Neat Info About Direct Method And Indirect Cash Flow

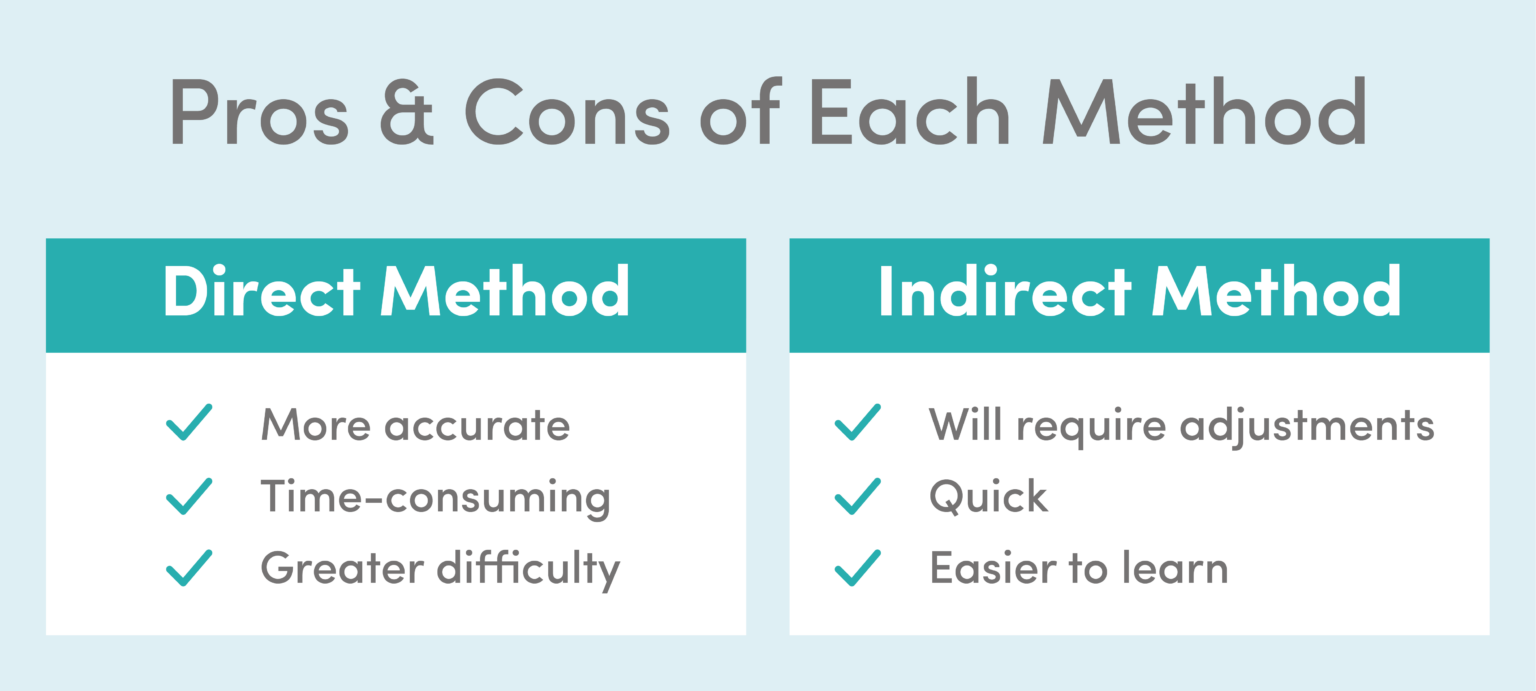

The two methods differ in their approaches, which are.

Direct method and indirect method cash flow. The cash flow statement can be generated using the direct method or the indirect method. There are two commonly used methods of calculating cash flow: This is not only difficult to create;

The direct method and indirect method of preparation of cash flow statement differ in the way the cash flows. The main way you can spot the difference between the direct method and indirect method is as follows: The purpose of this is to identify changes in cash payments.

It also identifies changes in cash payments and company activity receipts. What is the direct method? The direct method, also known as the income statement method, is one of two methods utilized while crafting the cash flow.

