Stunning Info About Profit And Loss Statement For Nonprofit Organization

Lesson 2 discusses special purpose frameworks, such as the cash and tax bases, and how they might affect the financial statements of a nonprofit organization.

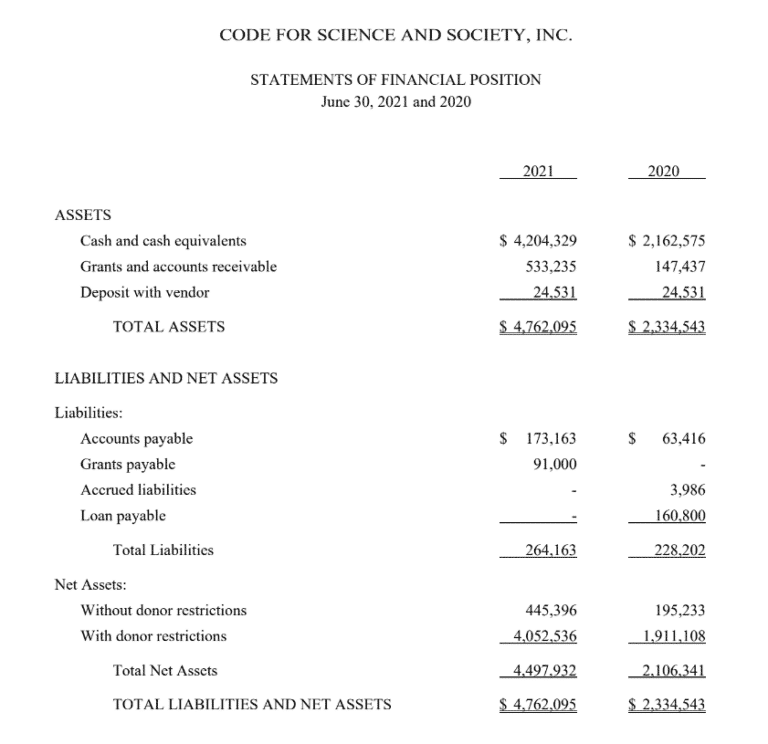

Profit and loss statement for nonprofit organization. Assets = liabilities + net assets here’s an example from code for science & society’s statement of financial position from 2021. The statement of activities (also sometimes called the operating statement) is like the nonprofit version of the income statement. You may also hear it referred to as a profit and loss statement or income and expense report.

In the first section of the statement of The activity reported on this statement covers a specified period of time, usually. Nonprofits use the statement of financial position to list their assets, liabilities, and net assets.

The statement of activities. Statements for nonprofit organizations. Nonprofit organizations are responsible for managing their finances in a way that is both transparent and accountable to their stakeholders.

