Beautiful Tips About Quickbooks Profit And Loss Report Wrong

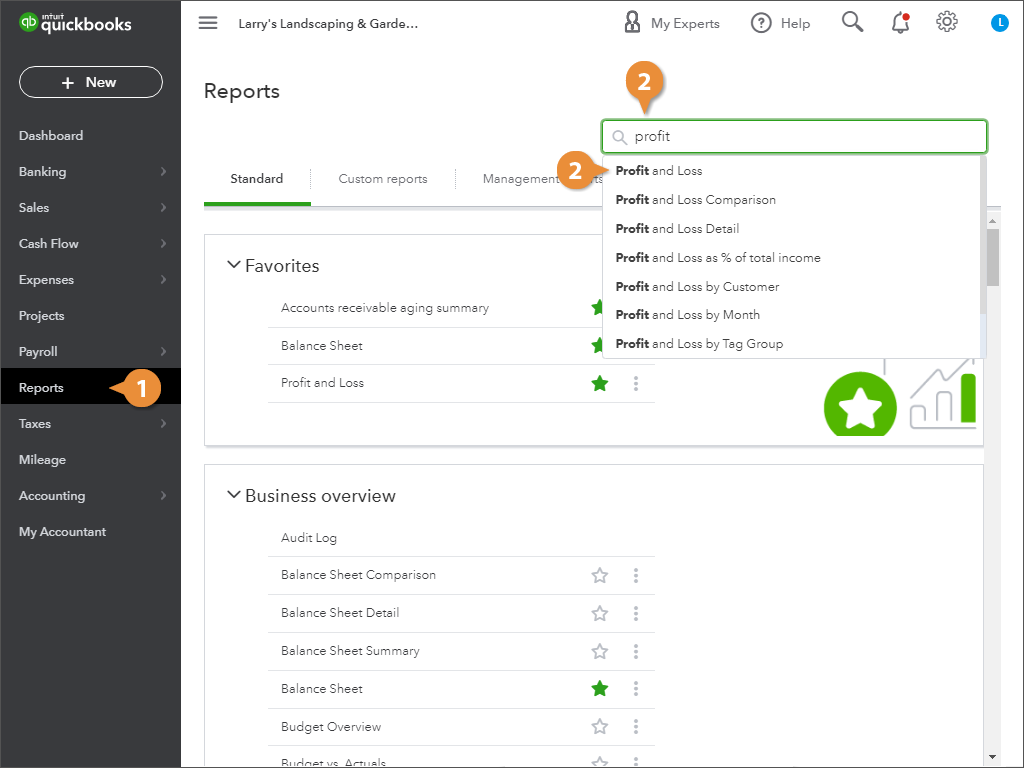

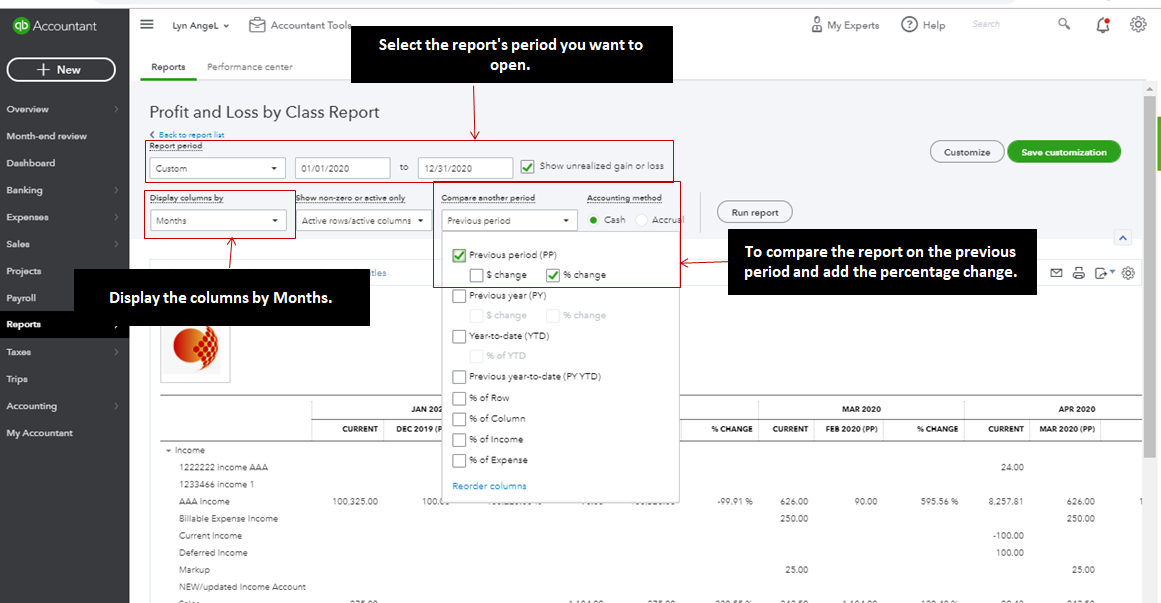

Now select the gear icon and click it.

