Fabulous Info About Balance Sheet Personal

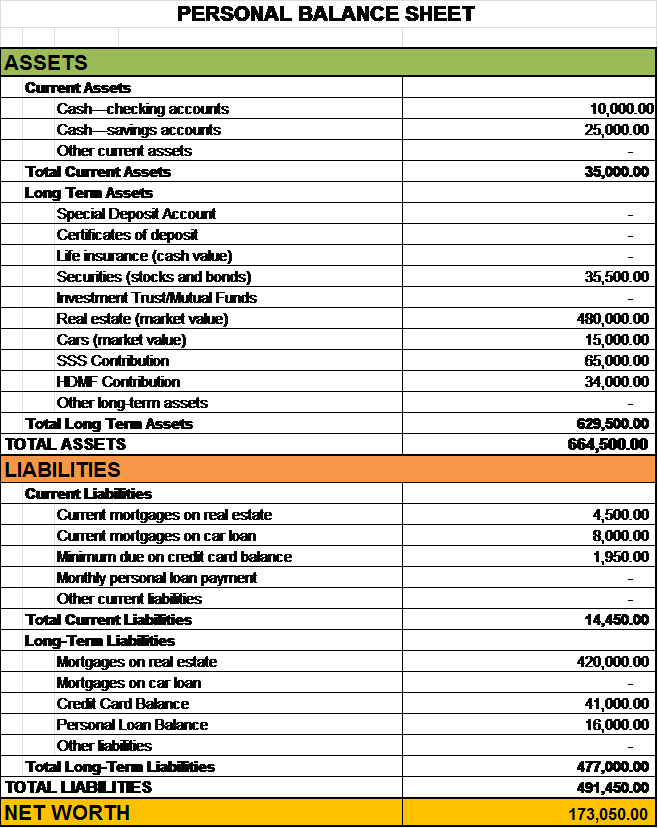

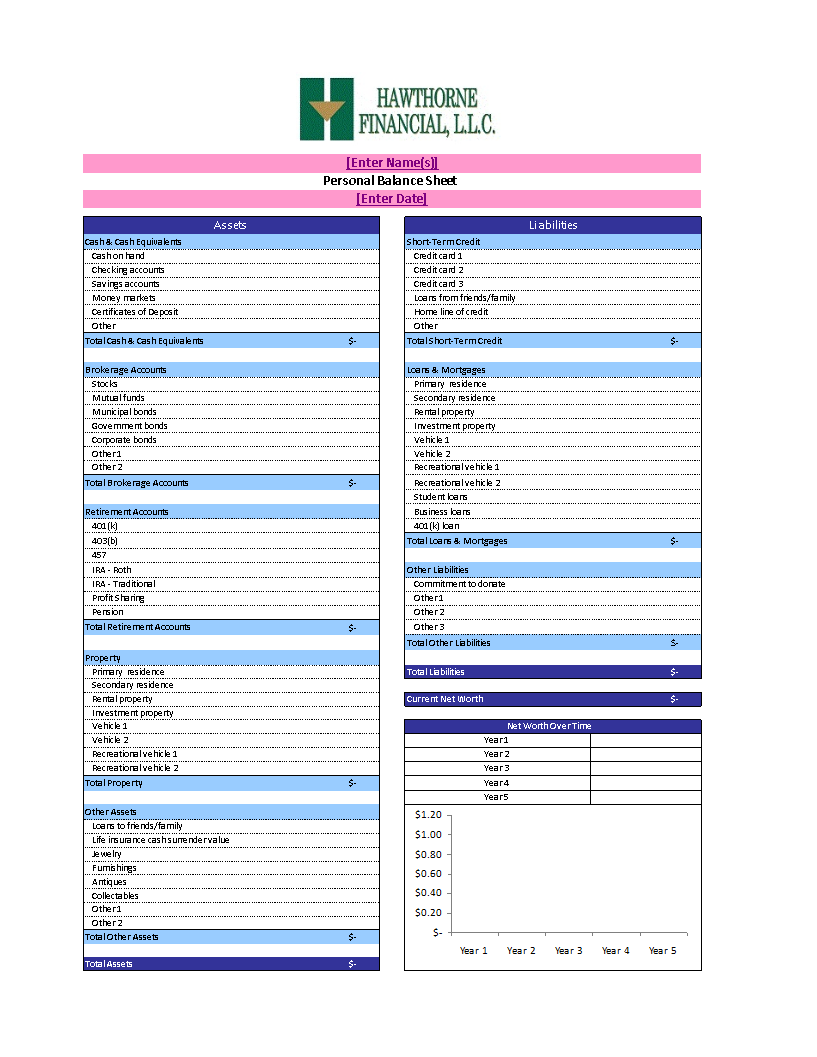

Let’s see a schematic representation of my personal balance sheet.

