Heartwarming Info About Accounting Journal Ledger And Trial Balance Examples

It is prepared in the form of a statement.

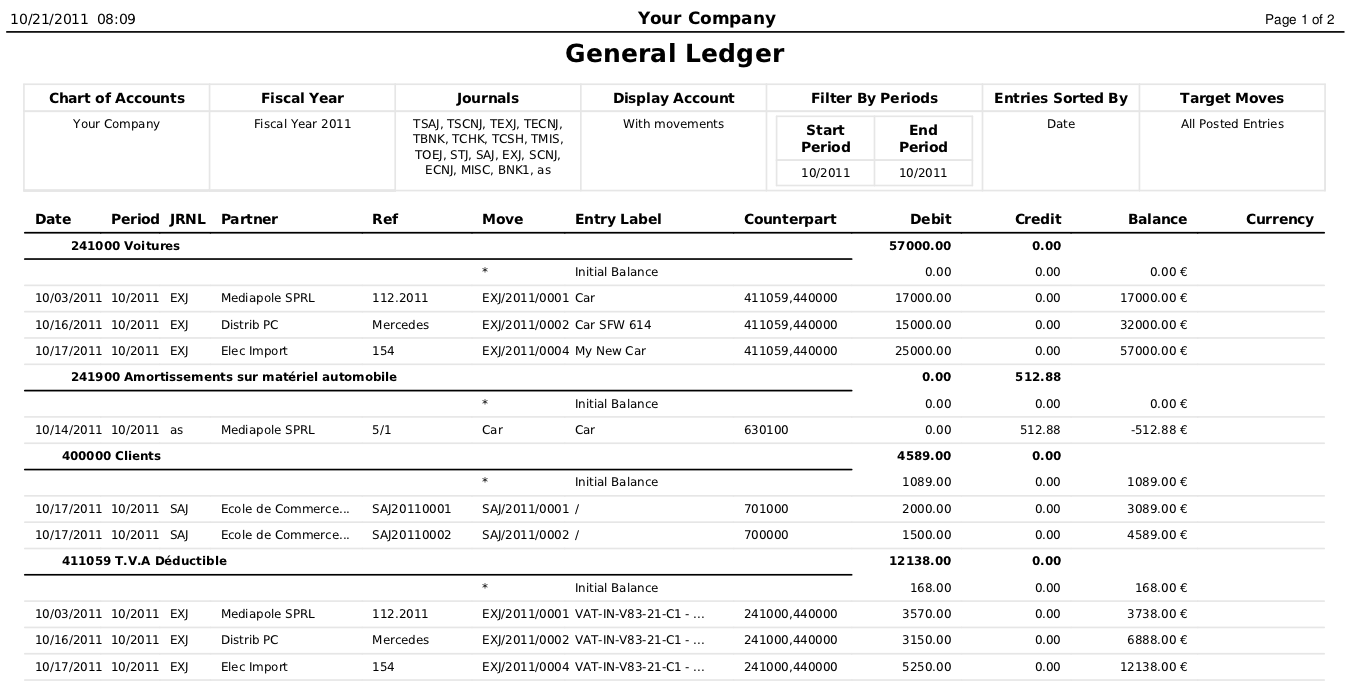

Accounting journal ledger and trial balance examples. It is not an official financial statement. It is prepared again after the adjusting entries are posted to ensure that the total debits and credits are still balanced. A journal is a chronological (arranged in order of time) record of business transactions.