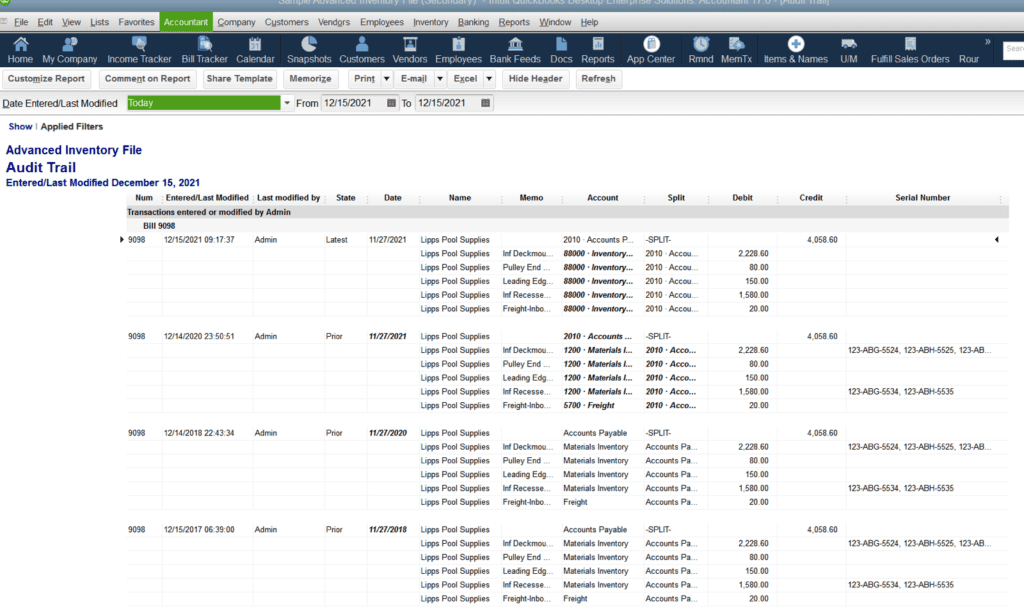

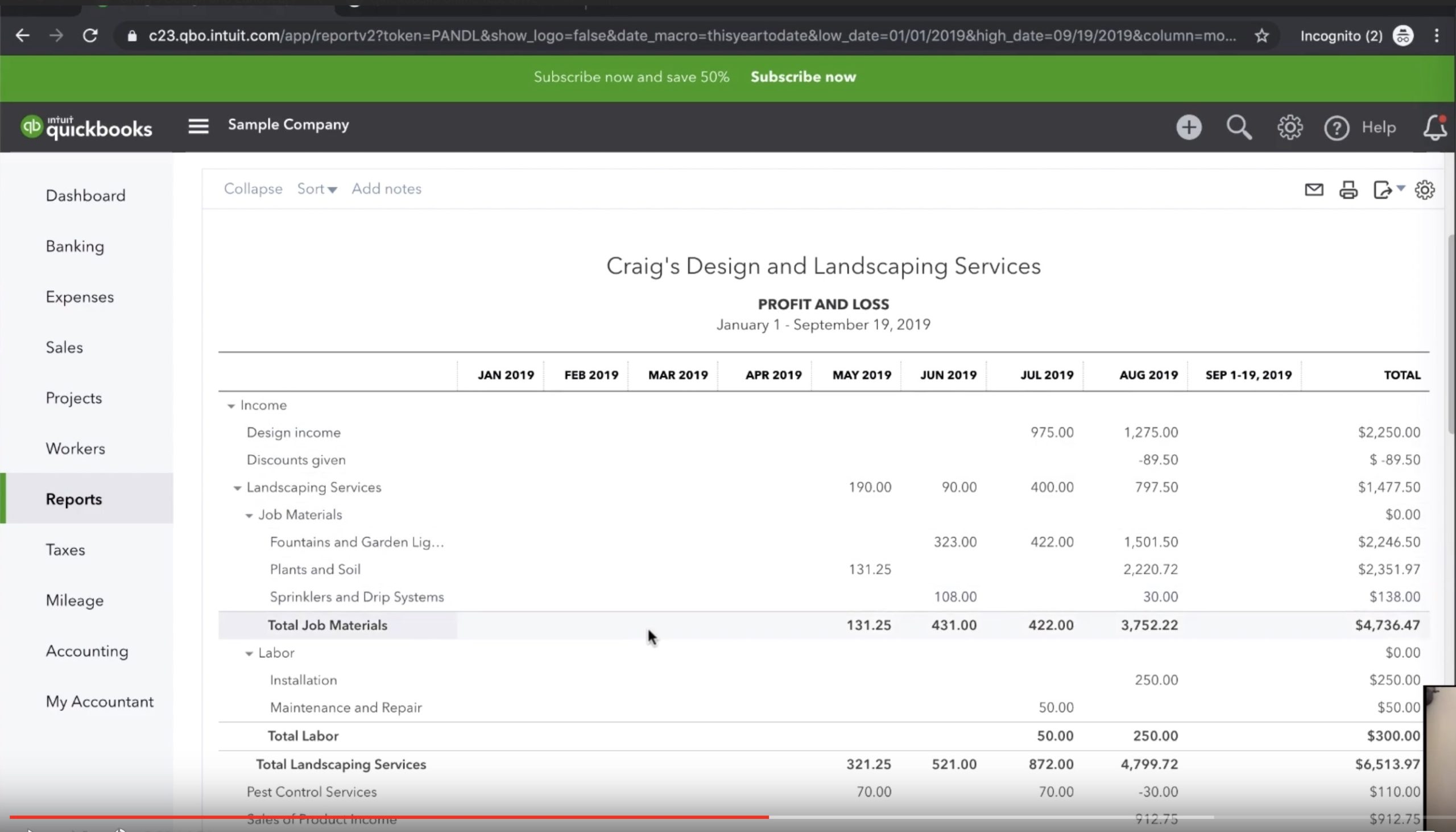

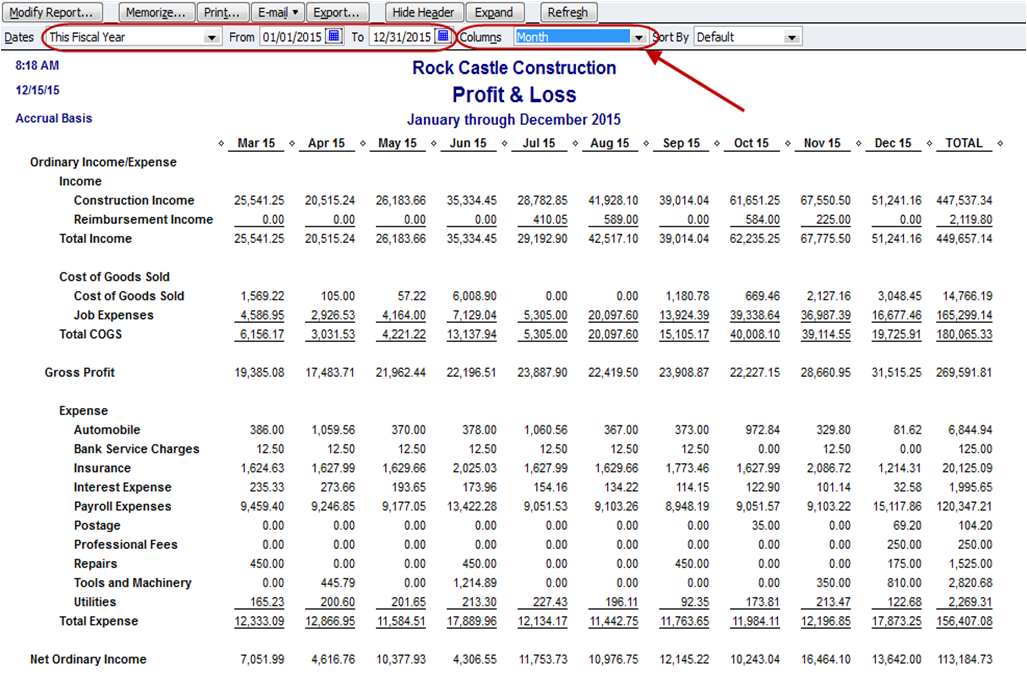

Quickbooks profit and loss report wrong. In this video, you'll learn how to run a profit and loss report that shows you your income by month in quickbooks desktop. It's great to see you back in the community! Track sales & sales tax.

Open your system and start the quickbooks accounting software. If you find that your income and expense transactions are missing from your profit and loss report, there are a few things you can do to troubleshoot this issue. Good morning, @mary with westcoast.

