Can’t-Miss Takeaways Of Info About Total Debt On A Balance Sheet

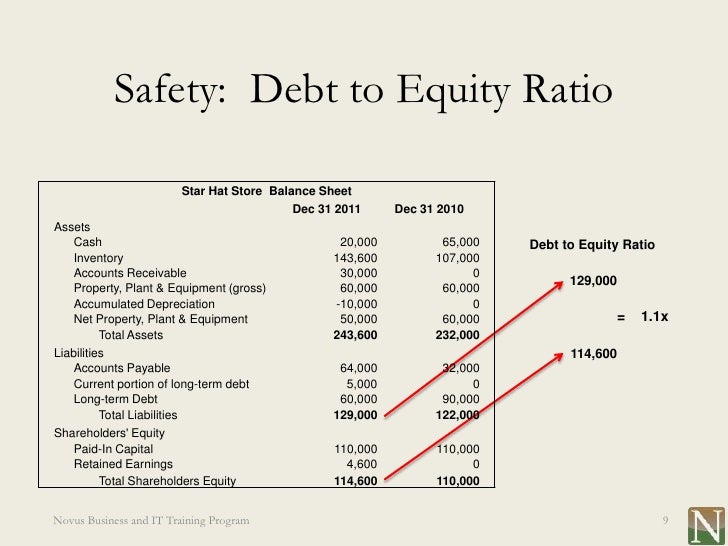

Debt + equity) to gauge the company’s reliance on debt financing.

Total debt on a balance sheet. Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable. Let’s say there’s a company with the following balance sheet data: Microsoft excel provides a balance sheet template that automatically calculates financial ratios such as d/e ratio and debt ratio.

