Wonderful Tips About Single Income Statement

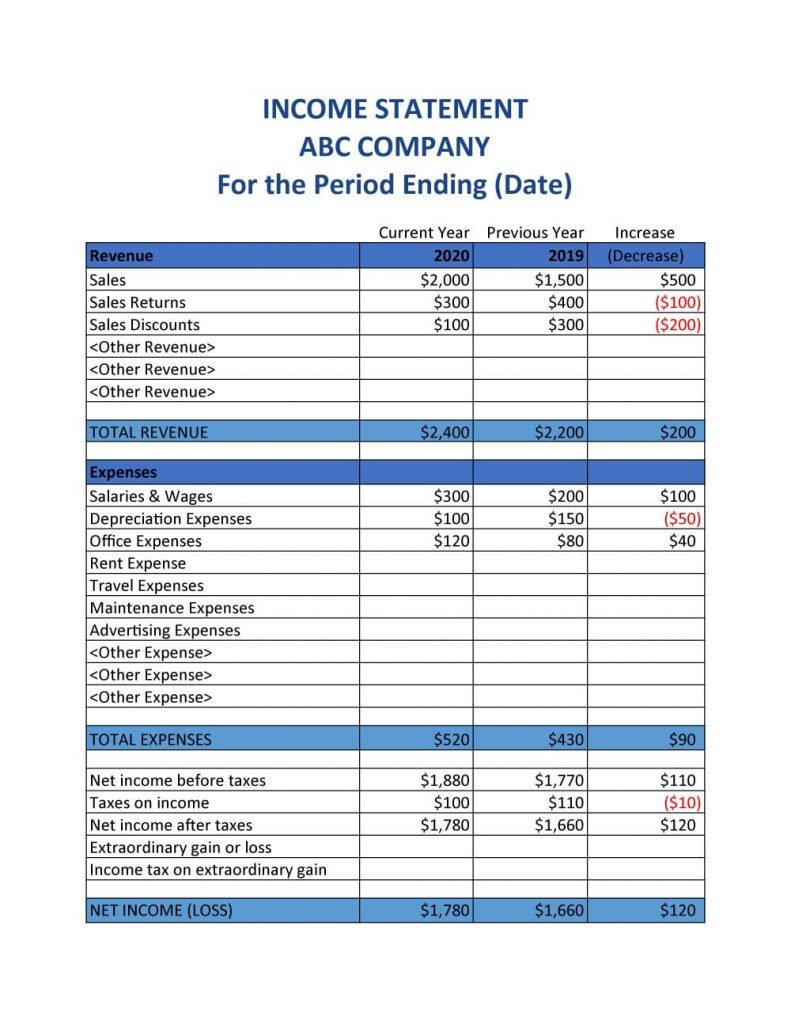