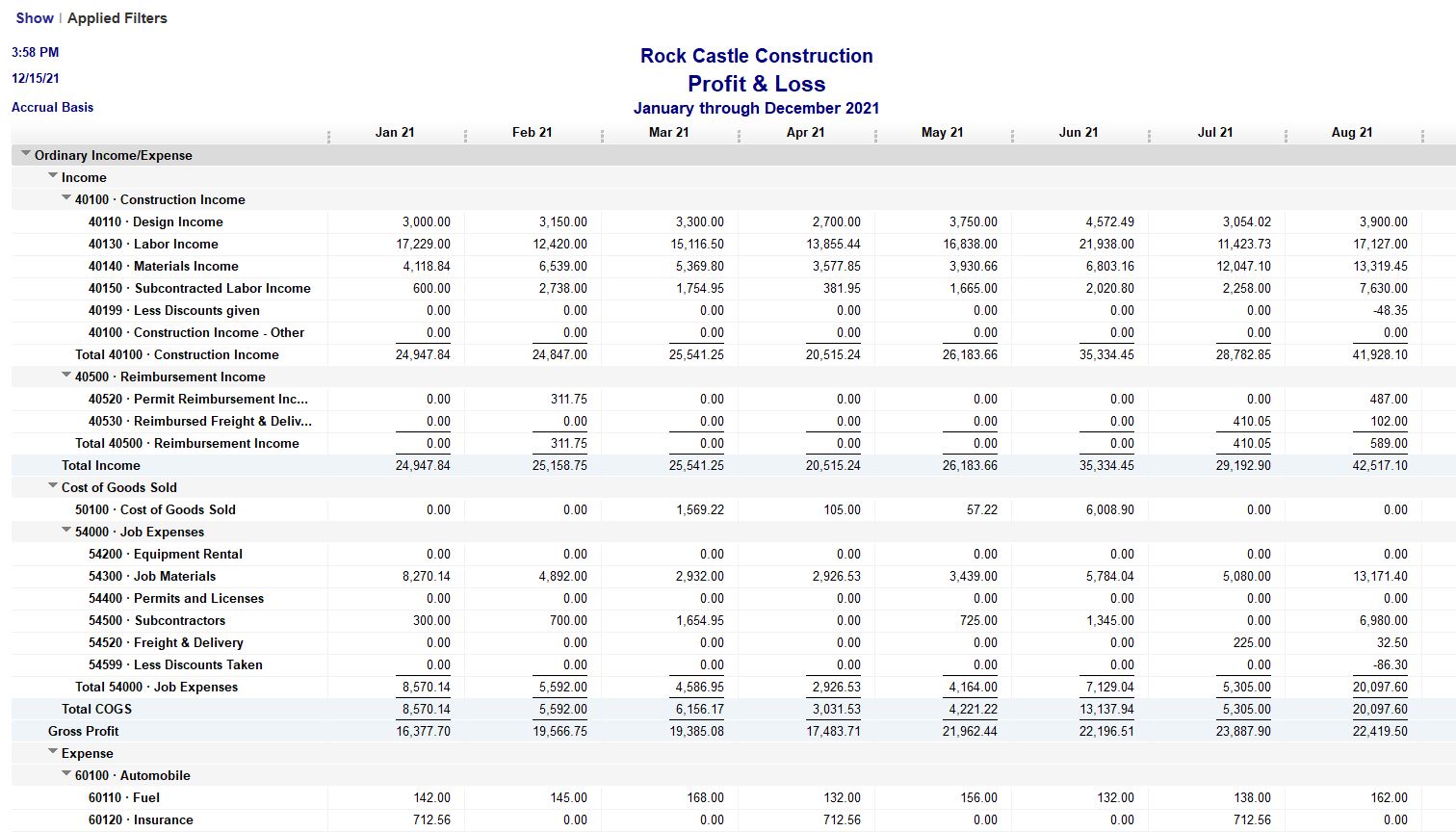

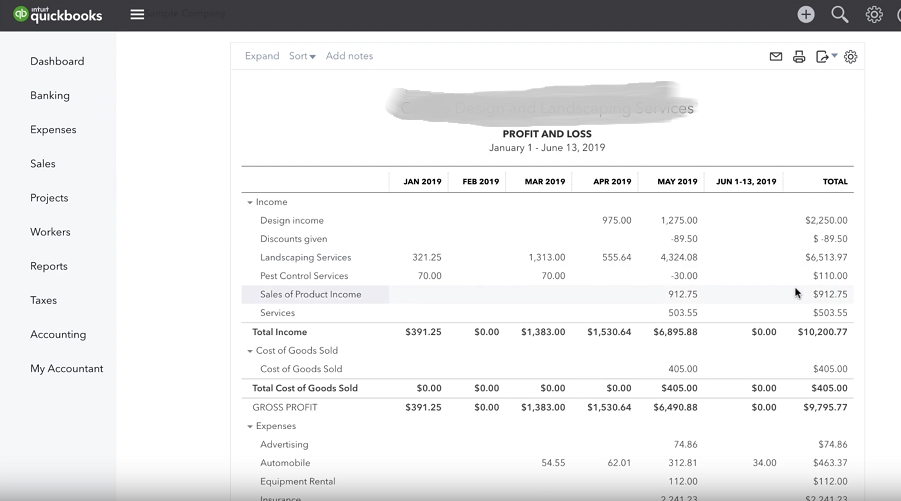

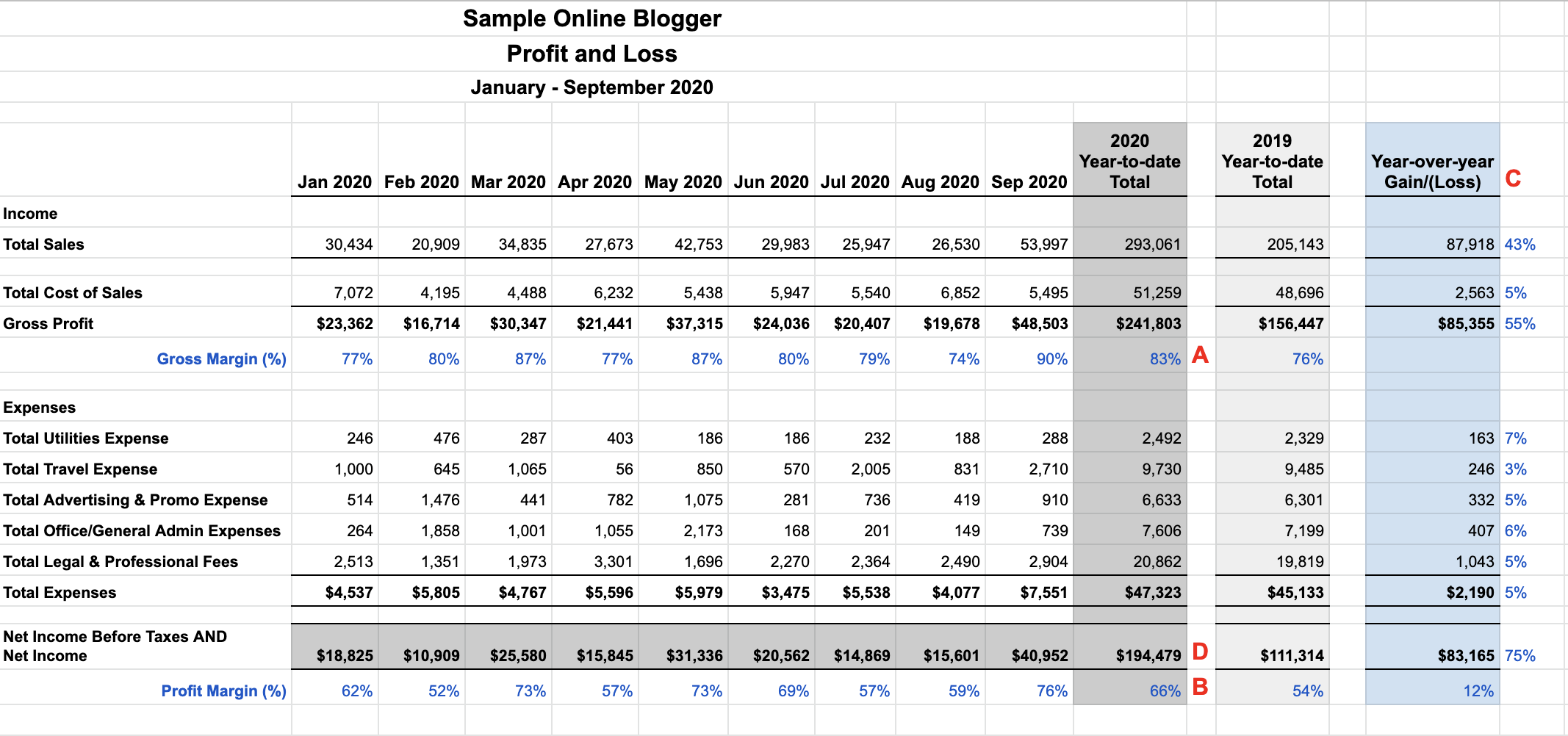

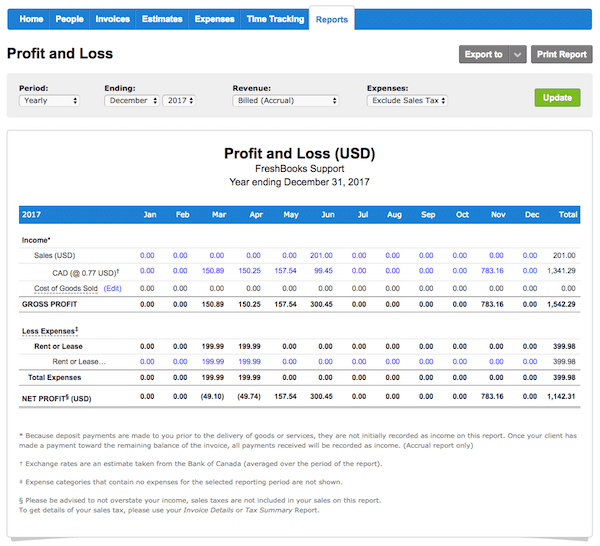

