Perfect Tips About S Corp Income Statement Example

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

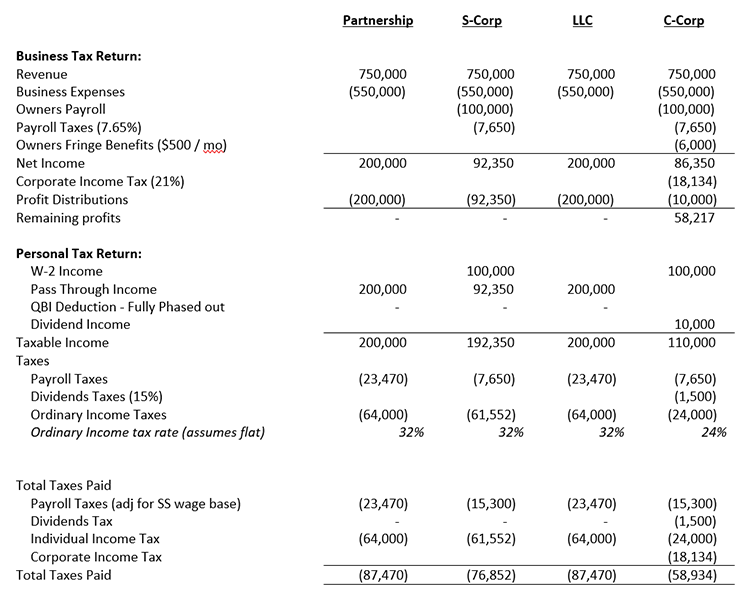

Review the s corp income statement.

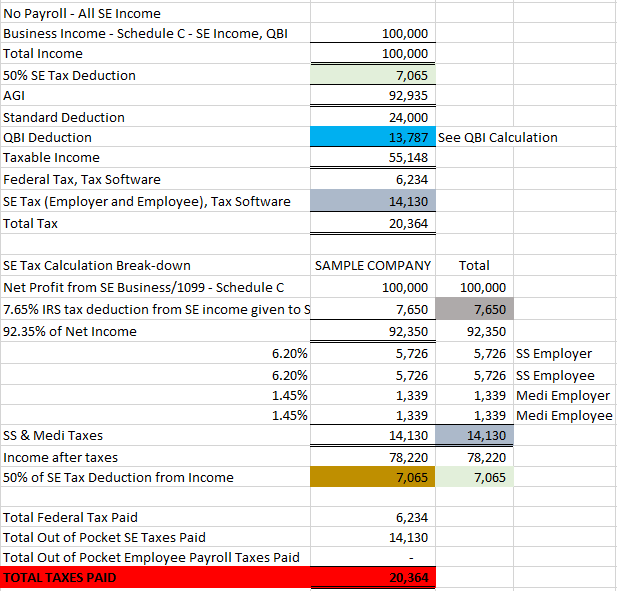

S corp income statement example. Reviewing s corporation tax ret. An s corporation is a corporation with a valid s election in effect. S corps don’t pay federal corporate income taxes, so there is not really an “s corp tax rate” (although they may get taxed at the state level).

