Cool Tips About Retained Earnings In Cash Flow Statement Deferred Gst Example

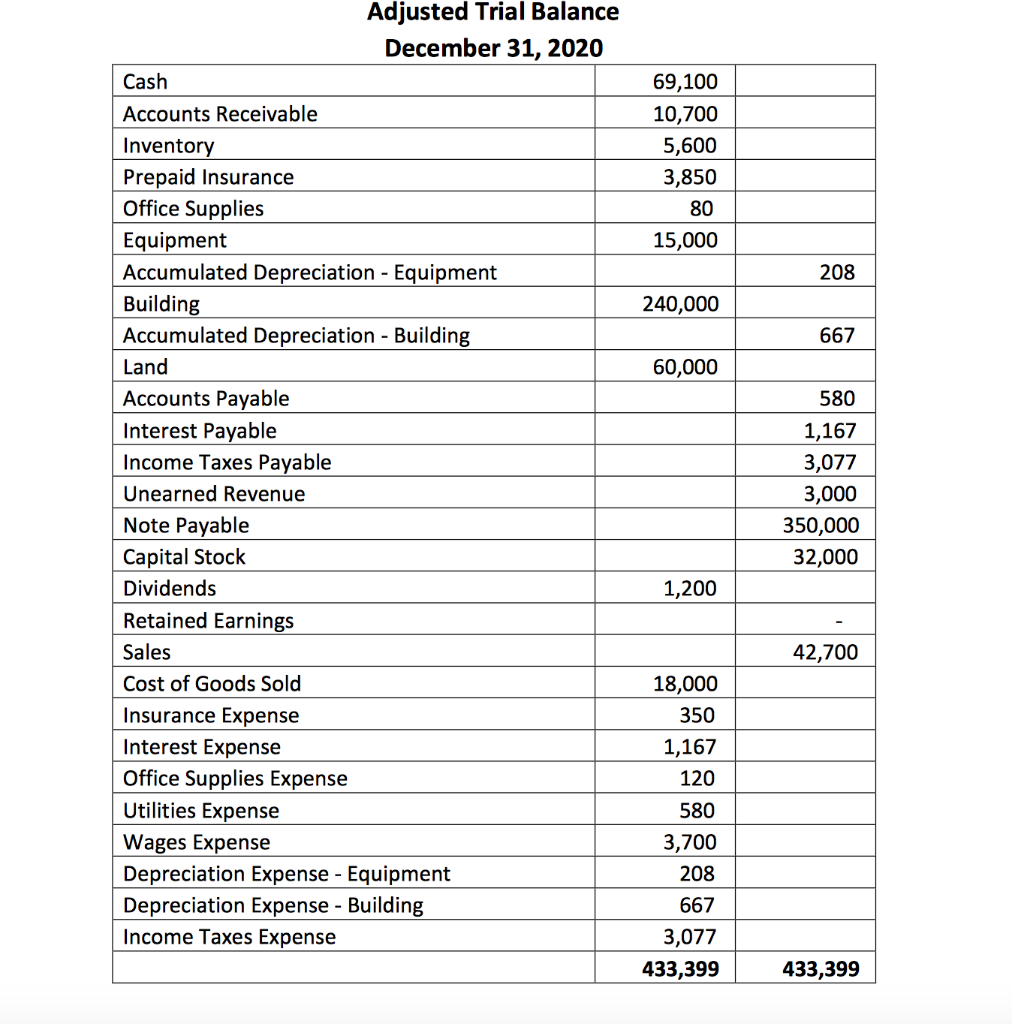

Let's assume you had the following numbers for a particular period:

Retained earnings in cash flow statement deferred gst example. There are two versions or methods or ways to present the cash flow statement. But fear not, because we are here to help crack the code for you! What is retained earnings on the balance sheet?

