Nice Info About P&l Profit And Loss Statement

There are several names of the profit and loss statement, which include an income statement, p & l account, a statement of the revenues and expenses, etc.

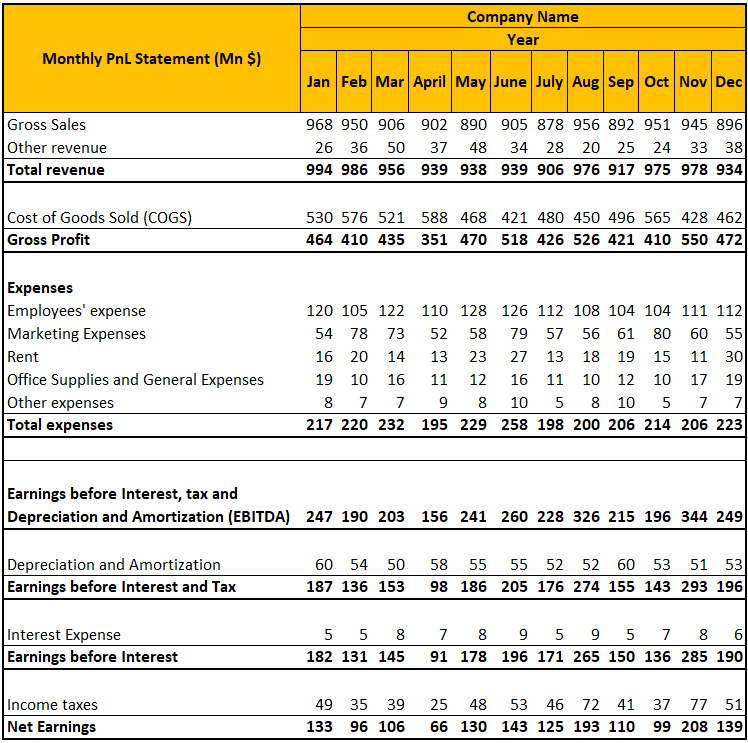

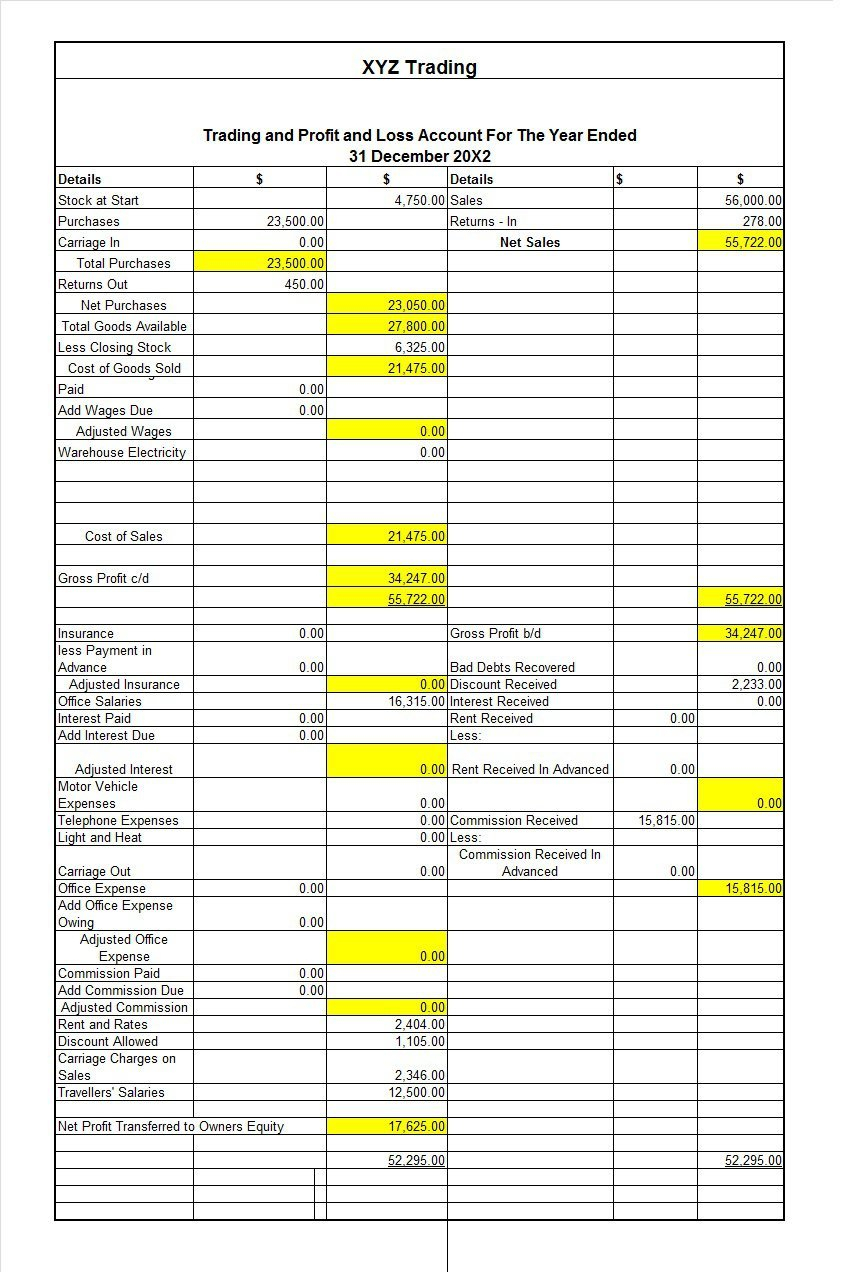

P&l profit and loss statement. The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in. A p&l statement compares company revenue against expenses to determine the net