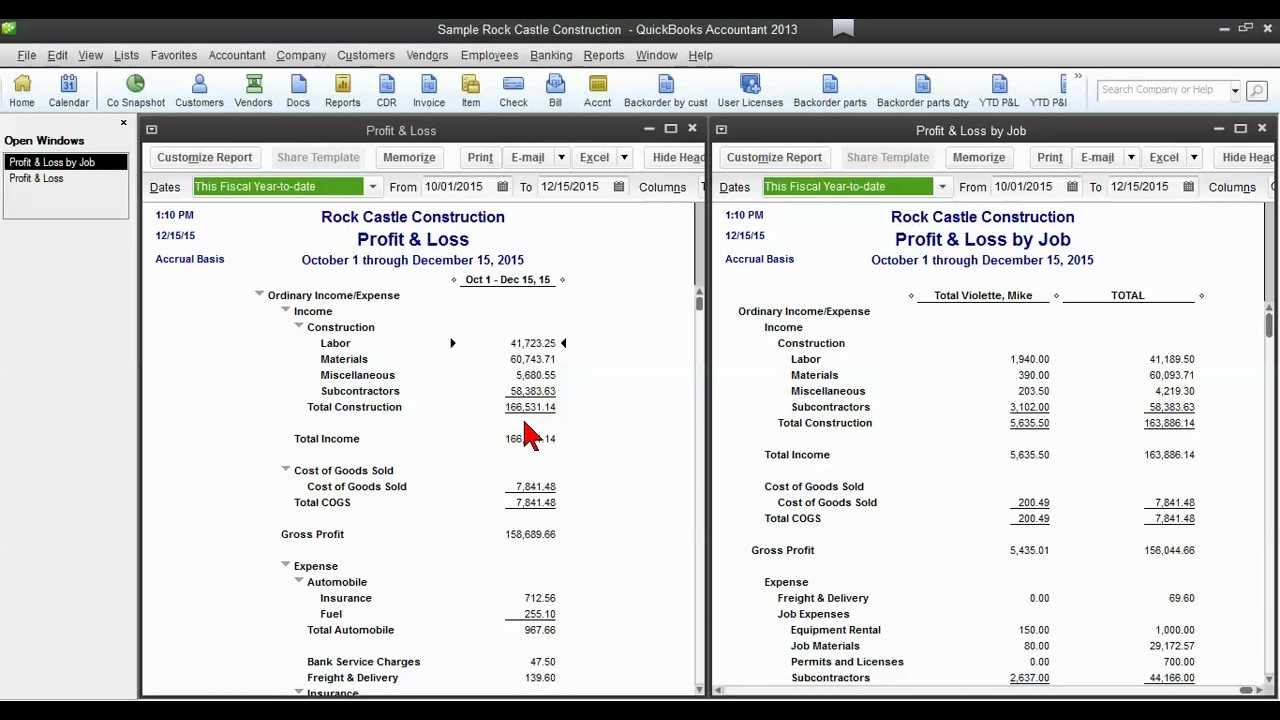

Profit & loss report not showing any income. With quickbooks profit & loss reports, you can see if your business is operating at a loss