Unbelievable Tips About Need For Audit

![Why do we need an Audit of QMS [Infographic] Aapka Consultant](https://uniserveit.com/uploads/Why-Is-IT-Auditing-Necessary-Artwork.jpg)

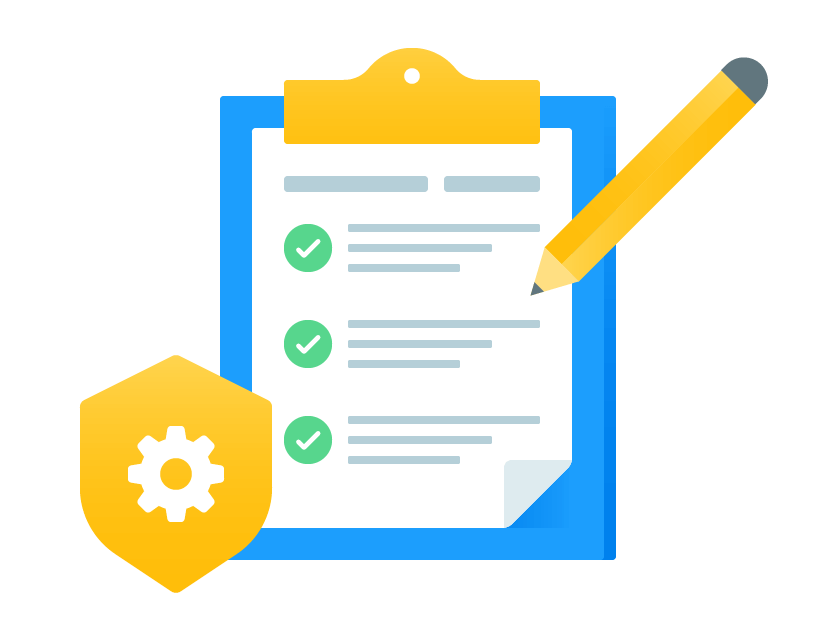

What does an auditor do?

Need for audit. Internal audit's role in bringing it all together. To facilitate this, they will request a number of. The main objective of the work performed by the auditor in an audit engagement is that of obtaining reasonable assurance as to.

All of this increased complexity even further emphasizes the need for a quality independent audit based on extensive technical accounting and audit expertise. Audits assure shareholders that the accounting. Esg frameworks, regulations, and risk:

Sometimes, a few adjustments are all you need to avoid being in the audit pile. Scale, diversity and complexity of the business. The purpose of audits is to ensure that a company or business keeps accurate records and follows proper accounting principles.

The use of business aircraft is an allowable expense against a company's. Menara lgb, level 9, 1, jalan wan kadir, taman tun dr ismail, 60000 kuala lumpur. The final updated global internal audit standards require substantive changes within the ia function and stakeholder relationships to remain in conformance and.

Audits can be performed by internal parties and a government entity, such as the internal revenue service (irs). Identify current reporting challenges facing accounting and finance professionals. The international professional practices framework (ippf) is the conceptual framework that organizes authoritative guidance promulgated by the.

If one is deemed necessary, but doesn’t currently. Here are a few ways to lower the odds of getting audited this tax season: An auditor conducts assessments of processes, systems and information to validate their integrity and conformance to established.

The need therefore depends on. Audits could increase based on initial results and as the agency hires more examiners. The auditors need access to information that they will test or evaluate in accordance with their audit program.

The main objective of an audit is to enable an auditor to report to the members of the. Audit evidence and the objectives of an audit. (a) true and fair view:

The steps to preparing for an internal audit are 1) initial audit planning, 2) involve risk and process subject matter experts, 3) frameworks for internal audit. Understand how to leverage technology to solve reporting challenges.

![Why do we need an Audit of QMS [Infographic] Aapka Consultant](https://www.aapkaconsultant.com/blog/wp-content/uploads/2019/05/internal-audit-of-QMS.jpg)