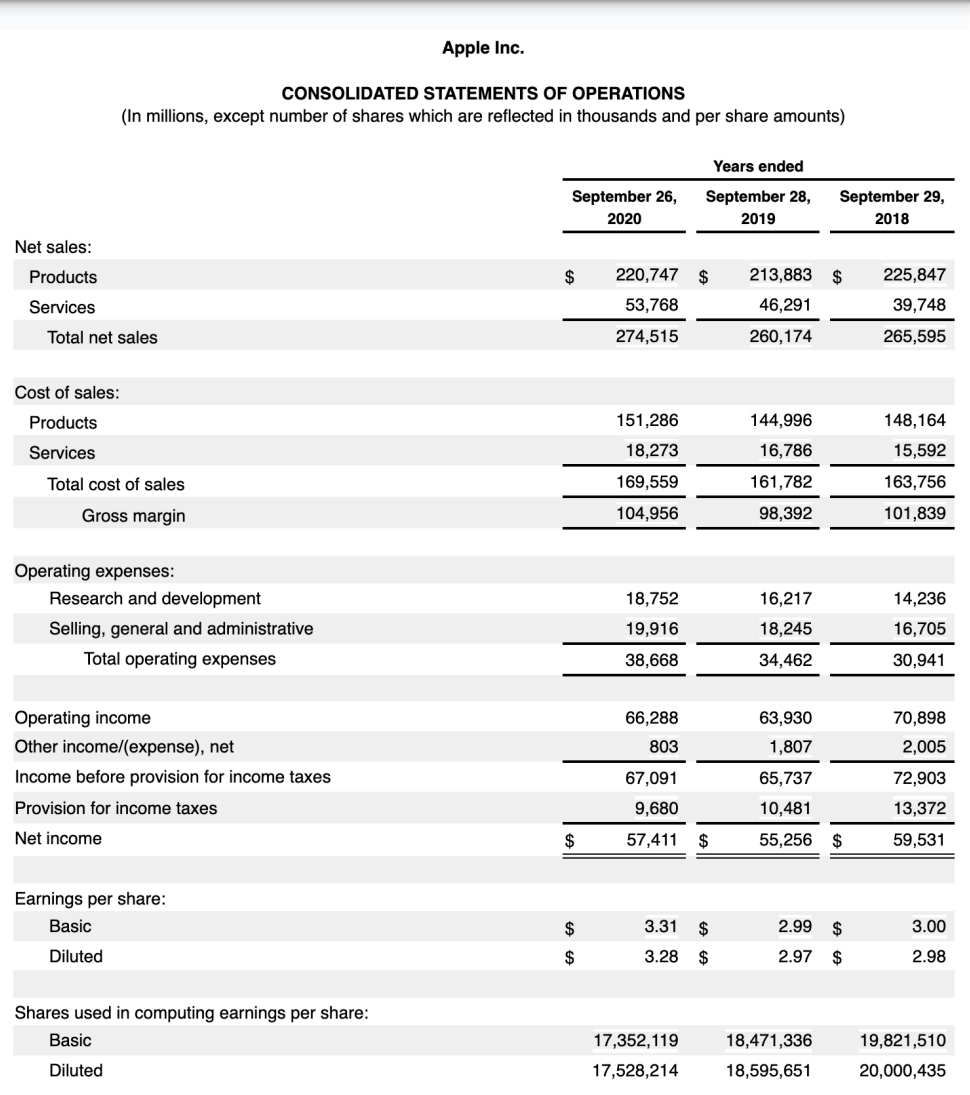

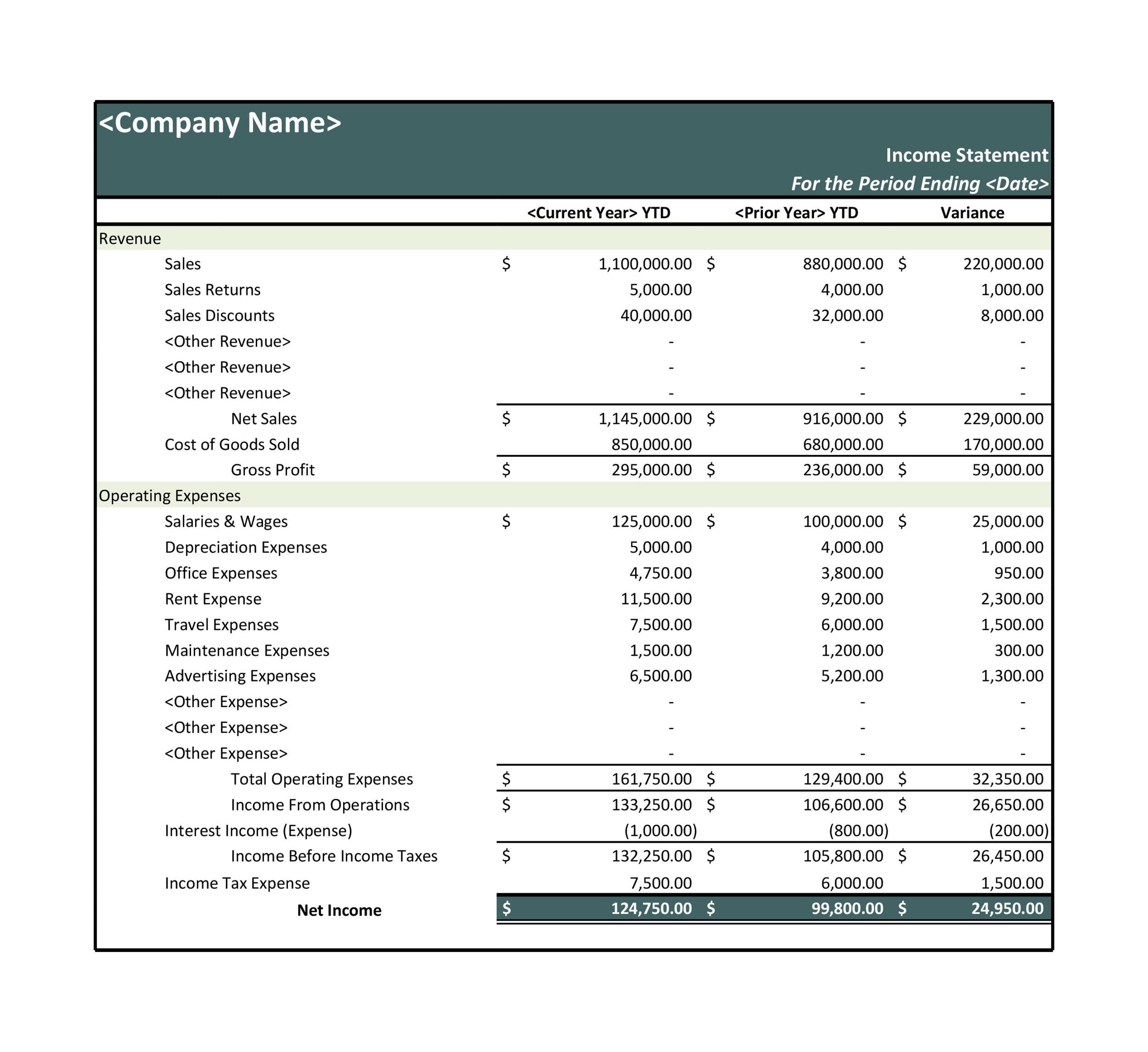