income of the business. So we searched the internet for the most frequently asked questions about.

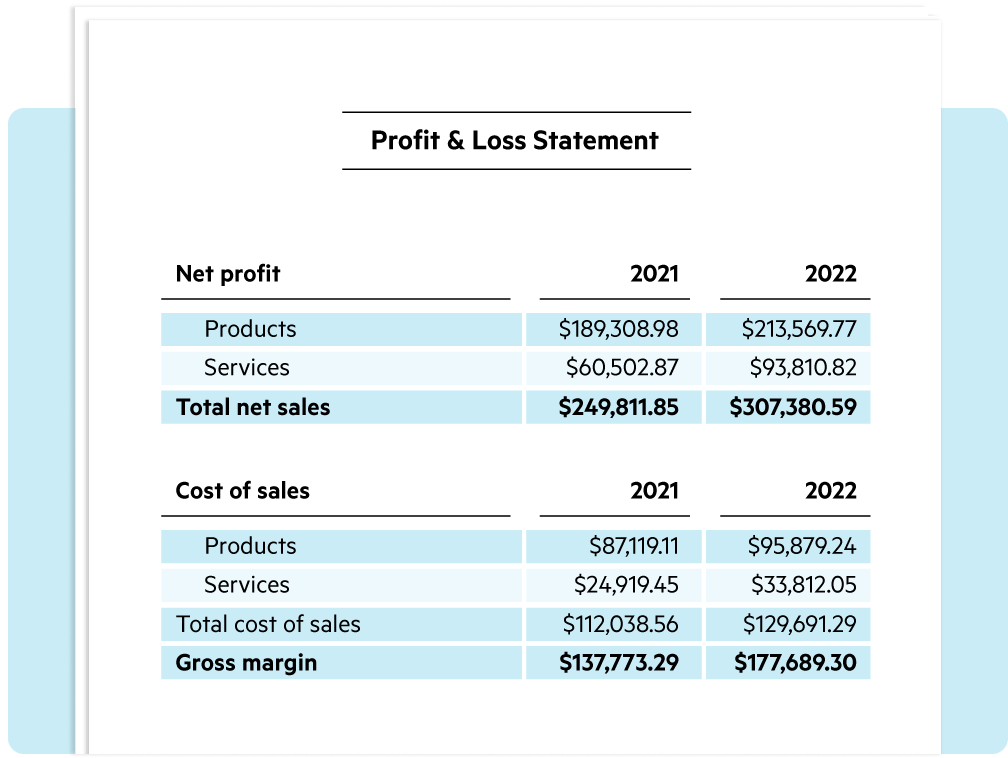

It contains information pertaining to a company’s revenue and expenses over a given period. A p&l statement, also known as a profit and loss statement or income statement, is a financial document that explains a company’s financial health for a given accounting period. Profit and loss statement (p&l) definition.