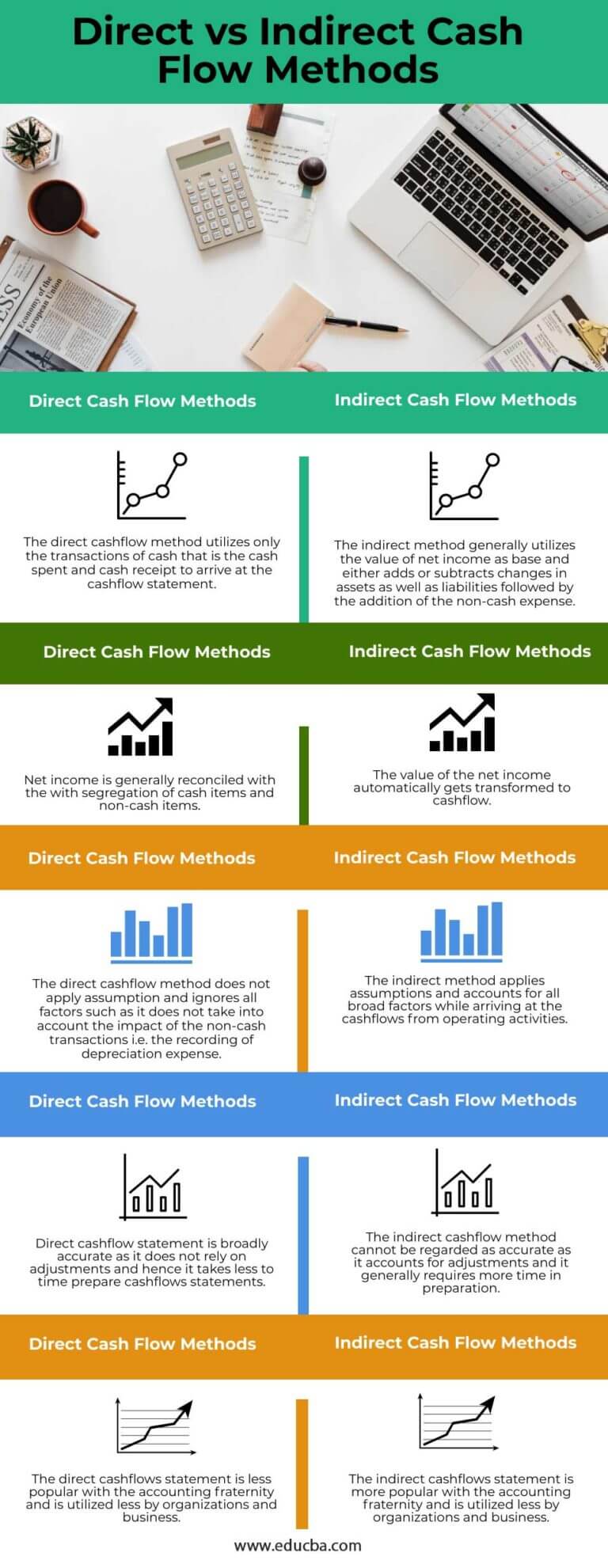

The main difference between the direct and indirect cash flow statement is that in direct method, the operating activities generally report cash payments and cash. What is the direct method for cash flow analysis? Direct cash flowis an accounting method that creates a detailed cash flow statement showing the cash changes over an accounting period.

