Beautiful Info About Loan Interest Balance Sheet

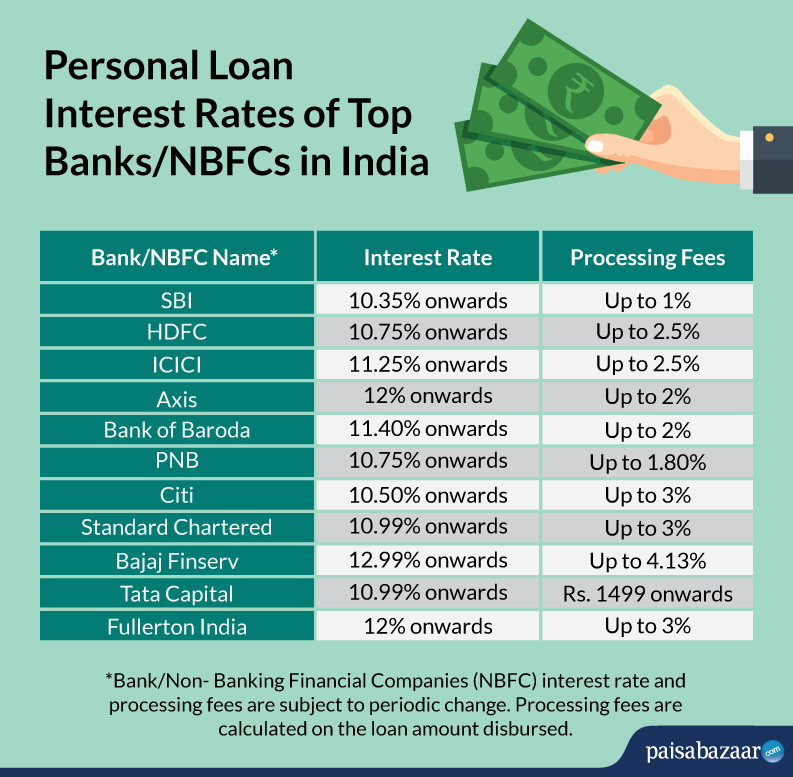

High interest rates and a strong balance sheet position will continue to.