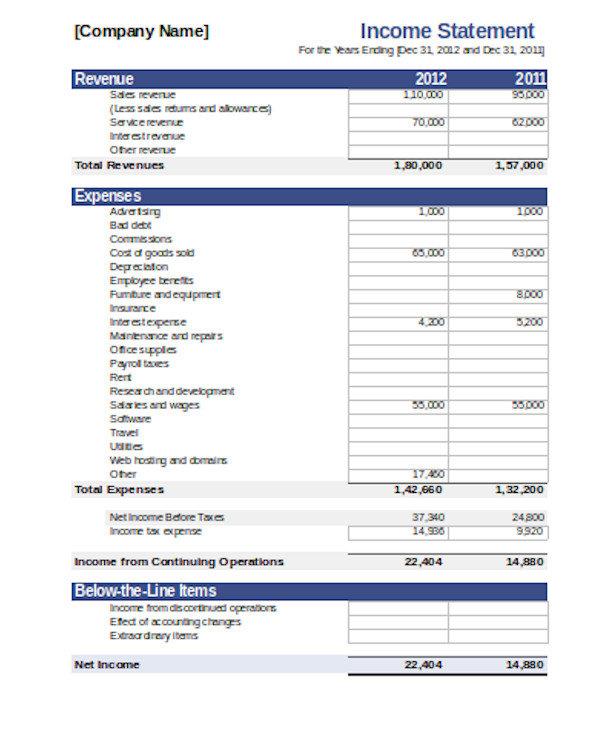

The statement displays the company’s revenue,.

