Smart Info About Revolving Fund In Balance Sheet

Under the second method, $6 million of the debt would be classified as noncurrent.

Revolving fund in balance sheet. Revolving funds must be held in interest bearing accounts, and interest paid on revolving fund balances must be remitted to the u.s. Such statements and balance sheets should reflect the. Off balance sheet financing is used by many businesses as an accounting tool and for raising additional capital from investors.

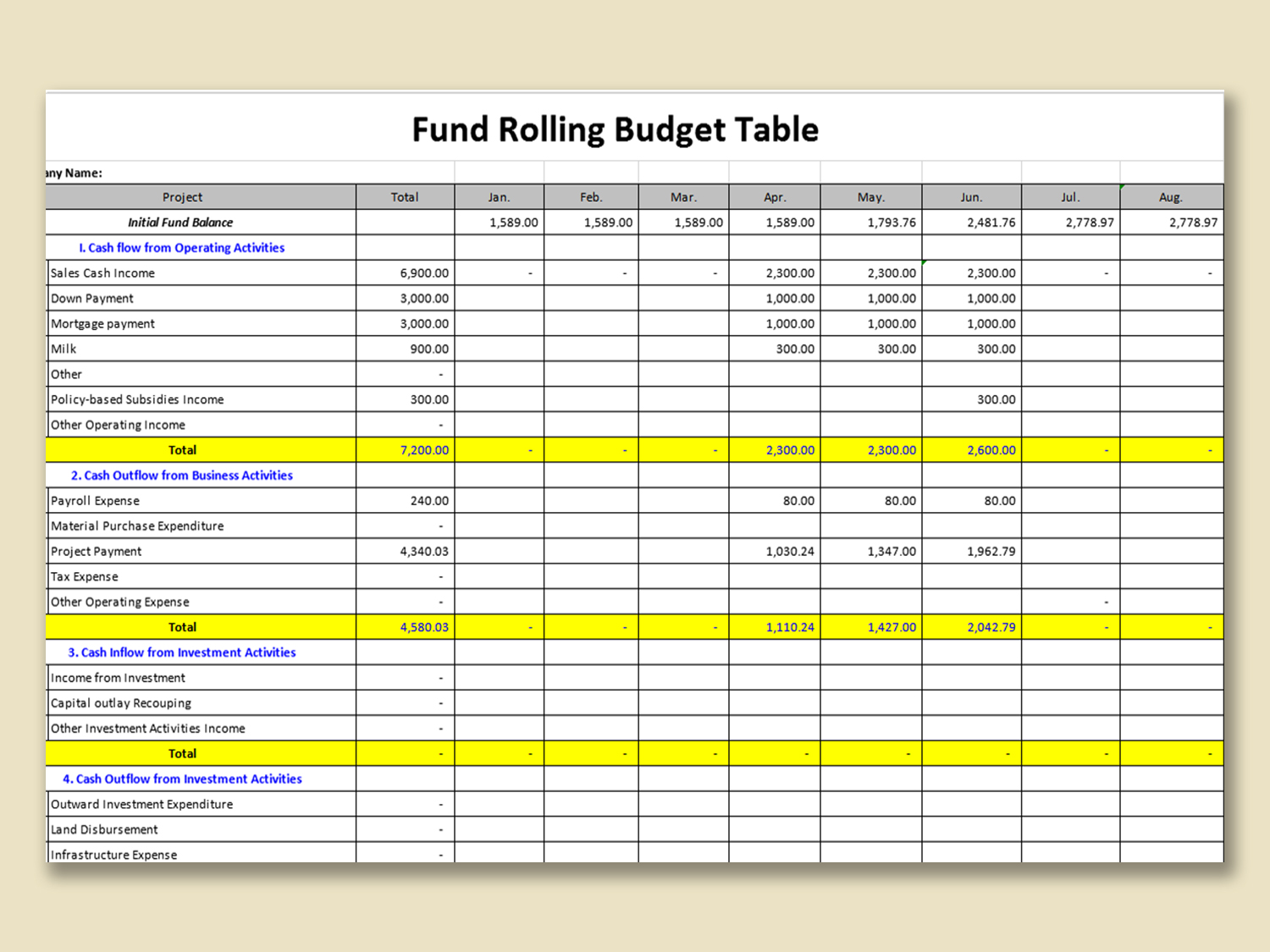

Of, relating to, or being credit that may be used repeatedly up to the specified limit and is. A revolving fund is a fund or account that remains available to finance an organization's continuing operations without any fiscal year limitation, because the organization. A revolving credit facility is one of the forms of business finance in which flexibility is provided to the companies to borrow and use the financial institution’s funds according.

