Underrated Ideas Of Tips About Profit And Loss Debit Balance In Sheet

Debit balance of p/l ac means a loss to the firm!

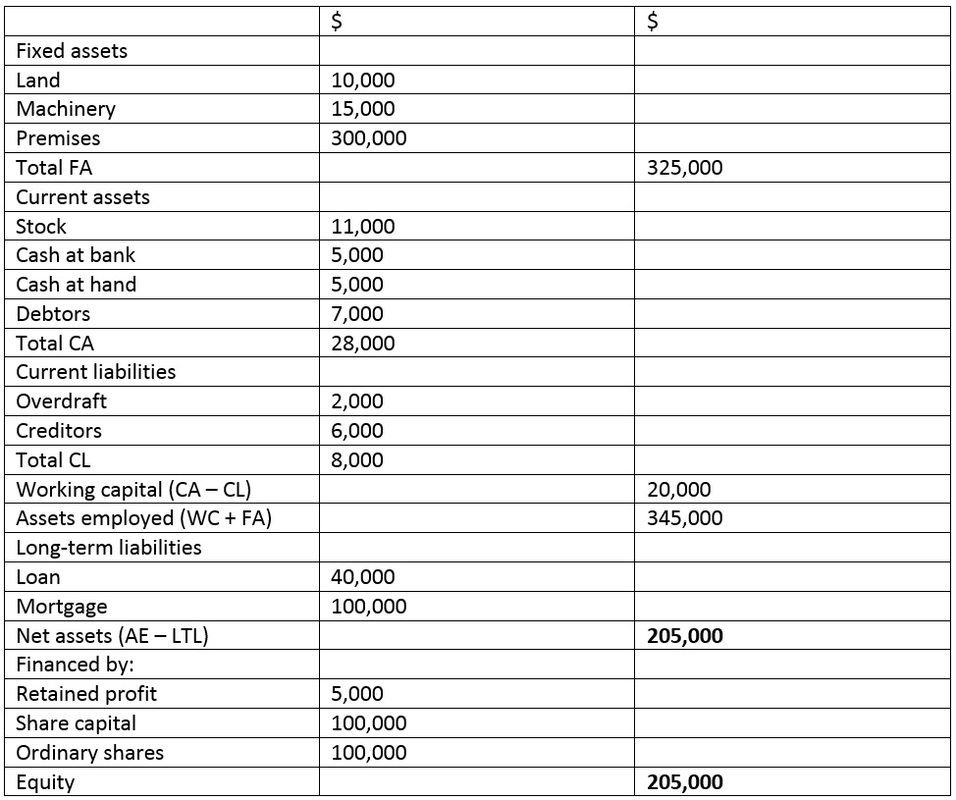

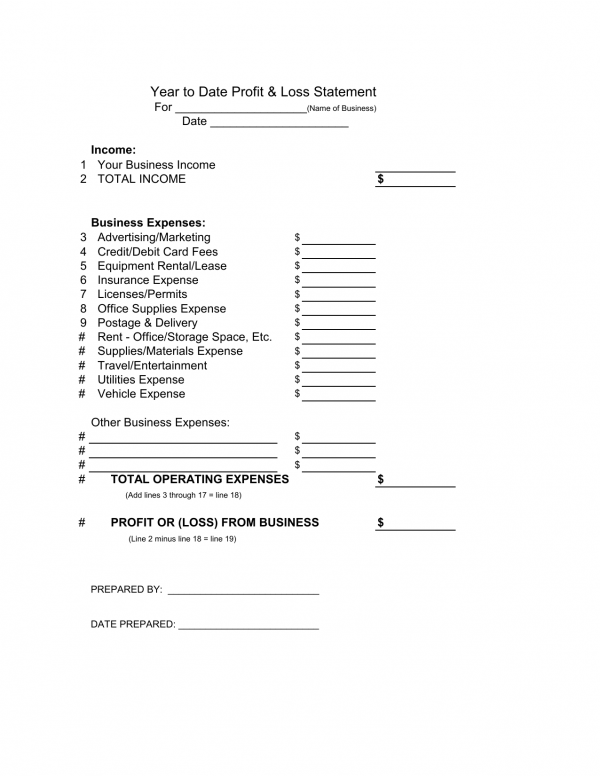

Profit and loss debit balance in balance sheet. A debit in one will be a credit in another. This indicates that the company has not made enough money to cover its costs. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.