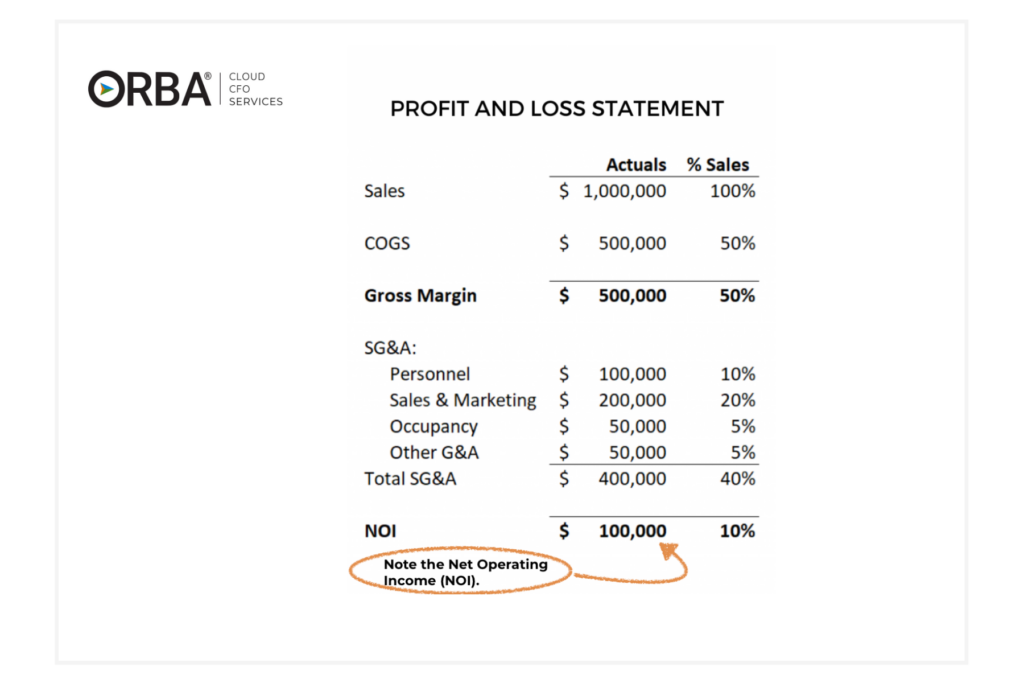

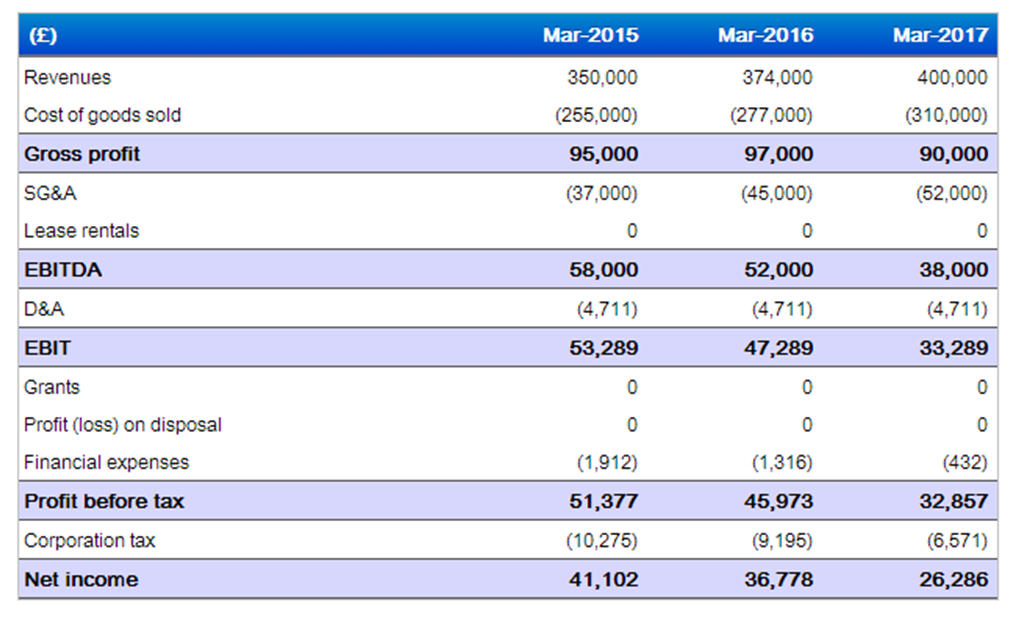

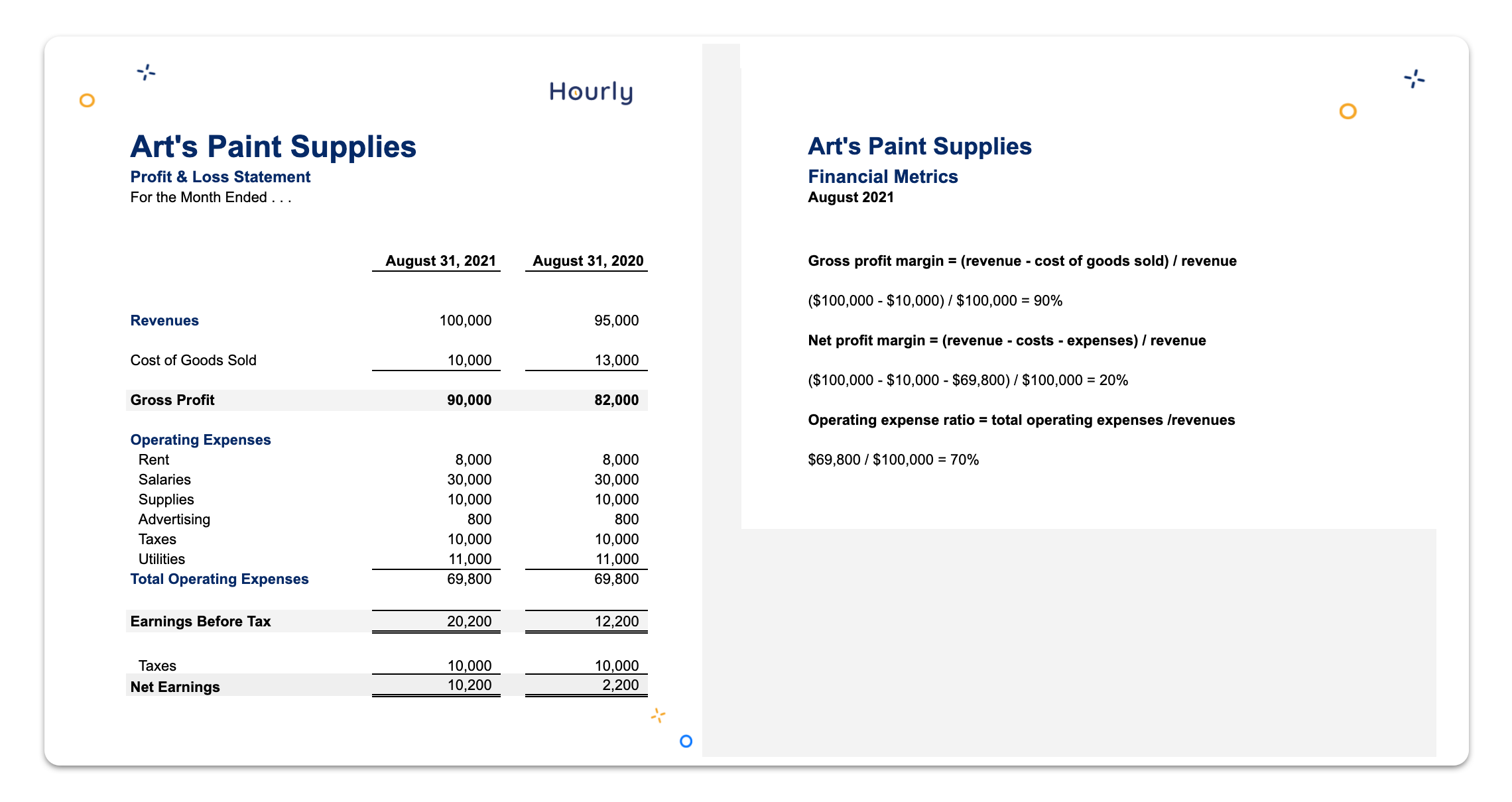

The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services. A profit and loss (p&l) statement, also known as an income statement, is a financial report that summarizes a company’s revenues, expenses, and profits or losses over a specific period, typically a quarter or a fiscal year. If registered at companies house, annual accounts are submitted.

Usually this is one fiscal quarter or fiscal year. The profit and loss statement summarizes all revenues and expenses a company has generated in a given timeframe. The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in.

Profit and loss statement of a company is an important statement for any company because it helps in knowing whether the company is earning the profits or not, which is the main motive. It shows company revenues, expenses, and net income over that period. What is the profit and loss statement (p&l)?

An accountant typically prepares the reports. Online bookkeeping and tax filing powered by real humans. A profit and loss statement, also called an income statement or p&l statement, is a financial document that summarized the revenues, costs, and expenses incurred by a company during a specified period.

A profit and loss statement—also called an income statement or p&l statement—is a financial statement that shows a business’s revenue, expenses, and net income over a specific period of time. Subtract operating expenses from business income to see your net profit or loss. What is profit and loss statement?

A profit and loss (p&l) statement is a type of financial statement covering a specific period and revealing a company’s revenues, costs, and expenses. You can obtain current account balances from your. Calculate revenue the first step in creating a profit and loss statement is to calculate all the revenue your business has received.

The p&l statement shows a company’s ability to generate sales, manage expenses, and. Let’s now dive deeper into the intricacies of the p&l / profit and loss statement. It gives you a financial snapshot of how much money you’re making (or losing) and can make accurate projections about your business’s future.

Ultimately, it helps show whether a company is making a profit or losing money. Understanding the p&l / profit and loss statement. The p&l statement is one of three.