Brilliant Tips About Cash Fund Flow Statement

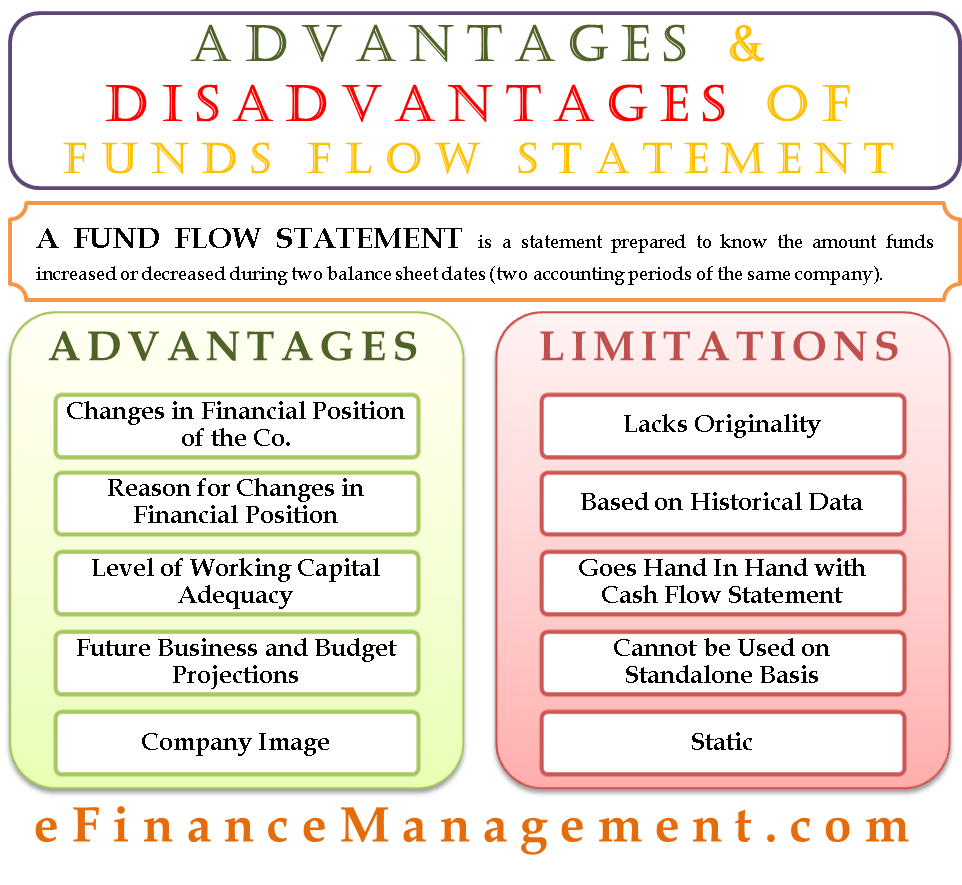

Several definitions of fund flow statements have been proposed in the past.

Cash fund flow statement. Taking into account the profit and cash generation in 2023, as well. This cash flow statement shows company a started the year with approximately $10.75 billion in cash and equivalents. A fund flow statement is a statement that shows the movement of funds and reports an enterprise's financial operations.

