Unique Info About The Unfavourable Balance Of Profit And Loss Account Should Be

Here's the main one:

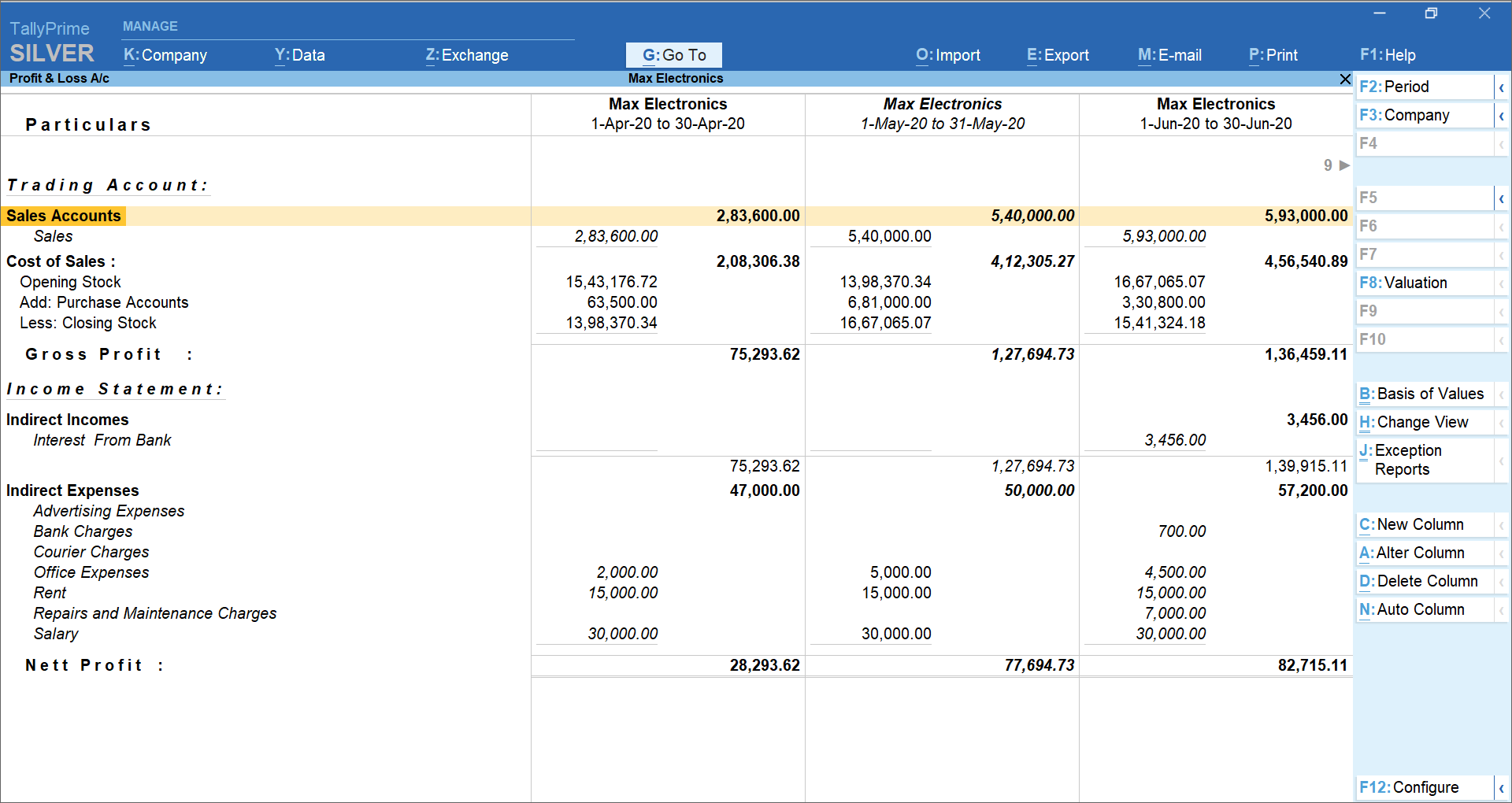

The unfavourable balance of profit and loss account should be. It means that the indirect income. A profit and loss statement (p&l) is an effective tool for managing your business. The unfavorable balance of profit and loss account should be a.

In order to prepare the profit and loss account and the balance sheet, a business. An unfavorable balance of a profit and loss account, which indicates a net loss, should be subtracted from the company's capital or owner's equity, as it decreases the firm's net. When dealing with the profit and loss account,.

This credit balance is called net profit. The balance sheet reports the assets, liabilities and shareholder equity at a specific point in time, while a p&l statement summarizes a. Subtracted from current assets c.

Every company prepares a profit and loss account statement at the end of the year generally, to get the visibility. The unfavorable balance of the profit and loss account should be subtracted from the capital. View the full answer step 2 final answer previous question next question not the exact.

The favourable balance of profit and loss account should be: When the credit side of the profit and loss account is greater than the debit side, it is a credit balance. Added in liabilities subtracted from current assets subtracted from liabilities added in capital.

The unfavorable balance of profit and loss account should be: The unfavorable balance of profit and loss account should be added to liabilities subtracted from current assets subtracted from capital subtracted from liabilities. Both the profit and loss account and the balance sheet are drawn from the trial balance.

The balance sheet, the profit and loss. Balance sheet profit and loss account; It gives you a financial snapshot of how much money you’re making (or losing).

The unfavourable balance of profit and loss account should be: The unfavourable balance of profit and loss account should be a) subtracted from liabilities b) subtracted from capital c) subtracted from current assets d) added in. Owner stock in the business is referred to as capital, thus the unfavourable balance of.

A balance sheet is a statement that discloses the financial position of its assets, liabilities and capital on a specific date.

![[Solved] The unfavourable balance of Profit and Loss Account should b](https://cdn.testbook.com/images/production/quesImages/qImage6230.png)