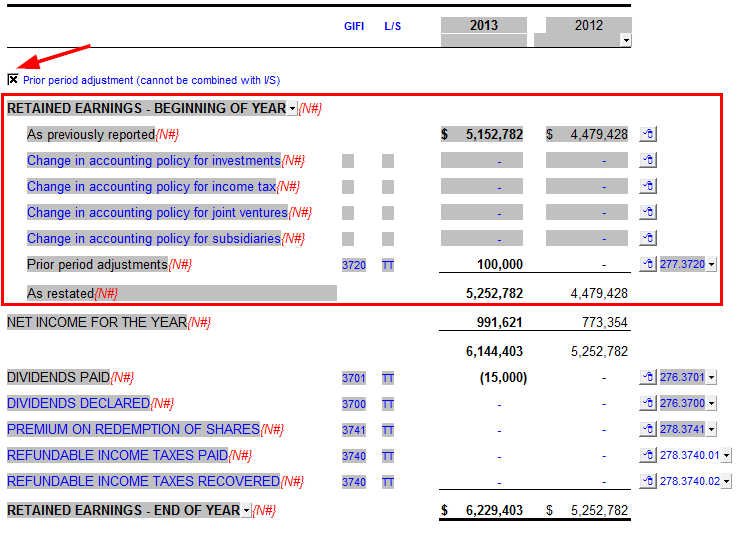

At the top of the cash flow statement, net income grows by the. Net income is equal to revenues minus expenses and is the bottommost listing on the corporation's income statement. Retained earnings are recorded in an equity account.

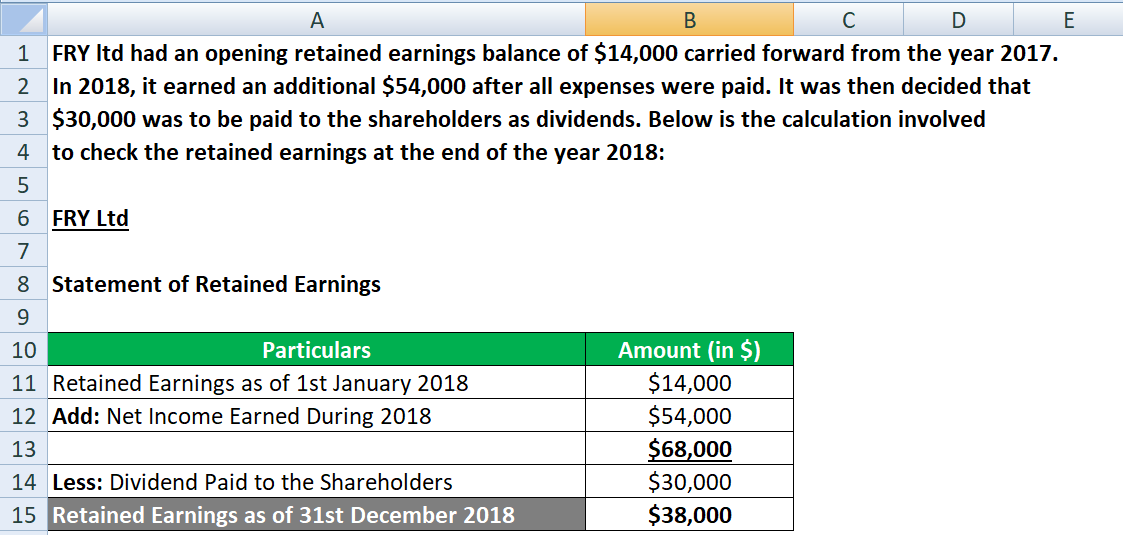

How to calculate retained earnings (formula + examples) january 2, 2022 6 minutes to read accounting & taxes retained earnings. Beginning re of $5,000 when the reporting period started $4,000 in net income. Current year profit is part of one version of the cash flow statement and excluded from.