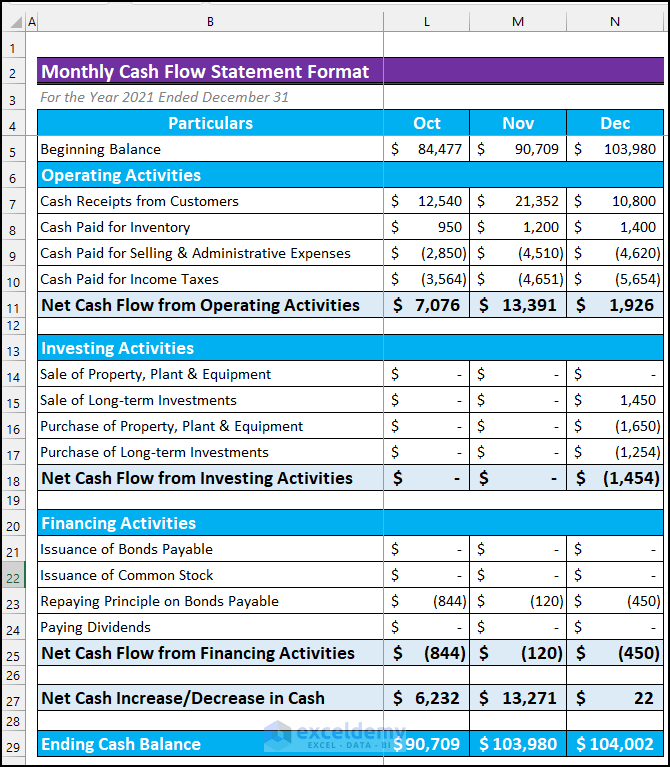

It accounts for three major business activities in which cash is exchanged, i.e., operating, investing, and financing. The cash flow statement is required for a complete set of financial statements. There are two types of inflow of funds in a business

Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). Equity income fund and agf systematic global infrastructure etf, which pay monthly distributions.

Fund flow is based on a wider concept called “working capital.”. Learn the differences between these two statements, examples of items included, and. A cash flow statement tells you how much cash is entering and leaving your business in a given period.

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. Cash flow is broken out into cash flow from operating activities, investing activities, and financing activities. The cfs highlights a company's cash management, including how well it generates.

However, while cash flow from operations considers all transactions related to the production cycle of a business, a funds flow statement only considers the differences between the current asset base and current liabilities of a company. Deal activity in saudi arabia is set to accelerate this year as the kingdom’s sovereign wealth fund looks to raise money for its ambitious projects, according to a top banker at the. Best for lower credit scores:

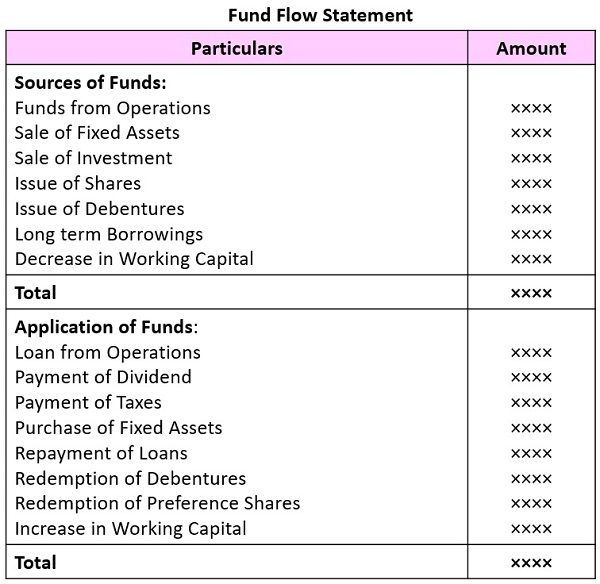

Cash flow statement is helpful in explaining the cash movement amidst two points of time. The cash flow statement shows the inflow and outflow of cash, whereas the fund flow statement shows the sources and uses of funds. By learning how to create and analyze cash flow statements, you can make better, more informed decisions, regardless of your position.

The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. 22, 2024 (globe newswire) — agf investments inc. Other definitions of fund flow statement.

The utility of fund flow is to understand the financial position of the company. A cash flow statement records the overall cash movement in and out of business throughout an accounting period. Fund flows are a reflection of cash that is flowing in and out of financial assets.

Investors use the fund flow information to determine where capital needs to be invested. Fund flow statements serve as a valuable tool for organizations to gain insights into their cash position, conduct a thorough financial performance analysis, and identify areas for potential financial management. It ascertains the closing balance of cash and cash equivalents at the end of the year.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)