Beautiful Info About Interest On Fixed Deposit In Balance Sheet

/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg)

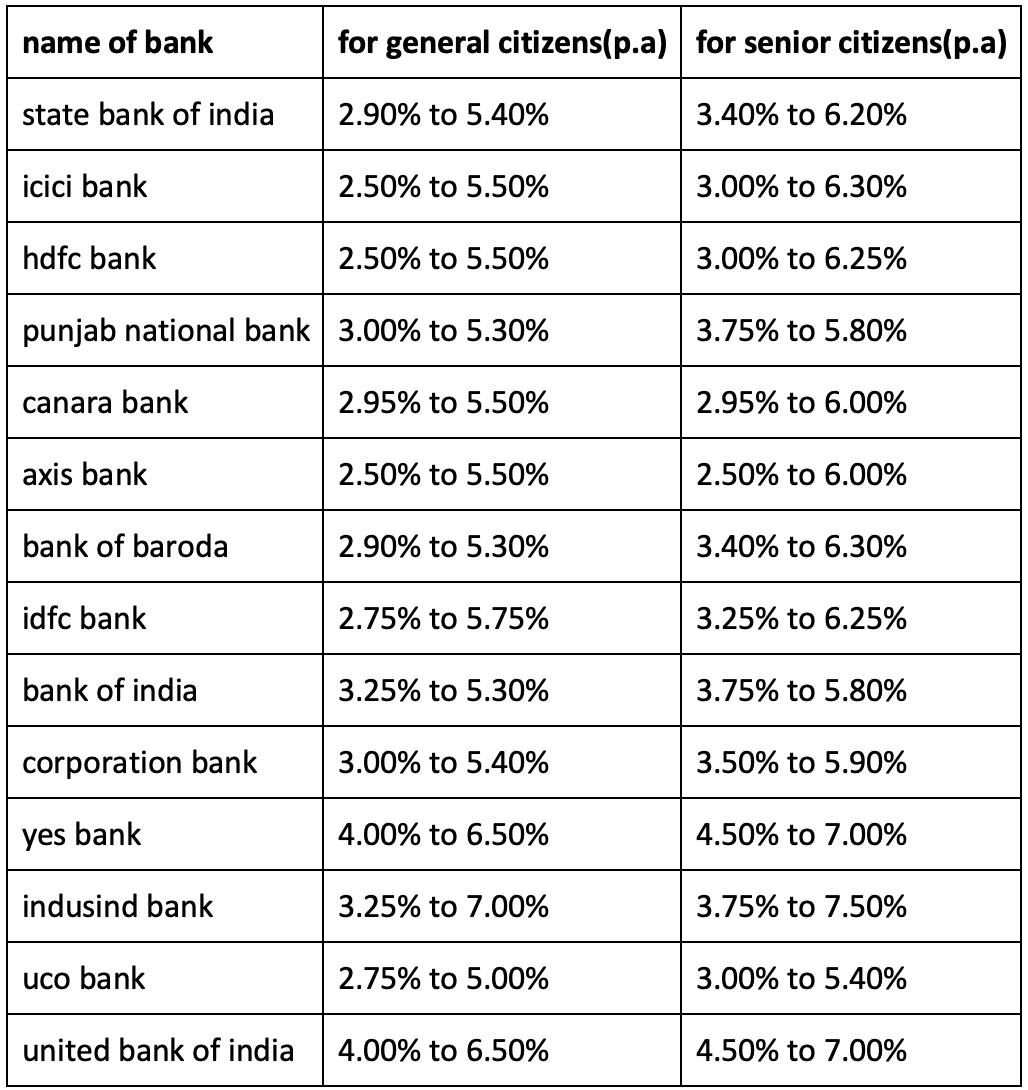

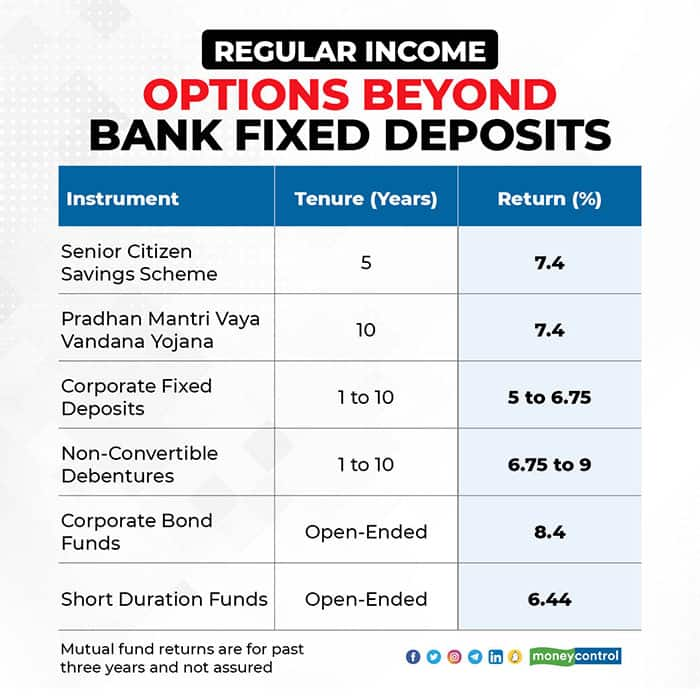

Term deposits offer a fixed rate of interest over the life of the investment.

