Top Notch Info About Cash Flow Financing

Cash on hand determines a company’s runway—the more cash on hand and the lower the cash burn rate, the more room a business has to maneuver and, normally, the higher its valuation.

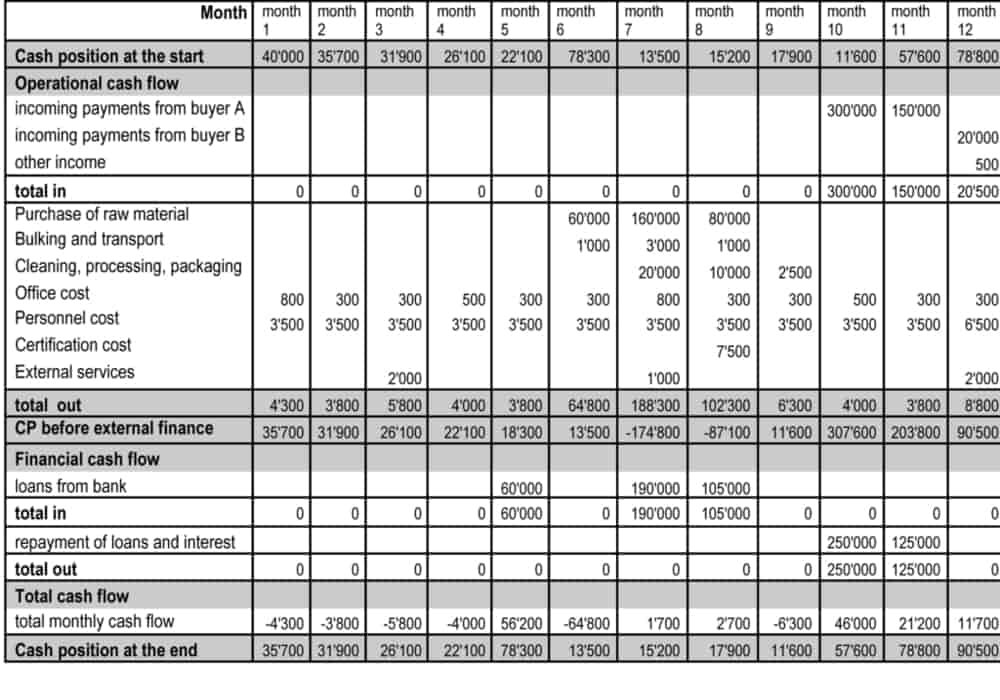

Cash flow financing. Best fast small business loans. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. Financing this article discusses the “ins” and “outs” of the types of cash flow and how they might impact your business.

Cash receipts from customers, including cash sales, were $800,000. Cash flow from financing activities (cff): Best for lower credit scores:

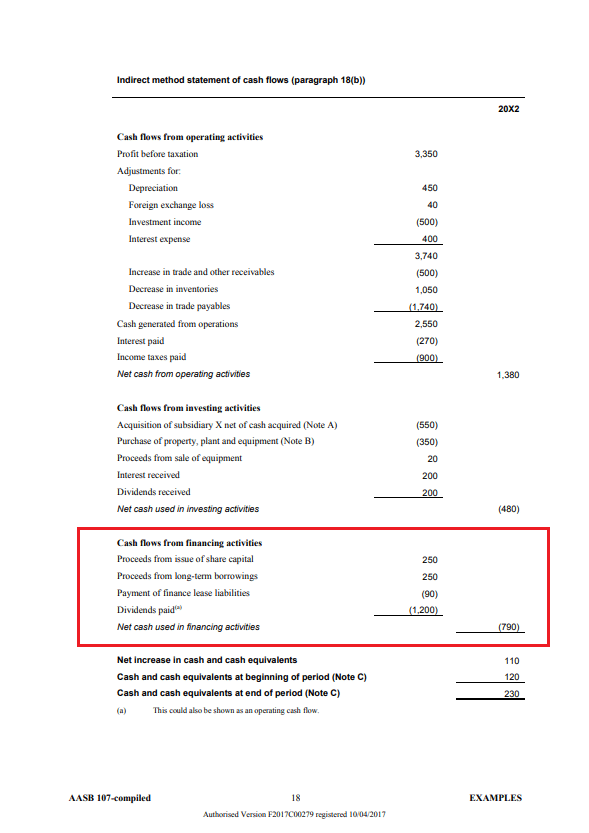

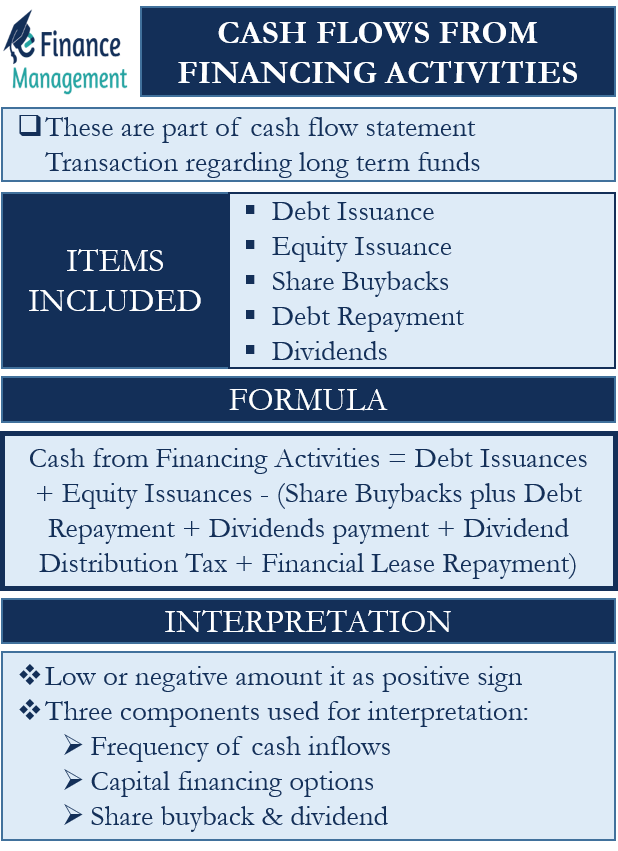

Additional informationduring the year, depreciation of $50,000 and amortisation of $40,000 was charged to the statement of profit or loss. Cash flow financing is a form of financing in which a loan made to a company is backed by the company's expected cash flows. The 3 main types of cash flow cash flow from operations (cfo) cash flow from investing (cfi) cash flow from financing (cff) what about free cash flow?

