Awe-Inspiring Examples Of Tips About Trial Balance Financial Accounting

Trump and his legal team tried to shift the blame for any inaccuracies in his financial statements onto his outside accountants.

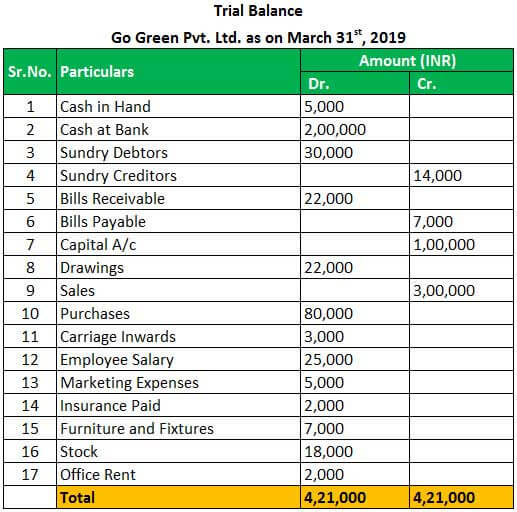

Trial balance financial accounting. As per the accounting cycle, preparing a trial balance is the next step after. Read more can be prepared by. Trial balances are a vital auditing technique used to ensure whether the total debit equals the total credit in the general ledger accounts, which plays a crucial role in creating the balance sheet and other financial statements.

A trial balance is a summarization of all journal entries made, aggregated by account. From this information, the company will begin constructing each of the statements, beginning with the income statement. The total of both should be.

Sample format of trial balance with pdf download. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that should equal each other. This information is then used to prepare financial statements.

A trial balance is a listing of all accounts (in this order: The total debits must equal total credits on. It’s used at the end of an accounting period to ensure that the entries in a company’s accounting system are mathematically correct.

Definition of trial balance in accounting. The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains, and. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time.

It is a working paper that accountants. This book deals with financial accounting concepts particularly the extraction of a trial balance. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.

A trial balance is a financial accounting document that lists the balances of all the general ledger accounts of a company at a specific point in time. A trial balance is a list of all accounts in the general ledger that have nonzero balances. This statement comprises two columns:

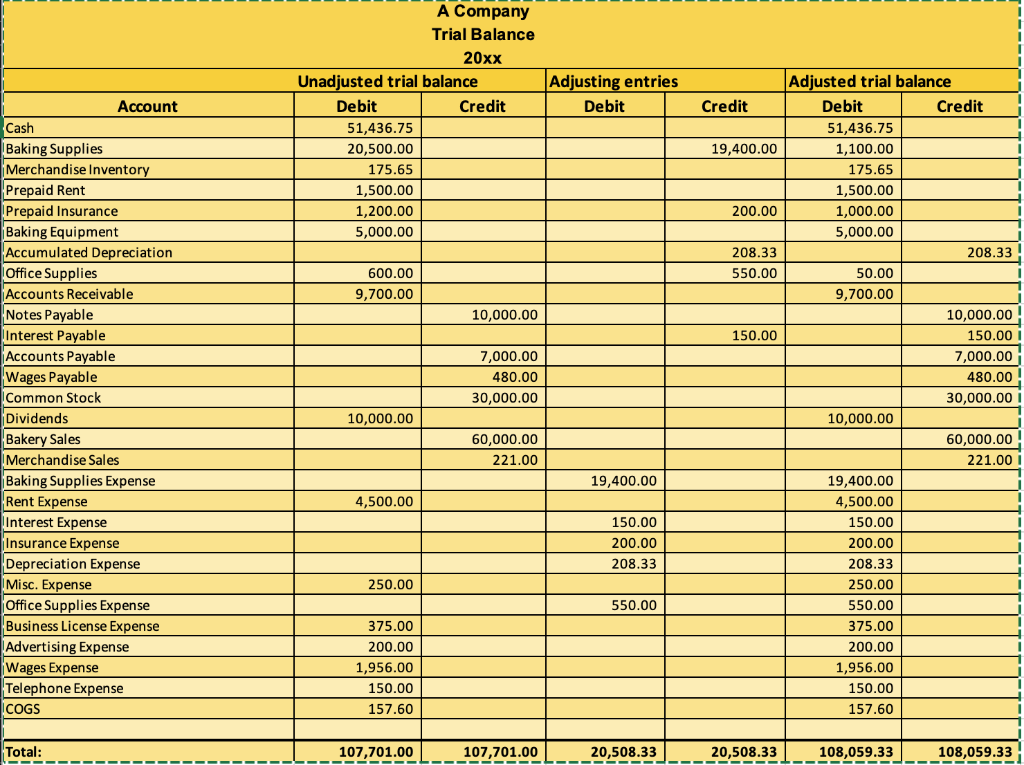

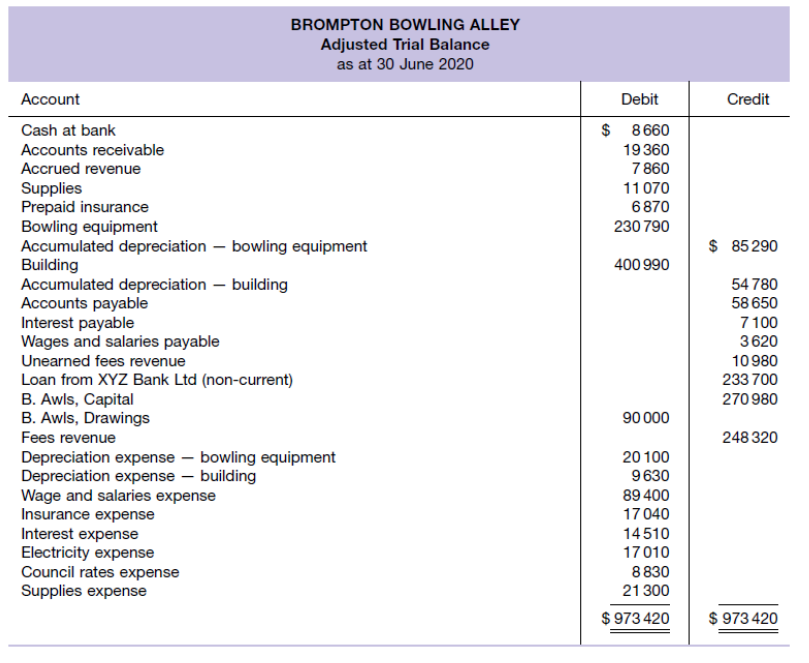

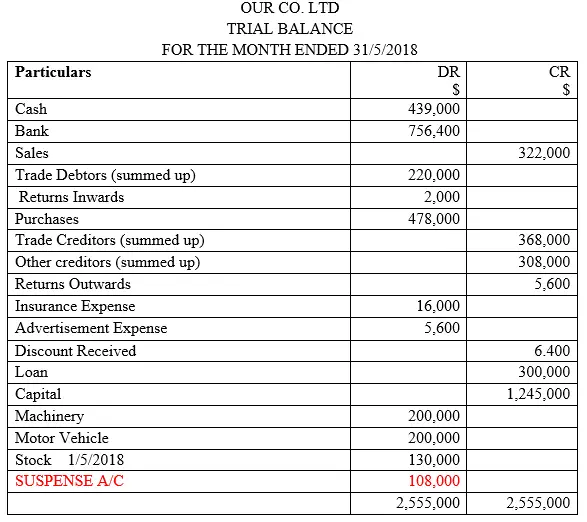

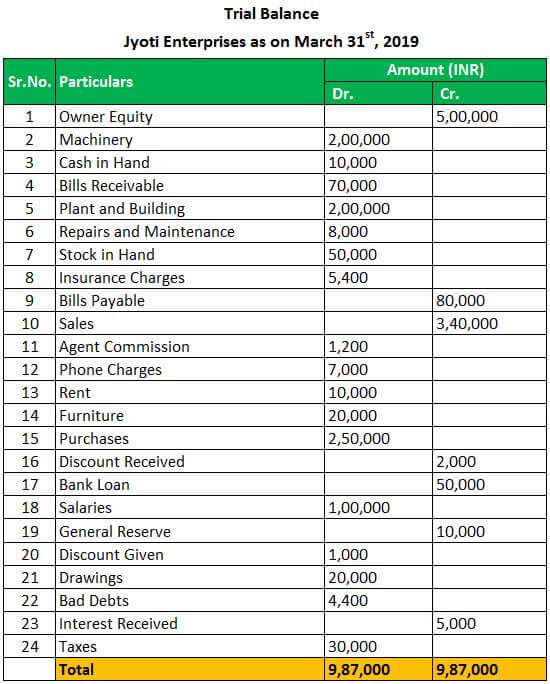

Trial balance is the regular business process by the end of a reporting period to ensure the correct mathematical entries of accounting books during the financial accounting period. Example of a trial balance document The suffix “account” or “a/c” may or may not be written after the.

Trial balance is the report of accounting in which ending balances of a different general ledger of the company are and is presented into the debit/credit column as per their balances, where debit amounts are listed on the debit column, and credit amounts are listed on the credit column. The trial balance only shows if the credit or debit sums are equal or not. It compiles all ledger accounts and details their balances as either debits or credits by following the core principle that.

Preparing an unadjusted trial balance is the fourth step in the accounting cycle. A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. Understanding the components of a.