Beautiful Tips About Balance Sheet Equity Accounts

Equity in accounting is the remaining value of an owner’s interest in a company after subtracting all liabilities from total assets.

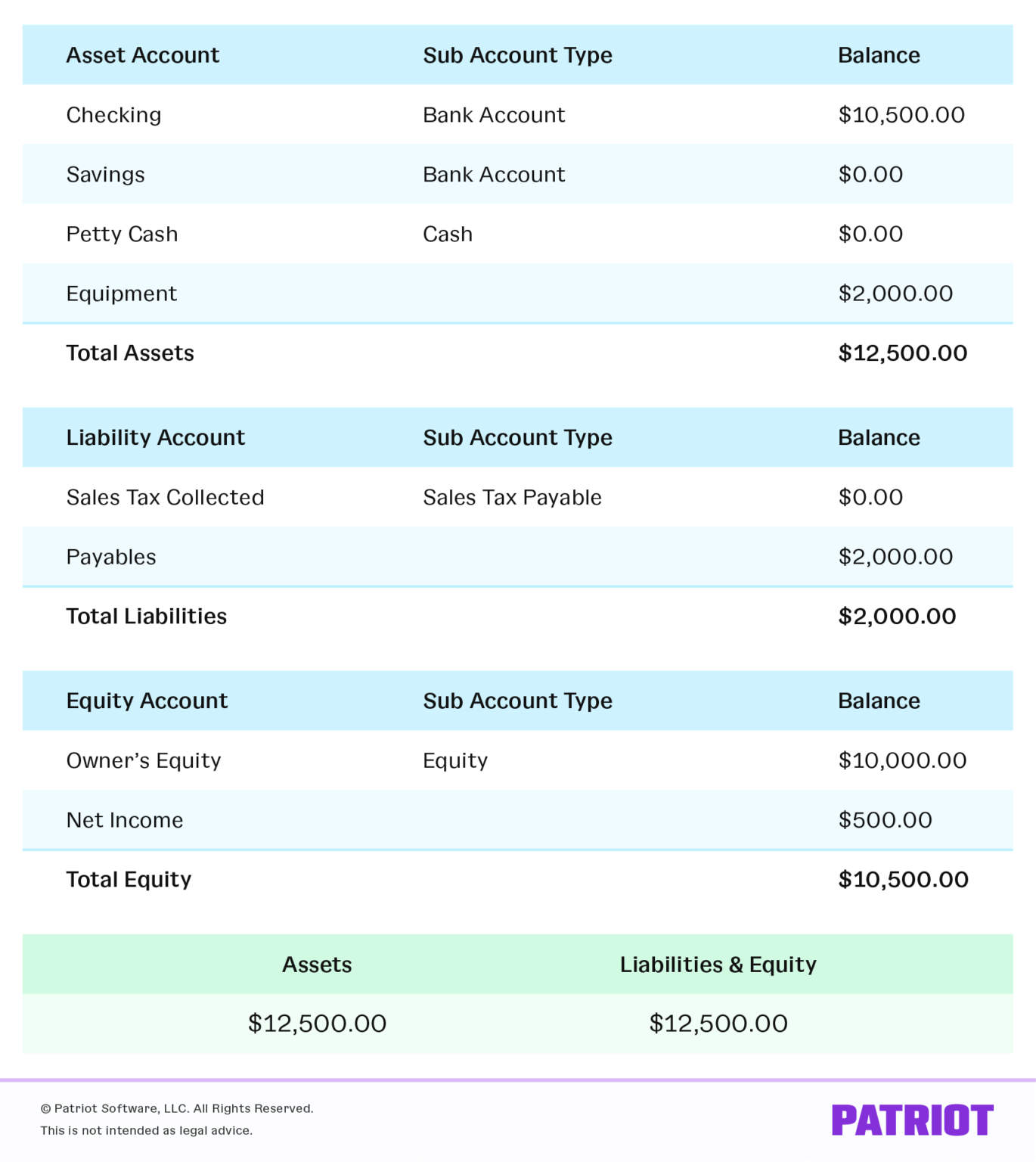

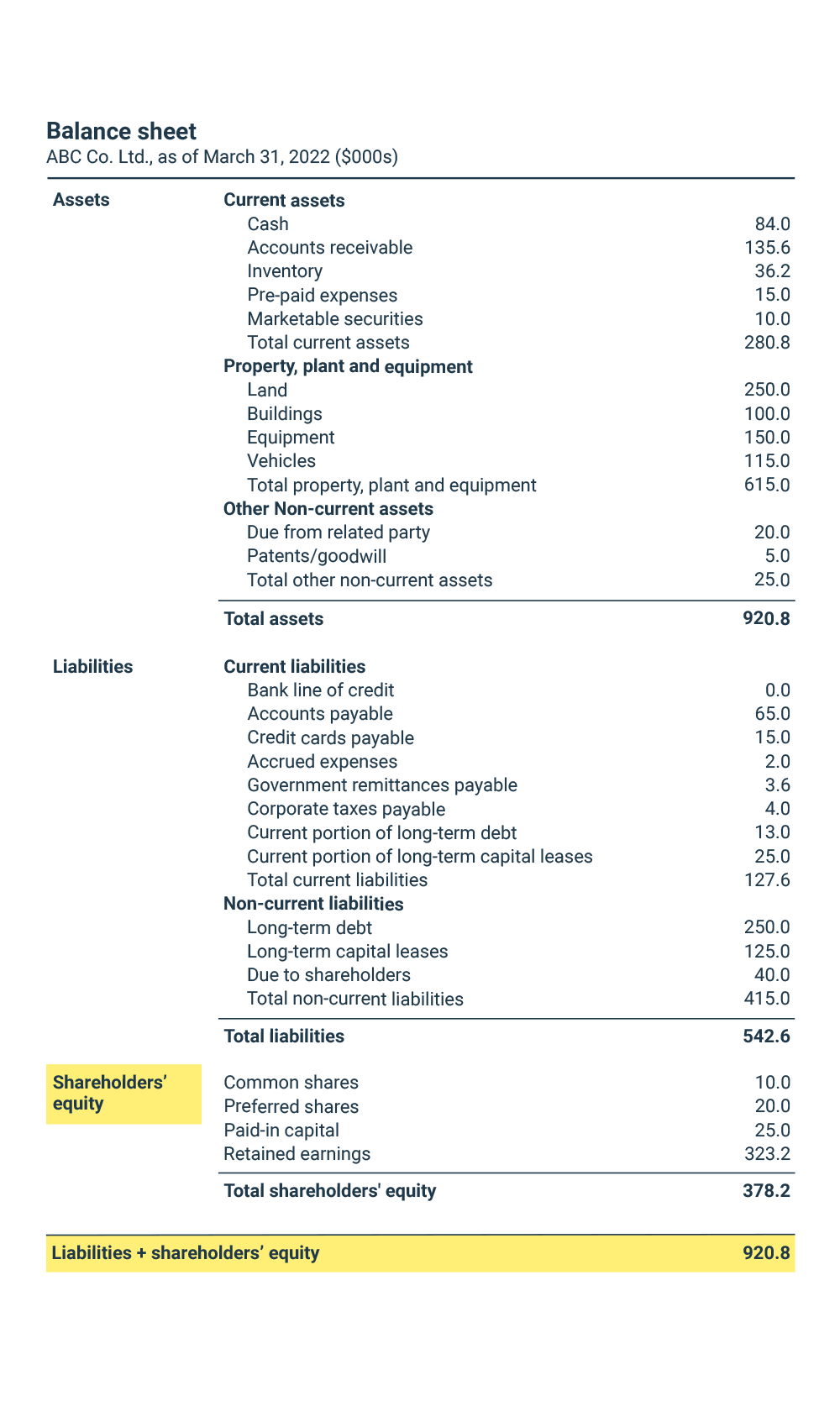

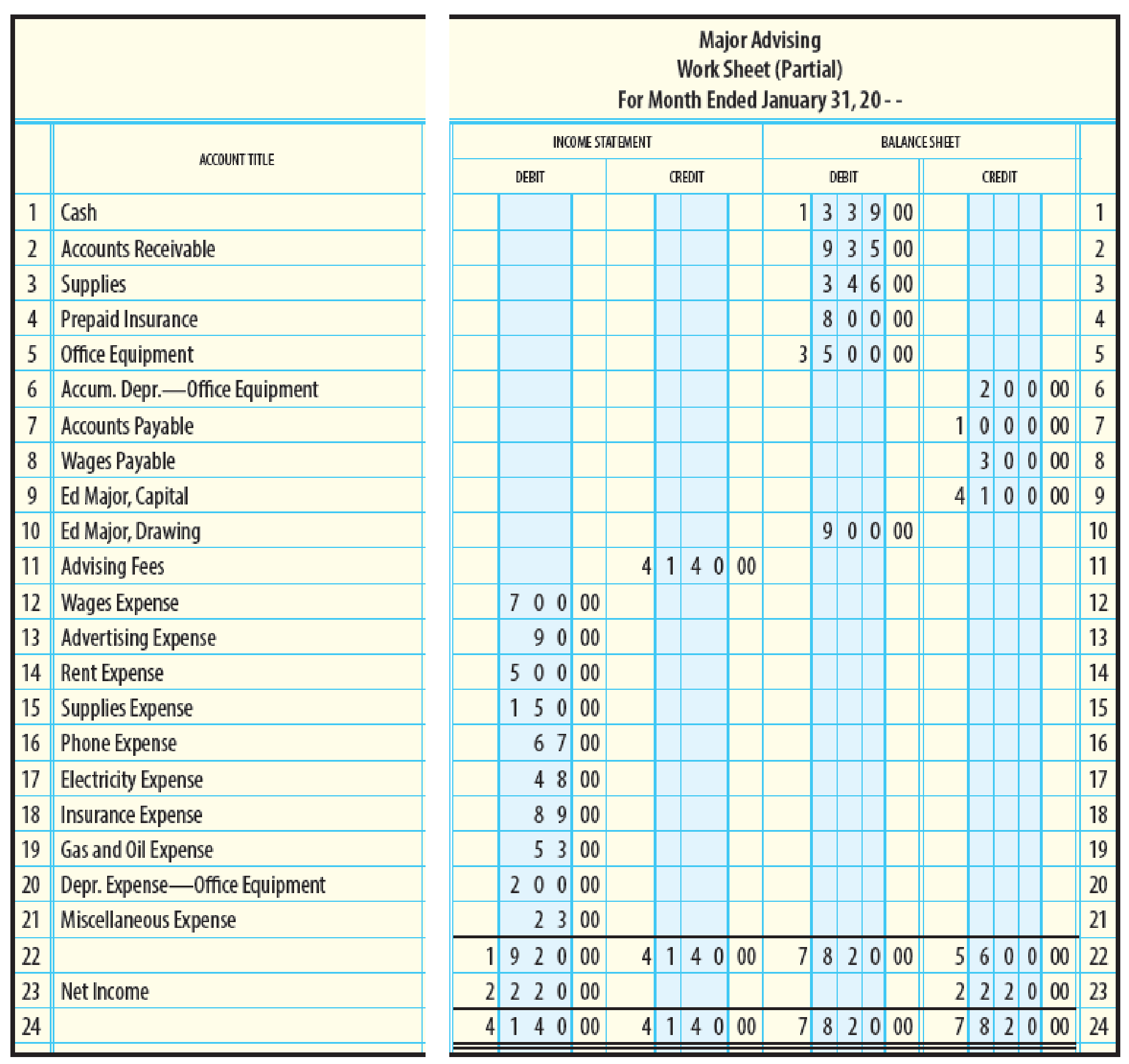

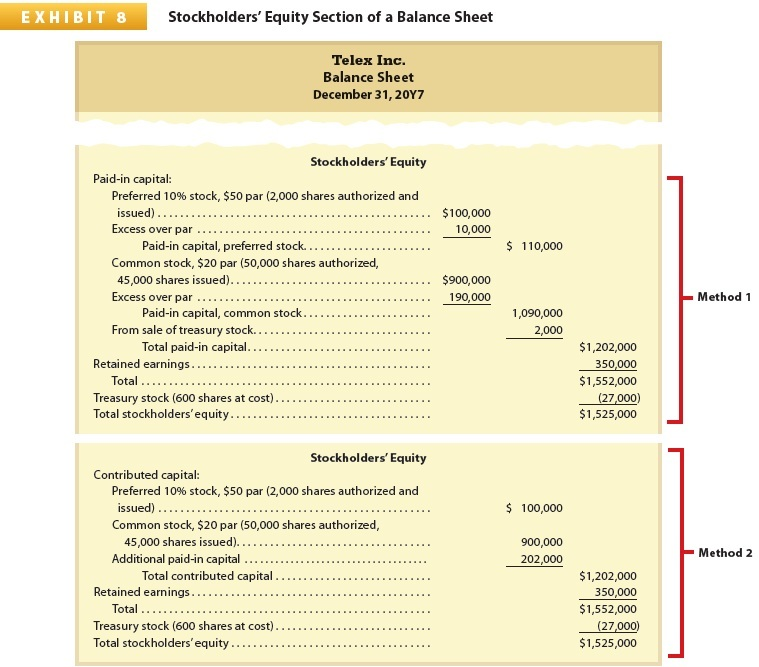

Balance sheet equity accounts. Stockholders equity (also known as shareholders equity) is an account on a company’s balance sheet that consists of share capital plus retained earnings. Beginner’s guide (sec.gov) “a balance sheet provides detailed information about a company’s assets, liabilities and shareholders’ equity. The calculation of equity is a company's total assets minus its total liabilities, and.

