Spectacular Info About Creditable Withholding Tax In Balance Sheet

![[Updated] Monthly Filing of Expanded/Creditable and Final Withholding](https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/382562b64ea10a383e479f8f073ef050/thumb_1200_1553.png)

This would mean that even before filing the income tax return in the philippines, the taxpayer had already.

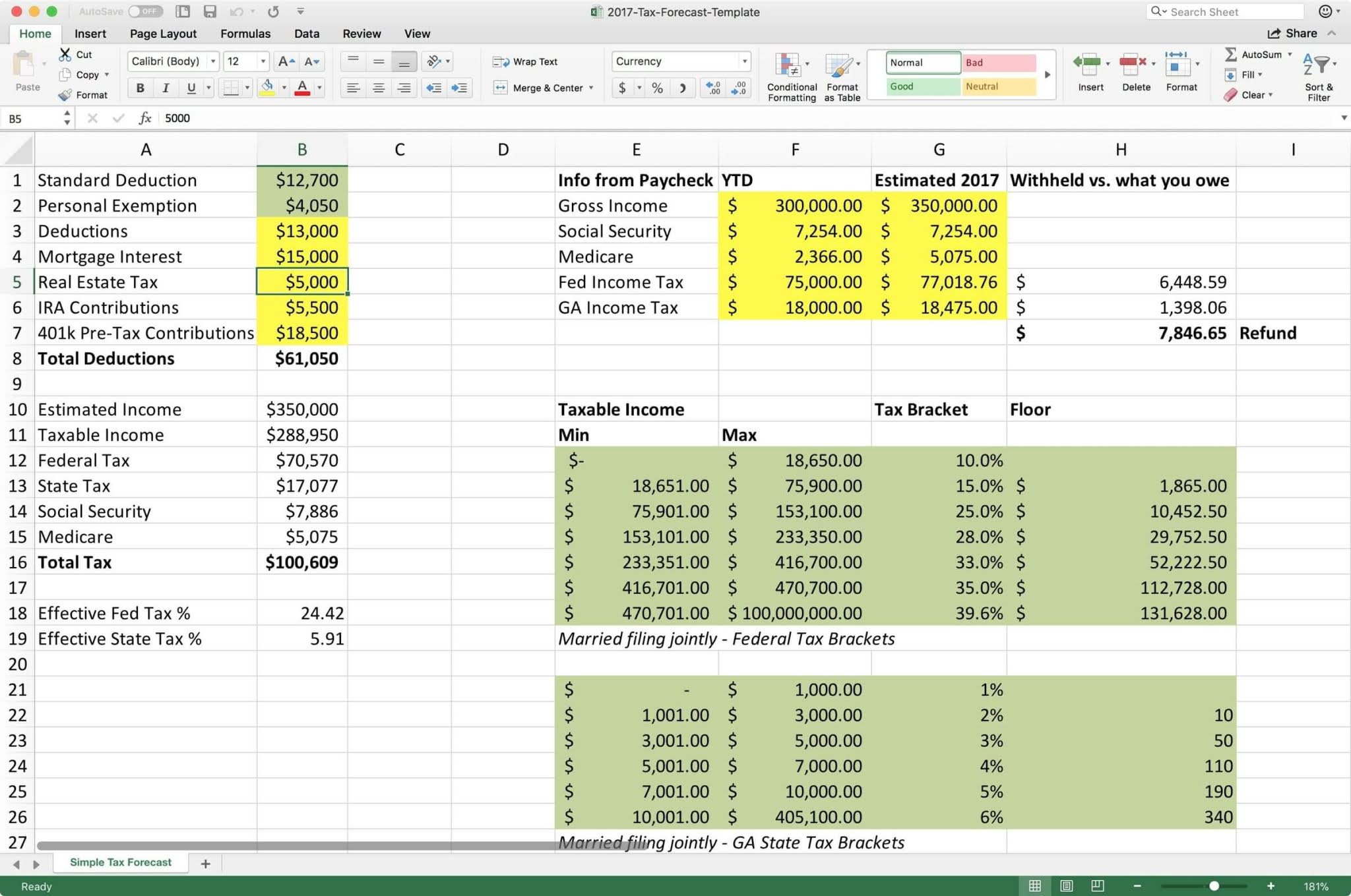

