Perfect Info About Pro Forma Balance Sheet For A Startup Business

Choose your start and end dates to create a customizable timeline.

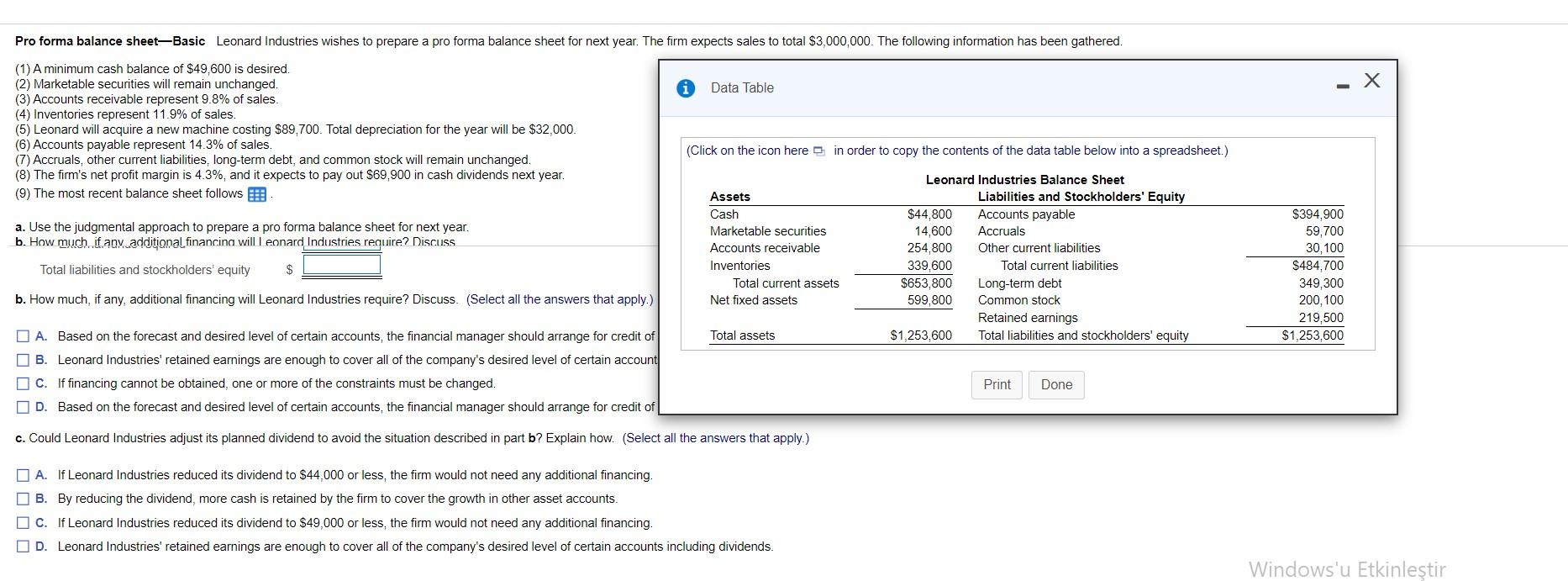

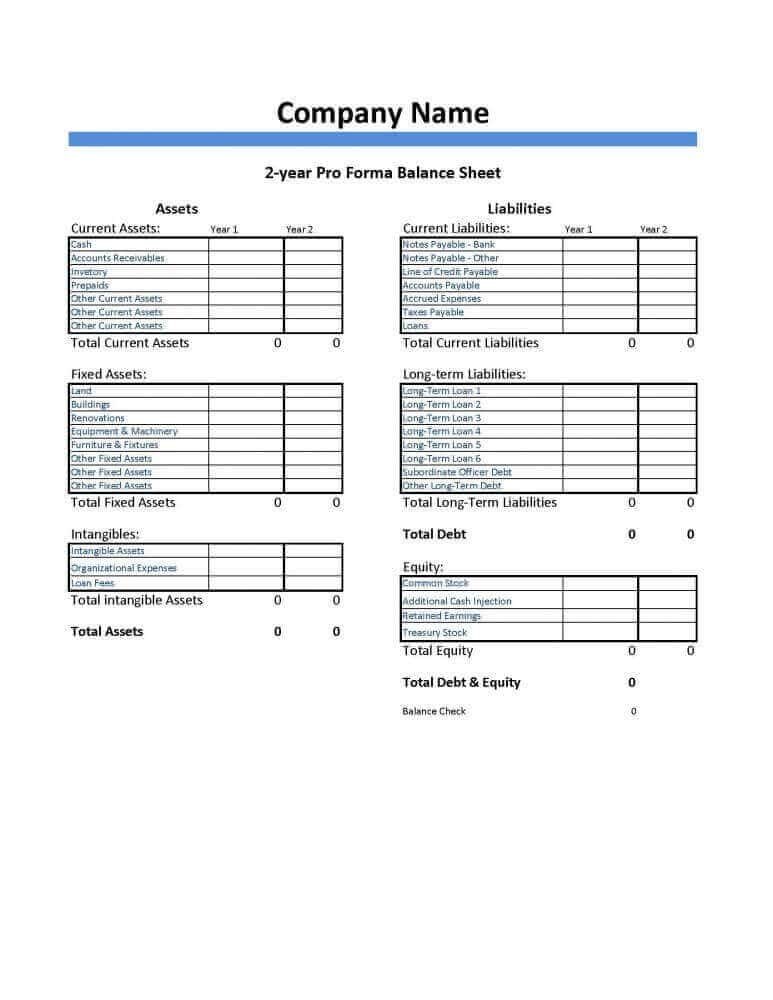

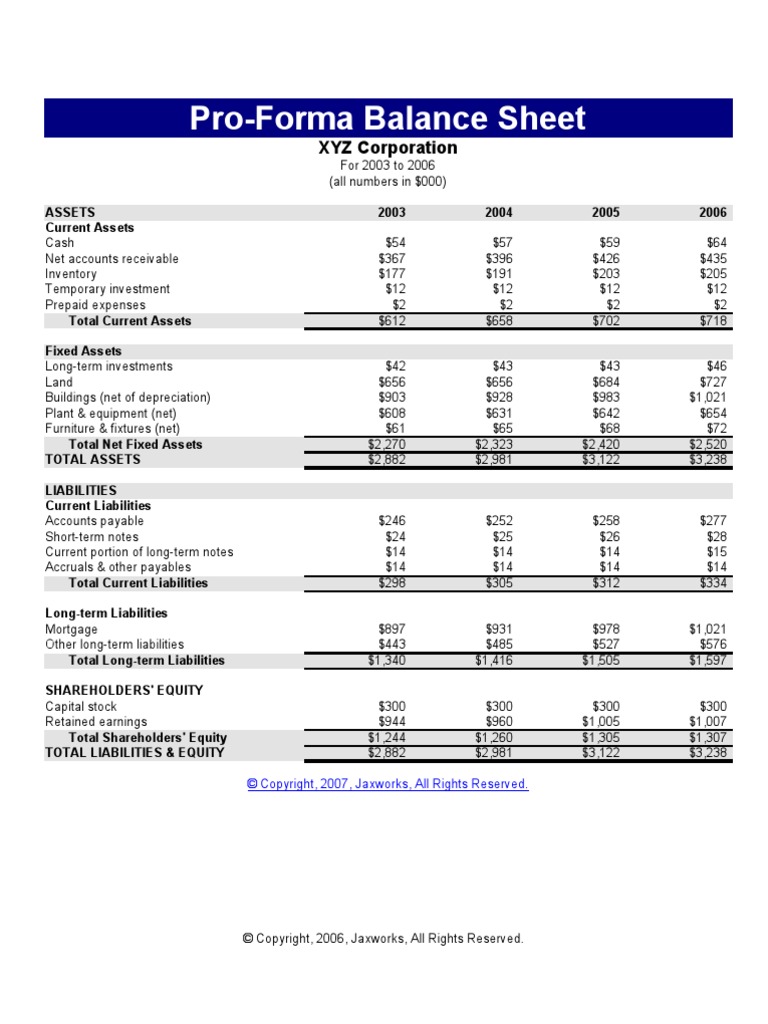

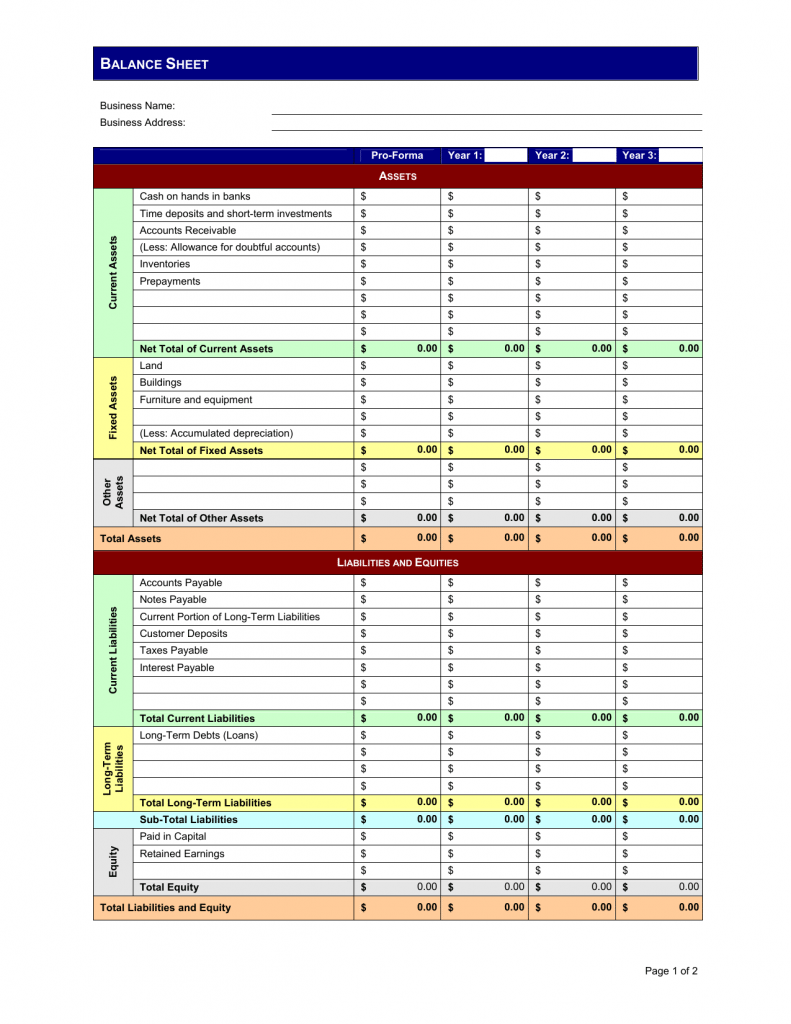

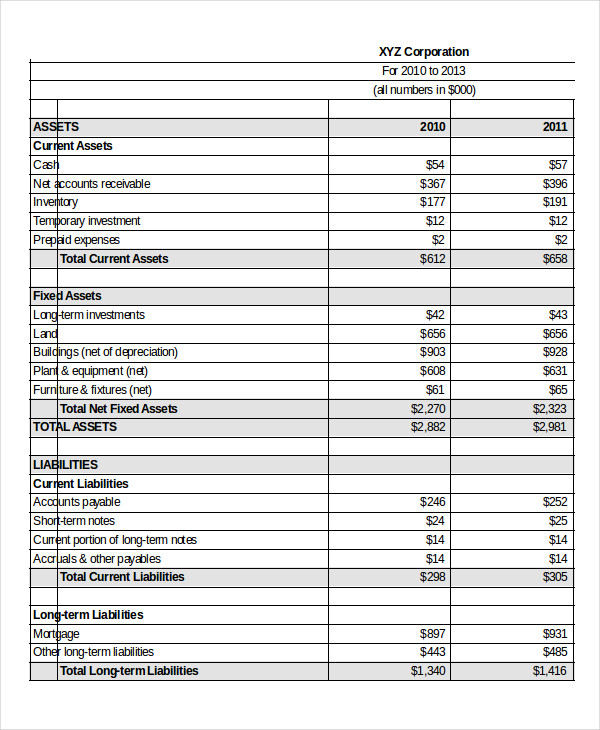

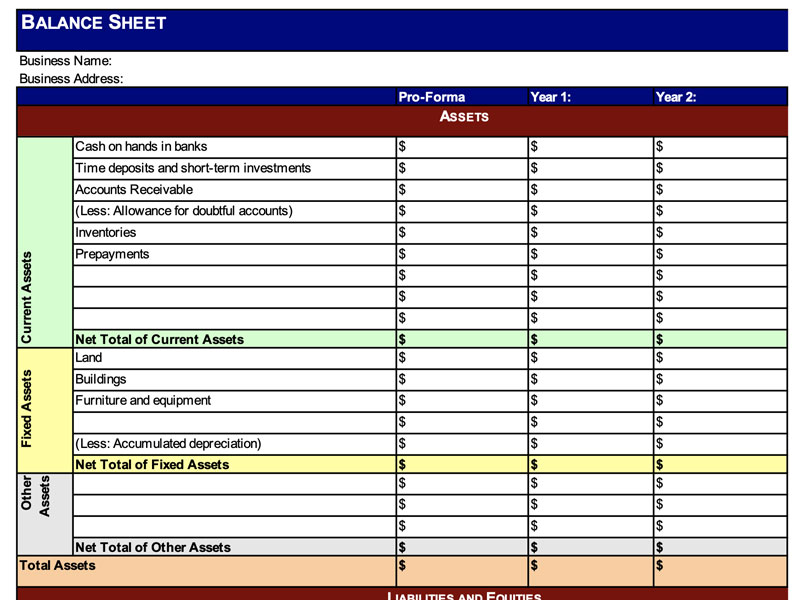

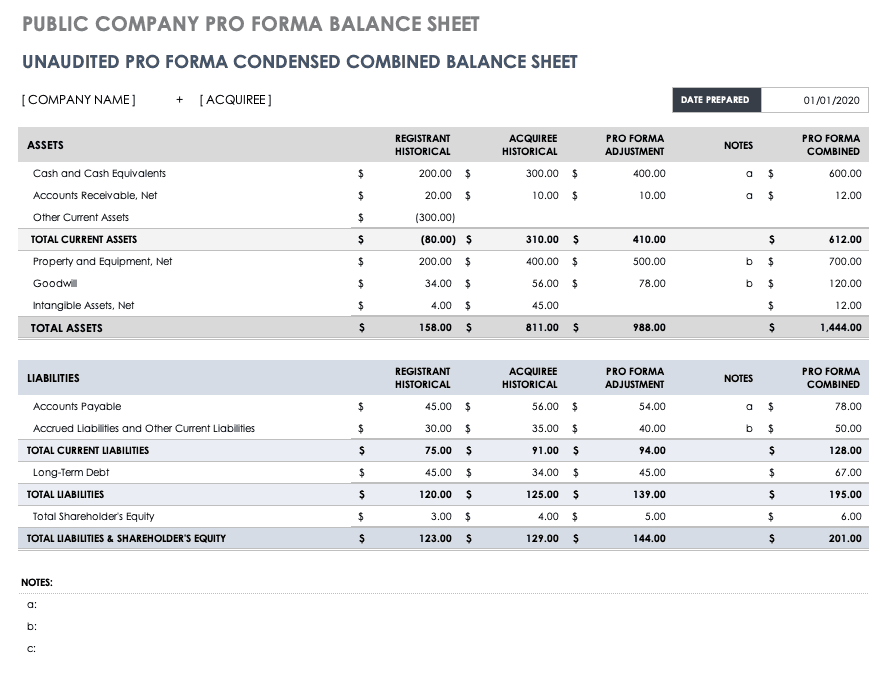

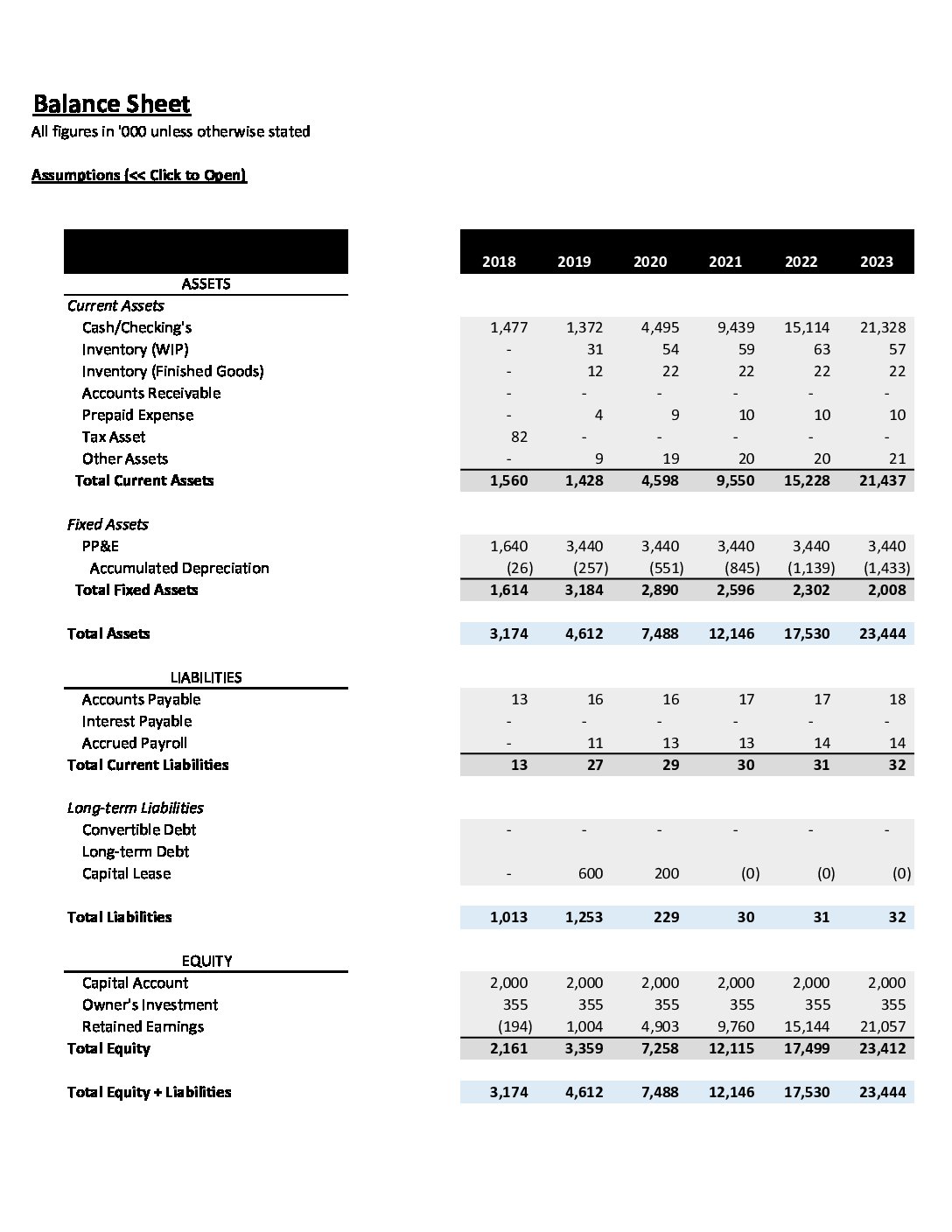

Pro forma balance sheet for a startup business. A balance sheet is a financial statement showing how much a company is worth according to its “book value.” it does this by listing out all of a company’s assets, liabilities, and owner’s equity for a given date. Pro