Beautiful Work Info About Net Profit Loss Balance Sheet

Because the balance sheet is more detailed then the p&l, you are well advised to seek.

Net profit loss balance sheet. Net profit is transferred to the capital account and shown on the liability side of a balance sheet. Balance sheet for the year ended december 31, 2023: Net loss or net income is a key indicator used to evaluate the company operating results in a specific period.

This is the amount of money left after all expenses, including taxes, have been deducted from your revenue. Airbus se continues to use the term net income/loss. If it happened in your financial past, the balance sheet reflects it.

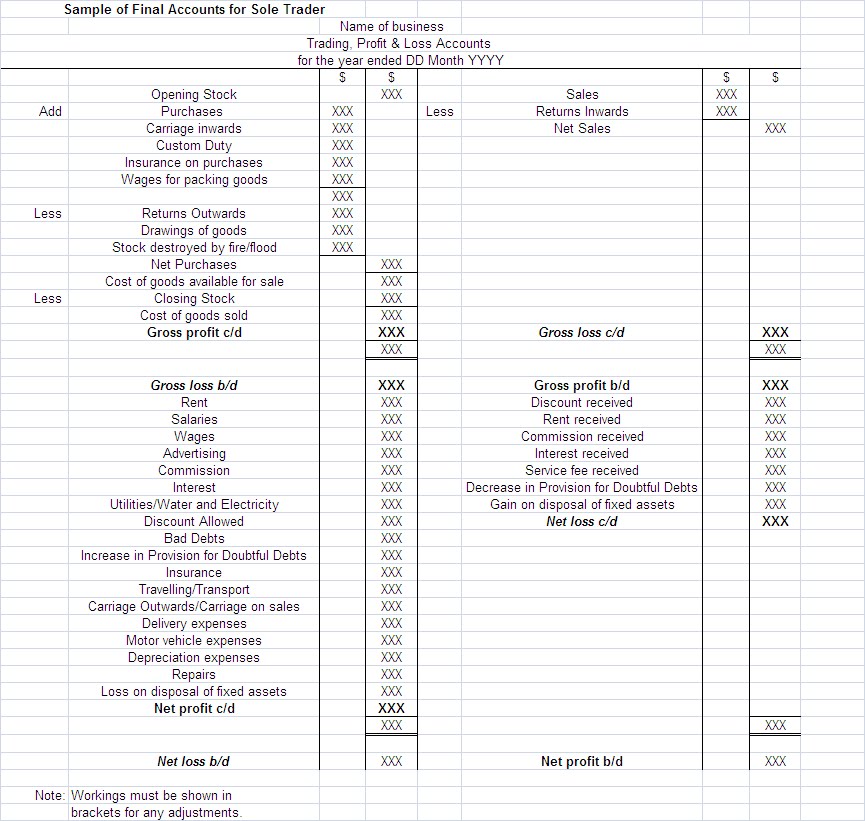

The net result over the course of an accounting period are therefore shown in the profit and loss account. The income side it is said to have earned a net loss. The balance sheet is one of the three fundamental financial statements and is key to both financial modeling and accounting.

The net profit belongs to the ownership of the business which is represented by the capital account. To get the net profit, you’ll need to divide your net profit by the turnover. As mentioned before, it shows the sales amount after these following are deducted from the company’s total revenue.

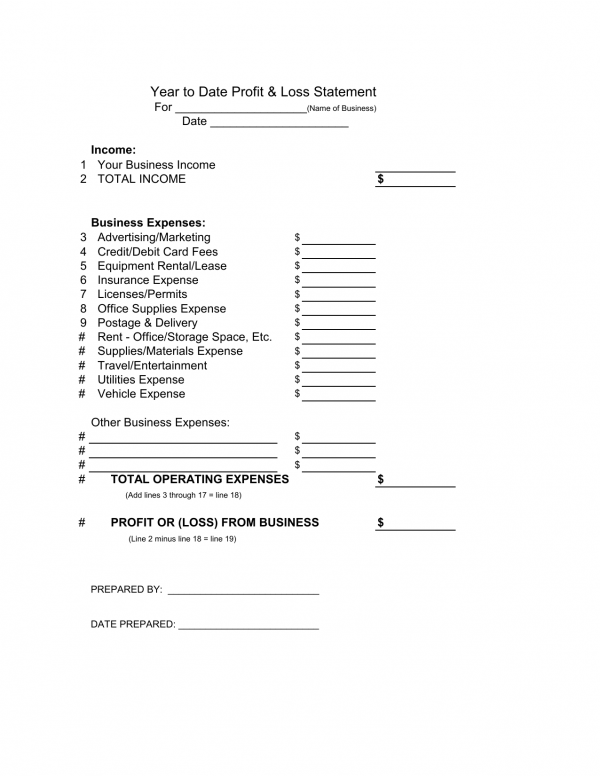

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. Return on capital employed 7.6% an increase of 6%. What is the balance sheet?

A profit and loss account is an account that shows the revenue and expenses of the firm from business operations during a financial year. The net profit or loss is obtained by deducting total expenses from gross profit. This shows you how much profit your business is making for every pound of sales.

Evaluates a company's financial performance over a specific period, such as a month, quarter, or. Profit and loss (p&l) statement balance sheet; A profit and loss statement is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year.it captures how money flows in and out of your business.

Assets = liabilities + shareholders' (or owner's) equity. Common size profit and loss statements can help you compare trends and changes in your business. This amount varies depending on the industry and the company's management.

The profit and loss account, in contrast, is an account that displays the period's revenues and expenses. A balance sheet is a statement that discloses the financial position of its assets, liabilities and capital on a specific date. The balance sheet, the profit and loss (p&l) statement, and the cash flow statement.

Therefore, the net profits or losses are ultimately transferred to the capital account. These calculations are most useful when you compare the margin for one period to another. The balance sheet displays the company’s total assets and how the assets are.

![Balance Sheet vs. Profit and Loss Account [2024]](https://res.cloudinary.com/goforma/image/upload/v1585669485/small business accounting/profit-and-loss-example_simgmu.jpg)