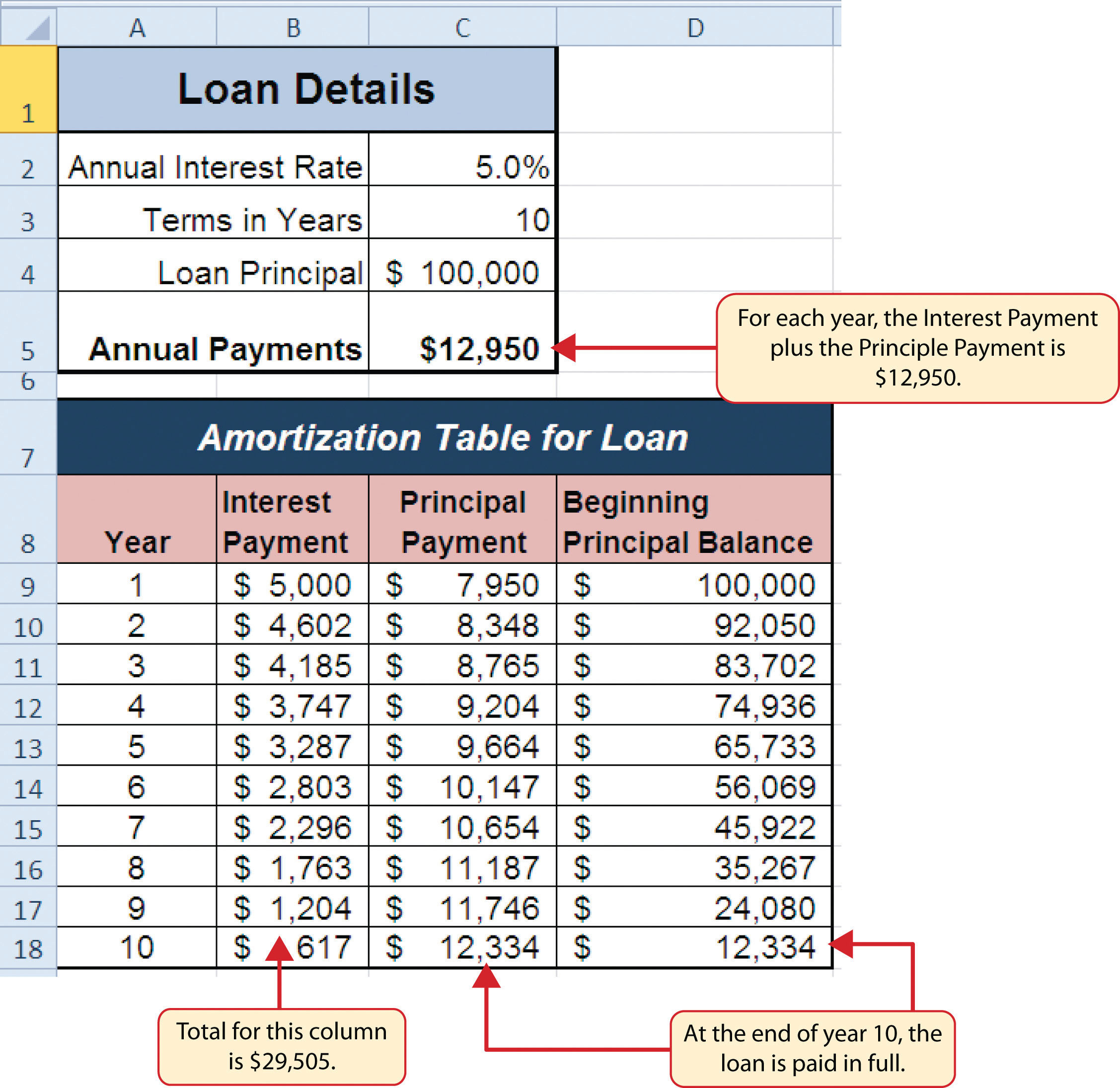

Loan interest balance sheet. Wafd witnessed revenue growth on the back of steady loan demand. An amortization schedule, sometimes called an amortization table, displays the amounts of principal and interest paid for each of your loan payments. Local job markets give hope that loan growth.

Loan payables to be recognized in the balance sheets as at 30 june 20x1, 30 june 20x2 and 30 june 20x3. As fixed assets age, they begin to lose their value. The only required arguments are the first three for interest rate, number of payments, and loan amount.

Our model estimates total loans and deposit balances to witness a cagr of 3.5% and 1.1%, respectively, over. Planned changes in the balance sheet will likely boost amalgamated financial's net interest margin this year. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