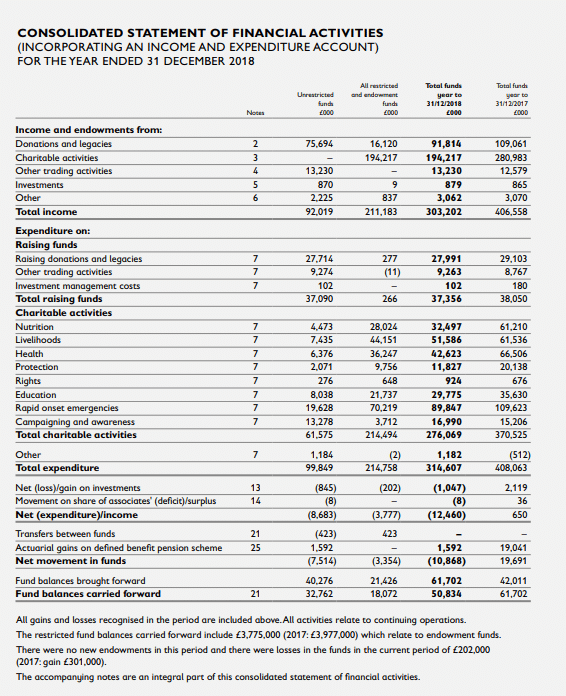

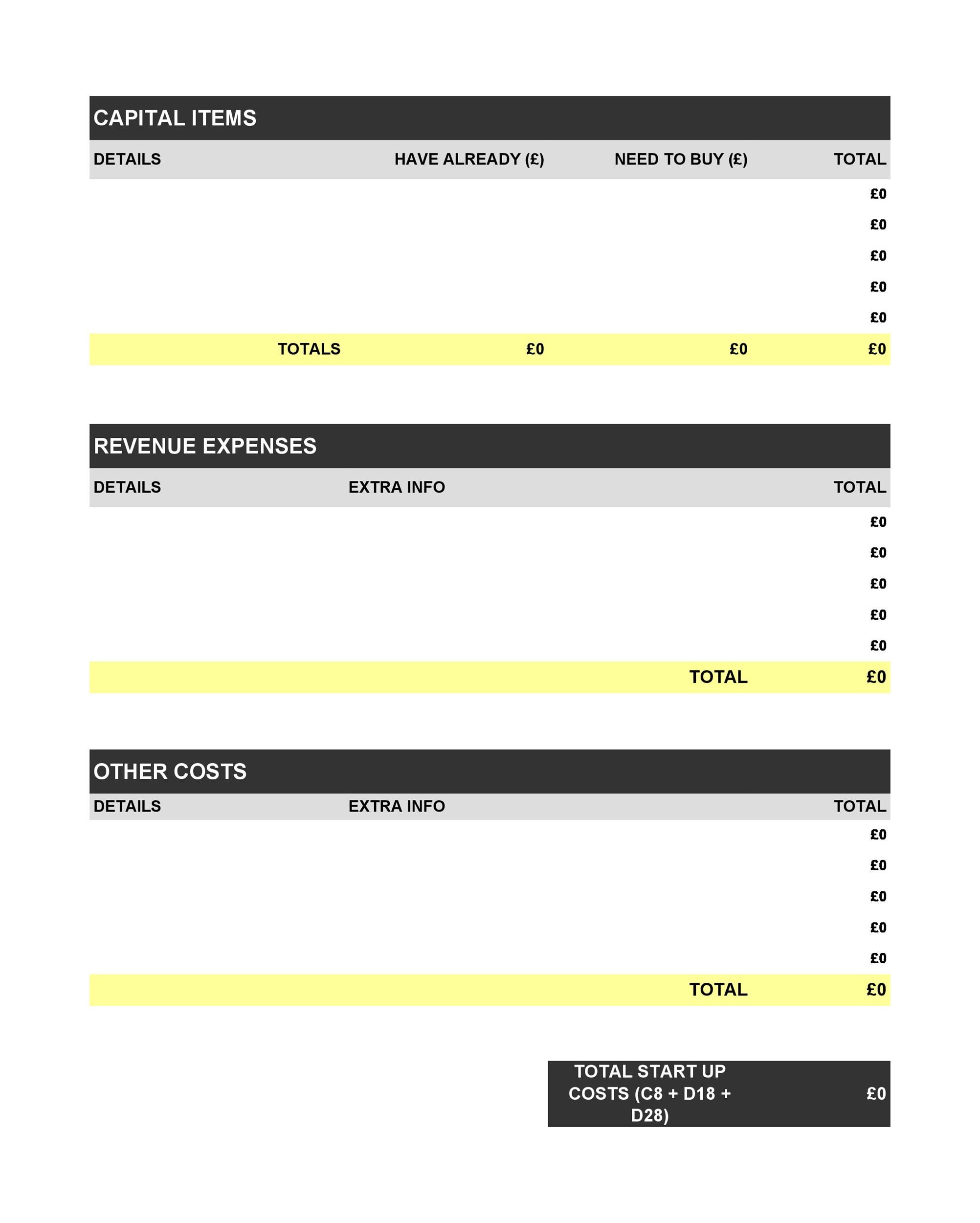

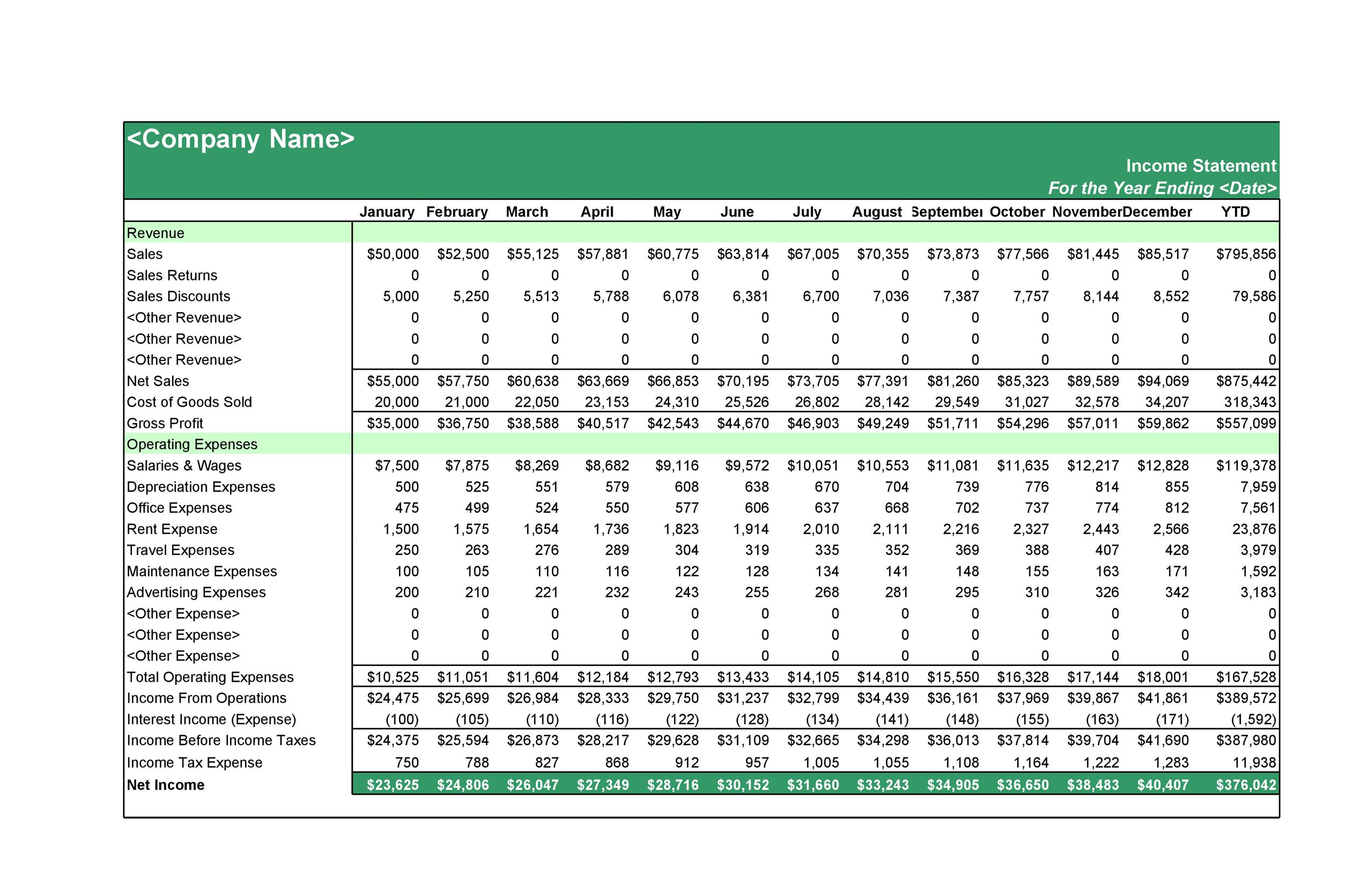

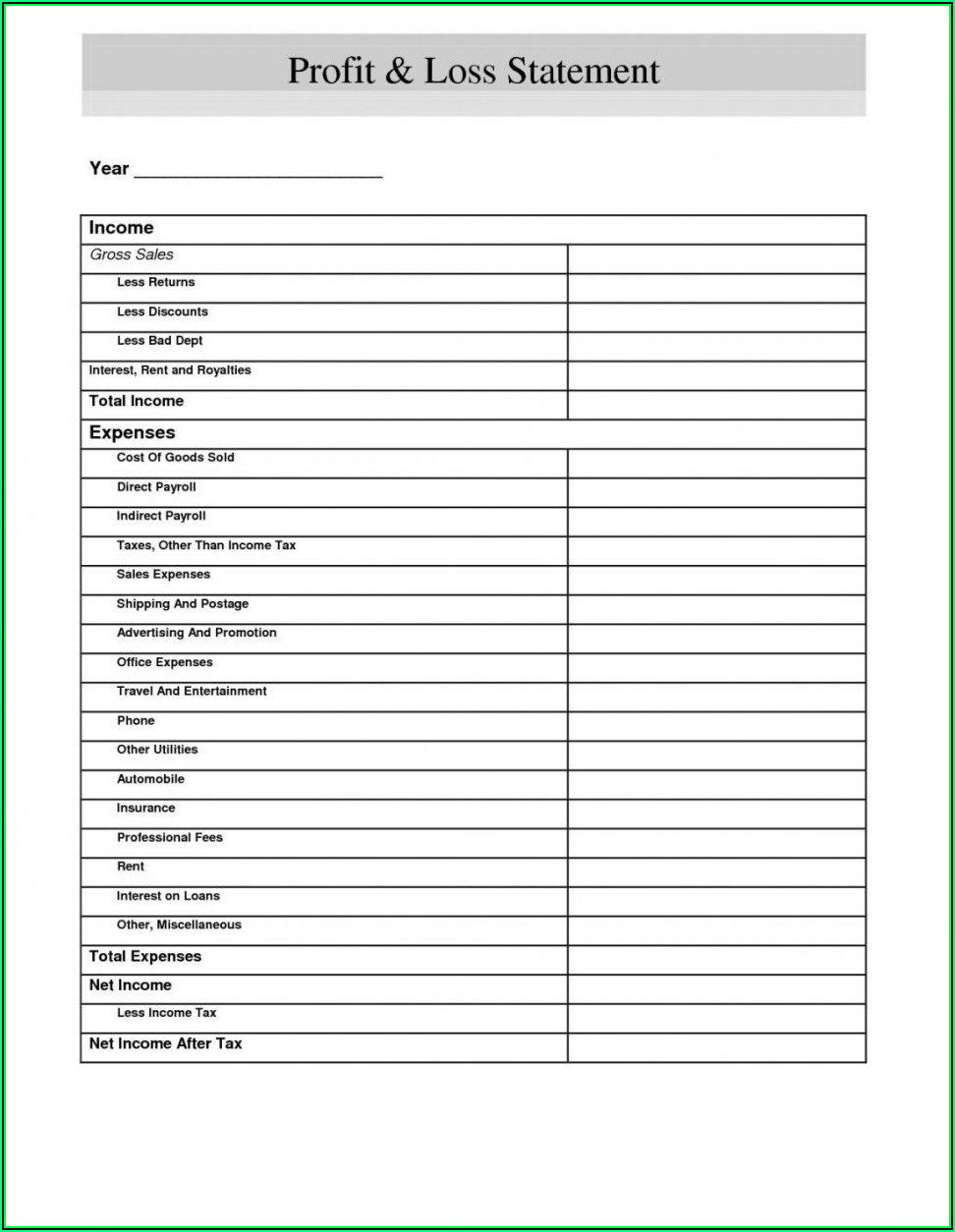

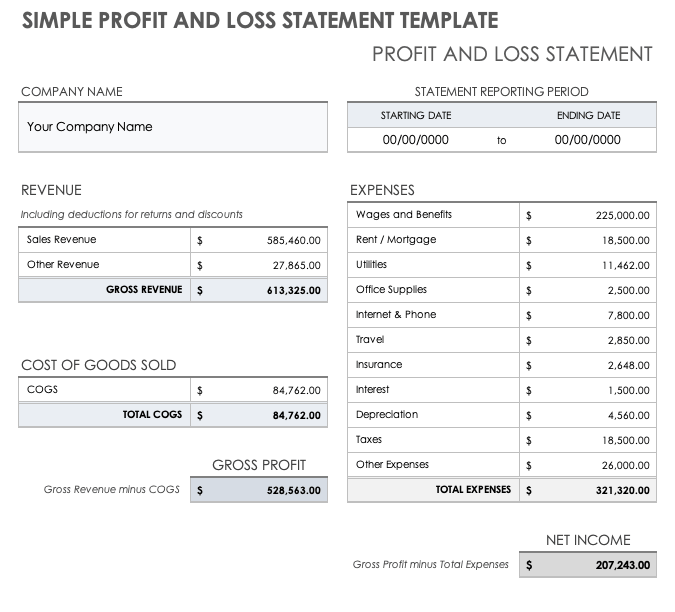

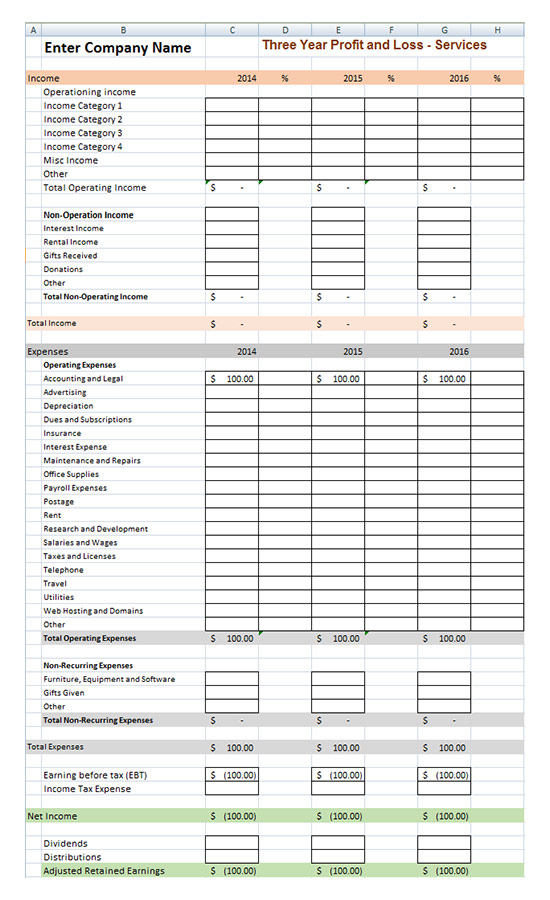

Nonprofit templates how to create a non profit financial statements [11+ templates to download] a financial statement is a sheet that shows the income and expenditure of an organization throughout a financial year. The detail of expenses may be provided on the face of the statement of activities, in the notes to the financial statements, or through a separate schedule (e.g., the statement of functional expenses). Ideally, a government wants expenditures to be very close to revenue in any given.