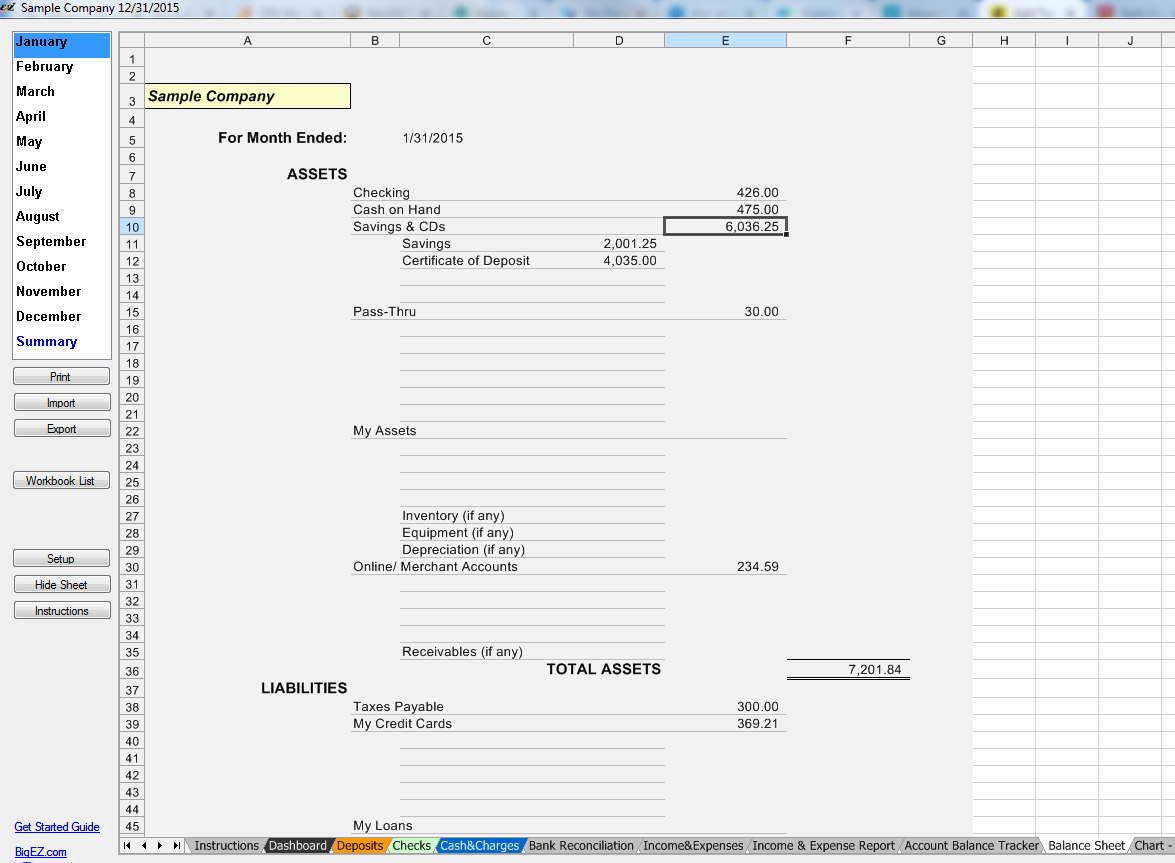

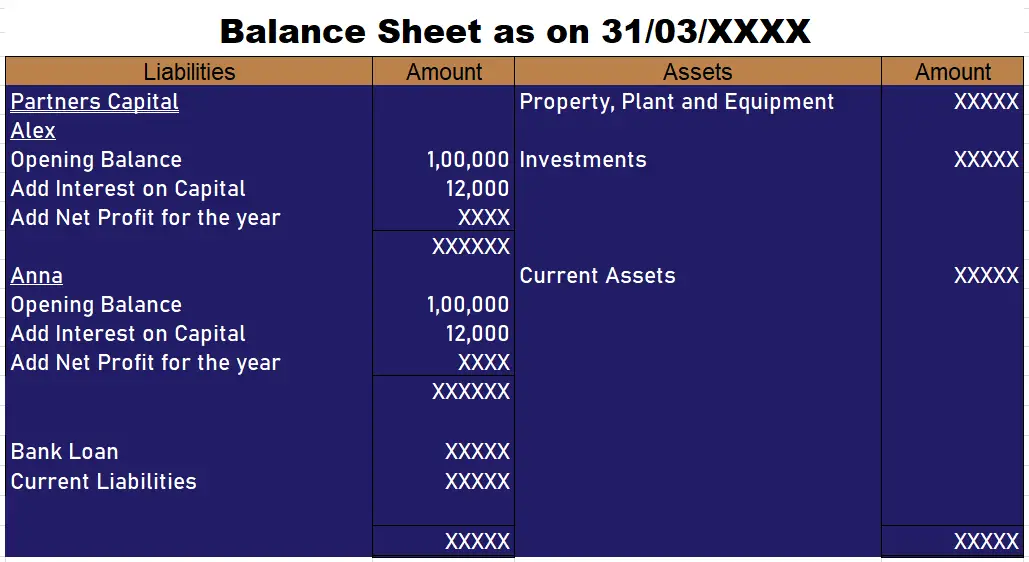

Interest on fixed deposit in balance sheet. A balance sheet is one of the primary statements used to determine the net worth of a company and get a quick overview of its financial health. This brief explores how the effects of rising interest rates. This is known as interest on deposits.