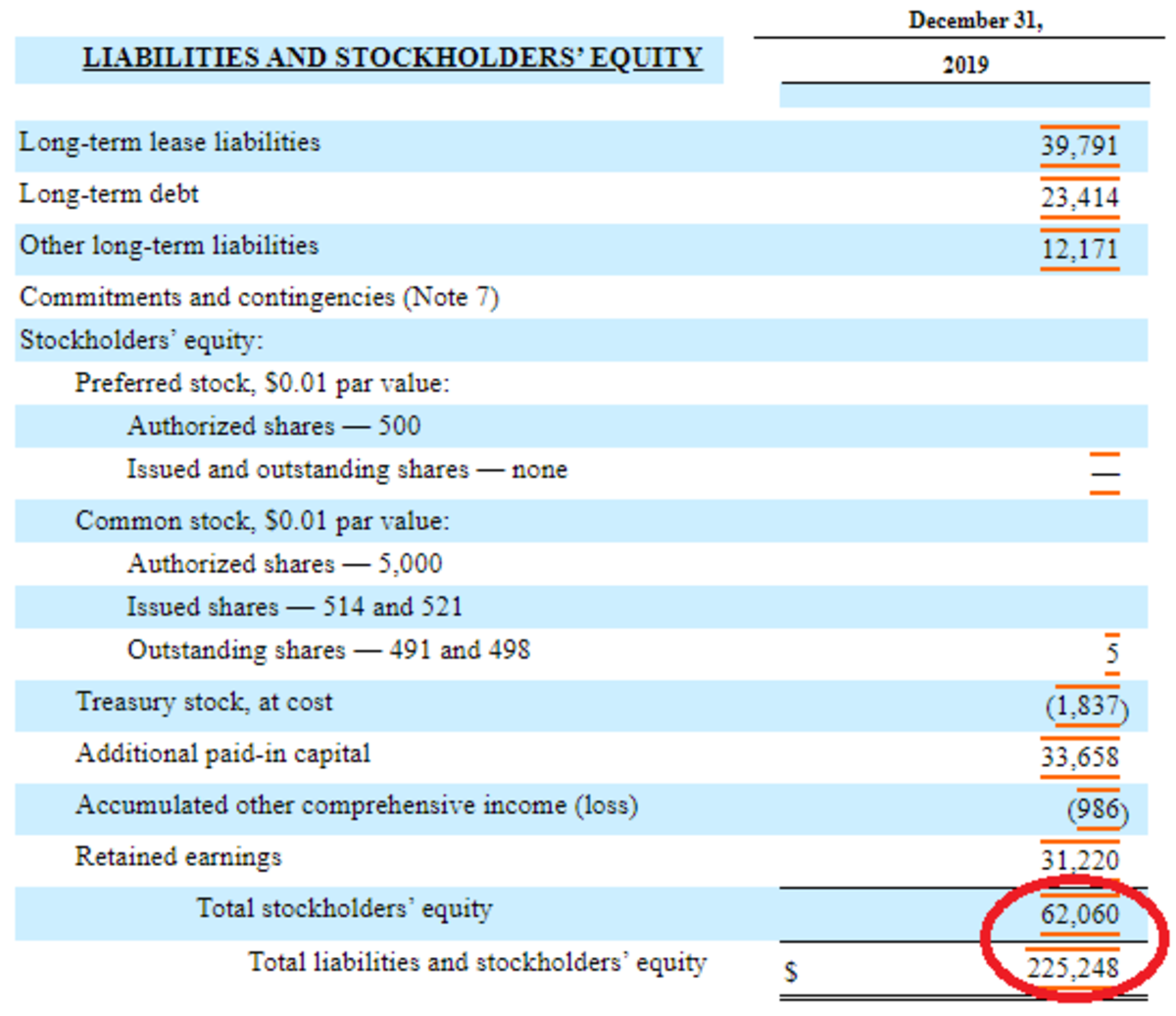

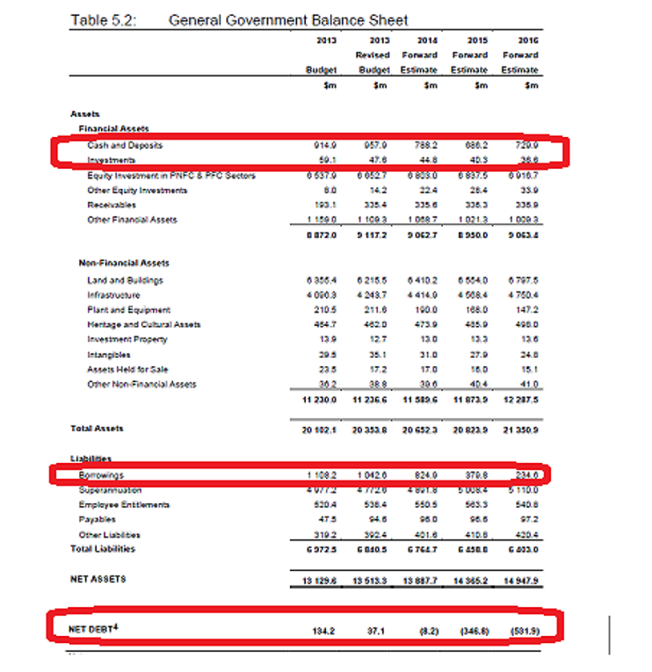

Excel formula to calculate tds ratio: In a balance sheet, total debt is the sum of money borrowed and is due to be paid. For example, a company’s debt balance can be compared to its total capitalization (i.e.

Figuring out your total debt may not be at the top of your financial agenda, but it's an important number to know. Total liabilities are the combined debts that an individual or company owes. Debt ratio = total debt / total assets.

Learn how to calculate your. Fact checked by vikki velasquez what is the debt ratio? =sum (debt/income)*100 in the example above (gross income of $11,000 and debt obligations of $4,225), the excel.

The best way to track your expenses each month is through the use of a balance sheet, which includes the total debt or liabilities a business has. Did you get it ⬇️樂 question: This formula is important because it gives you an overhead look at all your.