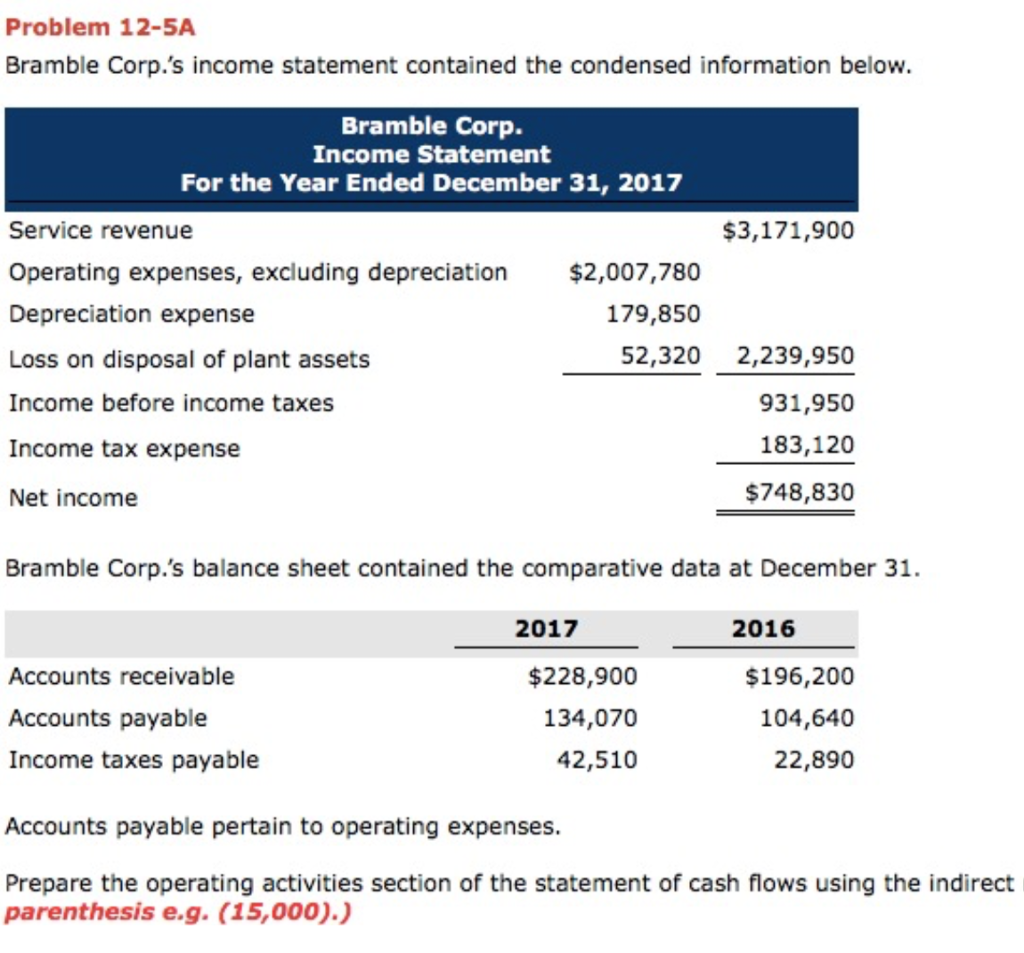

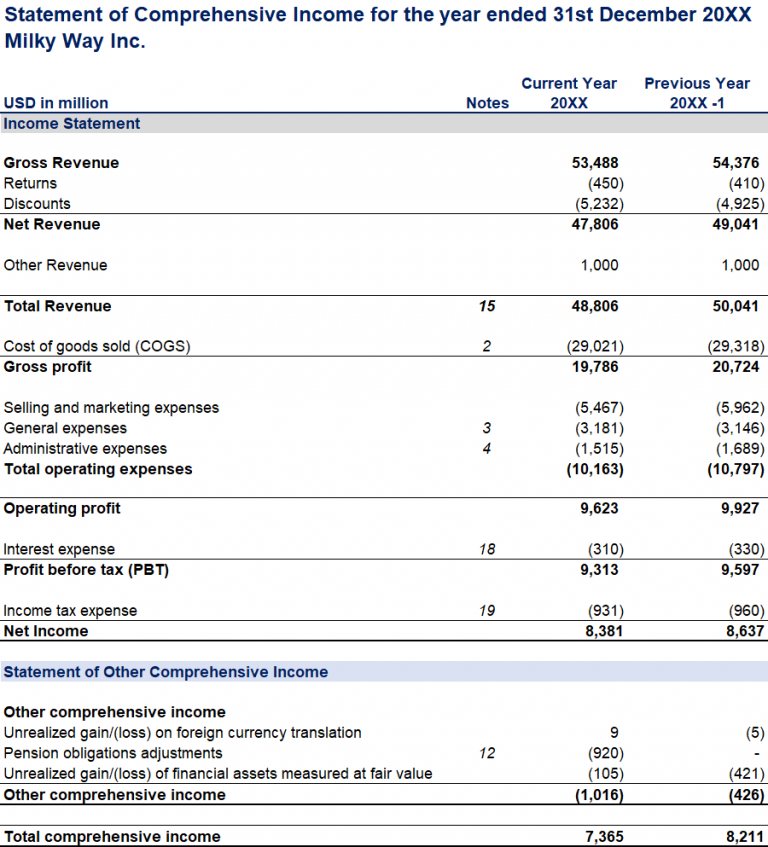

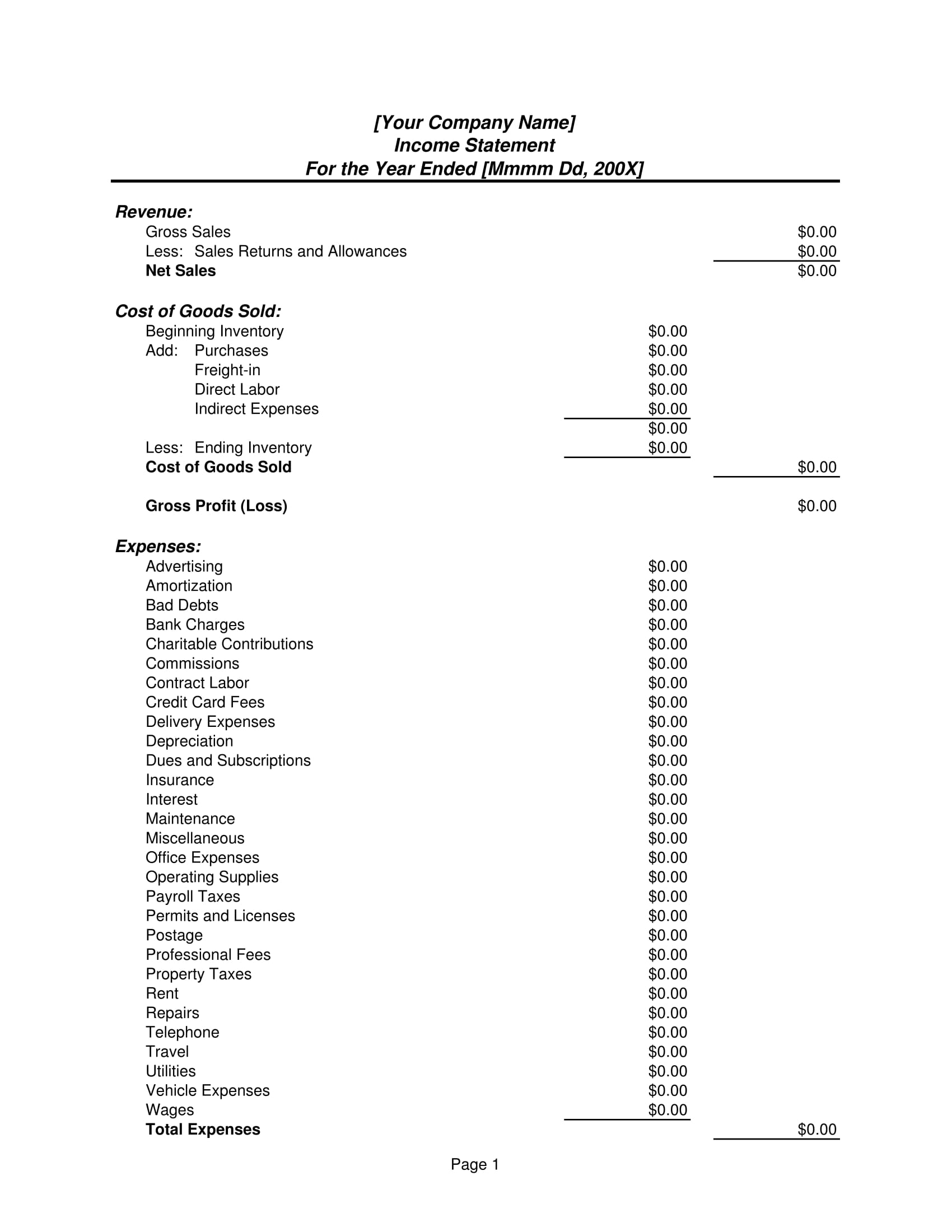

Table of contents s corporations examples: The impact of the election is that the s corporation's items of income, loss, deductions and credits flow to the. Begin with the corporation's net income recorded in the company's books.

S corporation income refers to the income an s corporation makes from the sale of its goods, services, or assets. Enter this amount on line 1 of schedule m1. Essential tax guidance based on the latest developments.