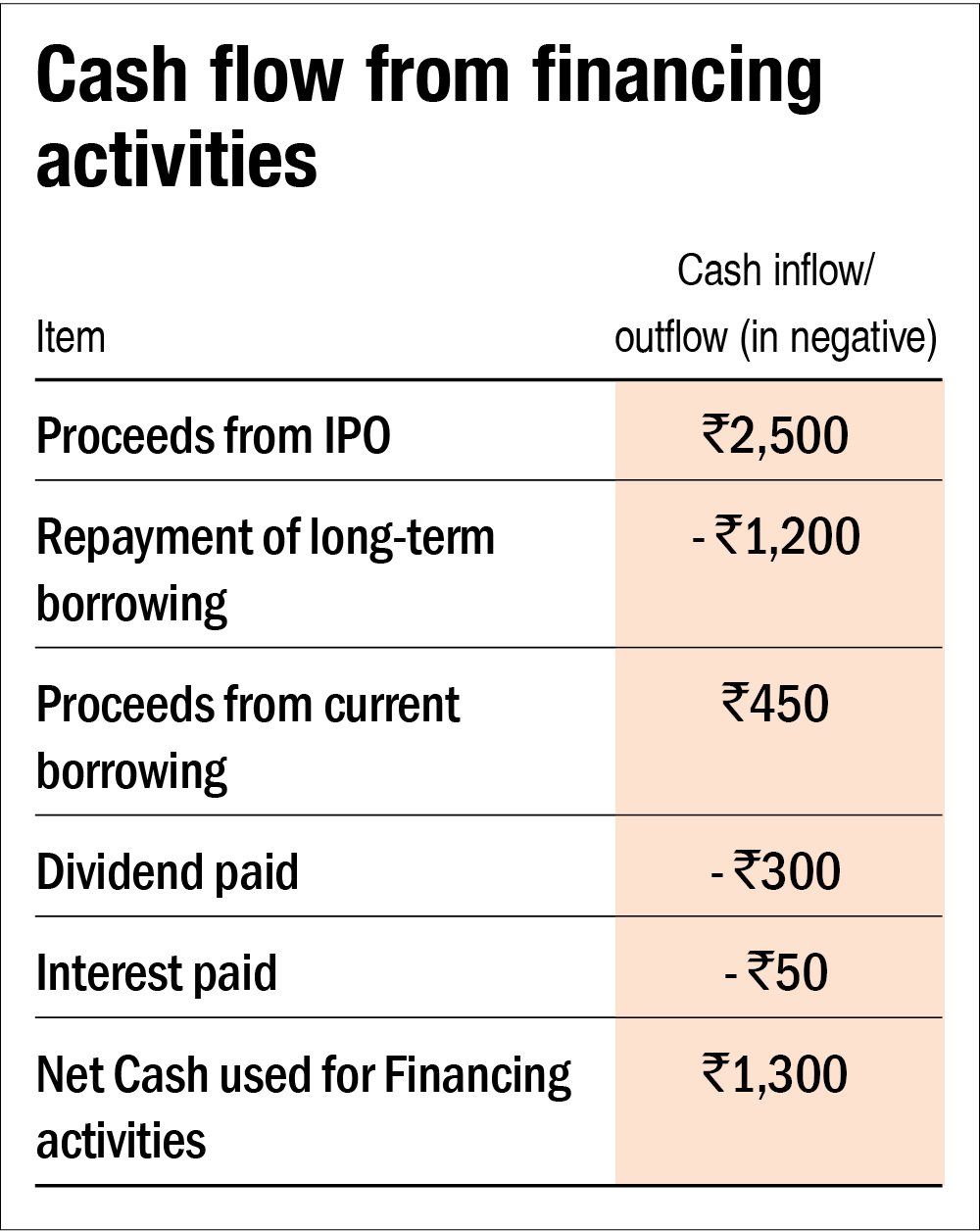

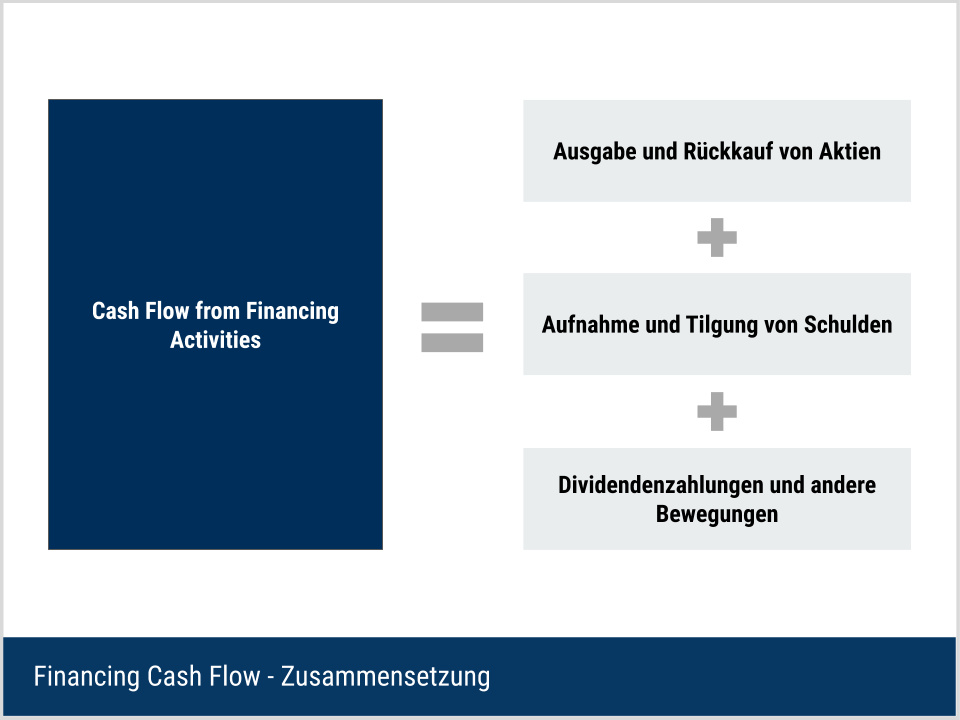

Then there’s cash on hand, which simply put, is the amount of capital a company has at its disposal to finance acquisitions, debt reduction, expansion and shareholder. Importance of financing cash flow Cash flow from financing activities is the third section of an organization’s cash flow statement, outlining the inflows and outflows of cash used to fund the business for a given period.

Cash flow financing is the financing of a loan through incoming cash flows. The net cash impact of raising capital from equity/debt issuances, net of cash used for share buybacks, and debt repayments — with the outflow from the payout of dividends to shareholders also taken into account. Firms have increased their hoards of cash, reaching $6.9 trillion, an amount larger than the gdp of all but two.

The financing activity in the cash flow statement focuses on how a firm raises capital and pays it back to investors through capital markets. These reports highlight the most significant illicit. Cash flow types what is cash flow?

Cashflow financing can help companies structure solutions that can help out when cash is usually tight. These activities also include paying cash. This is the result of several different financing activities that happened during that period of time.

Cash flow financing helps companies that generate cash from. Cash flow (cf) is the increase or decrease in the amount of money a business, institution, or individual has. The bbc reported a net cash flow of £170m for its annual report and accounts for 2020/2021.

Interest paid was $12,000 and taxation paid was $13,000. A typical cash flow statement comprises three sections: Cash received represents inflows, while money spent represents outflows.

Here we also discuss cash flow from financing activities, examples of apple, jpmorgan, and amazon. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). It’s essential because it mirrors your financial health and is the lifeblood that sustains your operations.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)