Have A Tips About Cost Of Revenue Income Statement

An income statement doesn’t just show.

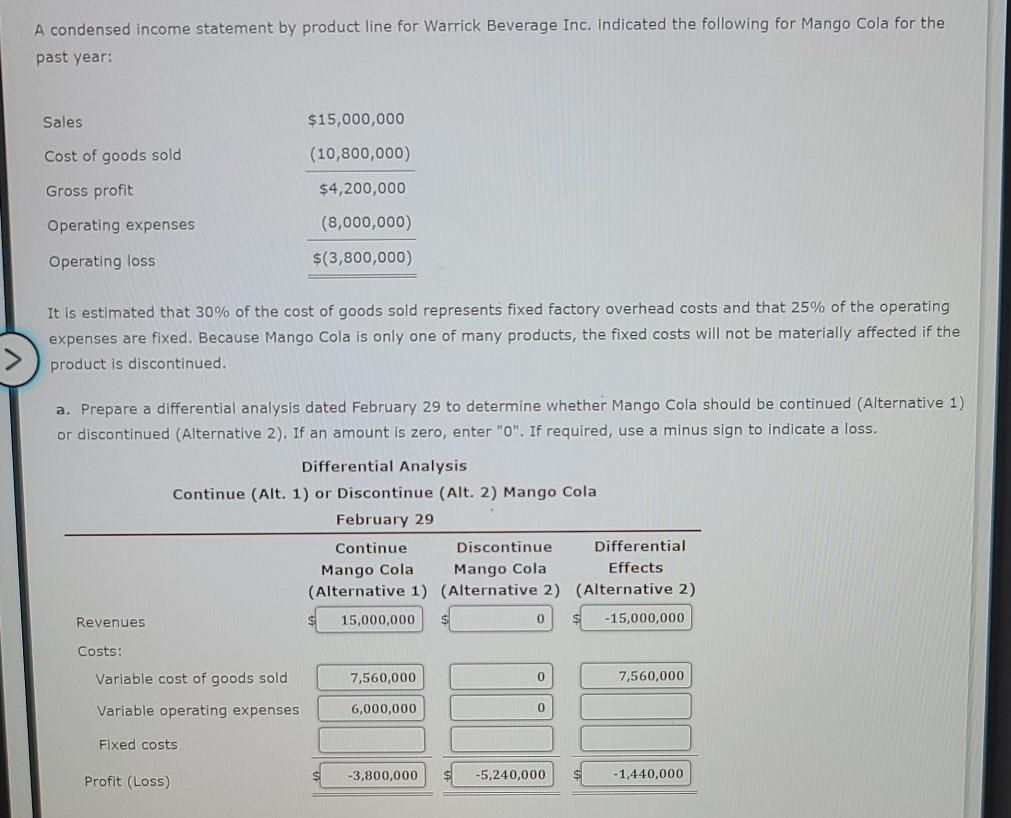

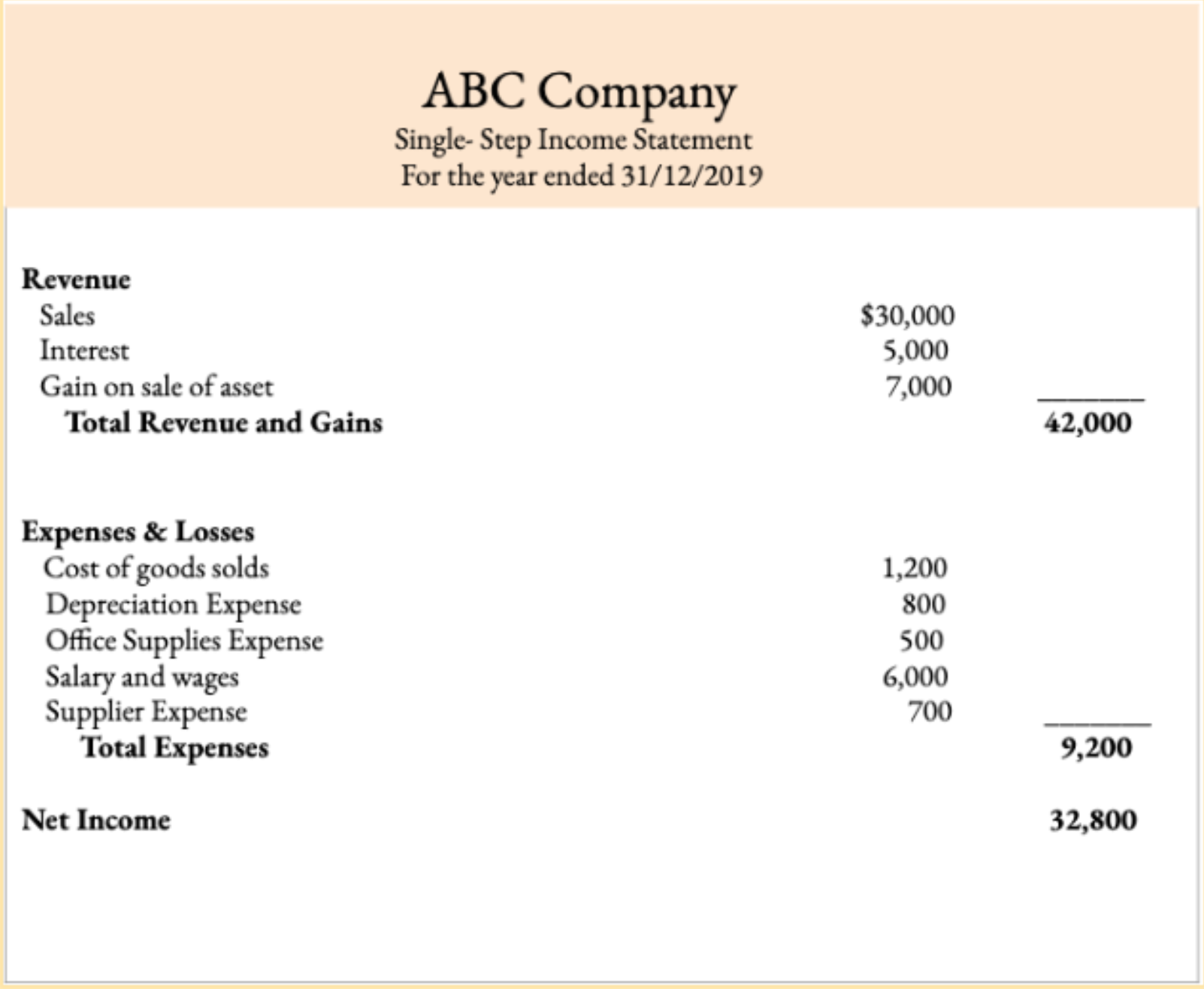