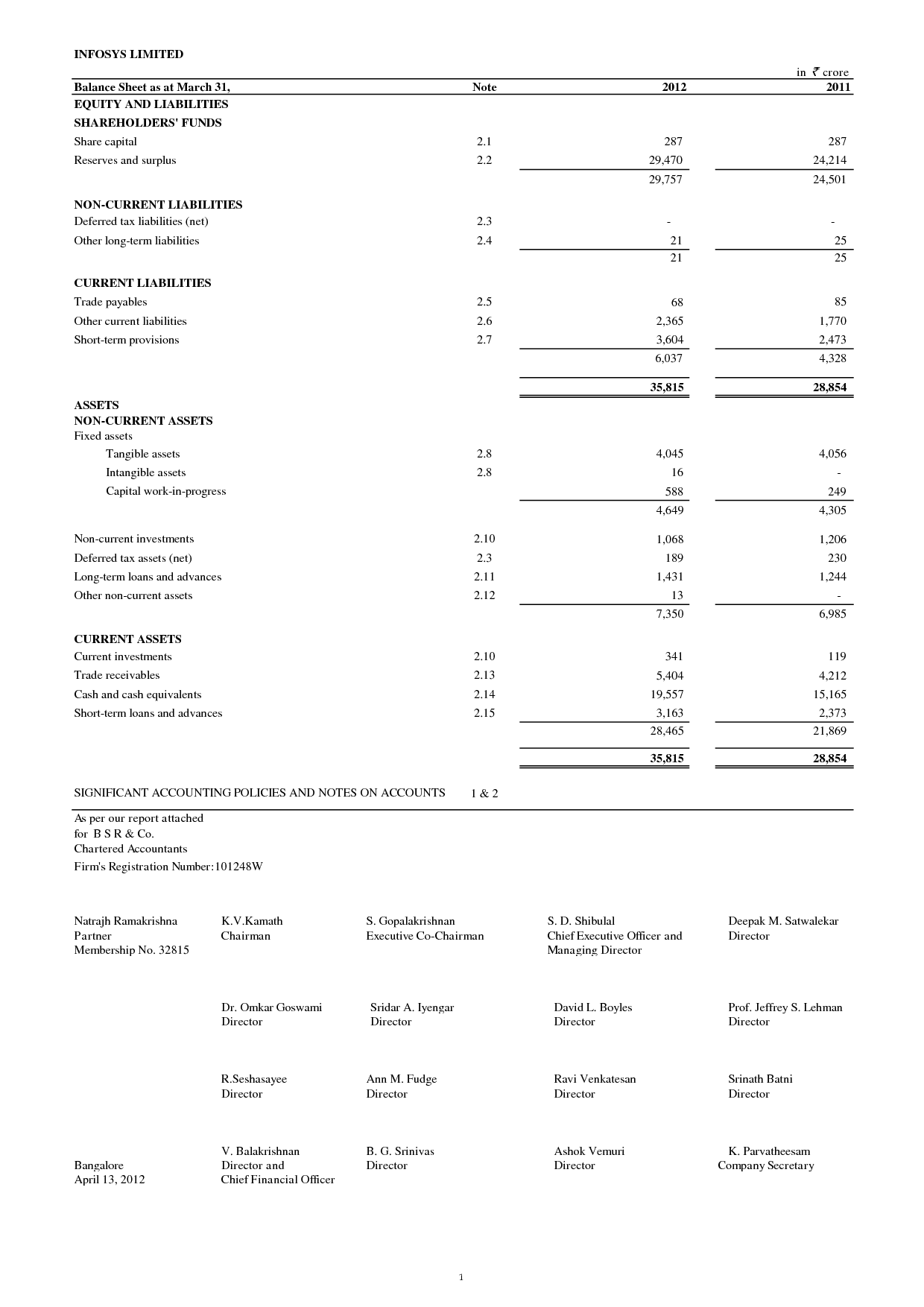

Common size profit and loss statements can help you compare trends and changes in your business. A balance sheet is a statement that discloses the financial position of its assets, liabilities and capital on a specific date. · have a market value of $5 billion or more.

