Painstaking Lessons Of Tips About Proprietary Fund Financial Statements

Accrual revenues and other financial resources are recognized when they are measureable and available revenues are recognized when they are both earned and measurable expenditures are recognized when a liability has been incurred with certain

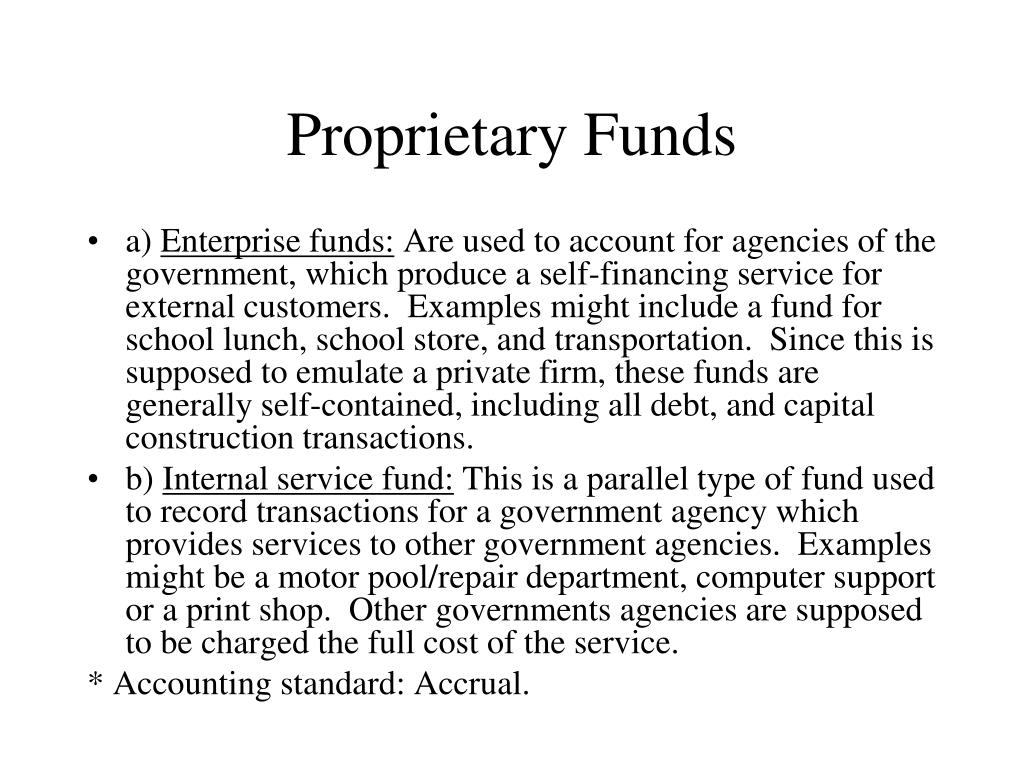

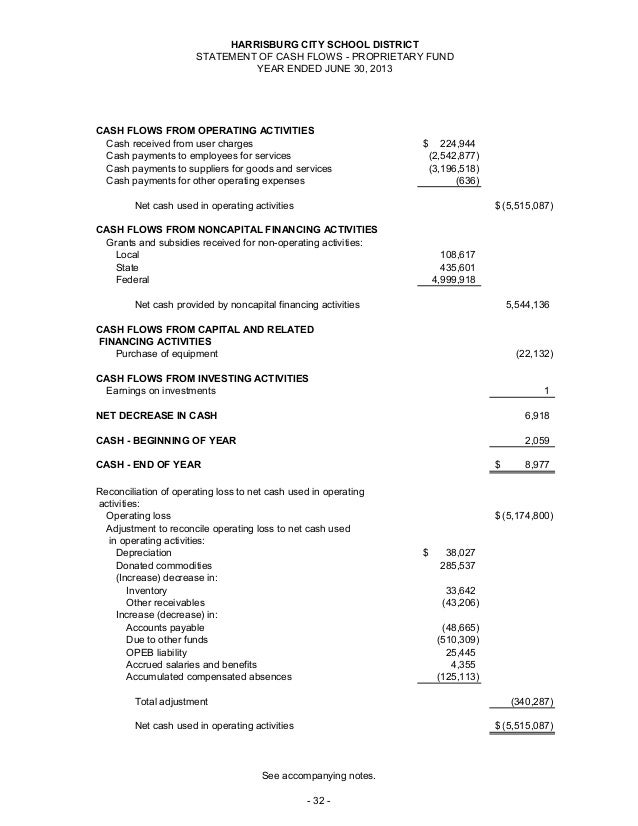