or profit. This video shows you how to create a profit and loss report a.k.a an income statement in quickbooks and how to customize this report to show you only the.

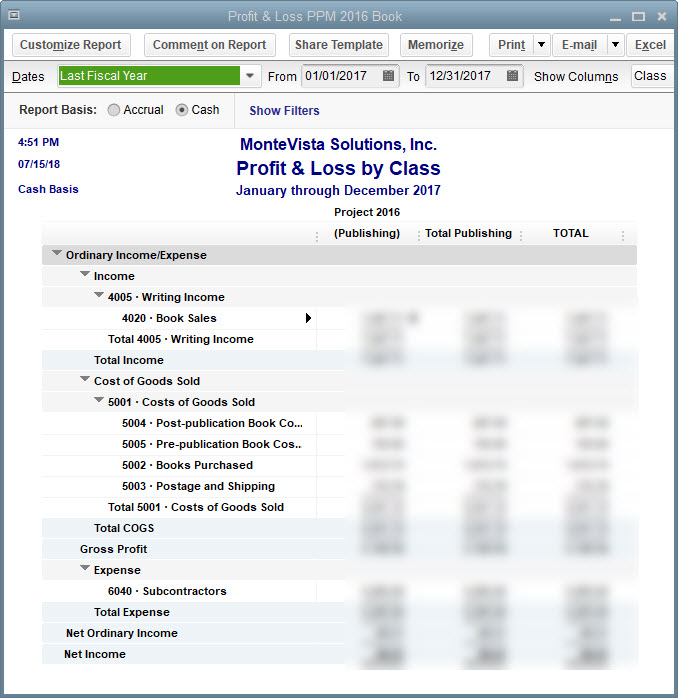

How do i change the account. The report can be run as often as desired to get insight on your business. Change it to cash basis and.

