Brilliant Tips About Foreign Currency Cash Flow Statement Example

This translation rule extends to the cash flows of a foreign subsidiary in consolidated financial statements.

Foreign currency cash flow statement example. The exchange rate used for translation of transactions denominated in a foreign currency should be the rate in effect at the date of the cash flows [ias 7.25] cash flows of foreign subsidiaries should be translated at the exchange rates prevailing when the cash flows took place [ias 7.26] The following are the examples of cash flows from operating activities: Ias 7 cash flow statements replaced ias 7 statement of changes in financial position (issued in.

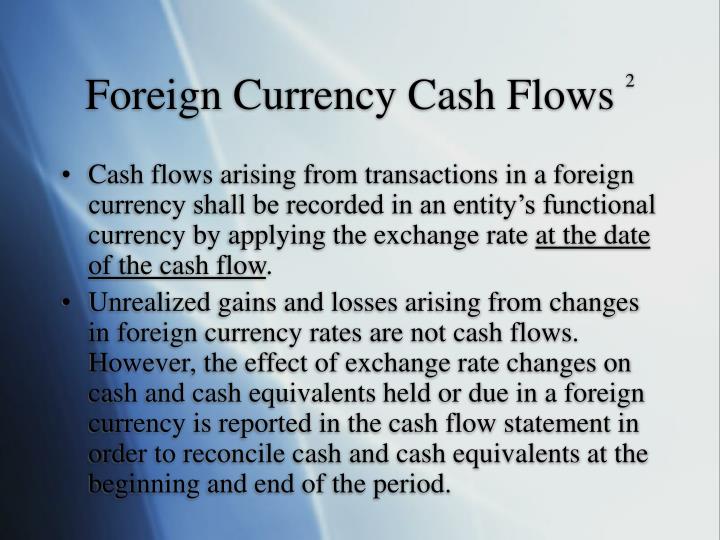

Foreign currency cash flows. 25 cash flows arising from transactions in a foreign currency shall be recorded in an entity’s functional currency by applying to the foreign currency amount the exchange rate between the functional currency and the foreign currency at the date of the cash flow. Preparing the consolidated statement of cash flows based on amounts reported in the consolidated balance sheets.