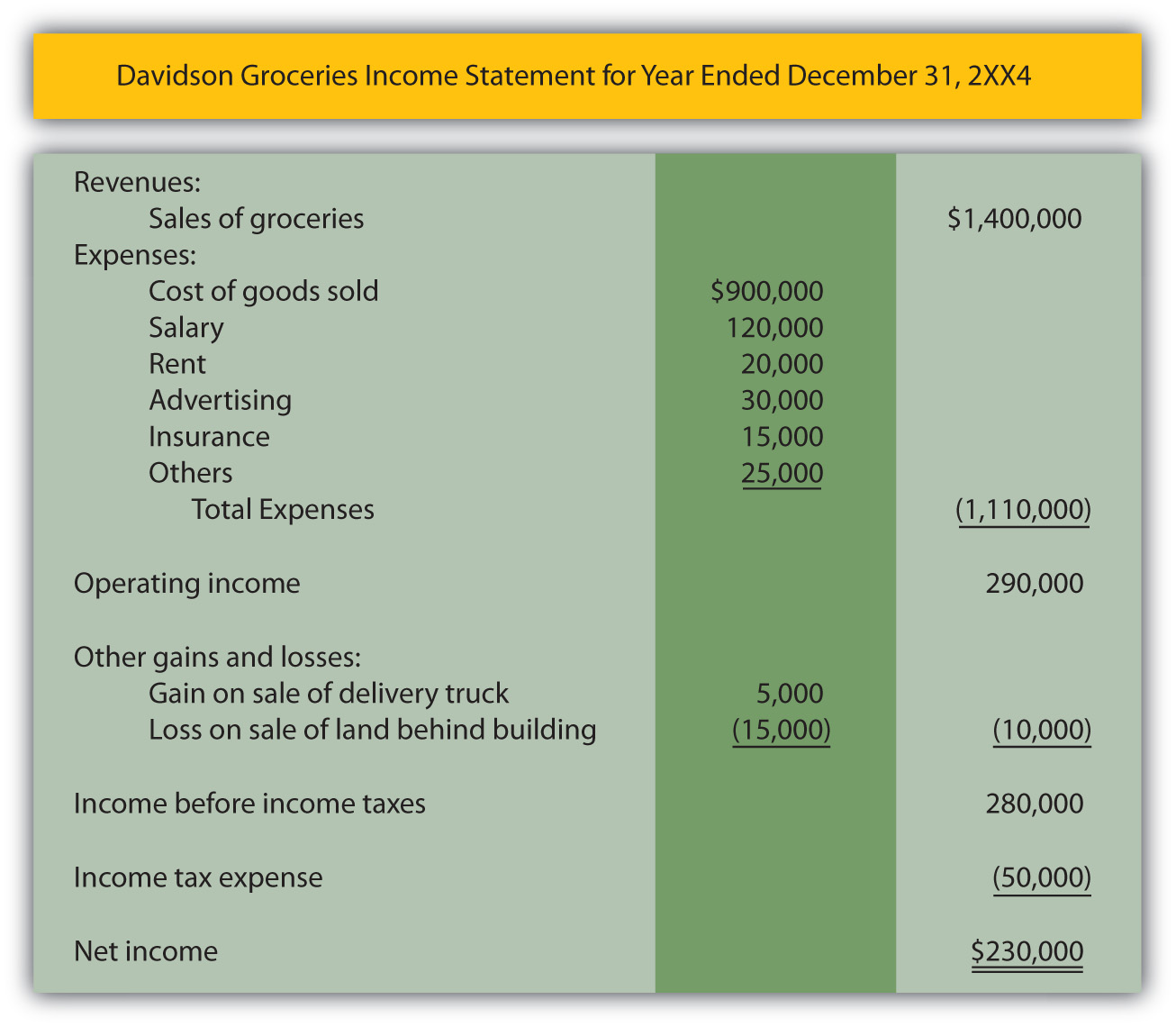

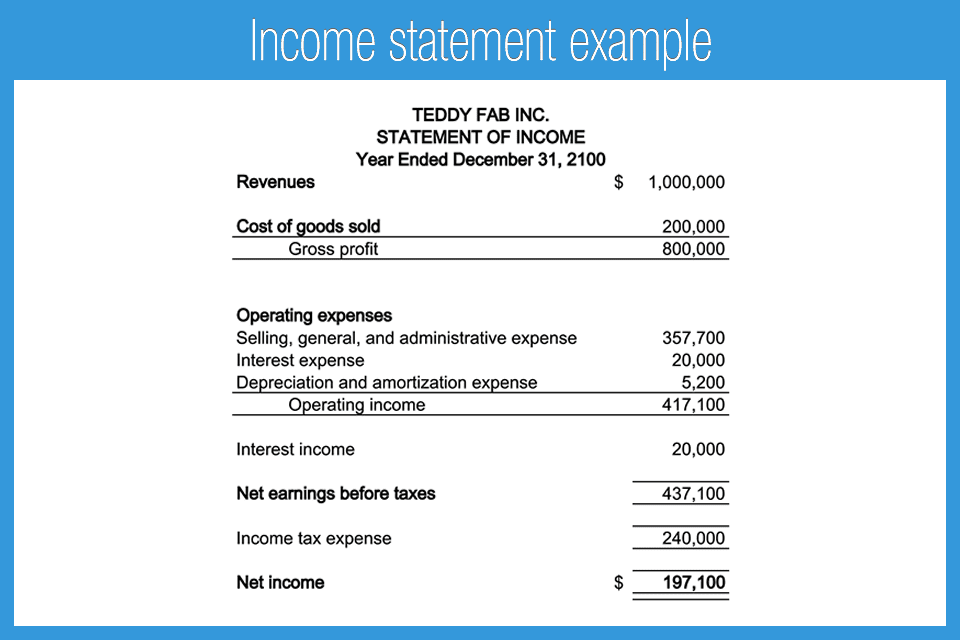