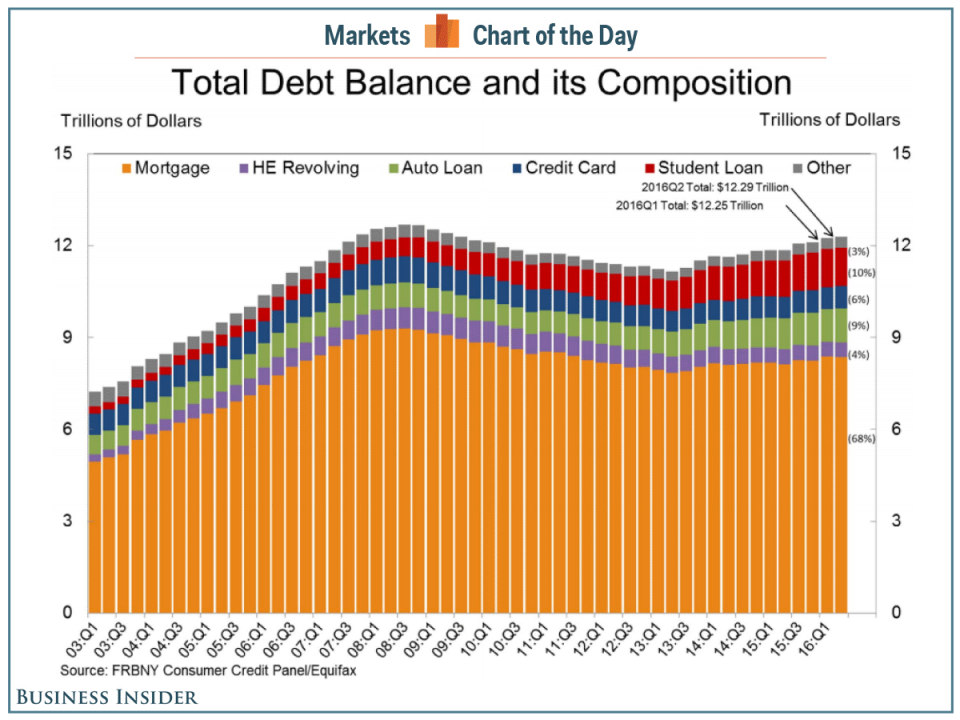

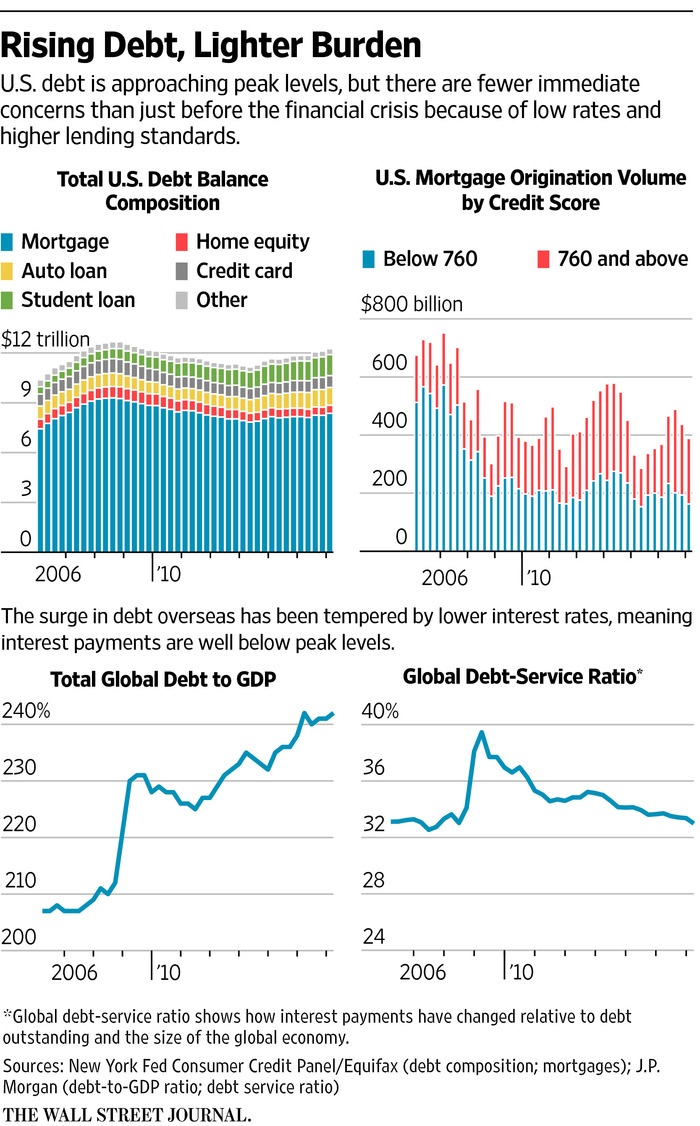

There are many classes of debt, ranging from mortgages held on various properties to lines of credit. Identifying a complete list of items. Total assets = $70 million.

They are generally broken down into three categories: Total debt = $30 million. The term debt ratio refers to a financial ratio that measures the extent of a company’s leverage.

Leverage ratio calculation example. Share your feedback. Or you could enter the values.