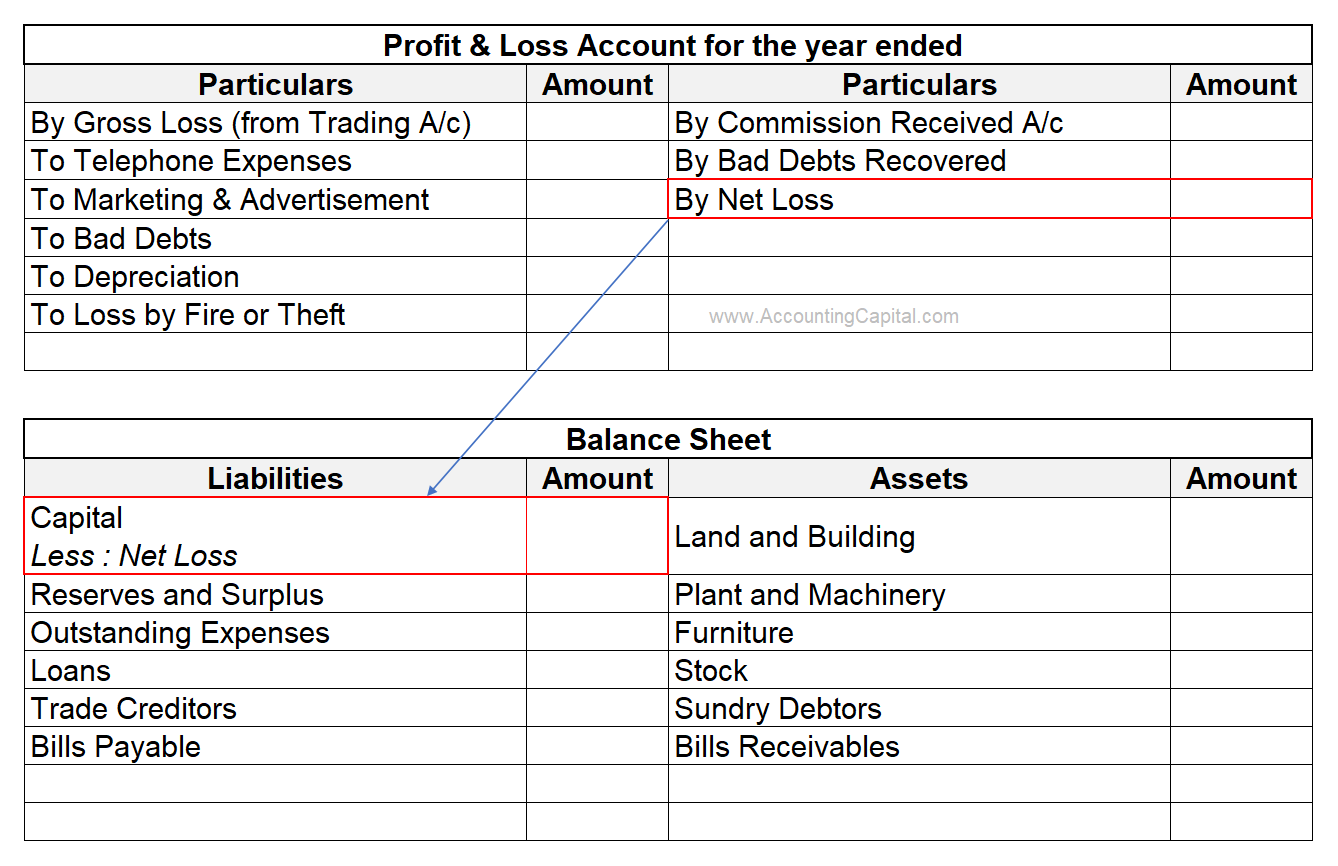

It gives you a financial snapshot of how much money you’re making (or losing) and can make. This loss is what we call the debit balance of a profit and loss account. The balance sheet preparation of the profit and loss account and balance sheet the advantages of financial statements.

2.6 balancing off accounts and preparing a trial balance. You can use your profit and loss account and balance sheets to calculate profit and loss and get a better idea of your profit margin. This ratio shows how much is owed compared to the company’s net worth.