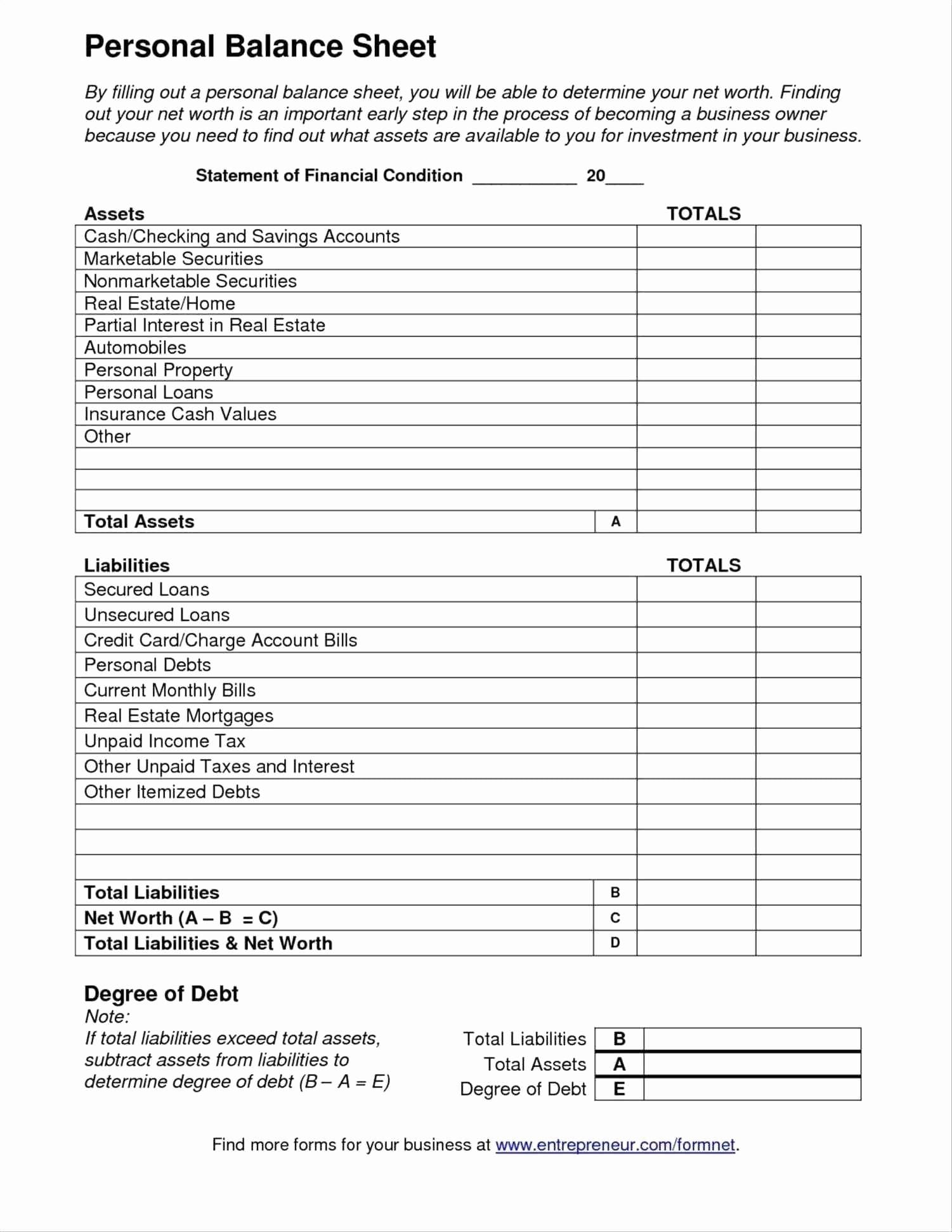

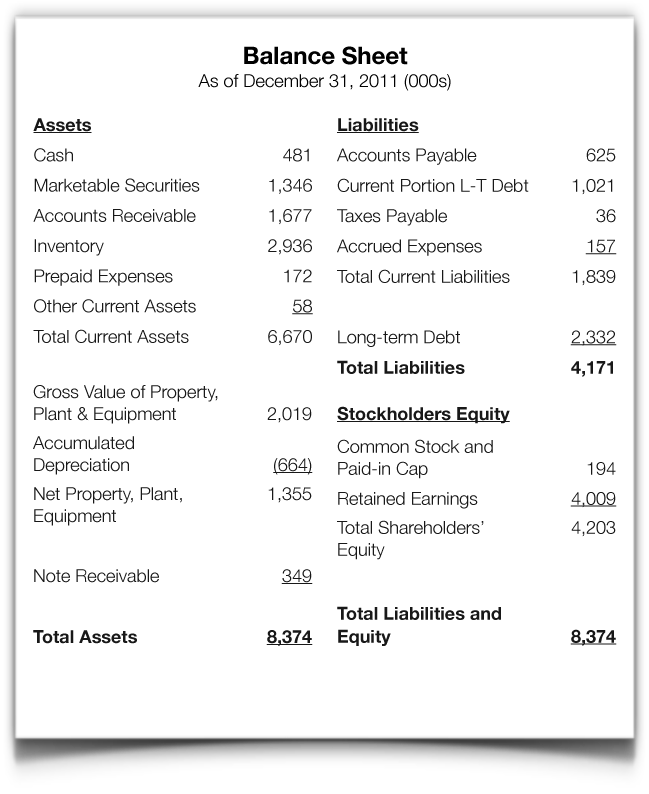

List the current portion of the loan payable and any accrued interest expense under the current liabilities section of the balance sheet. The noncurrent portion should be listed under the other liabilities section of the balance sheet. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

It represents interest payable on any borrowings—bonds, loans, convertible. Balance sheet lenders retain a loan for its lifetime, earning interest for the entire lifecycle of the loan. What is a balance sheet?