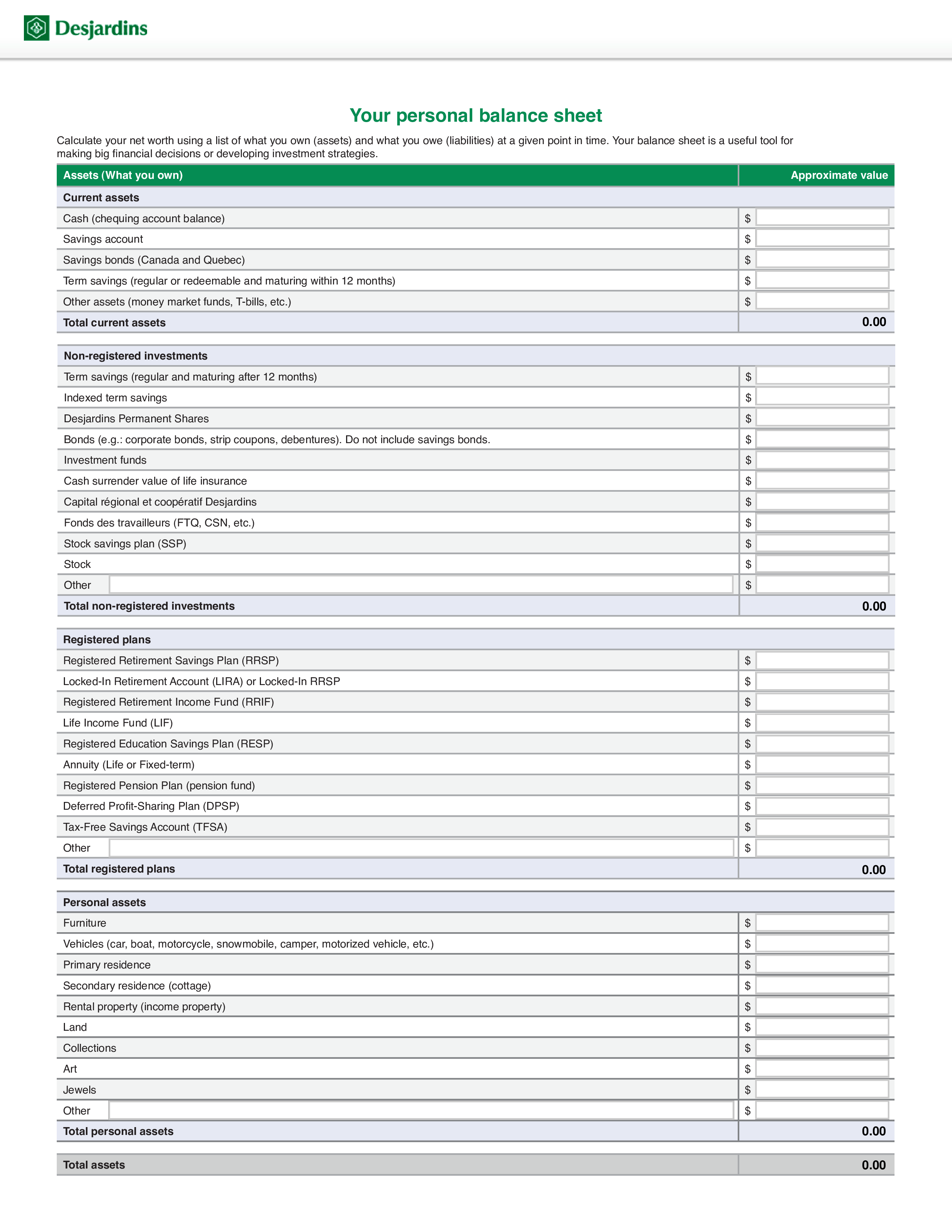

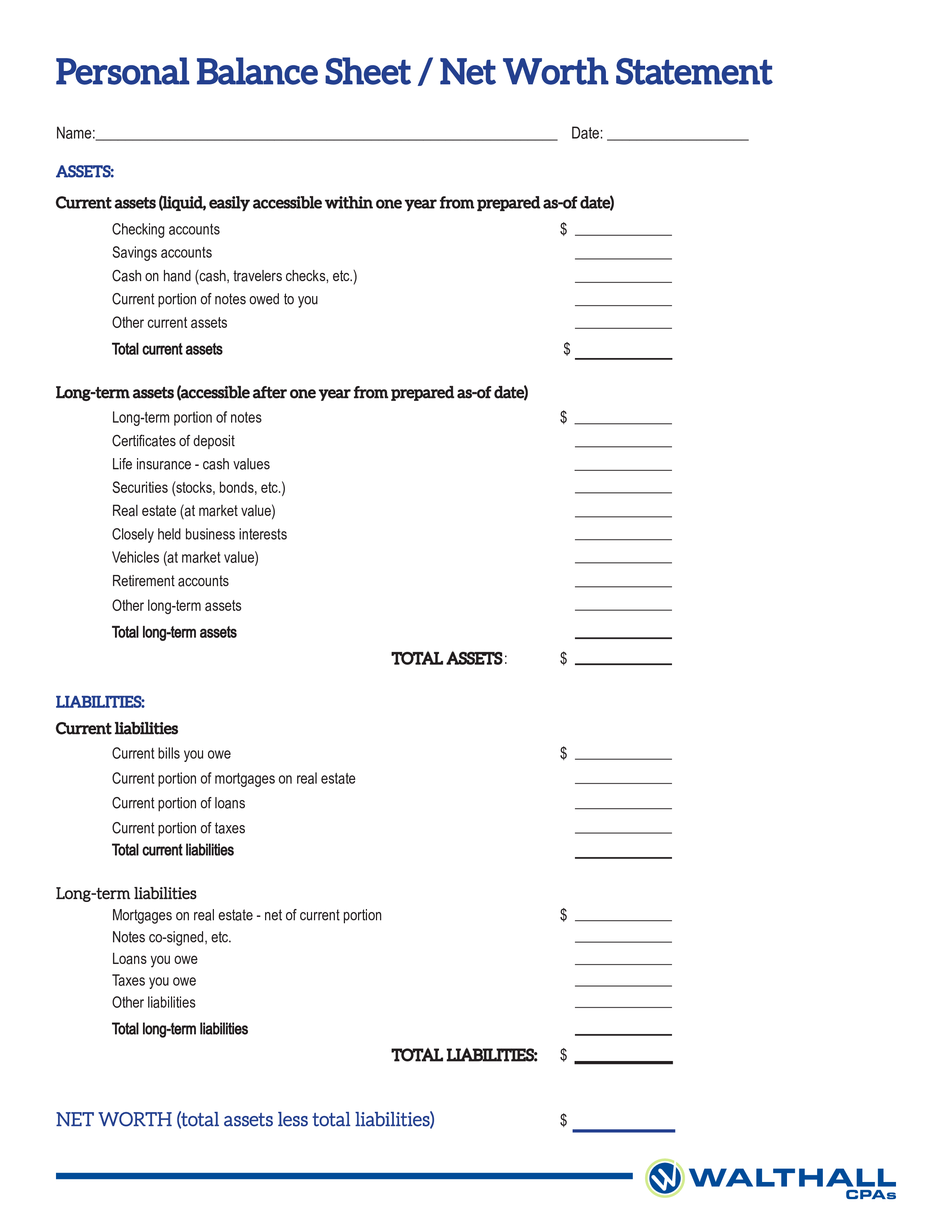

Balance sheet personal. Your personal balance sheet calculate your net worth using a list of what you own (assets) and what you owe (liabilities) at a given point in time. With this information, you can make adjustments that could either increase your assets or make sure you aren’t drowning in debt. 18+ personal balance sheet templates.