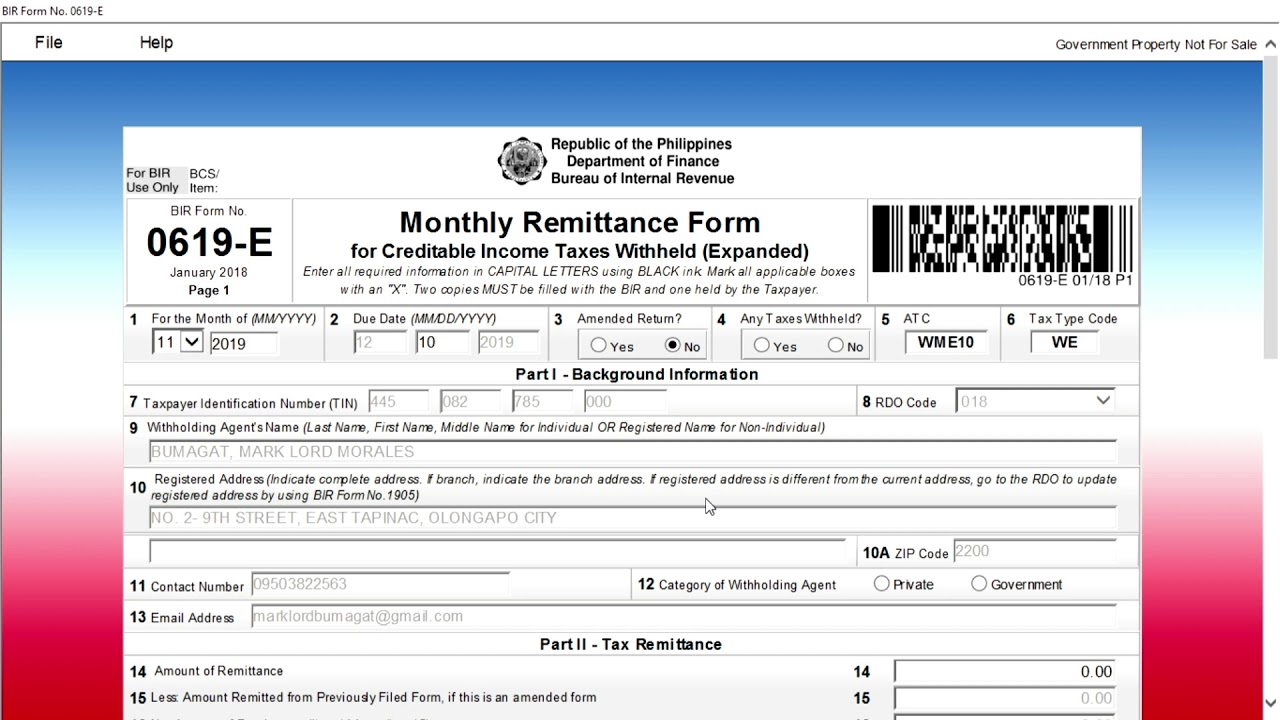

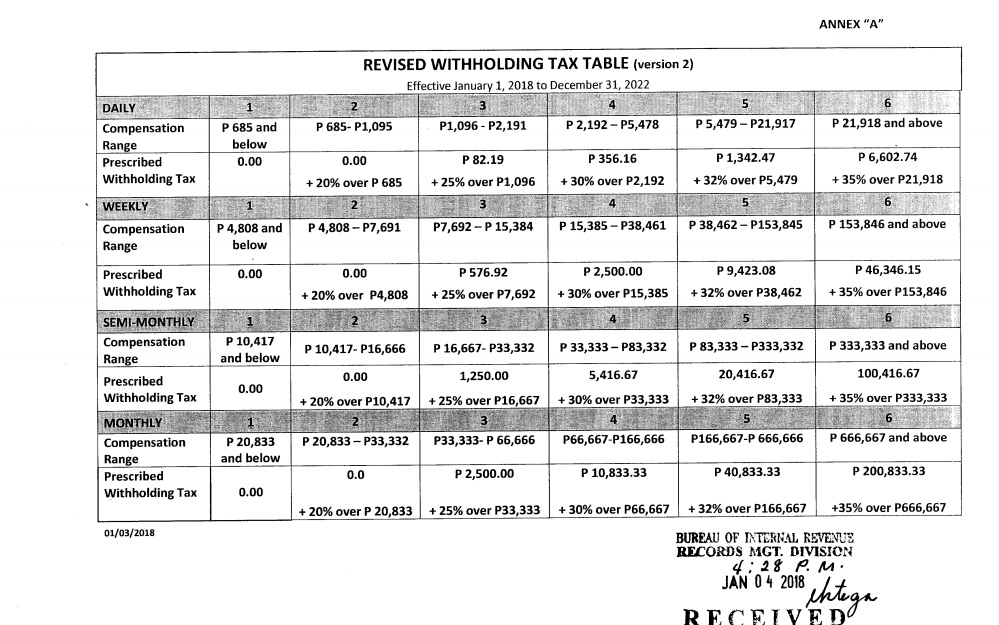

Creditable withholding tax in balance sheet. Withholding tax is used in many tax jurisdictions as an efficient and effective means of tax collection. In ian nettleton edited november 8, 2023 at 11:25am topic tax & filing how do i deal with withholding tax? The withholding tax suiteapp provides the following withholding tax reports for the philippines:

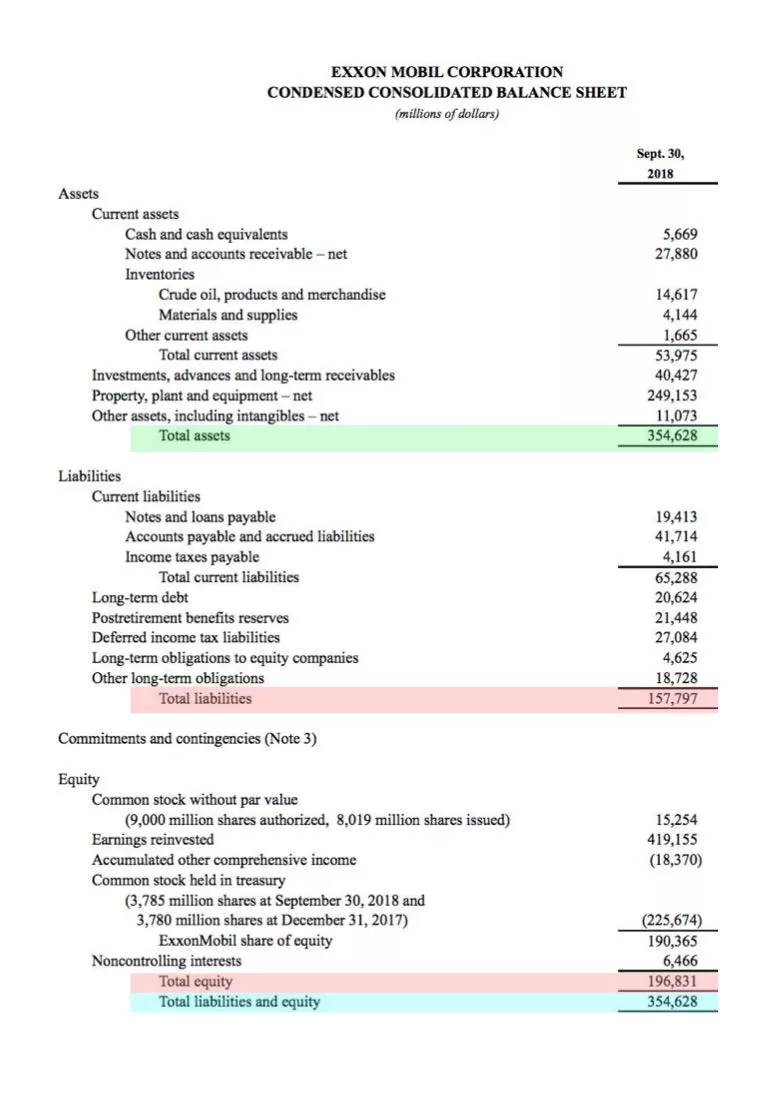

What is creditable withholding tax? For example, if an investor is in the 25% tax bracket, then. As stated under ias 12.46, current tax liabilities are measured at the amount expected to be paid to taxation authorities, using the rates/laws that have been enacted or.