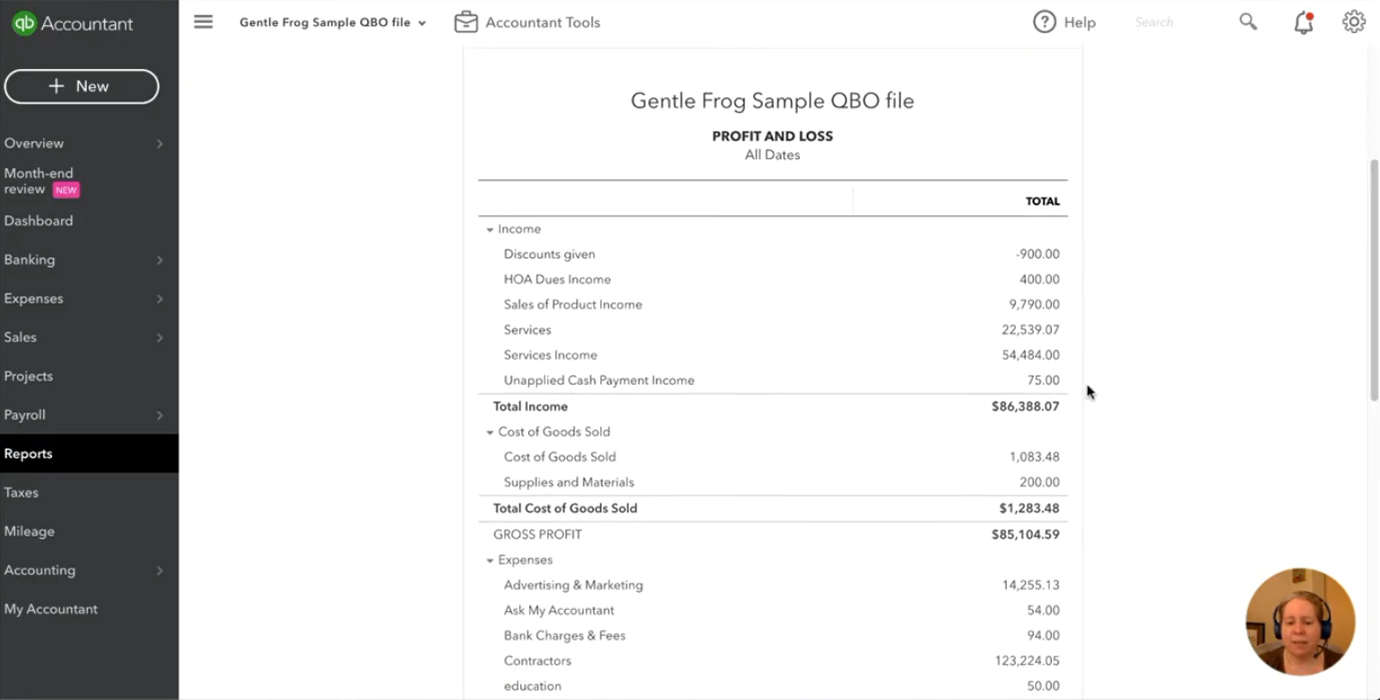

In this quickbooks tutorial you will learn how to review the profit and loss report in quickbooks online.please like, subscribe, and comment!contact rachel f. Resolution for issue 'how do i change the account order on the profit and loss report?' available: Reports and accounting.

The profit and loss report can be customized to show totals by month. In this quickbooks online tutorial you'll learn what is a profit & loss statement along with: If you wish to track all your sales taxes, you'll want to run the.

Click customize at the top. I recommend using the customization settings on the profit and loss. Best answers marshalla intuit february 08, 2021 01:07 pm hello, sounds like you are running your profit and loss in accrual basis.

In qbo, know that what you'll see in your profit and loss report is the income and expense total only.