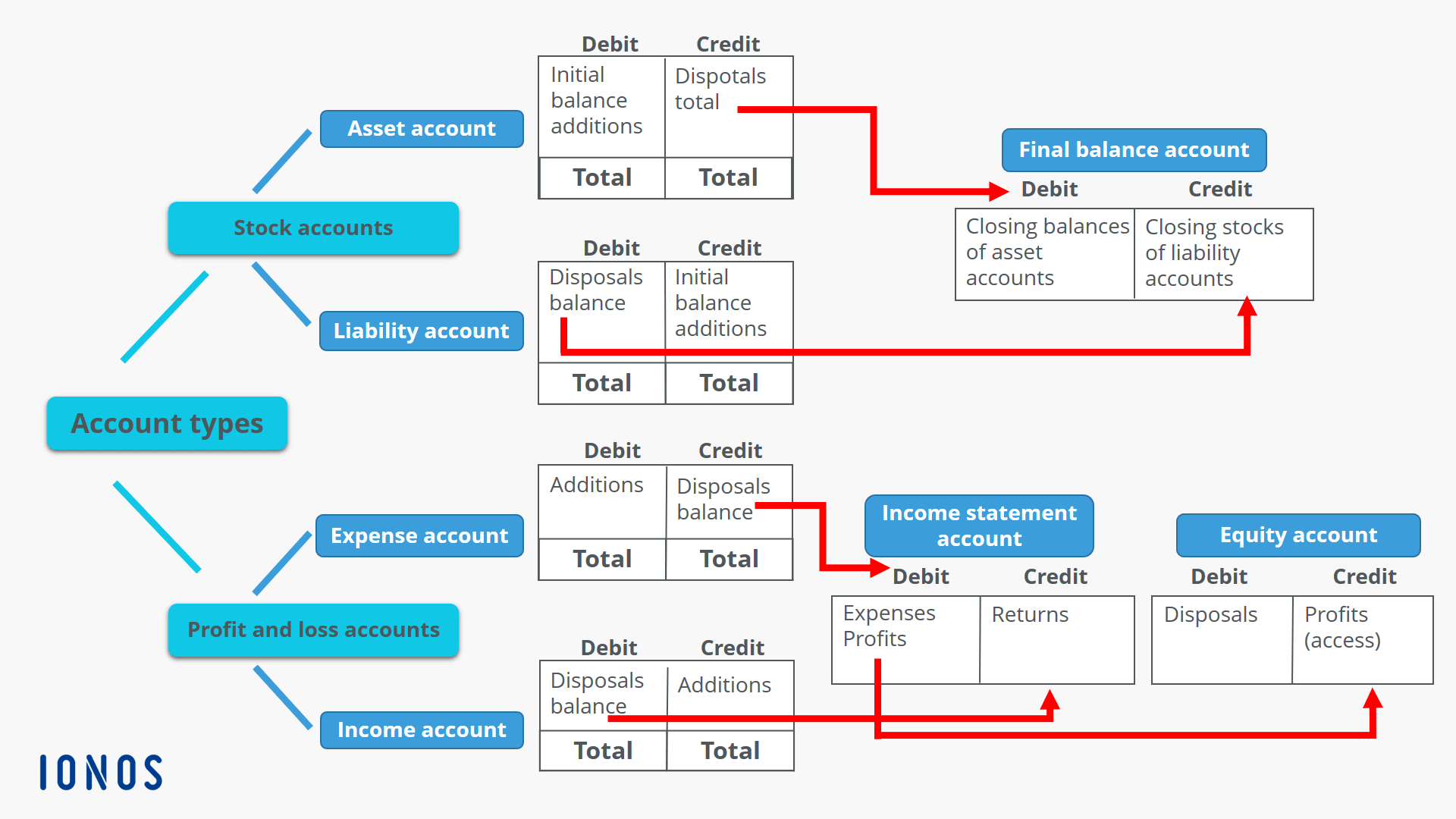

A p&l account with a debit balance can be subtracted from capital or be shown on the asset side of. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. The profit and loss account and the balance sheet work in harmony in double entry accounting.

A profit and loss account is an account. A profit and loss (p&l) statement is one of the three types of financial statements prepared by companies. If a company prepares its balance sheet in the account form, it means that the assets are presented on the left side or debit side.

7.1 the profit and loss account the profit and loss. To make my balance sheet powerhouses list, a company must: Total liabilities divided by shareholder equity.

The other two are the balance sheet and the cash. The proceeds of sale are credited to the account, and the balance on the account is then the profit or loss on the sale, to be transferred to the statement of profit or loss. A profit and loss statement (p&l) is an effective tool for managing your business.

2.4 a simplified uk balance sheet format. It is reflected as a negative amount, indicating the company has suffered losses. Items not shown in profit and loss account format.

Key difference between a balance sheet and a profit and loss account (p&l) provides a snapshot of the company's financial position at a specific point in time. In fact, you may even notice if. Drawings are not the expenses of the firm.