forma projections ensure that there are no surprises as you manage your liabilities and additional assets like inventories. This balance sheet reflects your business’s financial strength, detailing your assets, liabilities, and shareholder equity.

We put this guide together because there doesn't seem to be any great resources for beginners, so if you're unsure where to start, you're in the right place. First, list the value of all the assets in the business as of the startup date. A balance sheet gives potential lenders a picture of the position of a business as of the startup date so it can be a valuable component in being approved for startup funding.

Your startup’s financial position guides the decisions you have to make to scale and sustain your company. Additionally, we have used last year’s (2021) values. Pro forma income statement is an effective way to get ready for unforeseeable business hurdles, increased taxes, growth plans, and acquisitions.

A pro forma balance sheet can quickly show the projected relative amount of money tied up in receivables, inventory, and more. This financial plan projections template comes as a set of pro forma templates designed to help startups. This printable small business pro forma balance sheet template serves as your business's financial statement over the course of a specific timeframe.

Together, the documents help you assess whether your business’s. Steps in preparing a business startup balance sheet. Pro forma income statements pro forma balance sheets pro forma cash flow statements pro forma statements look like regular statements, except they’re based on what ifs, not real financial results.

However, like any template, you need to adjust it to suit your needs. Balance sheets offer a realistic look at the financial wellness of your company and what it's worth. This date is referred to as a “reporting date.”

A pro forma in the context of startups refers to a financial document or set of financial statements that projects the future financial performance of a company. You should also include a pro forma income statement, balance sheet,. A pro forma income statement is an effective way to gain the attention of potential investors, convince them on your growth plans and seek funding.

A balance sheet includes two sections, one for assets and one for liabilities. Pro forma template for startups. A pro forma income statement, along with a pro forma cash flow and a pro forma balance sheet, form the primary financial projections for a business.

Download it today and manage your pro forma balance sheet effortlessly! October 5th, 2022 | by: December 19, 2023 by michaela dale.

It is helpful in a variety of circumstances and, by providing a projection of future company assets, liabilities and equity, allows people to assess the health of a business. How to create a balance sheet for a startup. They should also be included with in the financial of a business plan.