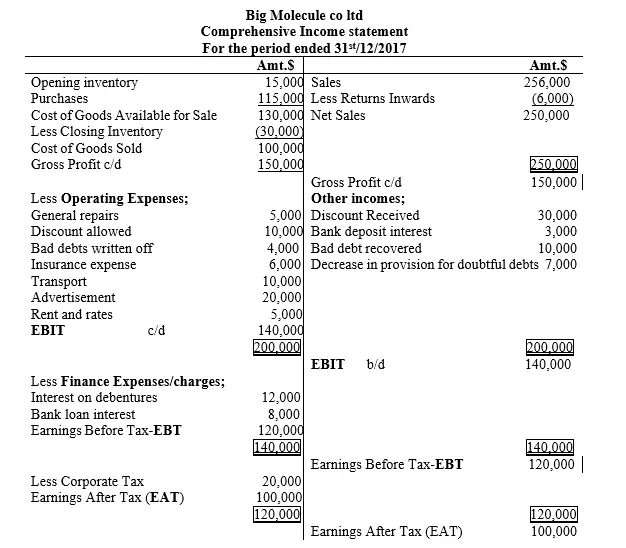

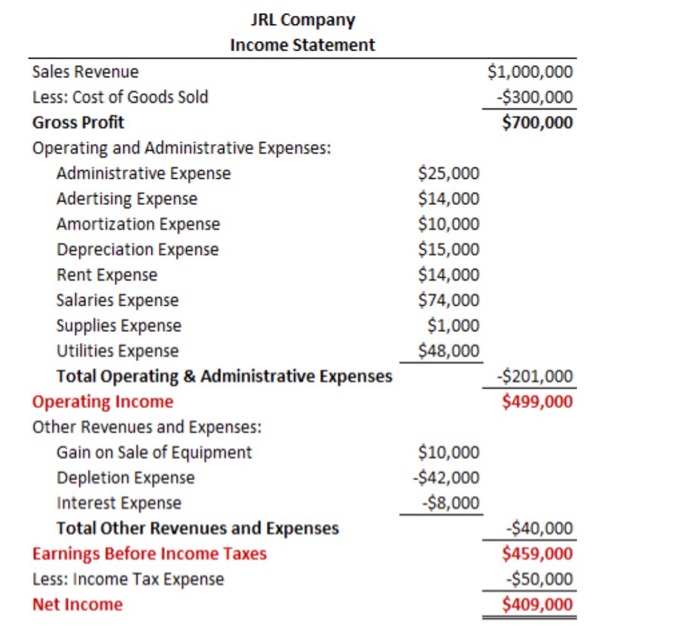

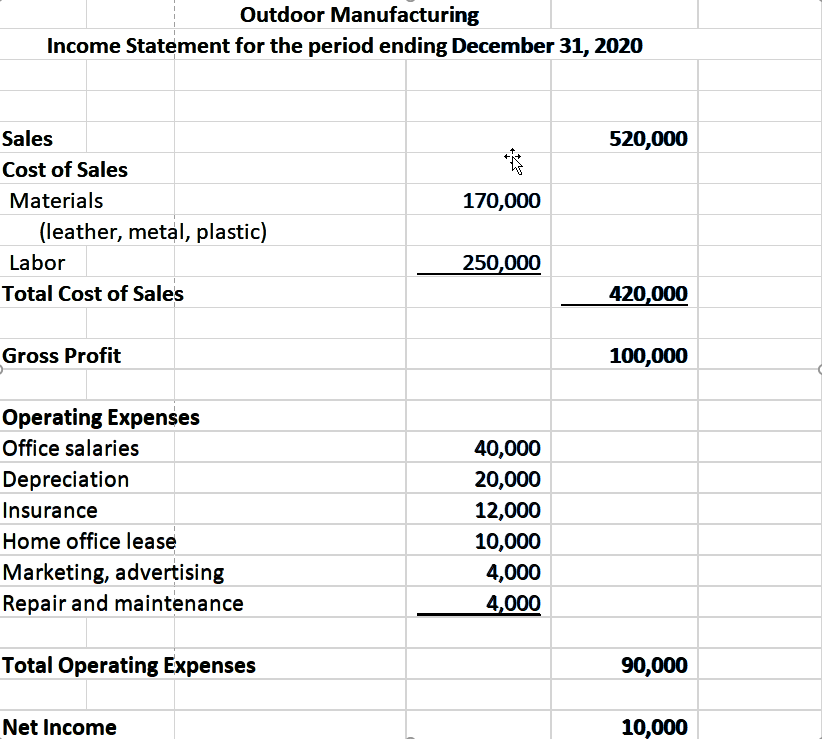

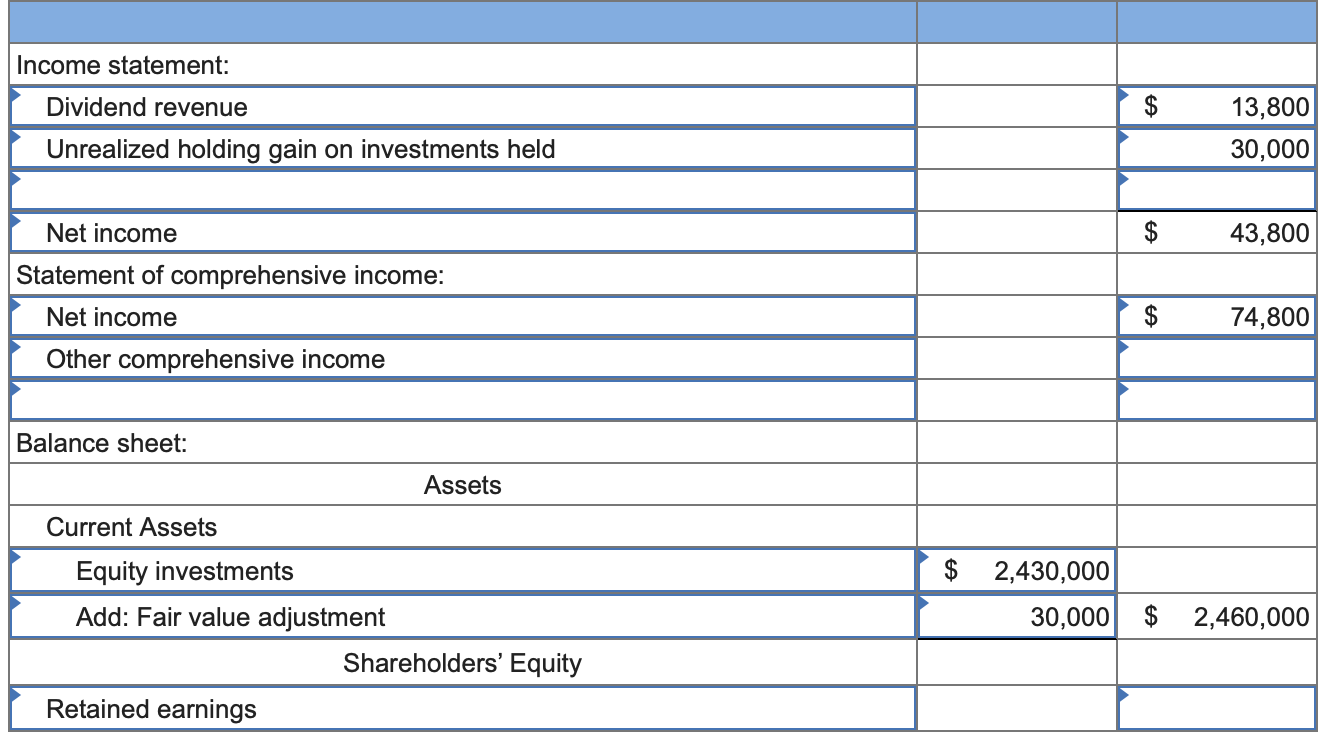

