Underrated Ideas Of Info About Bad Debts In Profit And Loss Account

In addition to the $354.9 million judgment in the civil fraud.

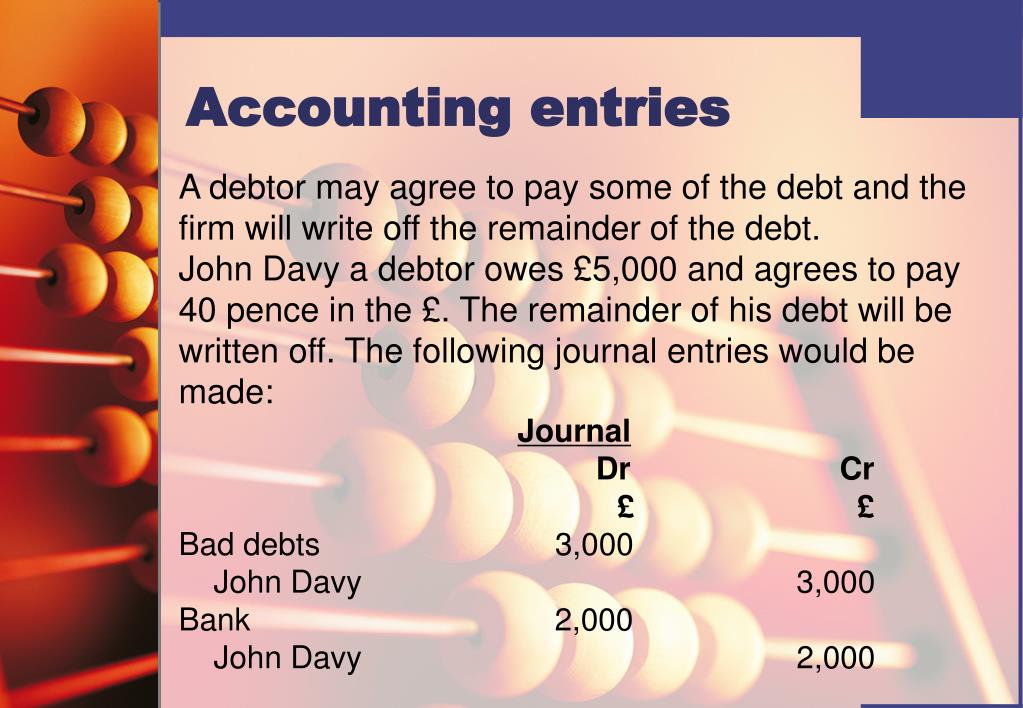

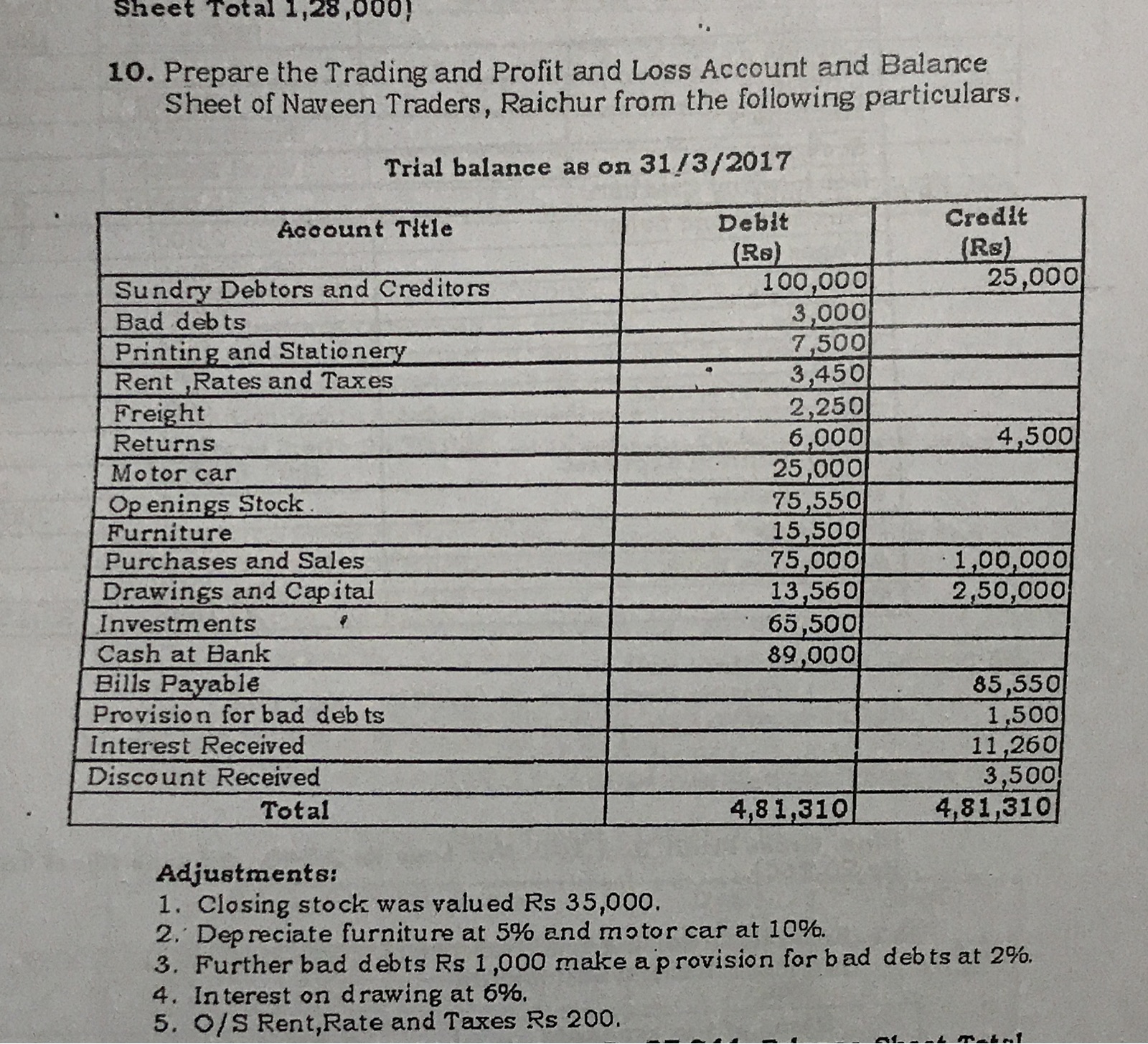

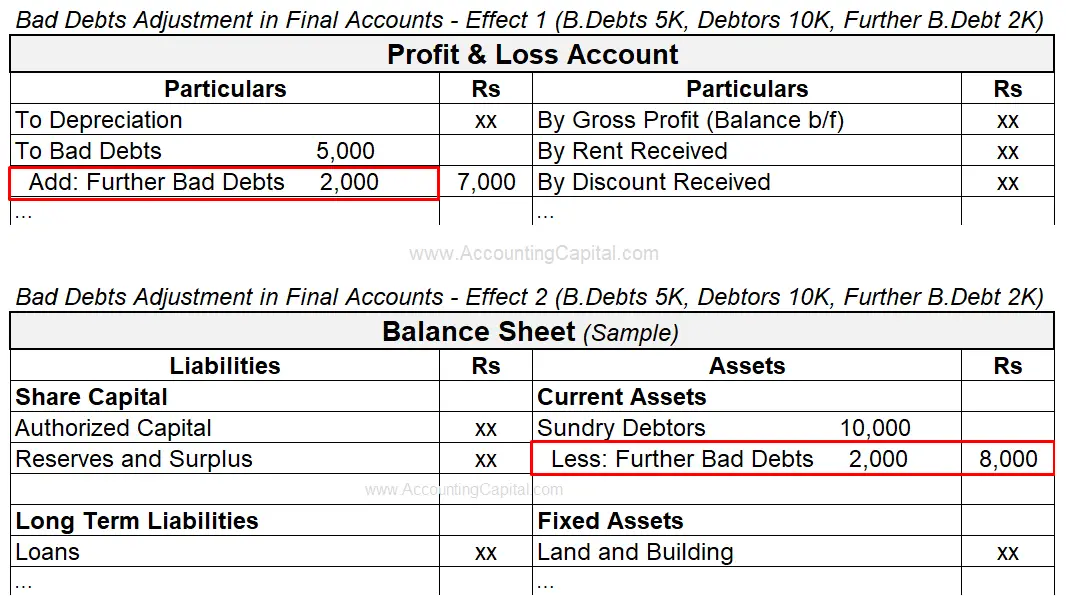