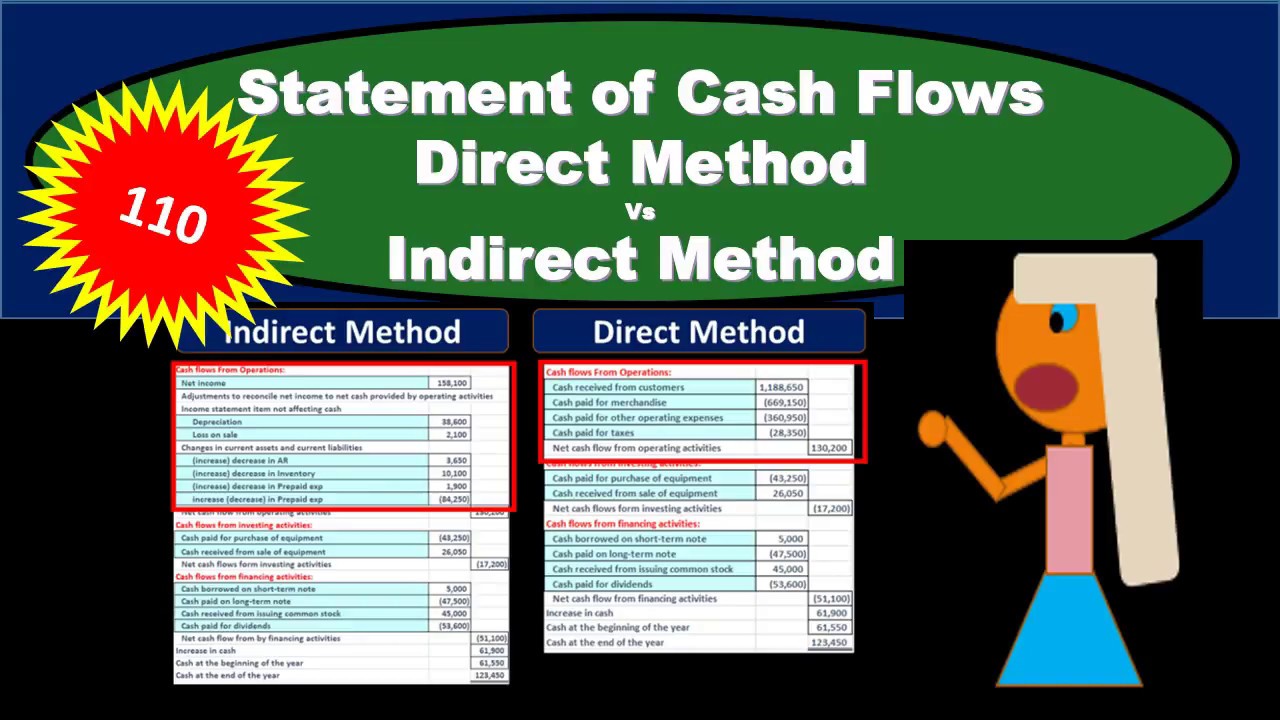

Comparing the direct and indirect cash flow methods. In the direct method, we find out actual cash received from customers and cash paid to employees, suppliers and for other operating expenses and we subtract the. The direct method lists all cash receipts and payments to calculate net cash from operating activities.

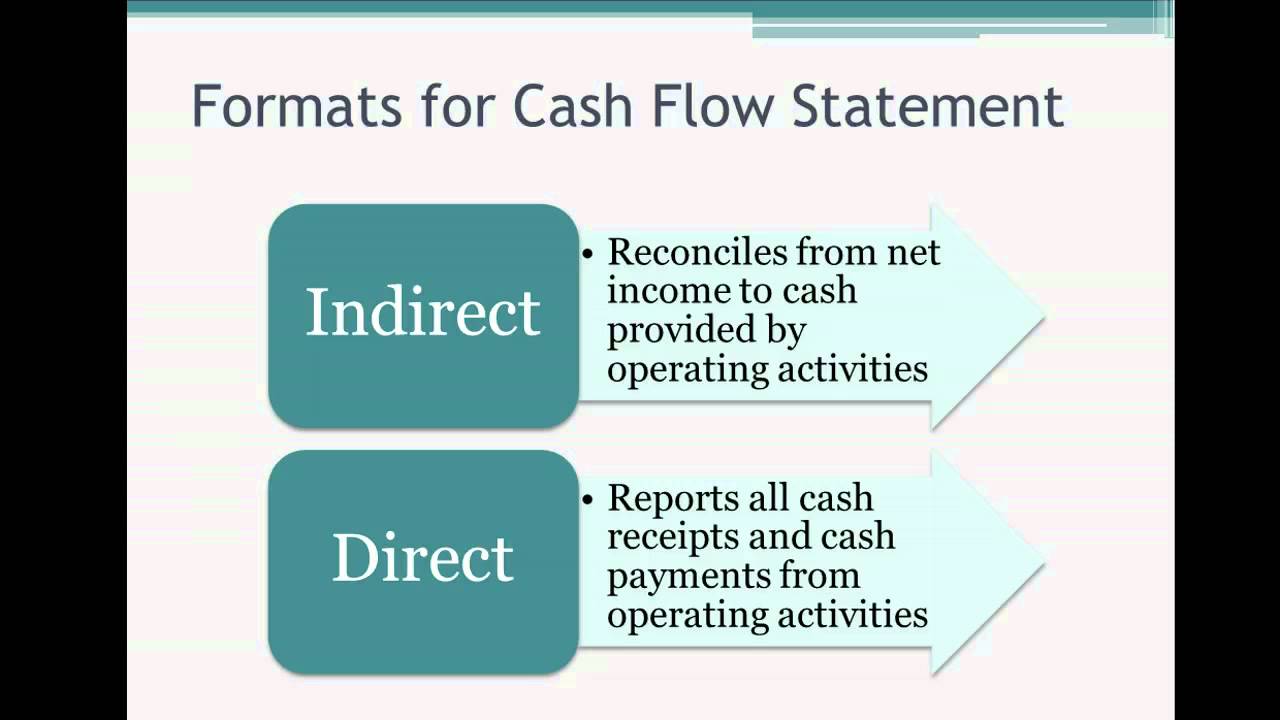

Direct vs indirect method cash flow statement. The indirect method for the preparation of the statement of cash flows involves the adjustment of net income with changes in balance sheet accounts to arrive. Direct and indirect cash flow methods use different techniques to report operating cash —the cash generated from your primary source of revenue.

The direct method uses cash basis accounting and tracks the cash inflows. The method lists every transaction on the company’s cash flow statement. The direct method and the indirect method.

The indirect method always starts with the net income. The direct method lists all receipts and payments of cash from individual sources to compute operating cash flows.