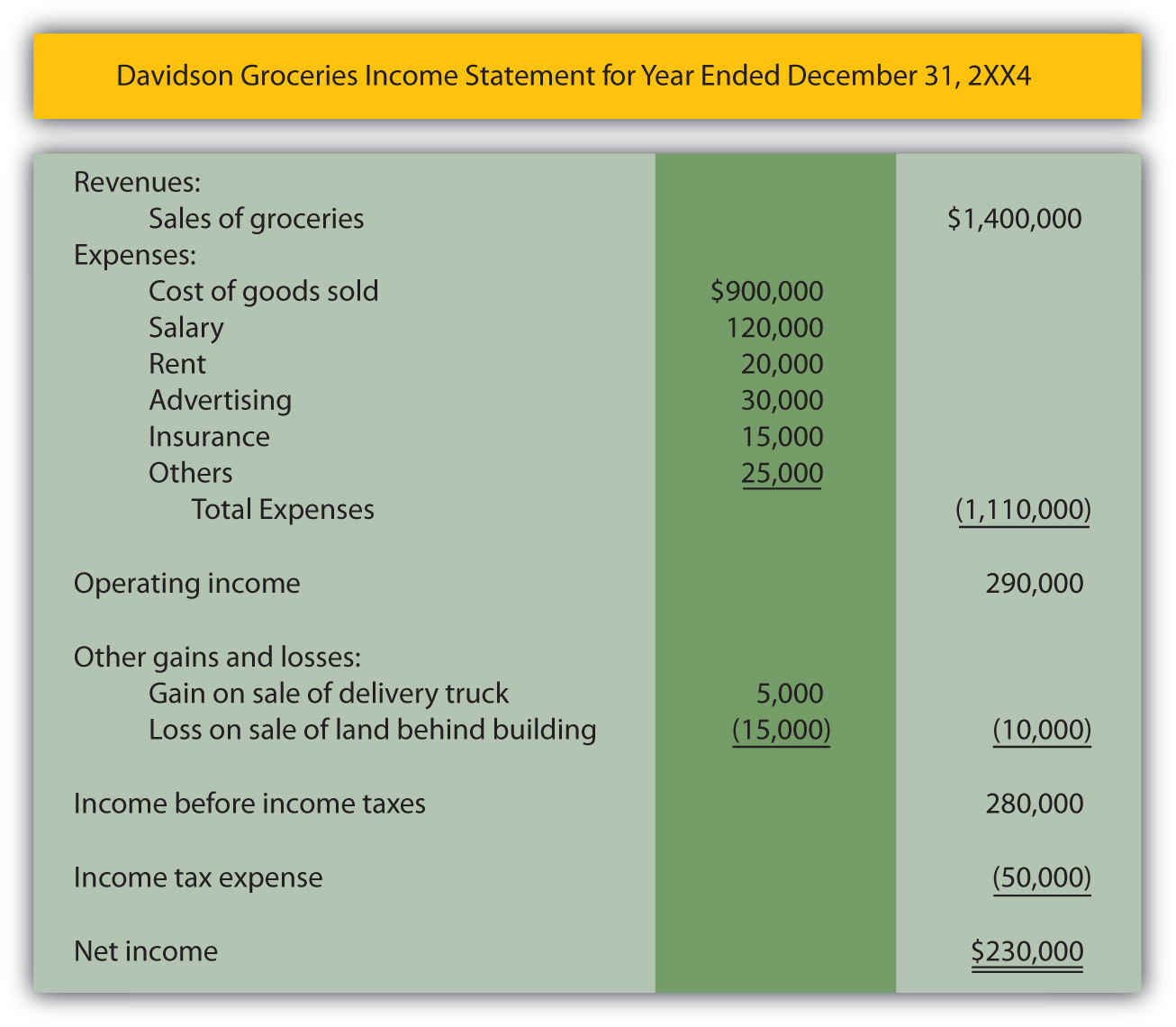

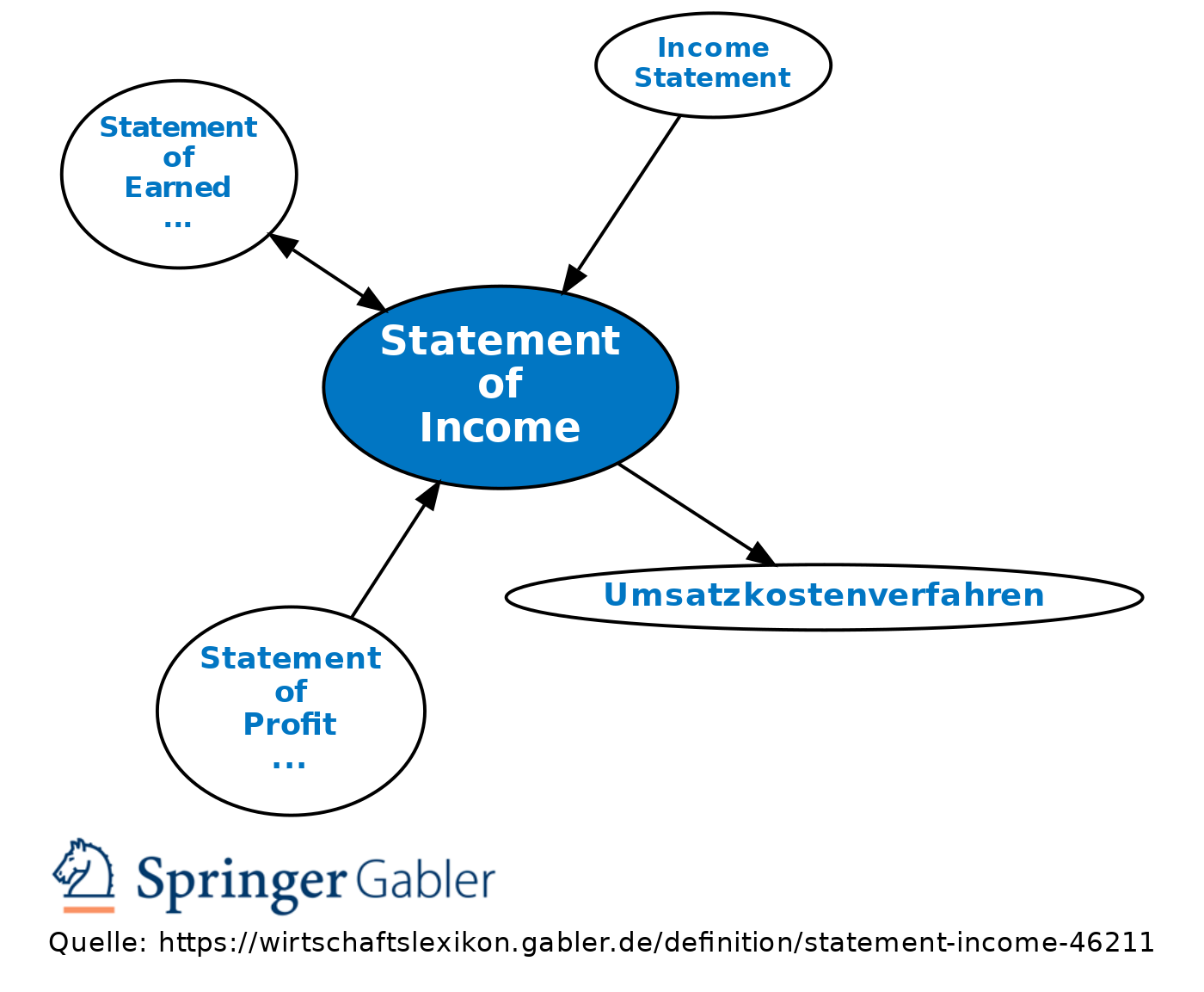

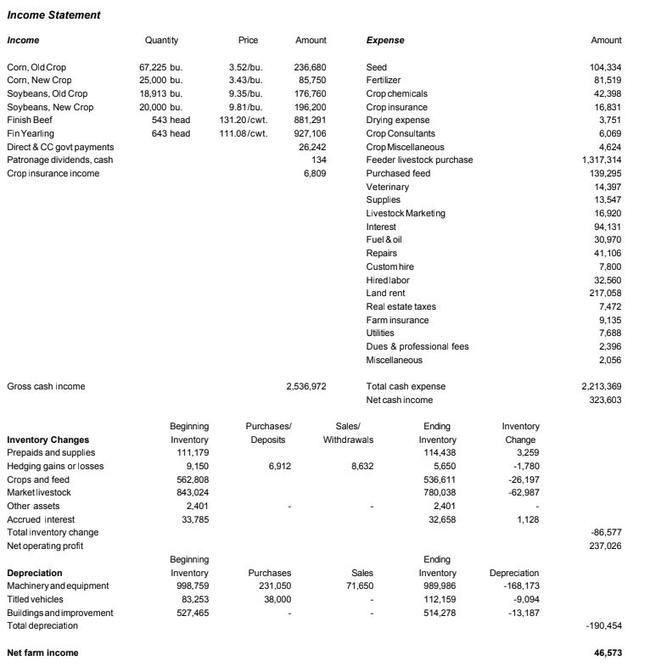

An income statement shows a company’s revenues, expenses and profitability over a period of time.

Social income statement. An income statement, also known as a profit and loss statement (p&l statement), summarizes a business’s revenues and expenses over a. Clause 10 amends section me 1(3)(a) to increase the prescribed amount from $34,216 to $35,204. Introduction compared to traditional accounting, social accounting is a relatively new concept.

Income range where 85% of your social security is taxable. The single step income statement totals revenues and subtracts expenses to find the bottom line. Revenues are streams of income generated from normal.

It refers to the inclusion of a wider range of factors in the. An income statement compares revenue to expenses to determine profit or loss. When you earn more, you will end up paying more in taxes.