The statement of activities measures the impact of the company’s revenues and expenses and gives users the total change in net assets. The statement summarizes the income and expenses of the organization during a specified amount of time. However, nonprofits are not in the business of making a profit (or a loss), thus this is an incorrect assumption.

These reports collectively provide the financial insights your nonprofit needs to thrive. This statement reports the change in net assets with donor restrictions and without donor restrictions. Thus, there is a drop in the ending balance of the temporarily restricted net assets.

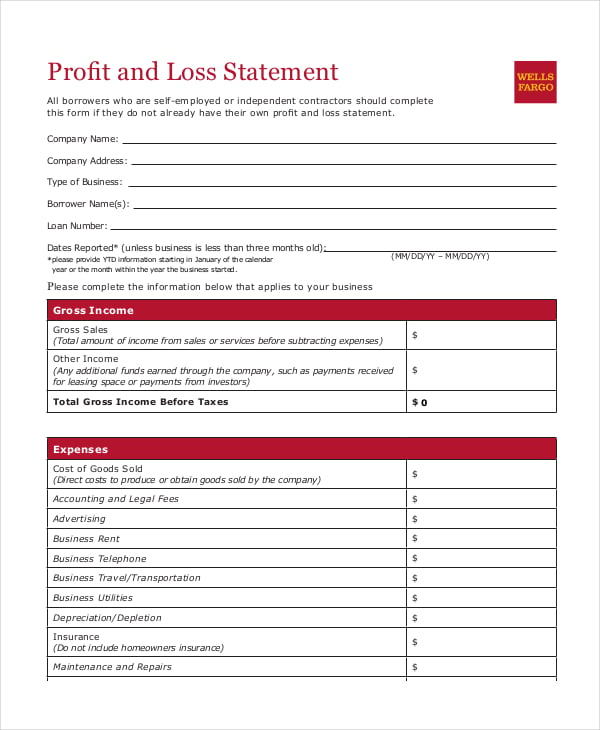

A nonprofit’s statement of activities is an adopted income statement, or profit and loss report. A key part of this process is understanding the nonprofit’s profit & loss (p&l) statement. The number of accounts in a nonprofit's general ledger could range from 30 to 1,000 or more.

A statement of activities, also called a profit & loss statement, is a financial report that shows how much a nonprofit organization earned or spent over a period of time, typically one year. Reading a nonprofit profit & loss statement: The soa report shows a nonprofit organization’s income, expenses, and net income for a specific period of time, all or part.

Lesson 1 takes a look at the notes that should be included in a nonprofit organization’s financial statements. The statement can be used to track the organization’s progress and make sure it is meeting its financial goals. The statement of activities is simply to show how the organization is using its revenue and expenses to support its mission.

Statement of financial activity having no profit does not mean that there is no income. Regular monthly reporting typically includes a statement of financial position (balance sheet), a statement of activities (profit and loss [p&l] and income statements), and other required reports. The statement is set up to give users a quick glance at the company’s net income for that time period.