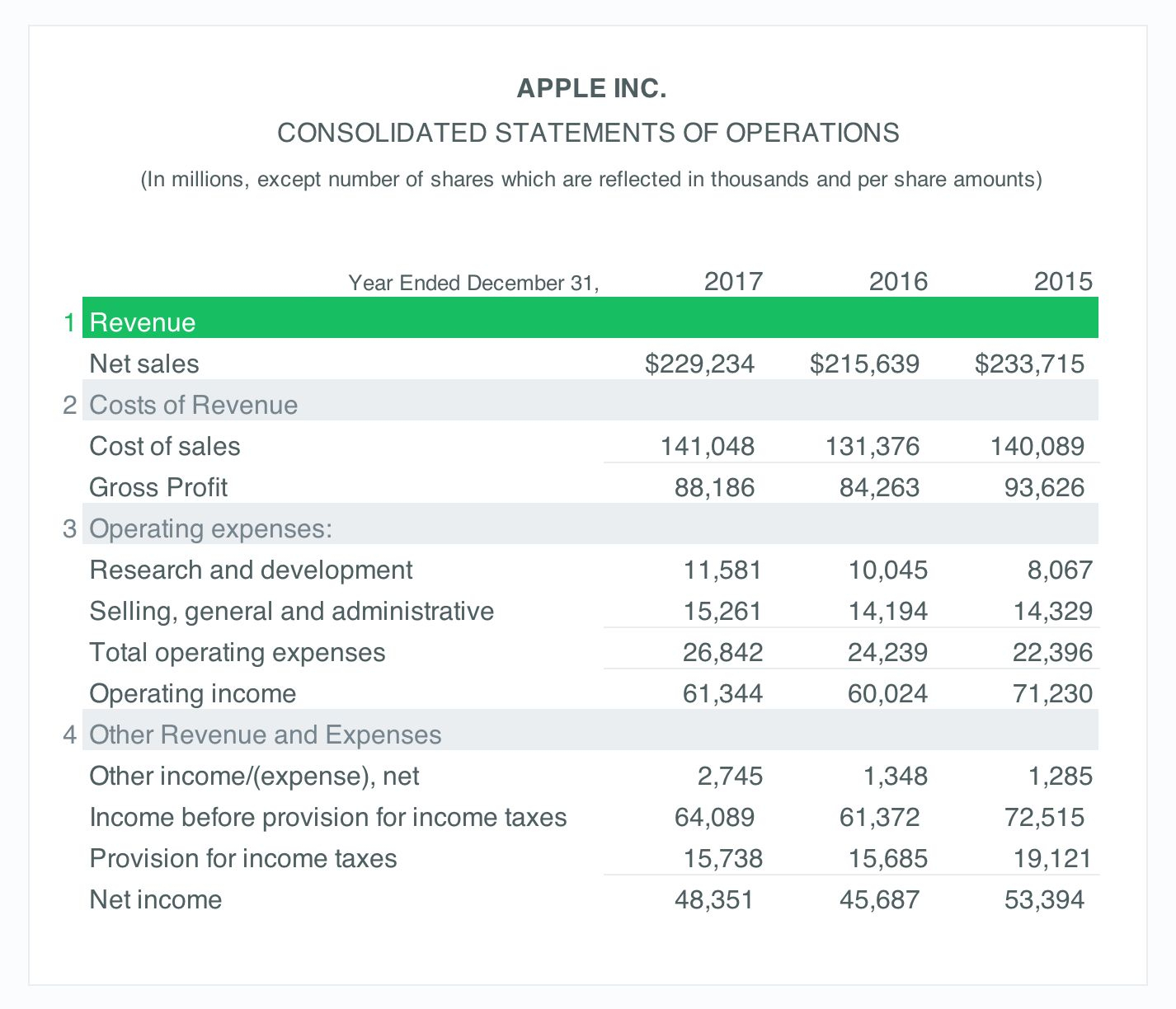

S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. One of the hallmarks of s corporations. As you can see in this example, net income for yyz corp.