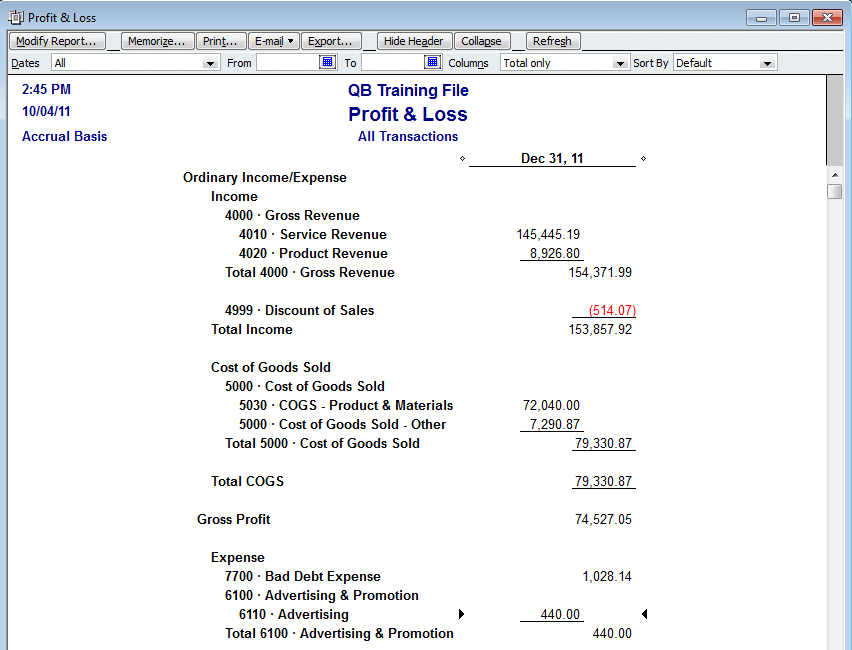

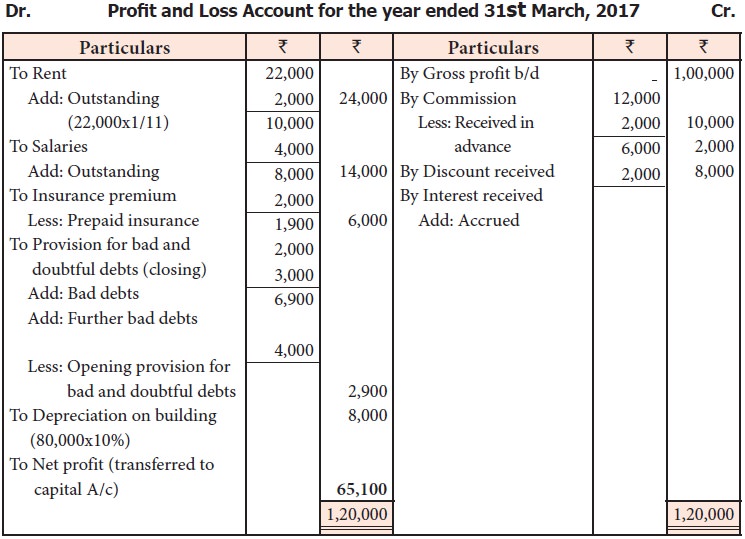

Bad debts in profit and loss account. The debtor’s account is then closed and the bad debts account is transferred, at the end of the year, to the debit side of profit and loss account. At the end of 2017, provisions for bad debts should be 2% of $432,000 = $8,640. The amount goes into the statement of profit or loss as an expense and is deducted from the receivables figure in the statement of financial position.