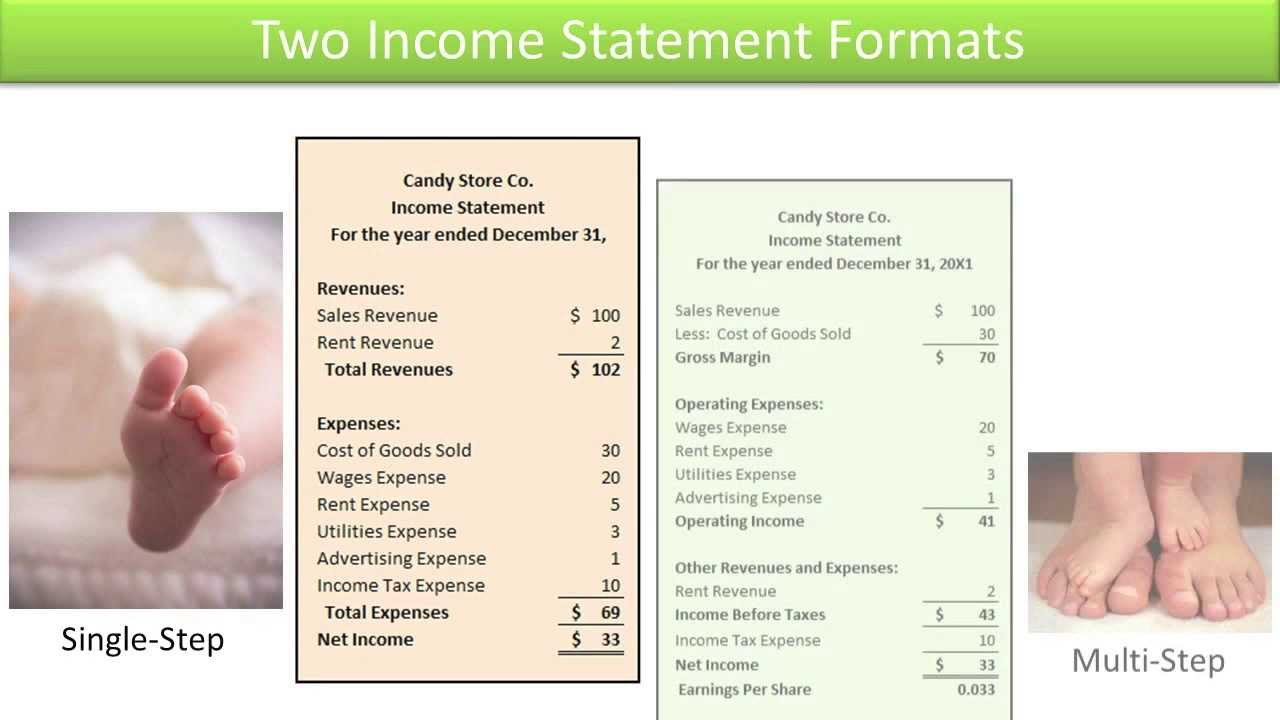

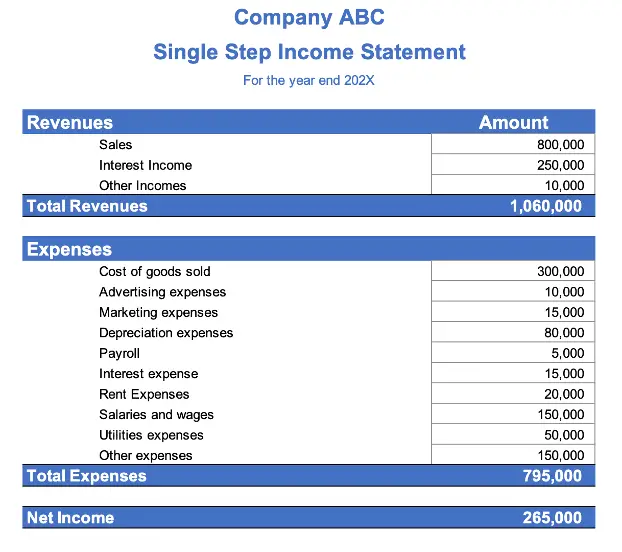

Single income statement. In other words, the single step. The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. If you are a single tax filer and your combined income is between $25,000 and $34,000, the ssa says you may have to pay income tax on up to 50% of your benefits.