With a provisional income of $34,001. Pick a time period for the income statement. The income statement reflects a company’s revenue and expenses, and it ultimately shows the net income of the business over a certain period.

The income statement (also called a profit and loss statement) summarizes a business’ revenues and operating expenses over a time period to calculate the net income for the. It can also be referred to as a profit and loss (p&l). The income statement summarizes the firm’s revenues and expenses and shows its total profit or loss over a period of time.

You can submit your monthly income statement to the department of community services online. What is an income statement? Social income statement part provides social benefits and costs to staff, local community and general public.

You can also view previously submitted income statements (if you submitted the. Asc 205, presentation of financial statements, and asc 225, income statement, provide the baseline authoritative guidance for presentation of the income statement for all us. The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time.

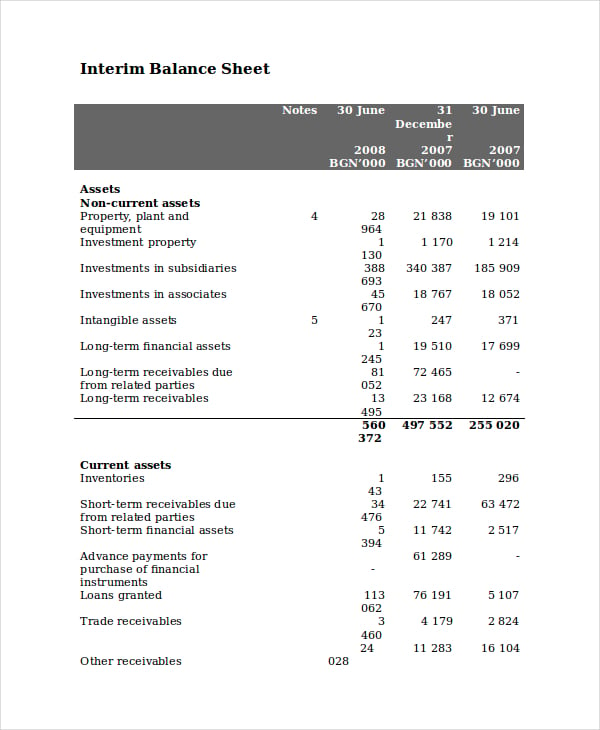

It is useful for people of all ages who want to learn about their future social security benefits and current earnings history. Calculate the cost of goods sold. An income statement is a financial report detailing a company’s income and expenses over a reporting period.

The income statement can be prepared in one of two methods. An income statement includes a company’s revenue, expenses, gains, losses and profit for a specific accounting period. An income statement is a financial statement that reports the revenues and expenses of a company over a specific.

Calculate the revenue earned from the sale of goods and services. Most companies prepare monthly income. (a) net income contribution.