Beautiful Tips About Cash Flow Statement Direct Method Format

Payments to suppliers, receipts from customers, and salaries paid to.

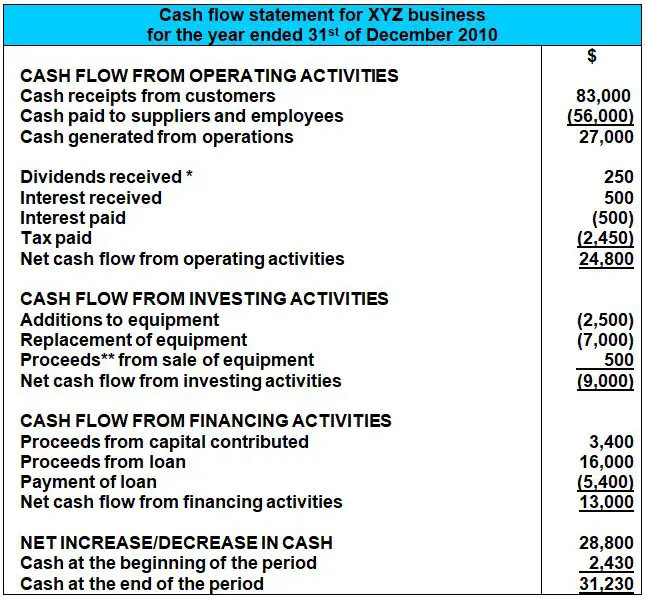

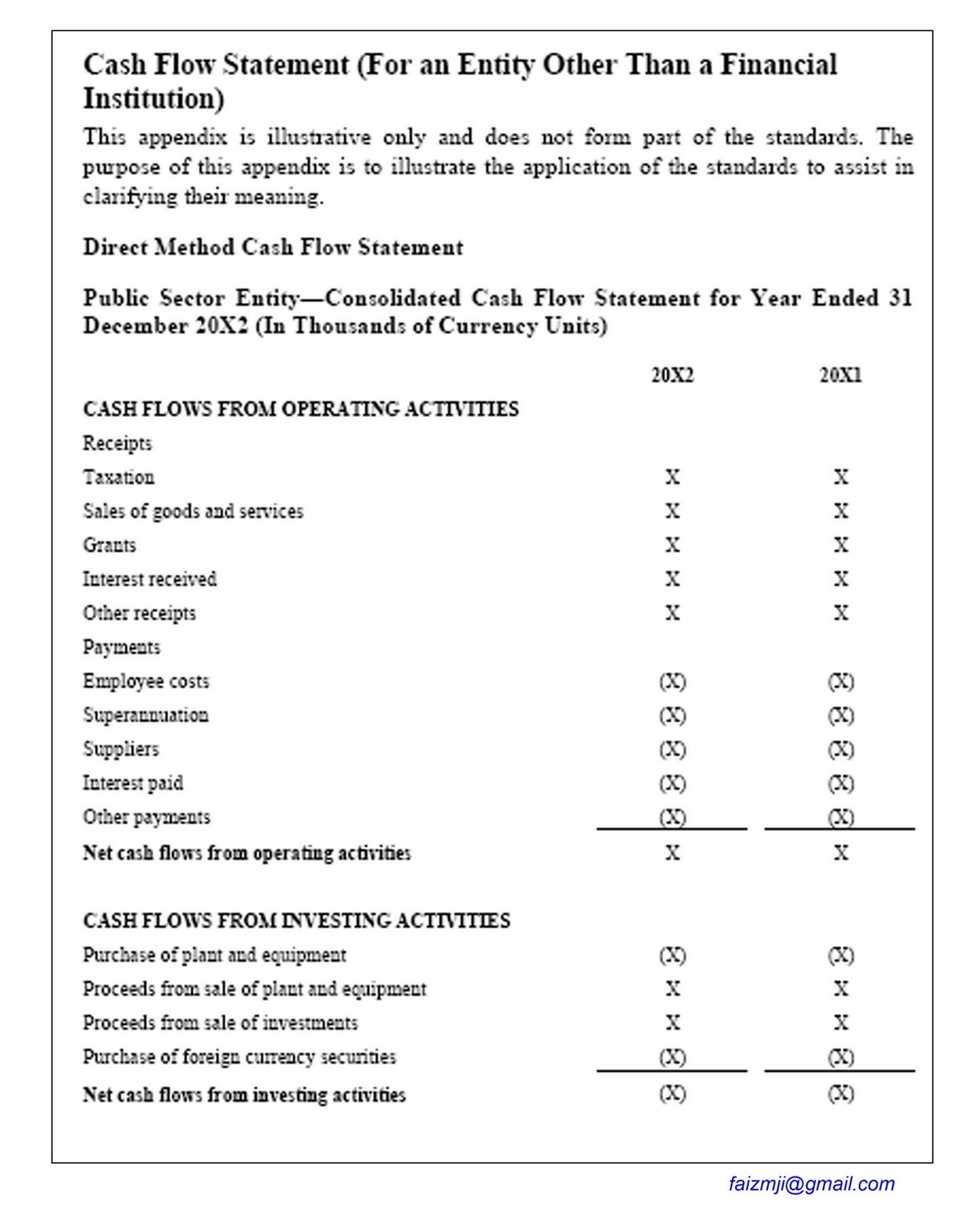

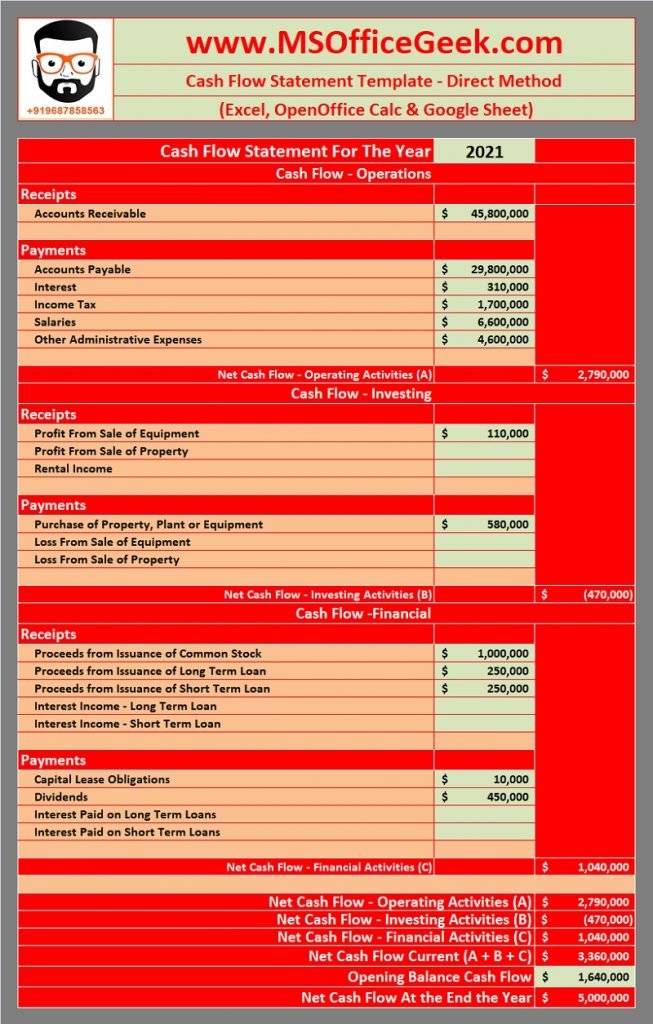

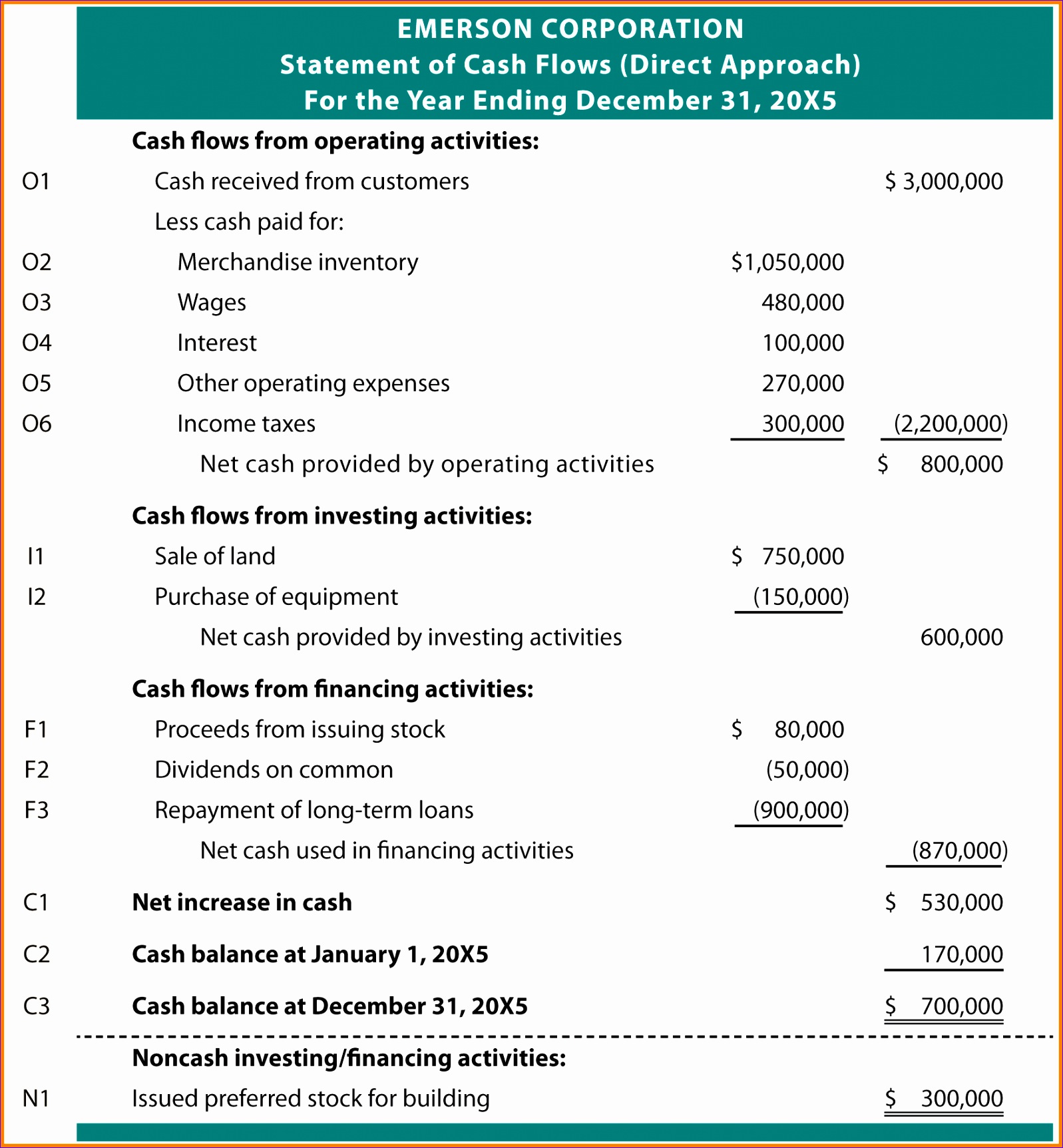

Cash flow statement direct method format. Cash flows from investing activities The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. The direct method lists all receipts and payments of cash from individual sources to compute operating cash flows.

Cash flow statement classifies all the business activities into three main categories. To illustrate direct method of statement of cash flows, we will use the first year of operation for tax consultants inc. Most use the indirect method.

The direct method is intuitive as it means the statement of cash flow starts with the source of operating cash flows. The operating activities, investing activities and financing