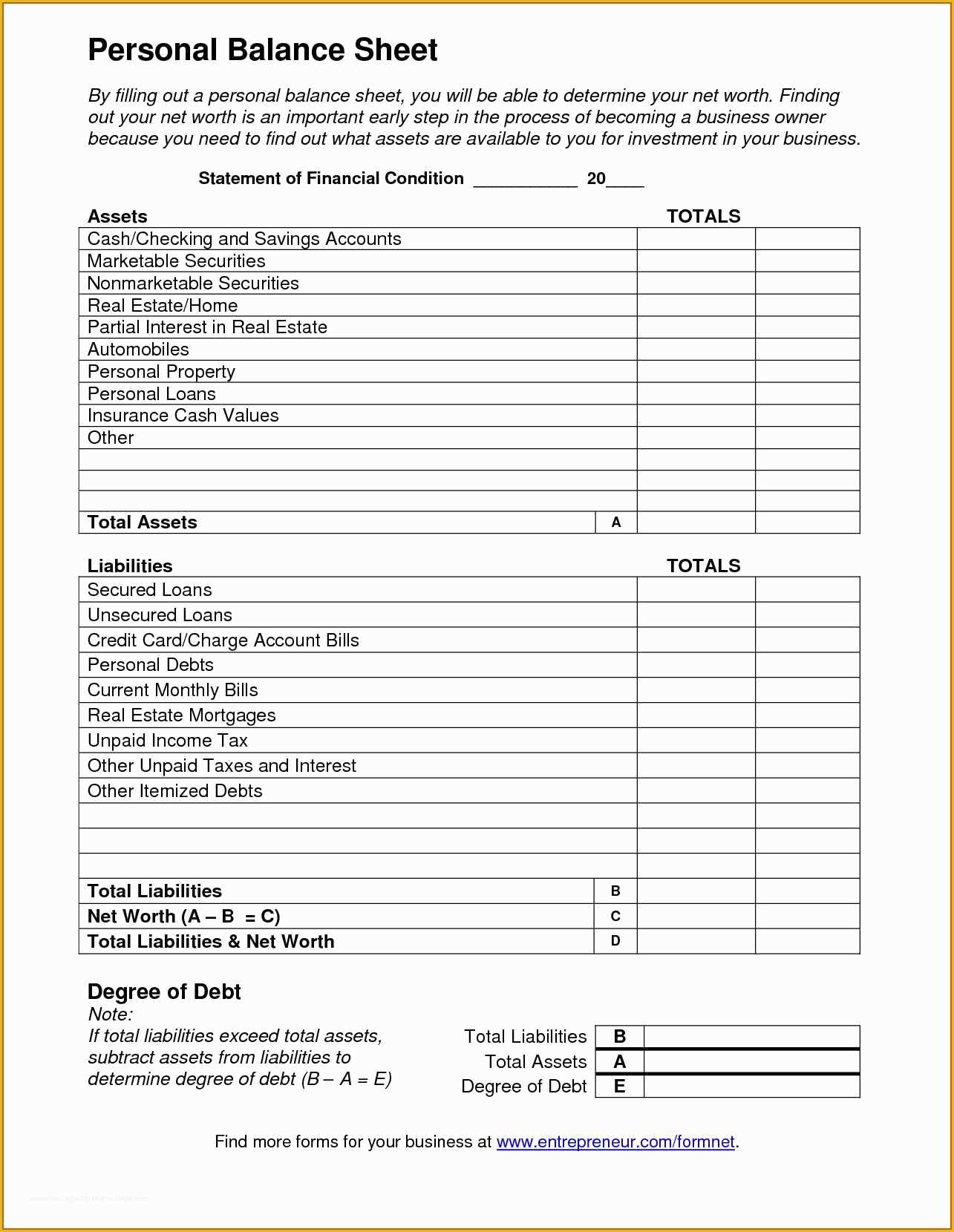

Knowing yourself to be a “company of one,” you have to learn to manage yourself the way you would manage a company. What is a personal balance sheet? This document provides details on your liabilities and assets.