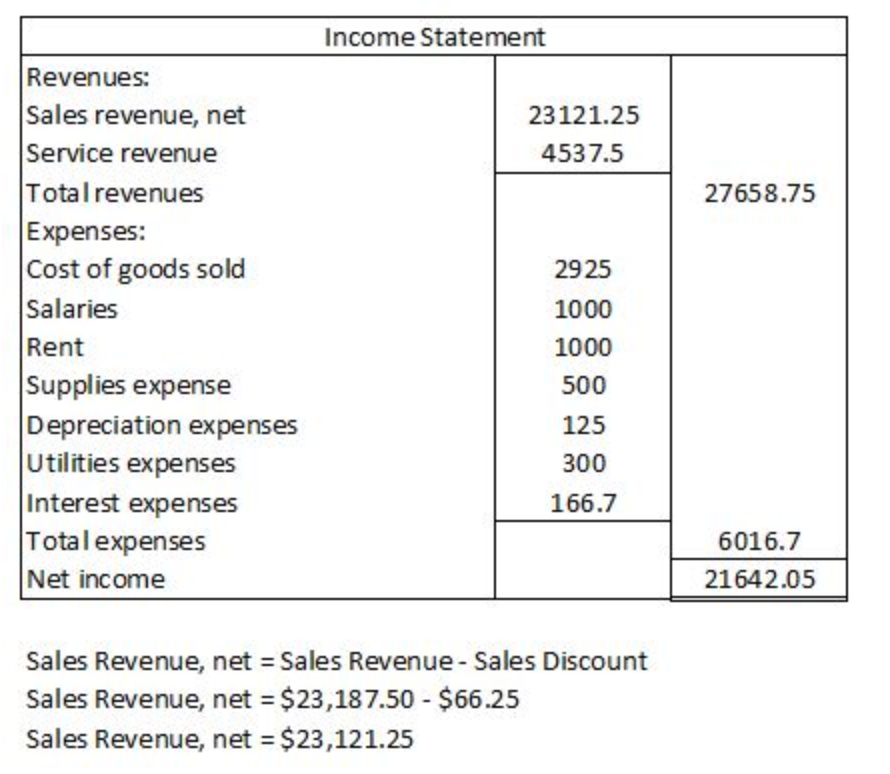

Cost of revenue income statement. 3 elements of income statement. As an example, here is the cost of revenue for the insurance company atlantic american corporation for the fiscal year ending on december 31, 2021: The three main elements of income statement include revenues, expenses, and net income.