activities. Cash flow statement format (direct method) okay, so before anything else, here's the format of the cash flow statement itself (see further below for explanations):

Cash flows from operating activities. A company can choose the direct method or the indirect method. Interest paid ( 270) income taxes paid ( 900) net cash from operating activities.

The direct method or the indirect method. This method shows a company’s total operating, financing, and investing cash flow over a set period. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories.

The cash flow statement direct method shows all the cash transactions a business completes. Cash paid to suppliers and employees ( 27,600) cash generated from operations. Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements.

The cfs measures how well a. Cash flow statement formula if the three sections are added together, we arrive at the “net change in cash” for the period. Under the indirect method, the format of the cash flow statement (cfs) comprises of three distinct sections.

The statement of cash flows direct method uses actual cash inflows and outflows from. They are cash flow statement indirect method and direct method. Net change in cash = cash from operations + cash from investing + cash from financing

These categories are operating, investing and financing activities. The direct method cash flow, where major classes of gross cash receipts and gross cash payments are disclosed. Direct method statement of cash flows.

The direct method is one of two accounting treatments used to generate a cash flow statement. The cash flow statement presented using the direct method is easy to read because it lists all of the major operating cash receipts and payments during the period by source. July 28, 2021 this article is tax professional approved a cash flow statement tells you how much cash is entering and leaving your business in a given period.