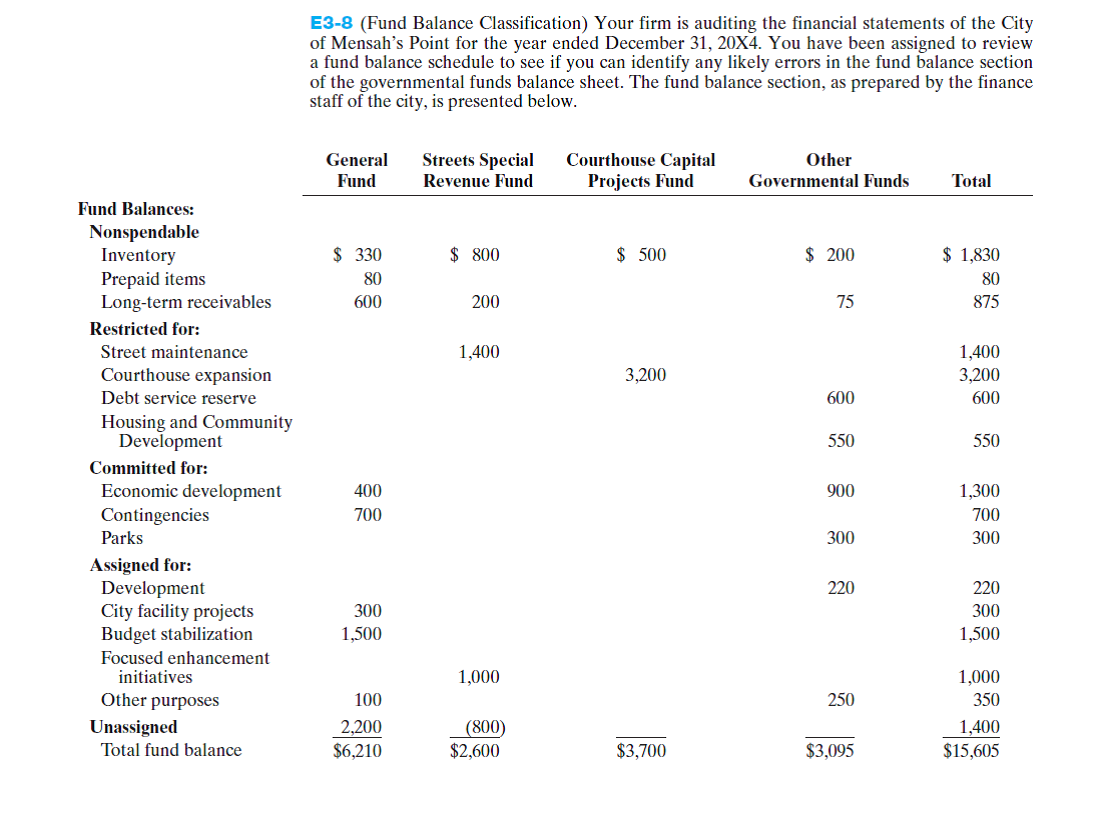

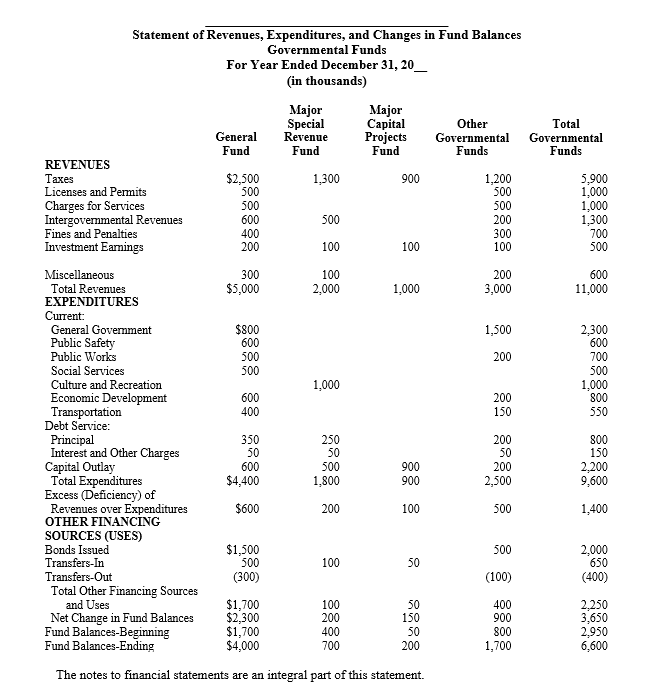

On december 28, 2016, concluding that there of was a congestion revolving fund loans and elimination problems. Public enterprise funds, intragovernmental revolving funds, and trust revolving funds. Statement of revenues, expenditures, and changes in fund balances 43 governmental include a summary reconciliation (net position & change in net.