Find the business' net income for the period. (definition, journal entries, and example) this implies that in the case where tax depreciation is greater than the depreciation expense in years 1 and 2, the entity has. Cash flow from investments:

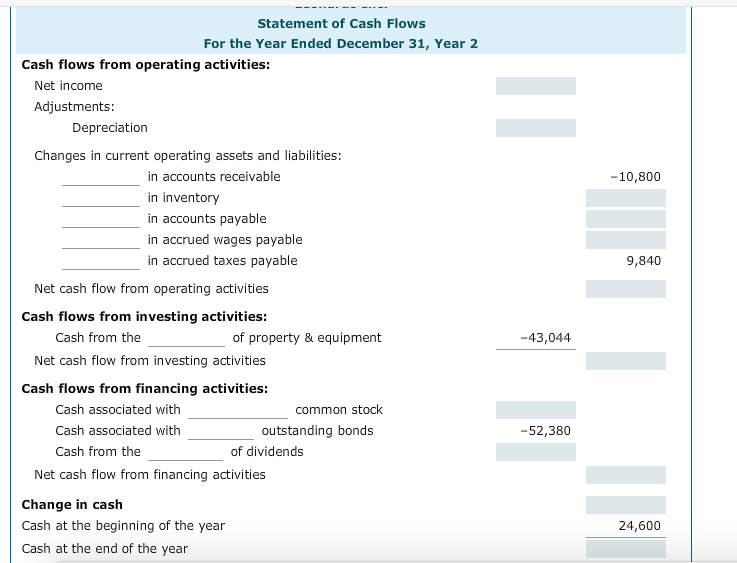

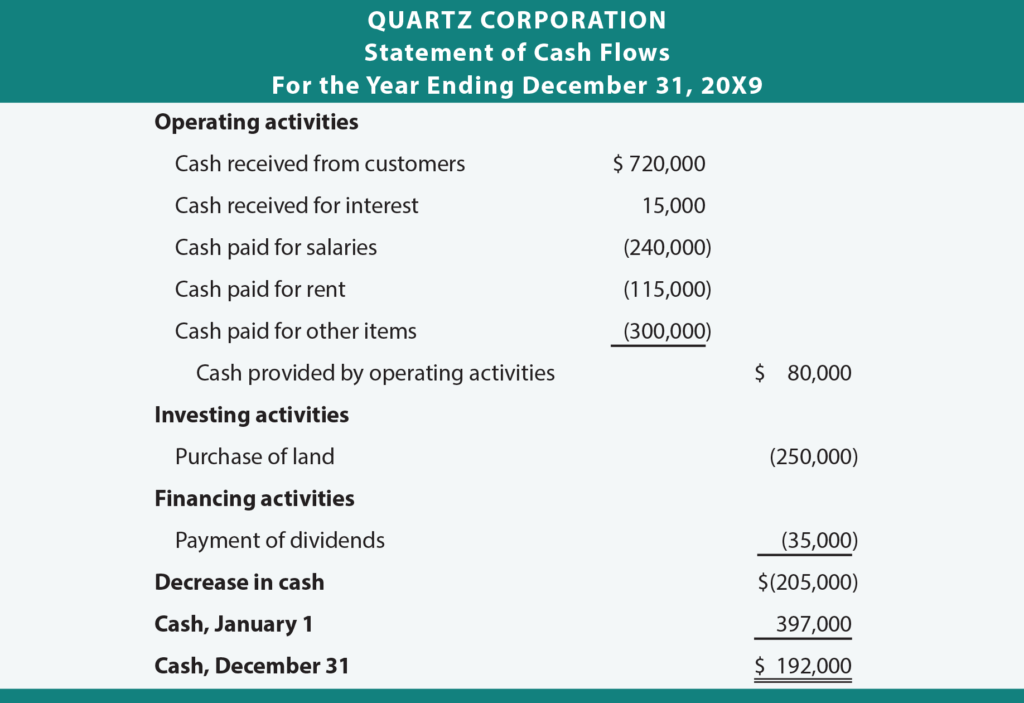

While the term may conjure up. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a. Solution here we can take the opening balance of ppe and reconcile it to the closing balance by adjusting it for the changes that have arisen in period that are not cash.