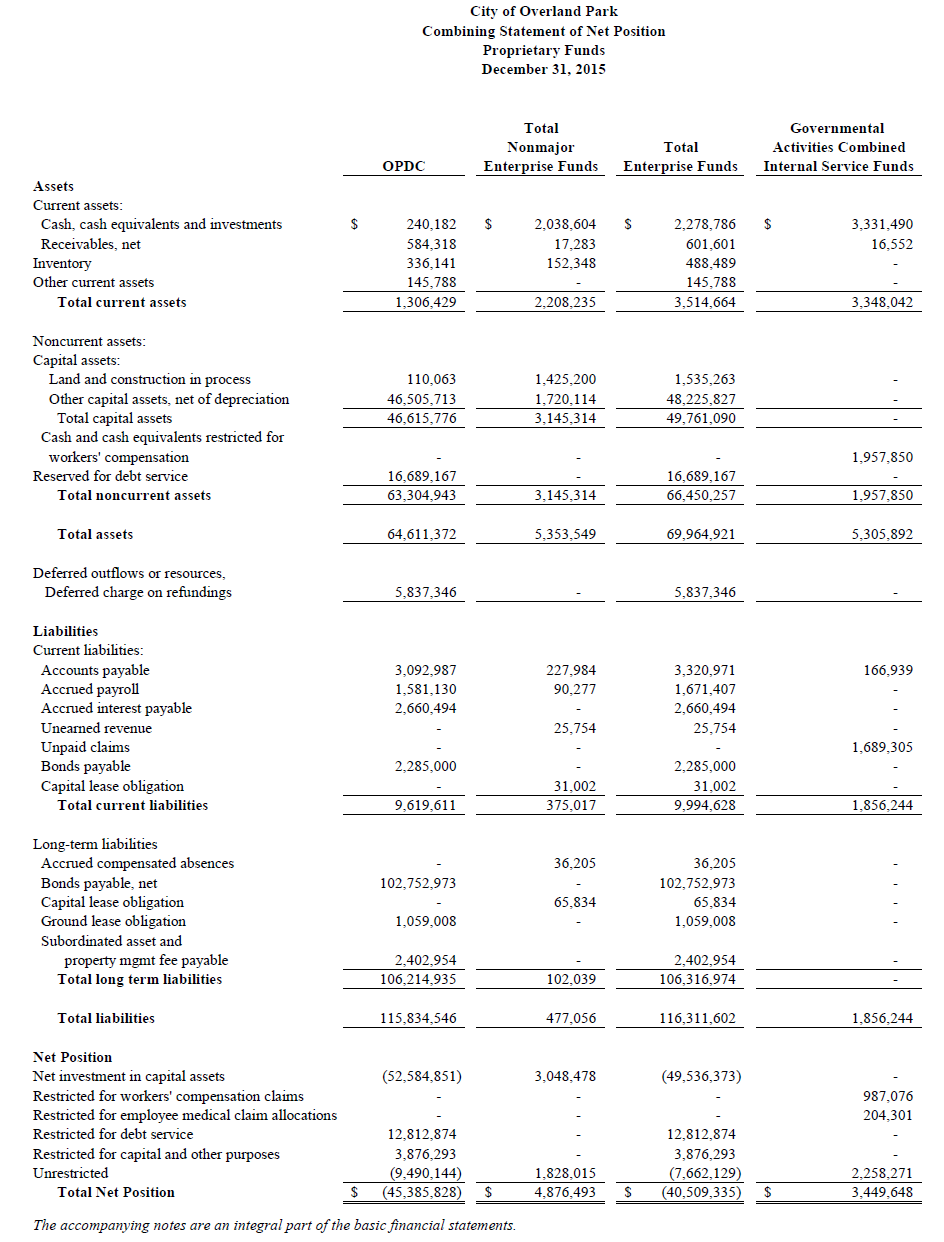

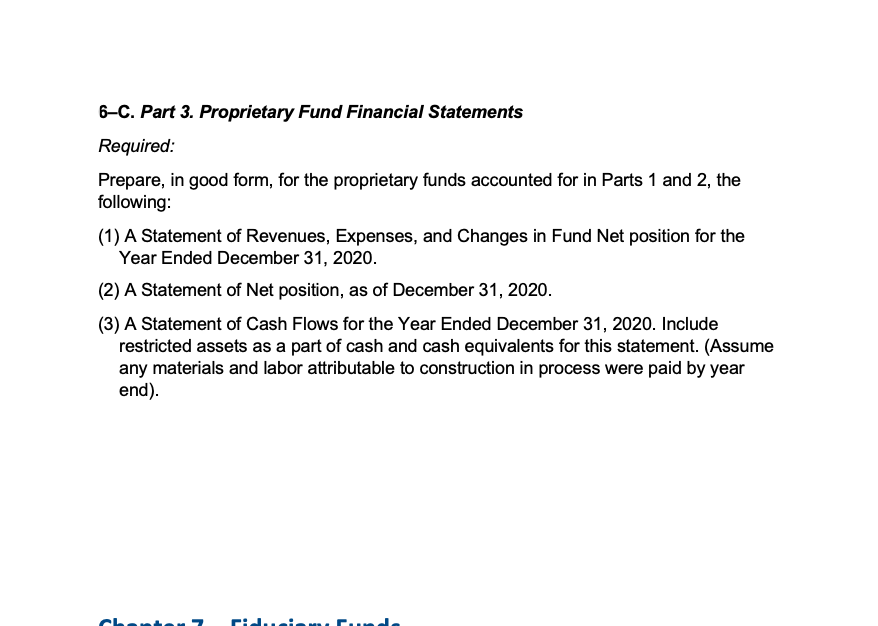

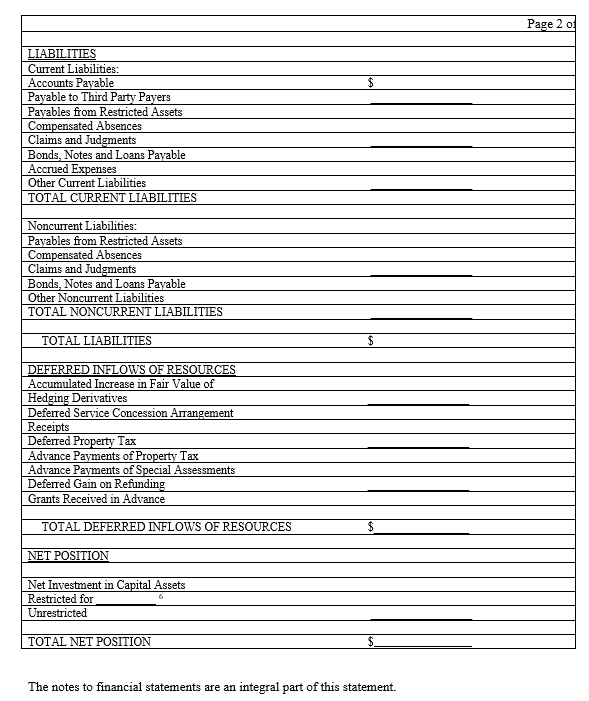

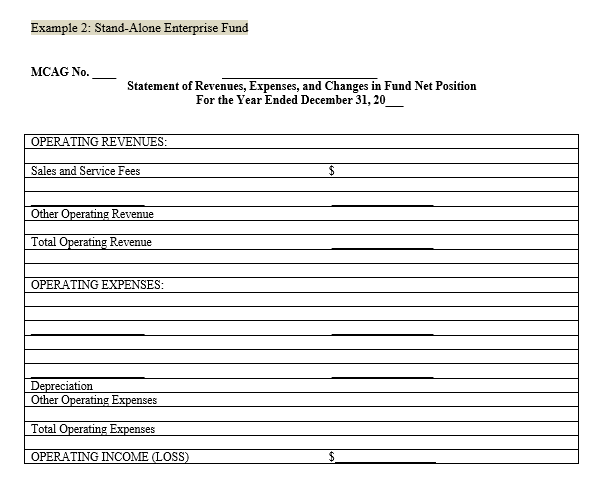

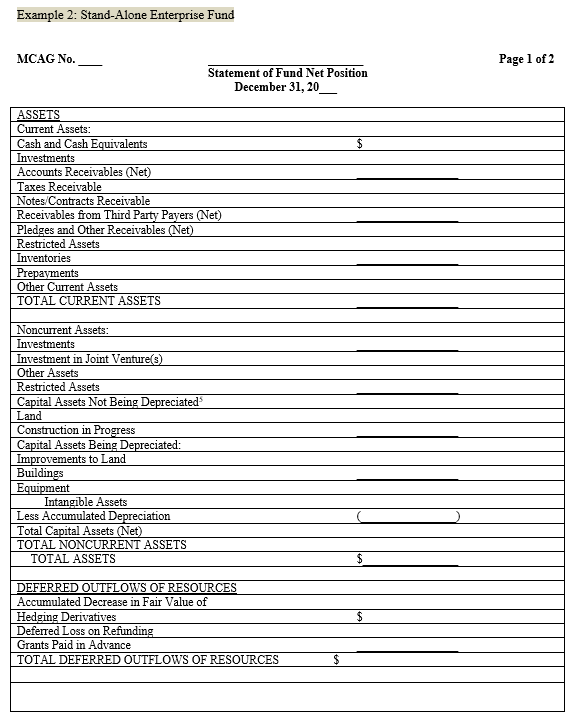

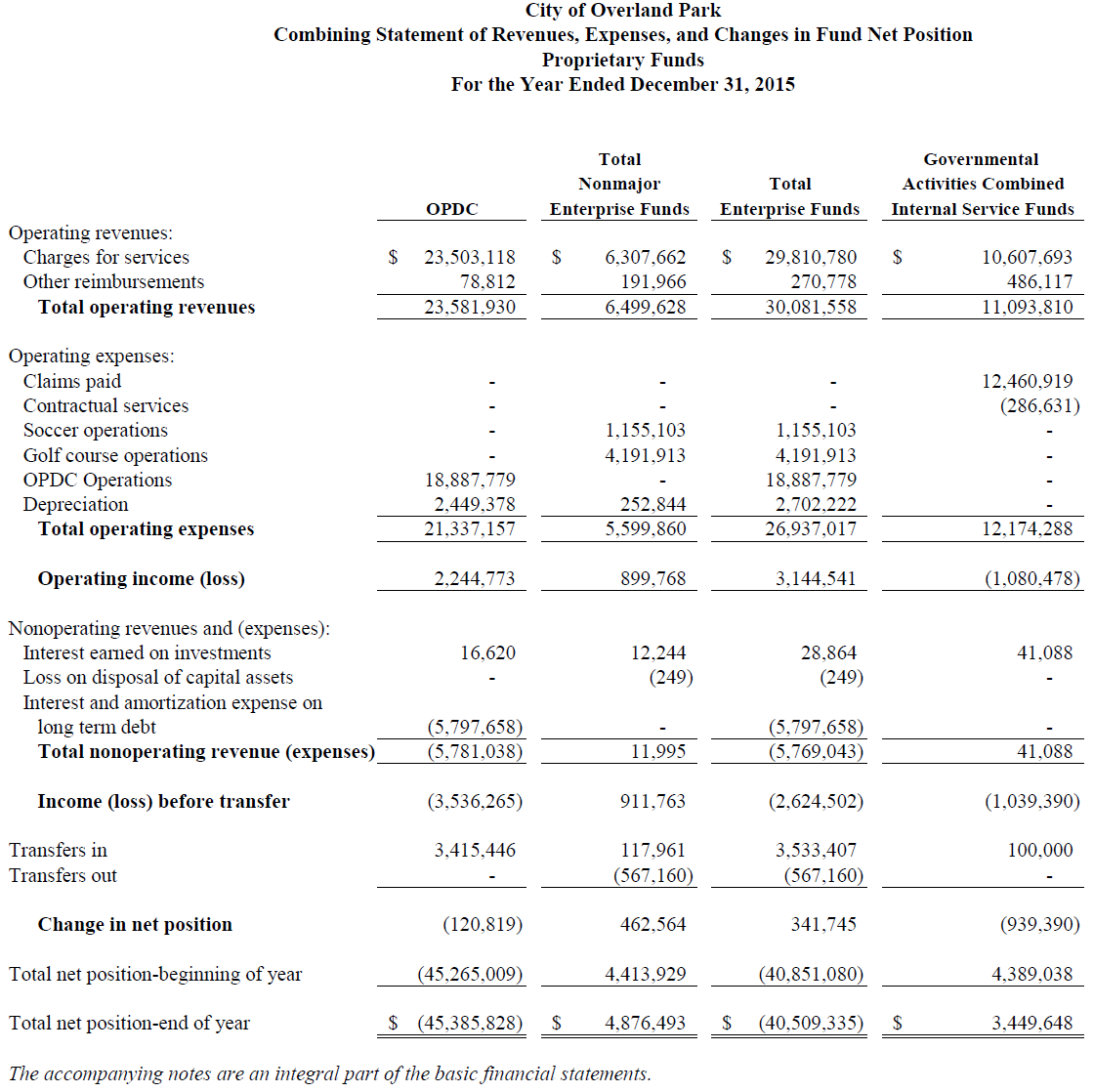

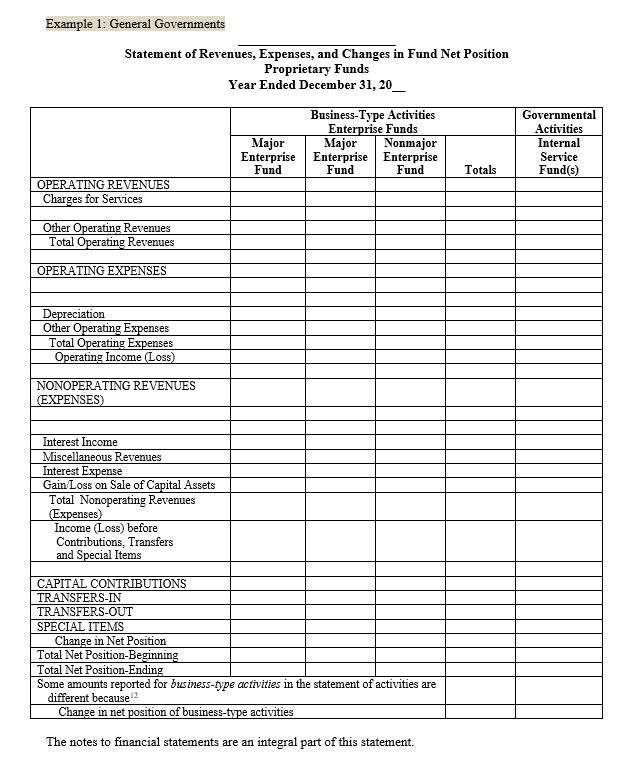

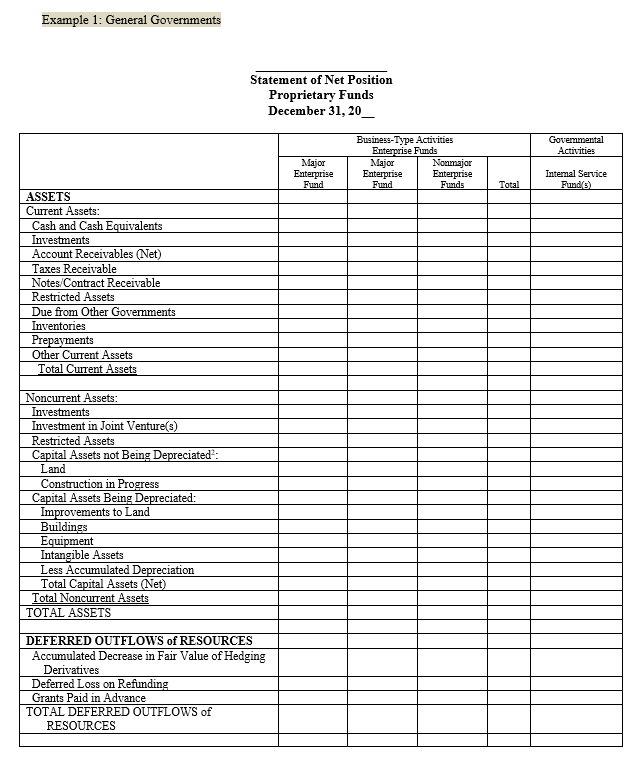

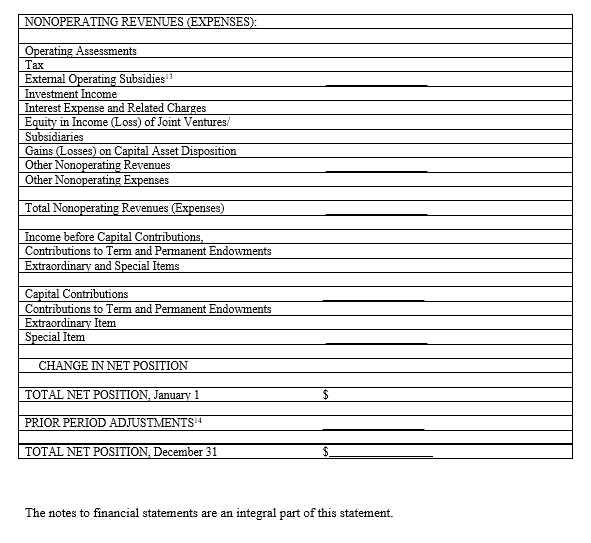

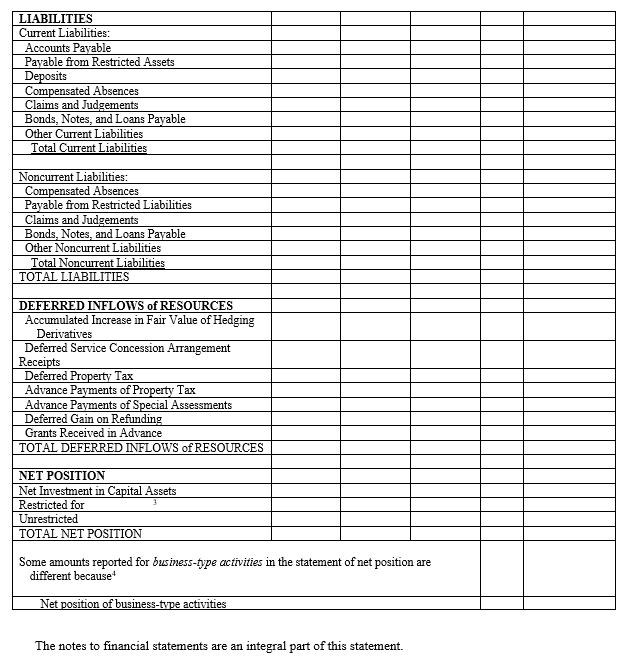

Proprietary fund financial statements. The statement of position the statement of revenues, expenses and changes in net position; The required financial statements for a proprietary fund are the statement of net position and the statement of revenues, expenses, and changes in fund net position. Factually, it is supposed to be reported in all the relevant places.

Governmental fund financial statements: Proprietary fund financial statements. Present fund financial statements for proprietary funds using the economic resources measurement focus and the full accrual basis of accounting.

Proprietary funds are presented using the economic resources measurement focus and the full accrual basis of accounting. Modified accrual proprietary fund financial statements: Proprietary fund financial statements (including financial data for enterprise and internal service funds) should be prepared using the economic resources measurement focus and the accrual basis of accounting.

Financial statements used to present proprietary funds: Statement of revenues, expenses and changes in net position; For governmentwide and proprietary fund financial statements (accounted for using economic resources measurement focus), these payments will be recognized as a rent expense, while for modified accrual fund financial statements, the rent payments will be recorded as expenditures.

As far as financial reporting for proprietary funds are concerned, it is included in classified statement of net position, statement of revenues, expenses, as well as changes in net fund position, and statement of net cash flows.