Balance sheet loans often come with lower interest rates compared to unsecured loans, as the collateral reduces the lender’s risk. Credit of $4,000 to cash (an asset account) the accountant can verify that this entry is correct by periodically comparing the balance in the loans payable account. To get the monthly payment amount for a loan with four.

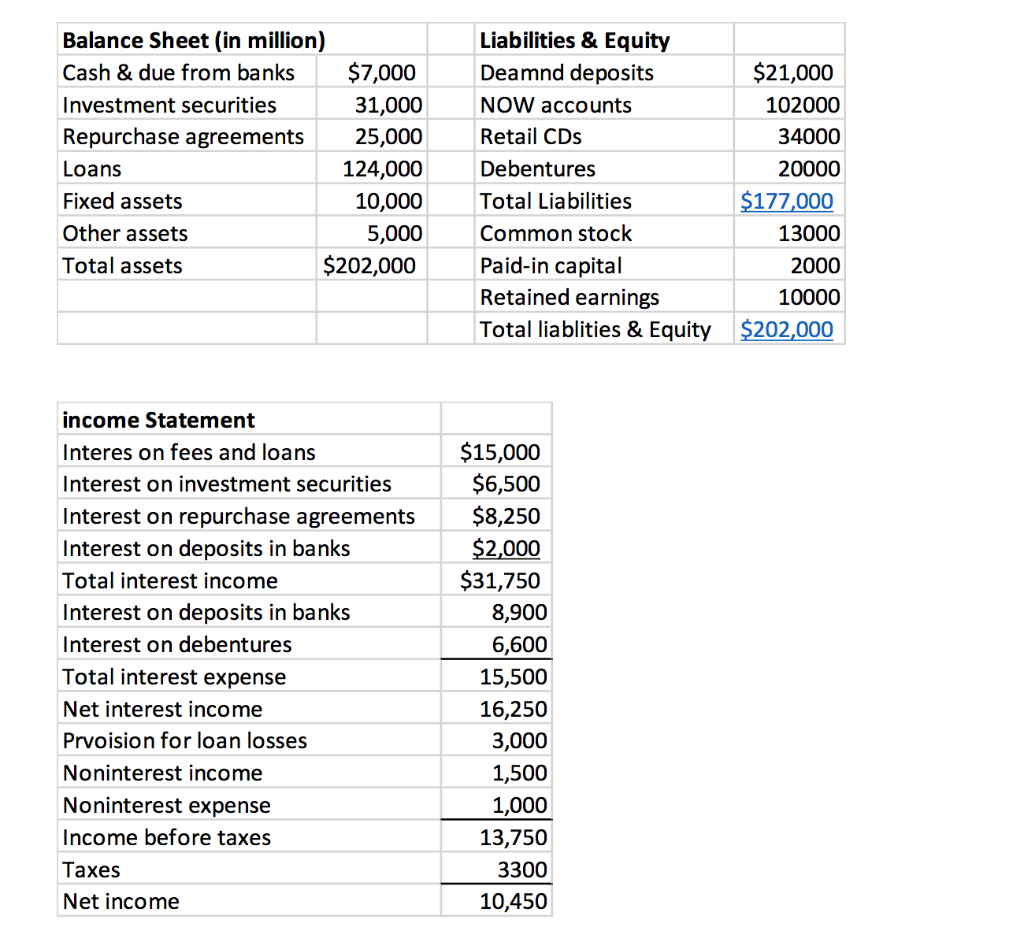

Using our earlier example of company a taking out a £50,000 loan with an annual interest rate of 6%, we can calculate the interest expense as follows: Interest payable is a liability account, shown on a company’s balance sheet, which represents the amount of interest expense that has accrued to date but has not been. A balance sheet provides a snapshot of a company’s financial performance at a given point in time.

This financial statement is used. Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable. Record the loan interest.

The amortized cost basis is. This increases the rate of return and provides lenders with. For example, if the current cash account is $5,000 and owner’s equity is $20,000, then the company paid out $1,000 in interest the new cash asset value is.

An amortization schedule is a table that lists periodic payments on a loan or mortgage over time, breaks down each payment into principal and interest, and shows. See fsp 8.3 for additional information on the presentation of loans. An amortization schedule is used to determine how much of each payment is applied to interest and principal each period.