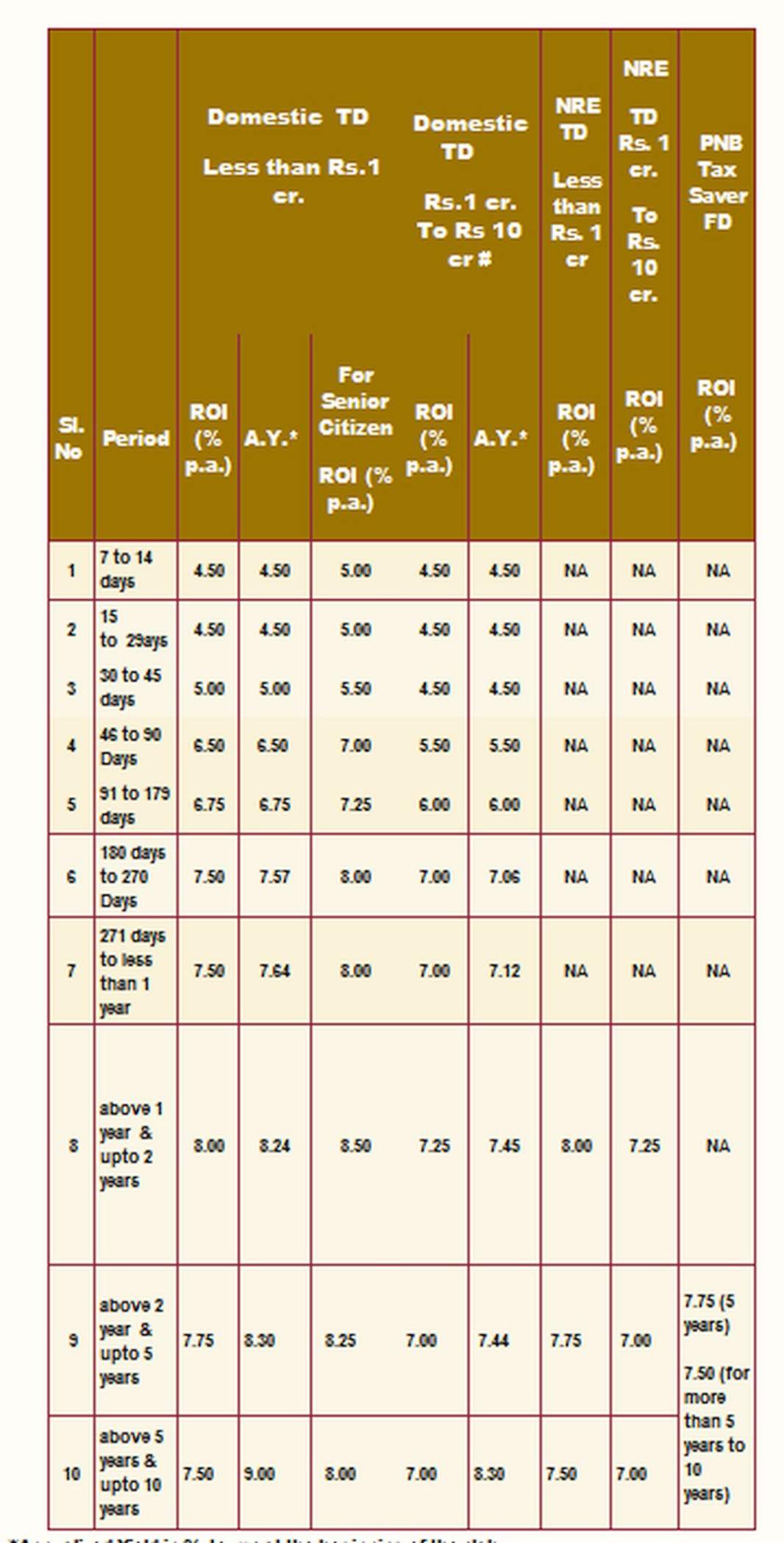

Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets (loans) and their cost of funds (customer. Journal entry for deposit on purchase of fixed assets. It will be classified as the current.

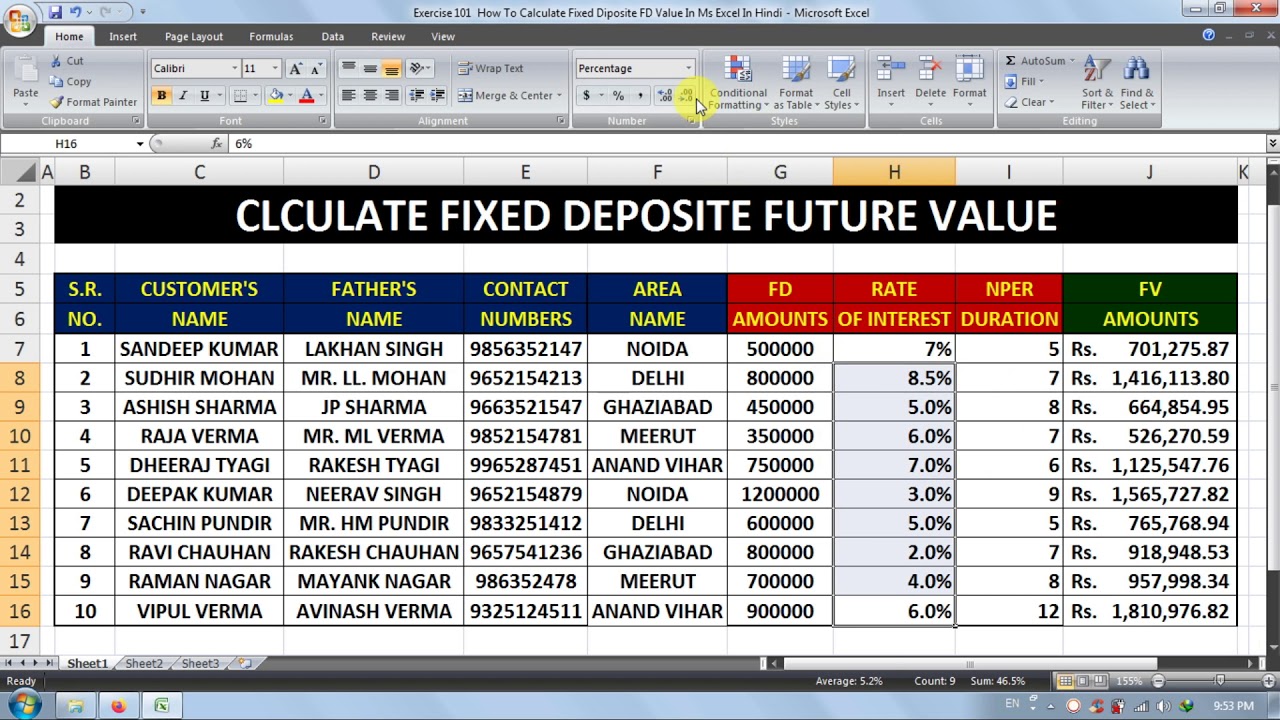

Accrued interest refers to interest generated on an outstanding debt during a period of time, but the payment has not yet. A fixed deposit is a type of financial investment where you deposit an amount of money for a set period of time to earn interest on the maturity date. What is interest income?

Written by cfi team what is accrued interest? Address the collective impact of heightened interest rate, liquidity and business model risks on a firm’s overall risk profile. About press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket press copyright.

The term deposit journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of. In any case, the disclosure requirements of ind as 107 would not apply to such investments. Interest rate risks on banks’ balance sheets represent a relevant financial stability concern with a view to the normalisation of monetary policy.

A current asset is any asset that will provide an economic benefit within one year. When an investment is made and deposited into the bank, the bank pays interest on that deposit.