Current assets/ immediate assets these are assets that can be easily converted into cash in a short span of time. A personal balance sheet is a financial document that provides a snapshot of an individual's financial position at a specific point in time. Use these balance sheet templates as financial statements to keep tabs on your assets (what you own) and liabilities (what you owe) to determine your equity.

Note that the balance sheet does not include cash flow but does include the total amounts due or the total value of each account. Personal financial statement: This loss takes into account the full release of the provision for financial risks, amounting to €6,620 million, which.

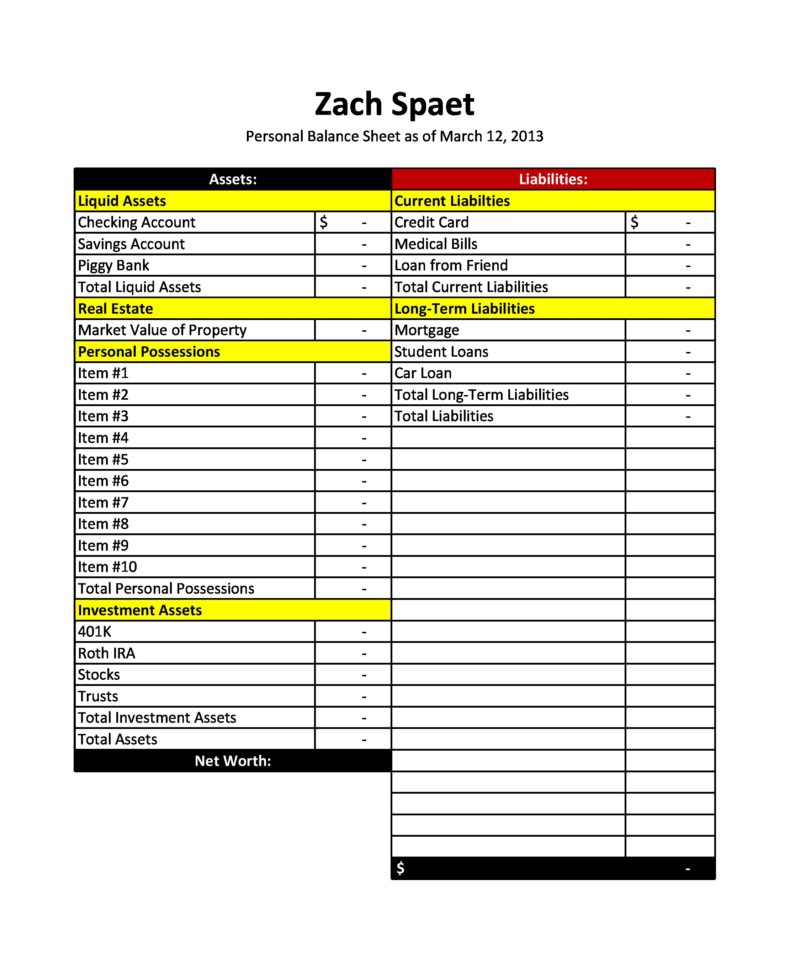

A personal balance sheet summarizes your assets and liabilities to calculate your net worth. Though i’m referring it as a ‘balance sheet’, but actually it is a combination of two reports in one: Drawing up a financial balance sheet.

Policymakers said slower qt could ease shift to ample. Get free smartsheet templates. Having a personal balance sheet template is a great way to keep track of everything you owe and own.

A personal balance sheet helps you reflect on your net worth, whether positive or negative, and identify areas where you can work to improve it. A personal financial statement is a document, or set of documents, that outlines an individual’s financial position at a given point in time. $5,000 in cash (asset) $20,000 in your 401(k) account (asset)

Total assets total liabilities recap total assets total liabilities Getting all your financial documents ensures you have accurate. Minres said it had $1.4 billion in cash at the end of the first half and net debt of $3.55 billion, up from $1.85.

You can use any type of spreadsheet like google sheets or excel to make this more manageable if you want. You can use this information in tandem with your cash flow statement to help you create a budget and pay down your debt. You should put $1,000 on your balance sheet.

Your balance sheet is a useful tool for making big financial decisions or developing investment strategies. You decide to pay $115.00 which covers the interest and removes $100.00 from the principal. Fed minutes suggest officials are seeking smallest balance sheet possible.