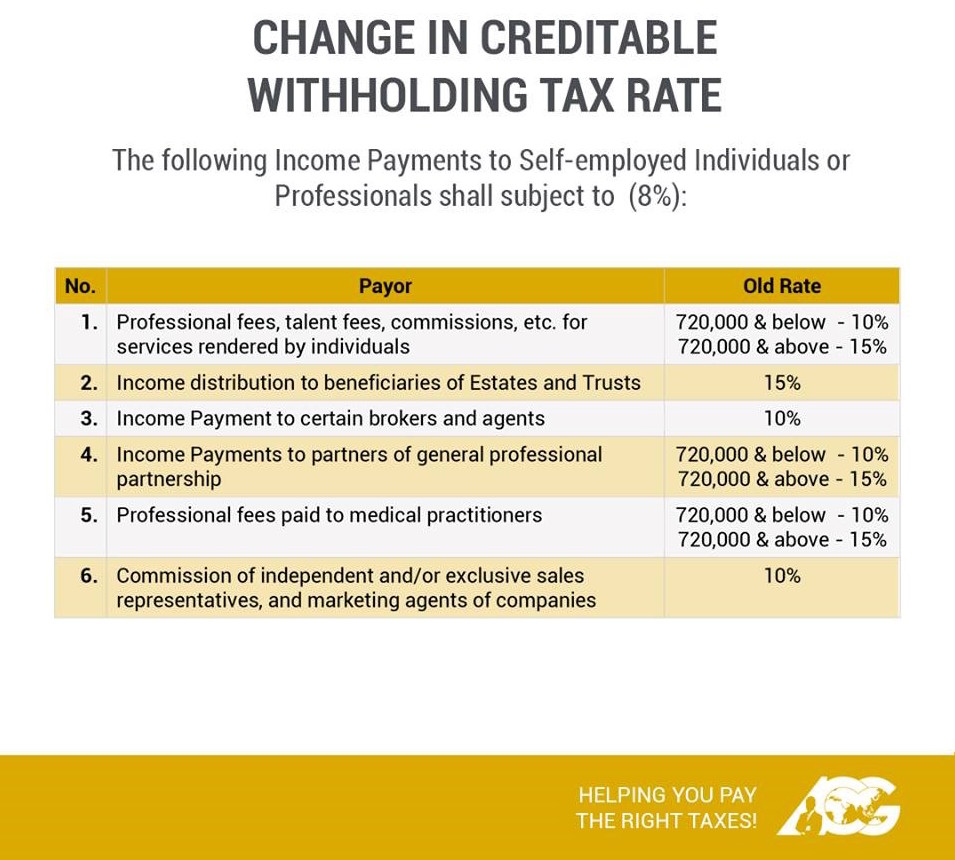

The relevance of creditable withholding tax system. Generally, there are two kinds of withholding tax, final withholding tax (fwt) and creditable withholding taxes (cwt). A payer withholds a set amount.

It also provides that claims for tax credit or refund of any cwt shall be given due course only when (1) it is shown that the income payment has been declared as part. A creditable withholding tax certificate (bir form no. Classification of withholding taxes.

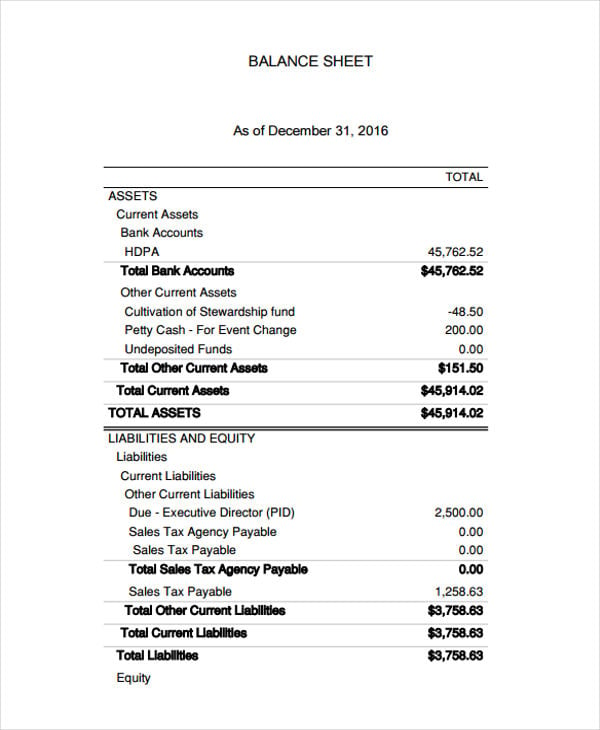

This is known as withholding tax. Explain lifeblood theory of taxation case digests for income taxation ₱666,667 and above prescribed withholding tax 0 0 +20% over ₱20, ₱2,500. Taxpayers pay the tax as they earn or receive income during the year.

When an investor receives dividend income or interest from their investments, the irs requires that a portion of those funds be set aside for taxes. The department of finance (dof) issued the following revenue regulations (rr): Creditable withholding tax systems are essentially the same as any other withholding of tax regimen.

Creditable withholding tax is an advance income tax of the payee. 2307) is a certificate to be accomplished and issued to recipients of income subject to expanded. How do i deal with withholding tax?

Certificate of creditable tax withheld at source (form 2307) monthly. Under the fwt system, the amount of. The amount of tax that is withheld depends on the investor’s tax bracket.

The term “creditable” means the taxes withheld (cwt withheld) are deductible from the income tax due the taxpayer payee (or can be offset against the. This loss to the taxpayer defeats the very intention of the withholding tax system, which is to. The tax base of an item is crucial in determining the amount of any temporary difference, and effectively represents the amount at which the asset or.

![[Updated] Monthly Filing of Expanded/Creditable and Final Withholding](https://www.grantthornton.com.ph/globalassets/1.-member-firms/philippines/tax-alerts/2018/02.08.2018/withholding.jpg)

![[TOPIC 16] WITHHOLDING TAX SYSTEM Final and Creditable (Expanded](https://i.ytimg.com/vi/afPgHThPH-E/maxresdefault.jpg)