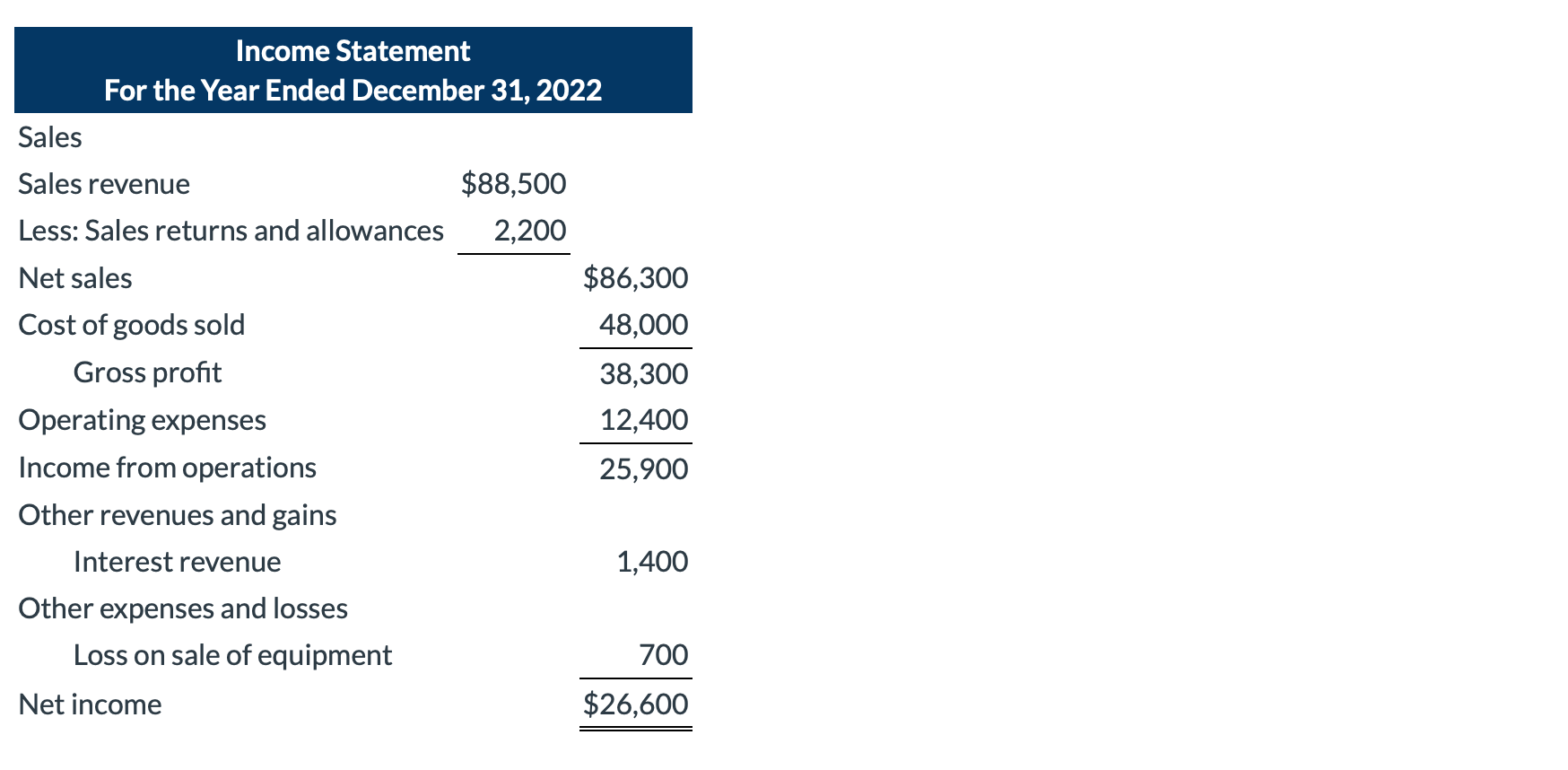

The annual financial statements of the ecb are prepared in accordance with decision (eu) 2016/2247 of the ecb of 3 november 2016 on the annual accounts of the ecb (recast). This year, the process of filing an income tax and benefit return may feel particularly daunting. The income statement focuses on four key items:

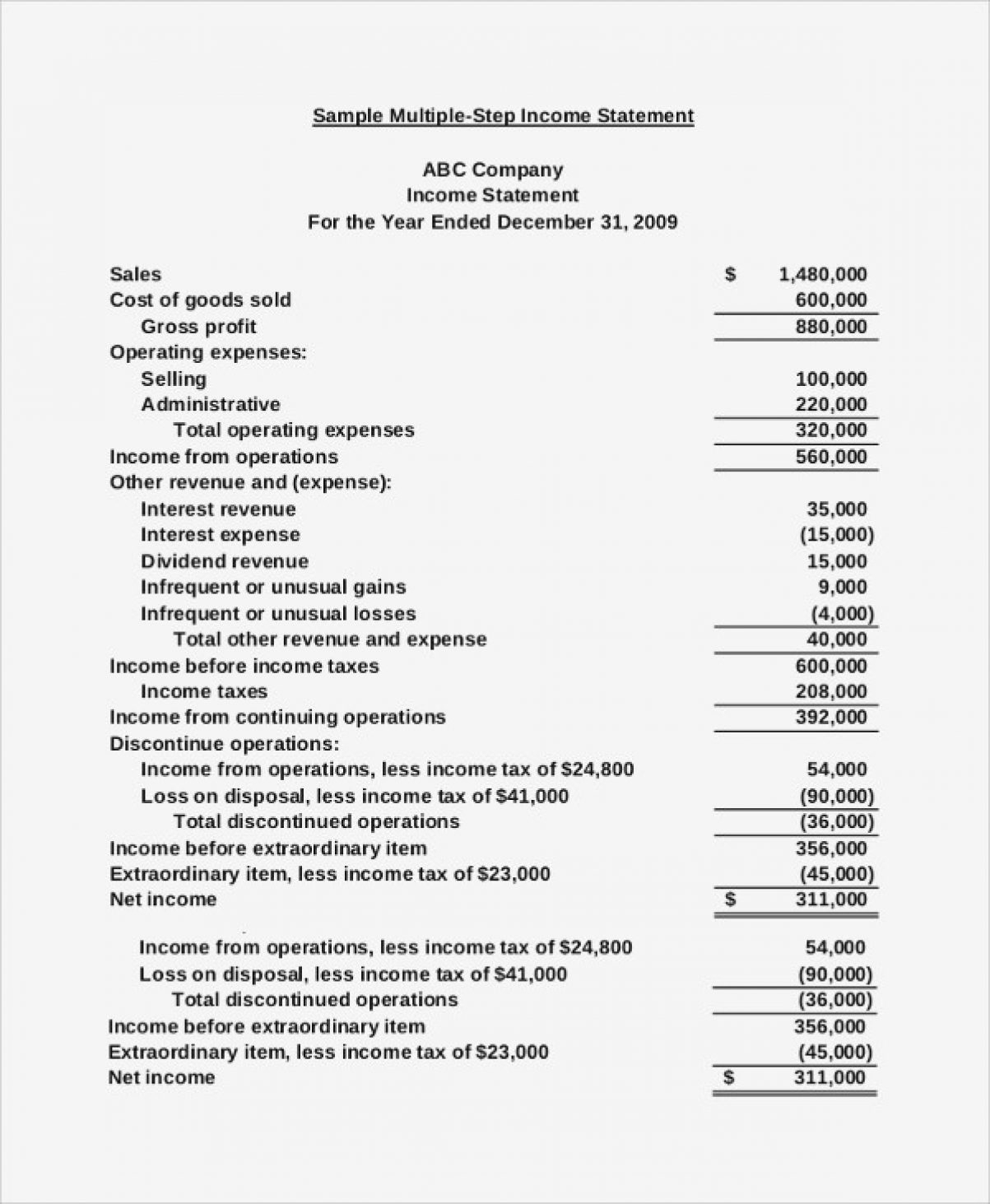

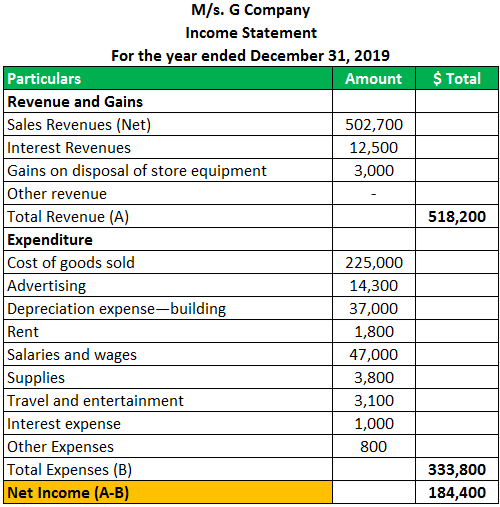

Revenue, expenses, gains, and losses. A single step income statement is a format of income statement, which uses just a single subtraction i.e. It is best for small businesses and.

Company name income statement for the year ended xxx 1. A single step income statement is a financial statement format that lists all expenses including cost of good sold in one column. It uses a single subtotal for all.

Income statement and free cash flow. However, the net income is reported. Revenues comprise all the income or amount of money received by.

This straightforward document merely conveys a. Rather the information is given under a single column and. An income statement is a good ally when highlighting.

Essentials to filing an accurate tax return.