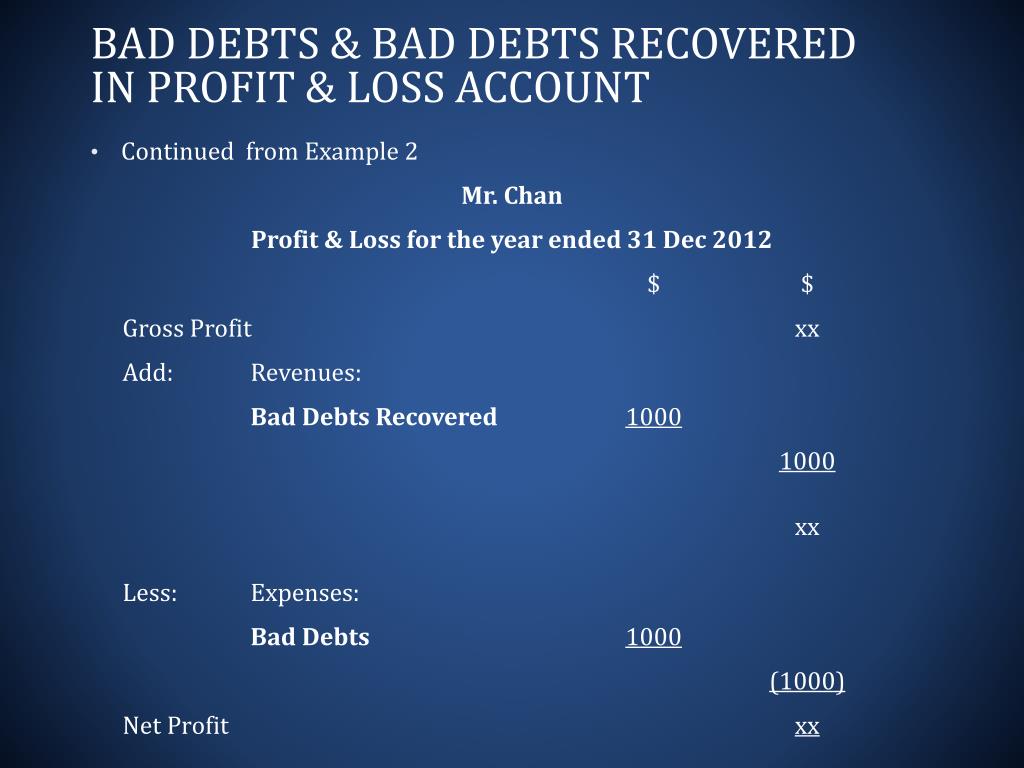

In case if bad debts are recovered, so it is again. Bad debts are those items of charge on the profits of the company that indicate the sums of money that could not be recovered from a debtor, during the year. Solution verified by toppr this provision is created by debiting the profit and loss account for the period.

Know more about bad debts with example, how to. A bad debt expense is a portion of accounts receivable that your business assumes you won’t ever collect. Bad debt is a reality for businesses that provide credit to customers, such as banks and insurance companies.

Bad debt refers to loans or outstanding balances owed that are no longer deemed recoverable and must be written off. It may be included in the company's selling, general and administrative expenses. Provisions for bad debts account, with the amount of anticipated bad debts at the end of each subsequent financial year, the balance of the provision for bad debts account is adjusted to the correct level of expected bad debts for the next year.

Incurring bad debt is part of the cost of doing business with customers, as. So we need a bad debt provision of £600, £100,000 x 0.6%. In case if the provision is already made for bad bets than it is first written off from it.

The ban on applying for loans from banks registered or chartered in new york could severely restrict trump's ability to raise cash. Profit and loss account bad debts is treated as an expense and debited to profit and loss account. This year the debtors are now £100,000, and we expect 0.6% of these to go bad, based on previous experience.

Provision for bad debts account; The nature of various debts decides the amount of doubtful debts. We debit this amount to profit and loss a/c.

Every business has its own process for classifying outstanding accounts as bad debts. Where is bad debt expense reported? A provision for bad and doubtful debts is created so that the debtors who are not able to make the payment of their liability on the due date has no major effect on the profits of the current year and the.

Provision is created out of profits of the current accounting period to reduce the amount of loss that may take place in the future. If provision for doubtful debts is the name of the account used for recording the current period's expense associated with the losses from normal credit sales, it will appear as an operating expense on the company's income statement. If you started with zero allowance for bad debt on the balance sheet and you recorded $500 of bad debt expense, the bad debt expense journal entry would increase bad debt expense on the profit & loss report by $500 and also increase the allowance for doubtful accounts (a reduction of assets) by $500.

However, there is already a provision of £500,. To the debtor’s (by name) account. Bad debts are the debts which are uncollectable or irrecoverable debt.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)