All the information required to compute shareholders' equity is available on a company's balance sheet, including total assets: What is the definition of the balance sheet? Equity accounts show up on both the balance sheet and the statement of equity (also referred to as the retained earnings statement, an equity statement, a statement of shareholder’s equity, or statement of owner’s equity).

The items in a balance sheet fall into one of these three categories. This study examines whether firms with debt contacts that contain more restrictive balance sheet covenants are more likely to conduct seasoned equity offerings. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

The balance sheet is based on the fundamental equation: A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time. What are equity accounts?

The balance sheet is just a more detailed version of the fundamental accounting equation—also known as the balance sheet formula—which includes assets, liabilities, and shareholders’ equity. Learn more in cfi’s free accounting fundamentals course! Types of equity accounts the seven main equity accounts are:

The above formula is known as the basic accounting equation, and it is relatively easy to use. Shareholders' equity is equal to a firm's total assets minus its total liabilities and is one of the most common financial metrics employed by analysts to determine the financial health of a. Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity.

Balance sheets are typically organized according to the following formula: Learn more about how it works. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

And turn it into the following: It can also be referred to as a statement of net worth or a statement of financial position. A company's balance sheet, also known as a statement of financial position, reveals the firm's assets, liabilities, and owners' equity (net worth).

Assets = liabilities + equity. Said another way, it’s the amount the owner or shareholders would get back if the business paid off all. To calculate total equity, simply deduct total liabilities from total assets.

What is net worth or owners’ equity? Add each asset as a line item within the relevant category and assign appropriate values. Equity below liabilities on the balance sheet, you'll find equity, the amount owed to the owners of the company.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-05-03at11.03.30AM-985f846f70e347c69f0f288359e7beed.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)