Increase in deferred tax liabilities will result as cash inflow, so it will be adjusted as positive side. The beginning balance is obtained,.

Corresponding amounts for the preceding period are. A statement of cash flows for an entity other than a financial institution the examples show only current period amounts. At the end of a financial year, any money earned (or lost) during the financial year is transferred to retained earnings.

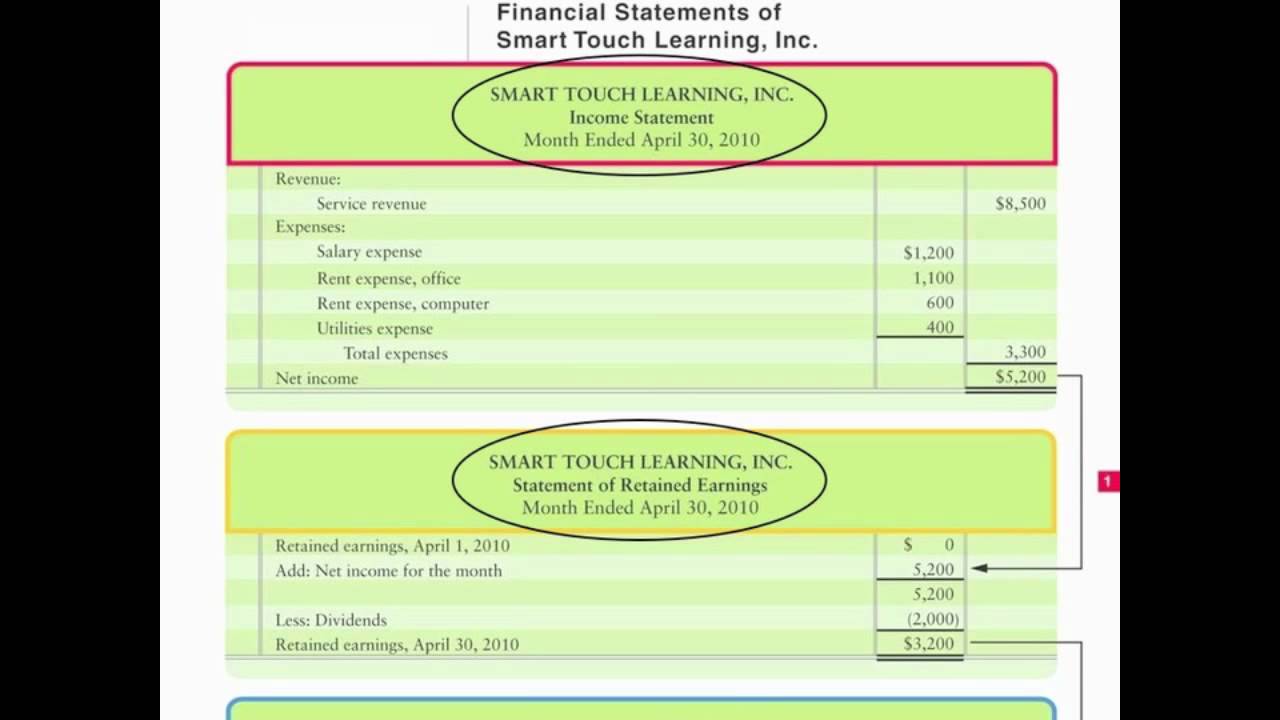

Retained earnings statement example. In this blog post, we’ll. Decrease in deferred tax liabilities will result in cash outflow, so it will be adjusted.

Stockholder’s equity (retained earnings specifically) grows by this amount of net income. The pattern of recognizing $100 in revenue would repeat each month until the end of 12 months, when total revenue recognized over the period is $1,200, retained earnings are. The starting balance in the statement of retained earnings is carried over from the retained earnings balance of the previous period.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)