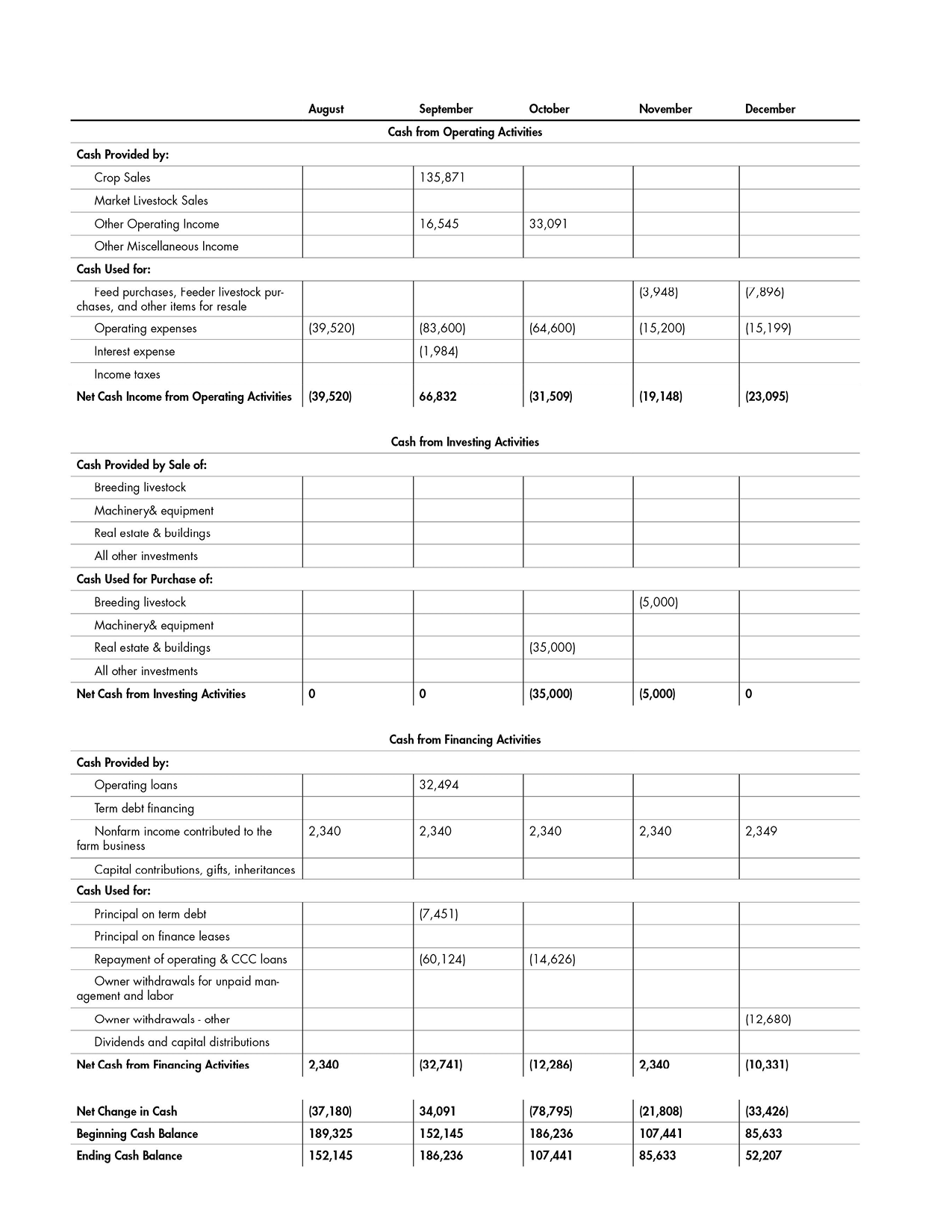

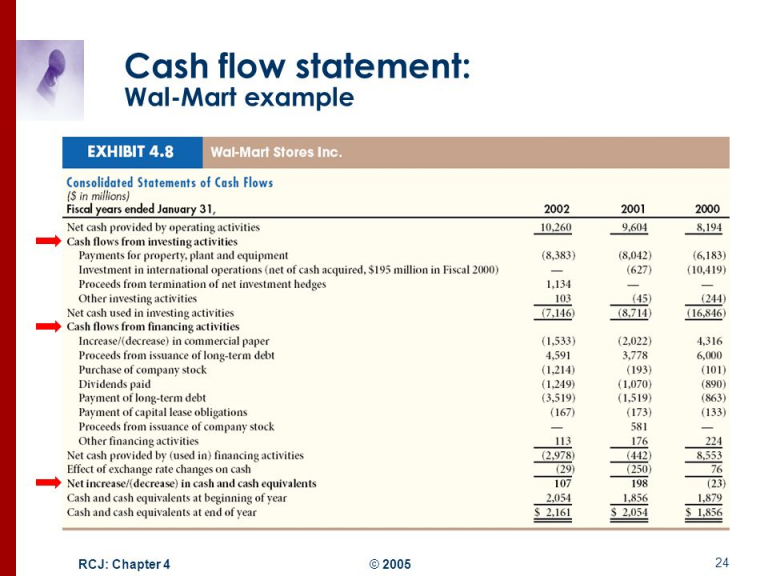

In our example, the parent company’s cash flow statement is in us dollars and the canadian subsidiary’s cash flow statement is in can dollars. Calculated using the direct cash flow method. 2 this standard supersedes ias 7 statement of changes in financial position, approved in july 1977.

The movements in the cash flow. The cash flow statement has 3 sections: Statement of cash flows examples from ias 7 representing ways in which the requirements of ias 7 for the presentation of the statements of cash flows and segment information for cash flows might be met using detailed xbrl tagging.

Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the international accounting standards committee in december 1992. Britain is not an extension of fsp corp, and its functional currency is the british pound. Please correct me if i'm wrong, the fx differences is disclosed in a separate line at the end of the cfs :

Currency translation differences that arise on the translation of foreign currency cash and cash equivalents should be reported in the statement of cash flows in order to reconcile opening and closing balances of cash and cash equivalents, separately from operating, financing and investing cash flows. To present a clearer picture of the two methods, there are some examples presented below. Once the canadian subsidiary’s cash flow statement is prepared in can dollars, you will need to convert it to us dollars, the reporting currency.

Typically, cash flows in foreign currency should be translated using the exchange rate applicable on the date of the cash flow. Ias 7 statement of cash flows ias 7 foreign currency cash flows. 1 an entity shall prepare a statement of cash flow in accordance with the requirements of this standard and shall present it as an integral part of its financial statements for each period for which financial statements are presented.

Cash flow from operations, cash flow from investing, and cash flow from financing. Foreign currency translation reserve (fctr) by leo » thu jun 17, 2021 7:58 am. Examples of a cash flow statement.

The following terms are used in this standard with the meanings specified: This standard does not apply to the presentation in a statement of cash flows of the cash flows arising from transactions in a foreign currency, or to the translation of cash flows of a foreign operation (see ias 7. An example of the cash flow statement using the direct method for a hypothetical company is shown here:

At the end, it adds up all the cash flows to show the overall net change in. Foreign currency cash flows • provides an overview of the requirements related to cash flows from foreign currency transactions • addresses common application issues on this topic It’s nearly always presented in this exact order.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)