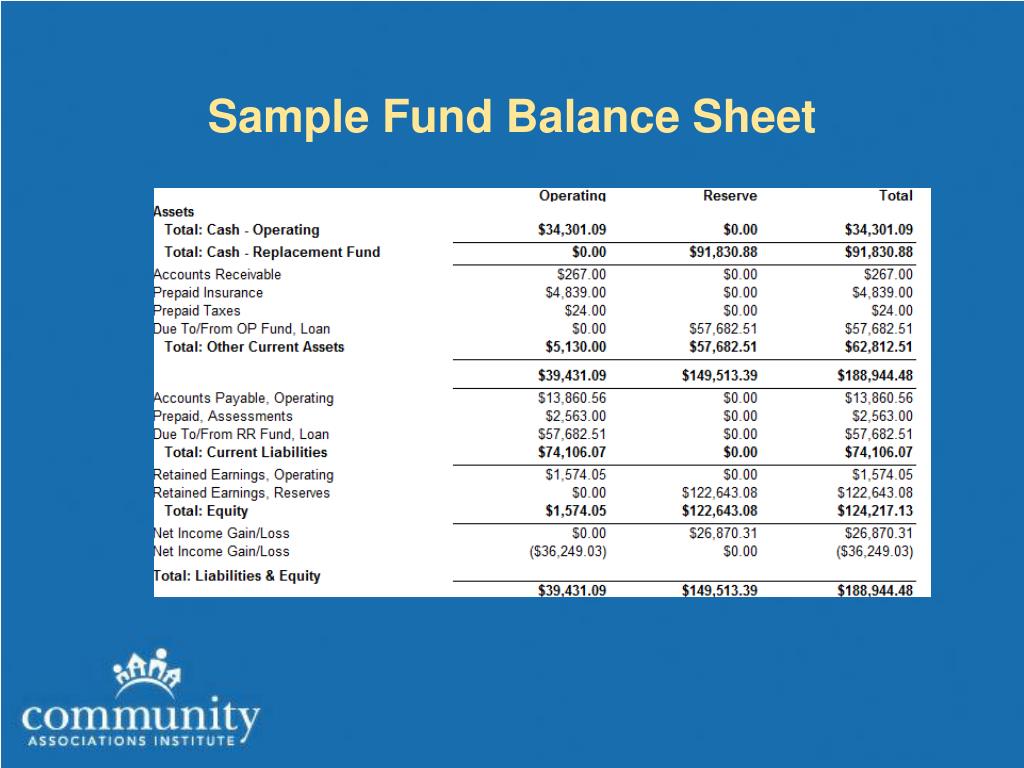

A revolving fund is an available loan balance that is replenished as a borrower pays back a lender. Revolving fund receivables from the balance sheet are important. The approach of ‘revolving fund’ would be an appropriate solution to finance for the community initiatives in water and sanitation sector, particularly for managing drinking.

A state ministry/institution extends revolving fund financing to the public, which then repays. Under the first method, all of the debt would be noncurrent because fsp corp is not in violation of the covenant (i.e., it has a sufficient borrowing base at the balance sheet date). Treasury not less than annually.

The amount can then be. October 20, 2023 what is a revolving fund? The authorized balance of imprest, petty cash and other revolving funds should be reported as cash in the general ledger in whichever fund expenditures are expected to.

The revolving funds in the other funds category consist of the following: There are three types of revolving funds: Fund and did not report the revolving fund as an asset in its balance sheet.