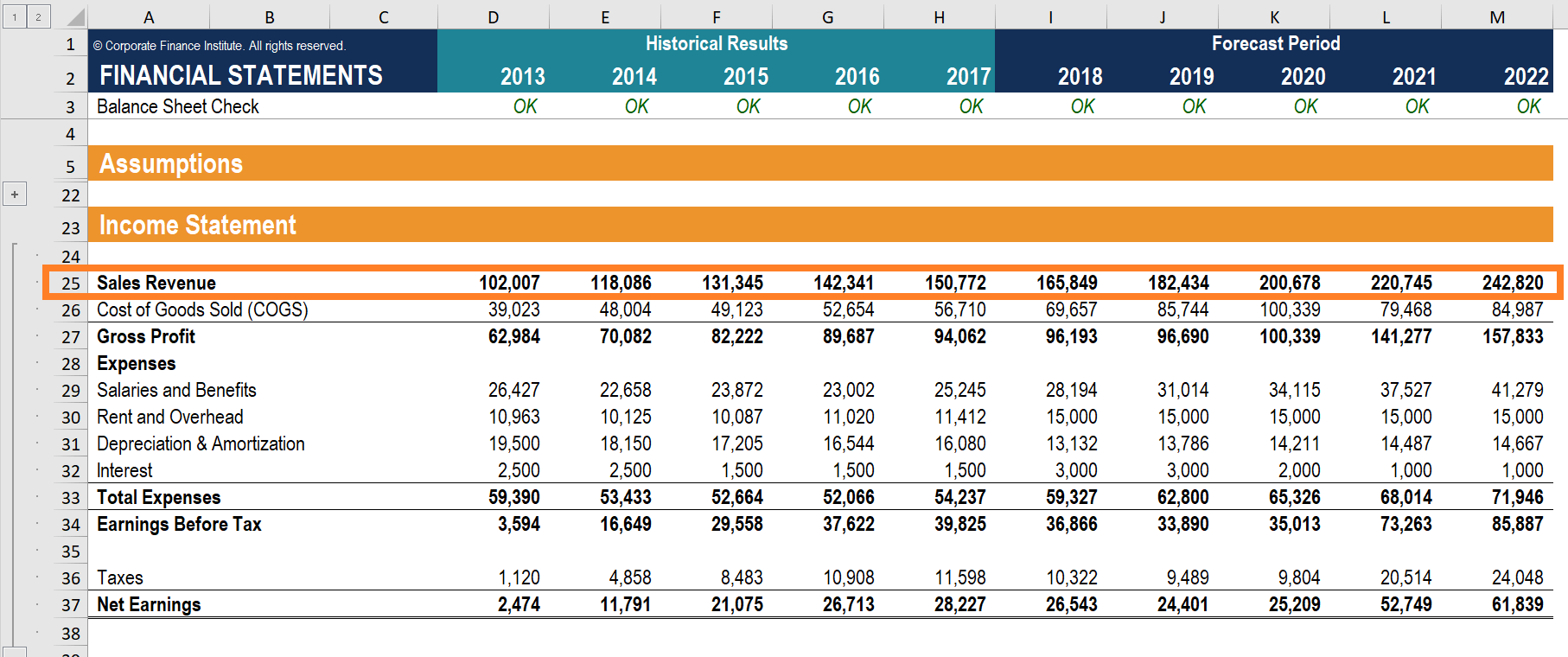

It is designed to represent the direct costs associated with the goods and services the company provides. This income statement shows that the company brought in a total of $4.358 billion through sales, and it cost approximately $2.738 billion to achieve those sales, for a gross profit of $1.619 billion. Revenue is the money generated from normal business operations, calculated as the average sales price times the number of units sold.

Yarilet perez what is revenue? Calculate the cost of revenue step 5:

For the quarter, gaap earnings per diluted share was $4.93, up 33% from the previous quarter. The cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company while attempting to generate revenue. Cost of goods sold (cogs) common pitfalls and best practices utilizing cost of revenue in financial analysis

Santa clara, calif., feb. An income statement (also called a profit and loss statement, or p&l) summarizes your financial transactions, then shows you how much you earned and how much you spent for a specific reporting period. Not only does it help in profit calculation but also in cost optimization.

Cost of goods sold examples (cogs) purchase of. Define cost of revenue step 2: Nvda) today reported revenue for the fourth quarter ended january 28, 2024, of $22.1 billion, up 22% from the previous quarter and up 265% from a year ago.

The income statement communicates how much revenue the company generated during a period and what costs it incurred in connection with generating that revenue. How much money a business took in during a reporting period; Revenues are the incomes that the company generates from the sale of goods or services or other activities related to the main operation of the company’s business.

These revenues from net cost yields the federal government’s “bottom line” net operating cost of $3.4 trillion referenced above. Cost of revenue excluding d&a: Introduction to cost of revenue step 1:

Cost of revenue information is found in a company's income statement. The cost of revenue is the sum of the cost of labor, materials, marketing, distribution, and sales discounts. The cost of revenue is the total cost incurred to obtain a sale and the cost of the goods or services sold.

For example, on december 31, 2020, company abc decided to create its income statement. Add up all your revenue from sales during the reporting period and deduct your returns and concessions. Generally, any costs that are directly connected with manufacturing and distribution of goods and services can.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)