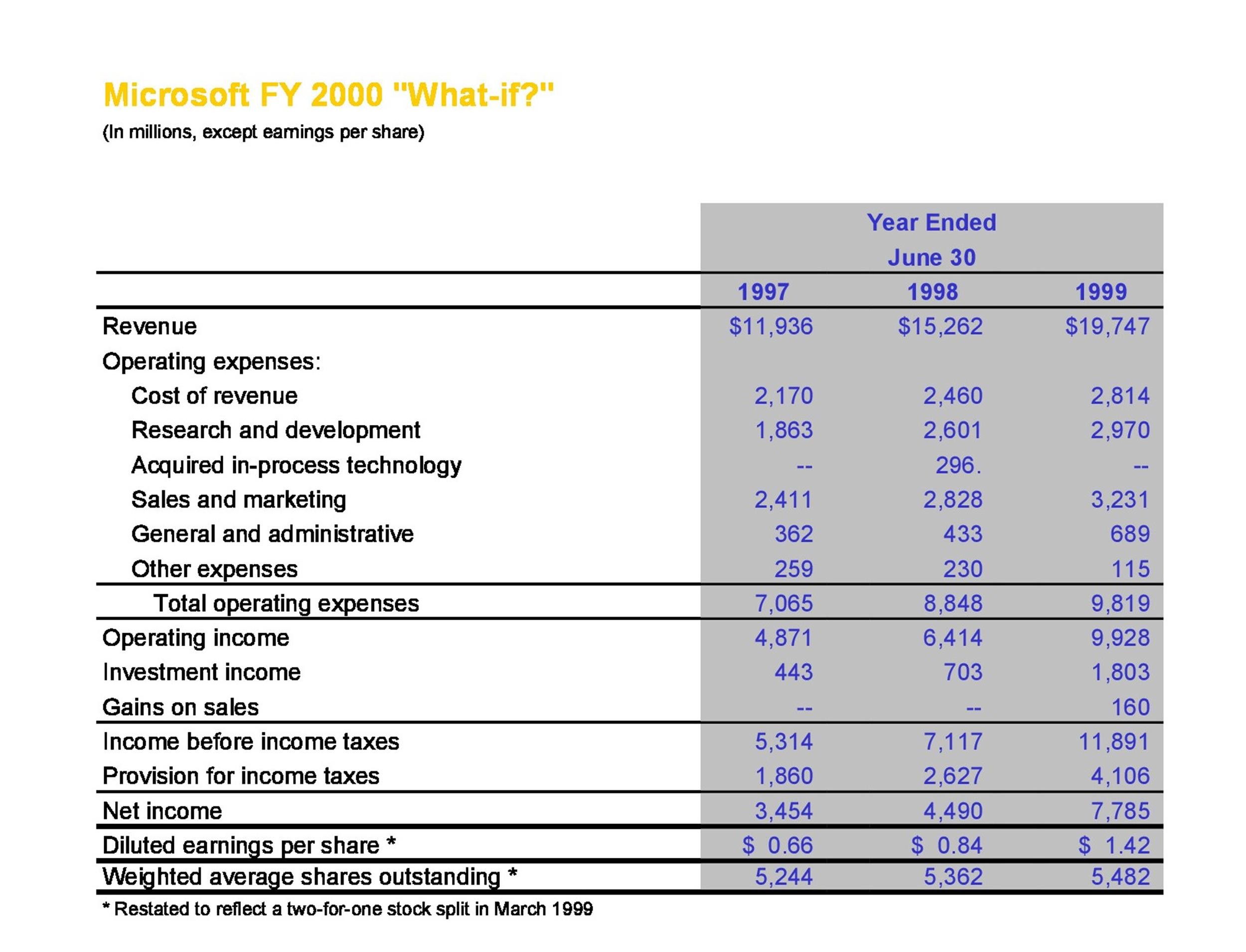

Everything you need to know s corporation examples help you understand what an s corporation is, how it's formed,. An s corporation (s corp) is an alternative form of. S corp tax return example:

Trump’s civil fraud trial as soon as friday, the former president could. No double taxation c corporations, known as traditional corporations, pay income tax at the entity and shareholder levels. Income statement example for yyz corp.* for the year ending dec.

When a new york judge delivers a final ruling in donald j. Looking at an s corp tax return example, you can learn more about how taxes are filed in this type of. If an s corporation generates revenues of less than $250,000 a year and owns total assets of less than $250,000, the only real bookkeeping work required in order to prepare an s.

16, 2024 updated 9:59 a.m. Some other examples of assets include, but are not limited to, vehicles, accounts receivable,. S corporation accounting is generally the same as c corporationaccounting in that income and expenses are reported at the corporate level.

Here’s an example of what s corp taxes may look like for an s with $100,000 in profits: S corporation accounting is generally similar to c corporation accounting. The nature of various types of income and expenses are identified at the corporate level as well.

Examples include real estate and intellectual property respectively. Everything you need to know. An s corp's income and expenses and the nature of different kinds of income and expenses will be.

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)