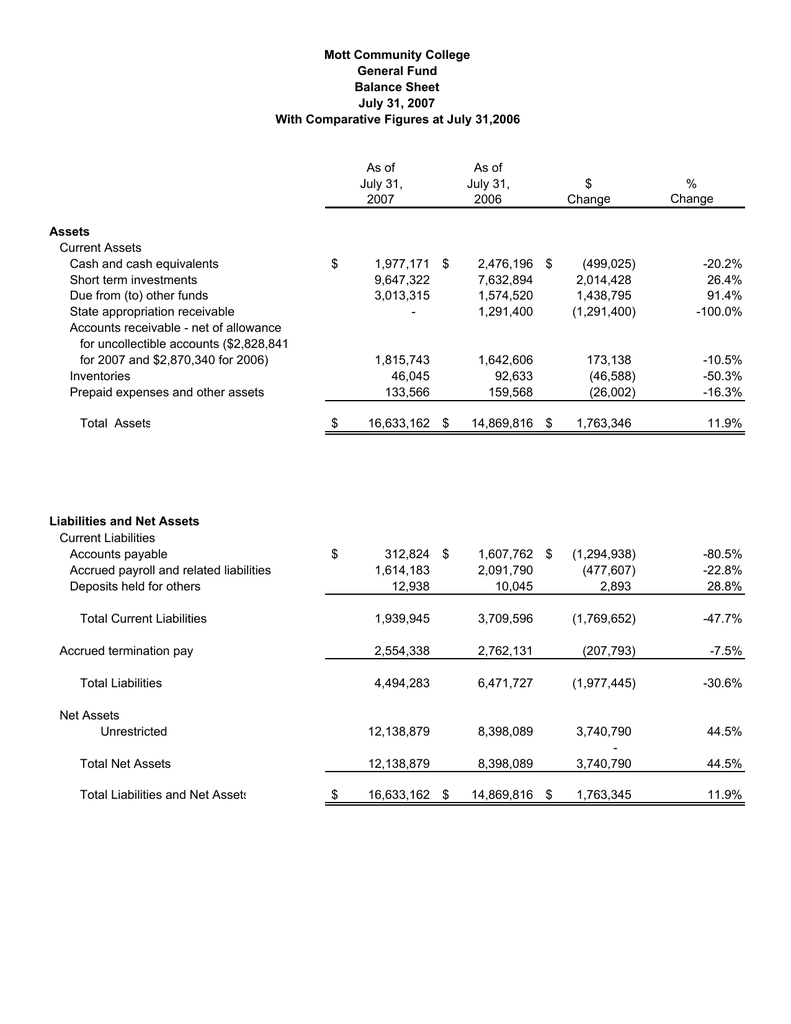

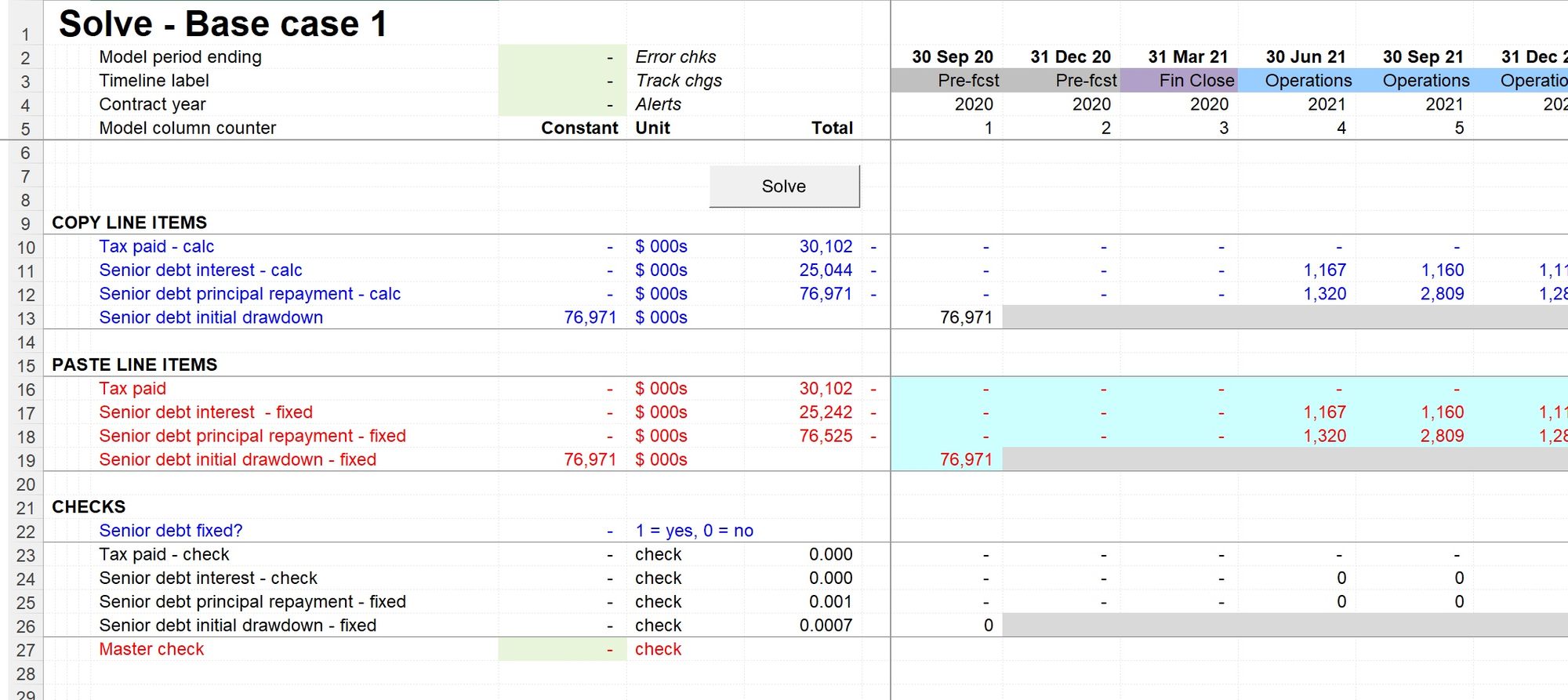

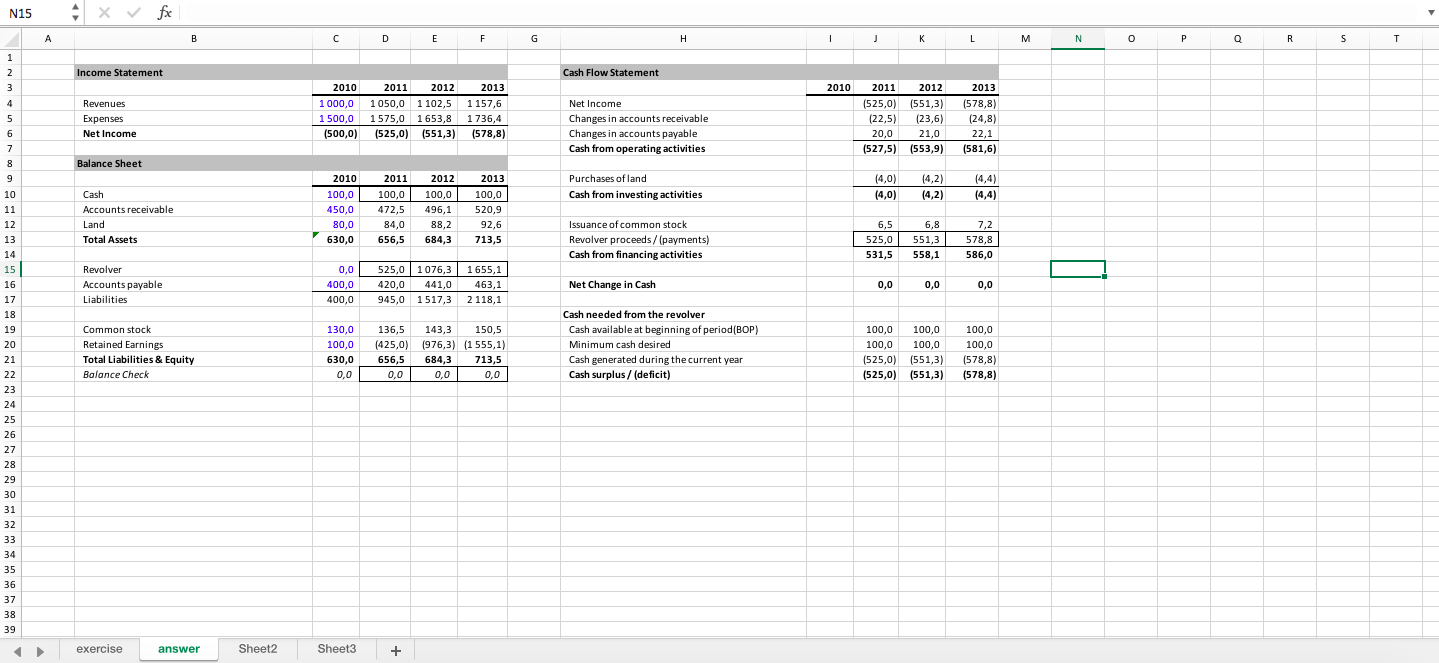

When a company applies for a revolver, a bank considers several important factors to determine the creditworthiness of the company. Comparatively, the cash balance was $575.3 million at september. This model will demonstrate how modeling the revolving credit line can work within a 3 statement model (consisting of income statement, balance sheet and cash.

Project pro forma balance sheets, income statements, cash flow, and supporting statements of the applicant.