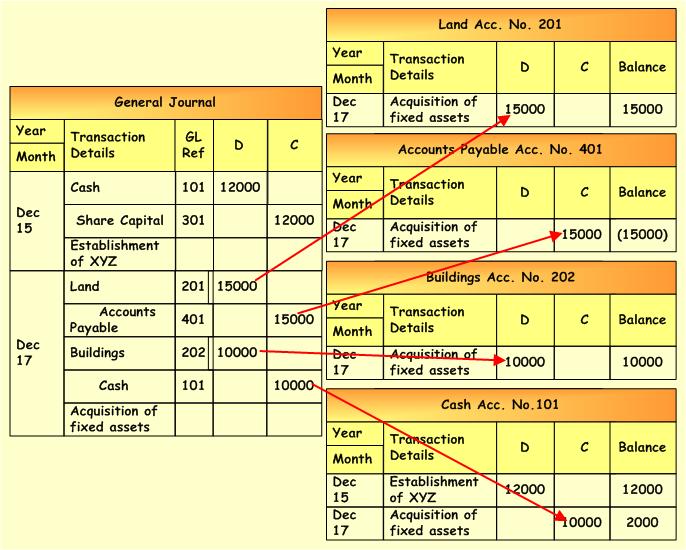

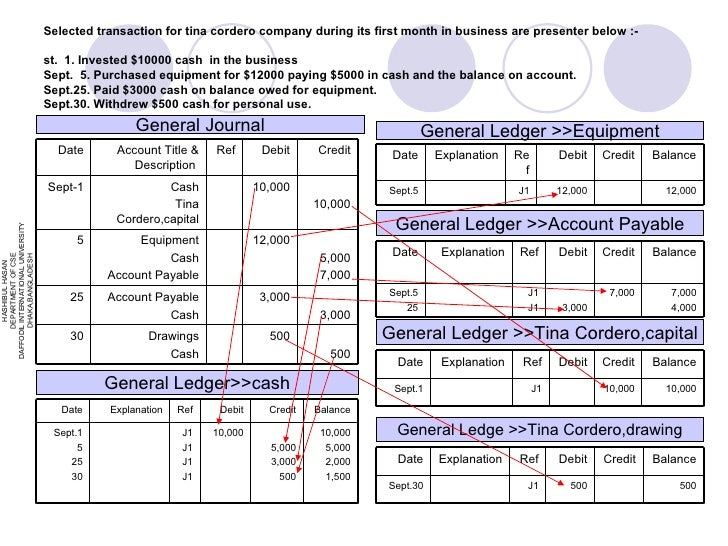

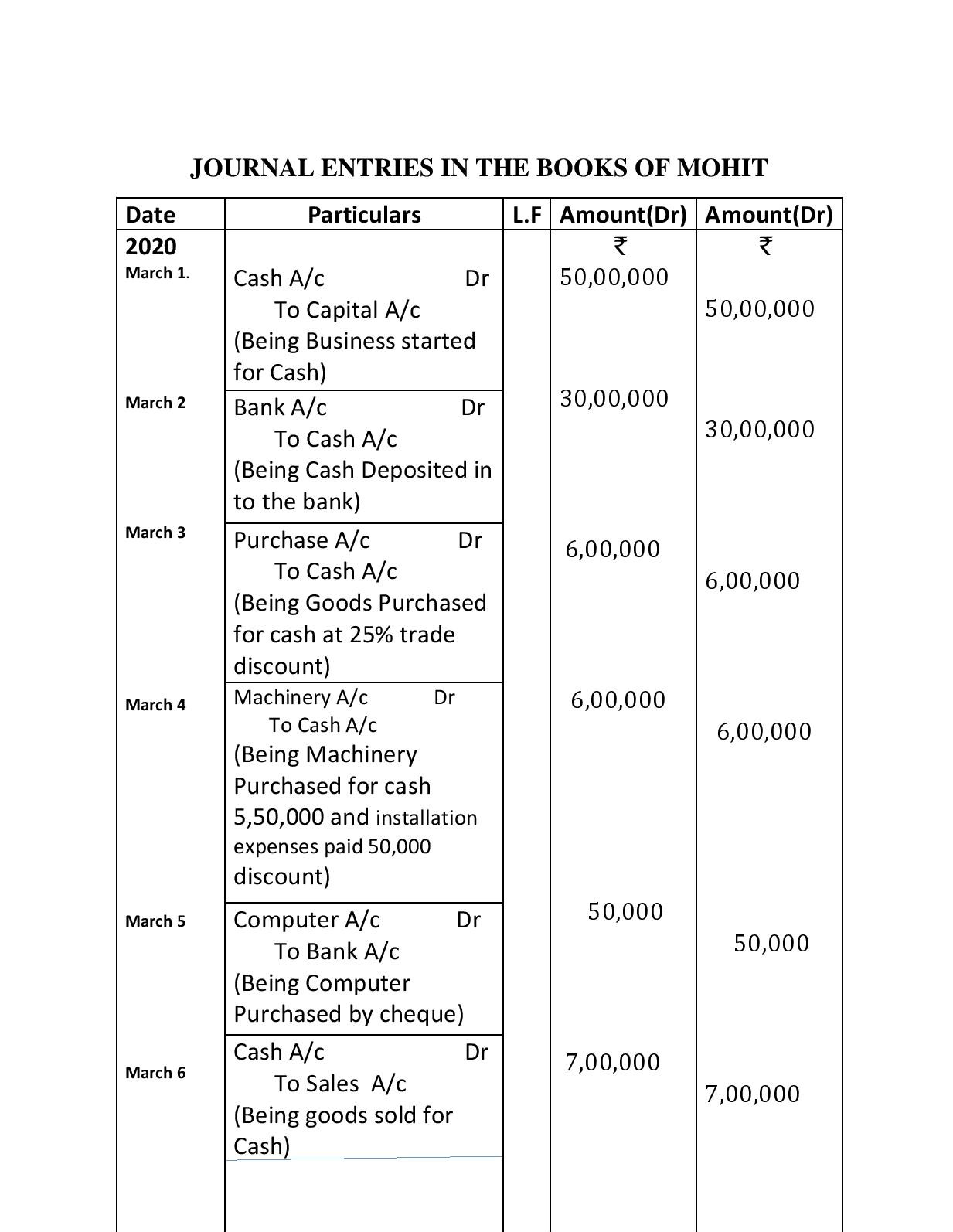

20 transactions with their journal entries, ledger and trial balance The steps are identifying economic transactions, classifying them, recording them in journals, posting to ledgers, preparing trial balance, preparing adjusting entries and adjusted trial balance, preparing income statement, and finally preparing the. In this article, we will discuss the basic concepts of financial accounting i.e.

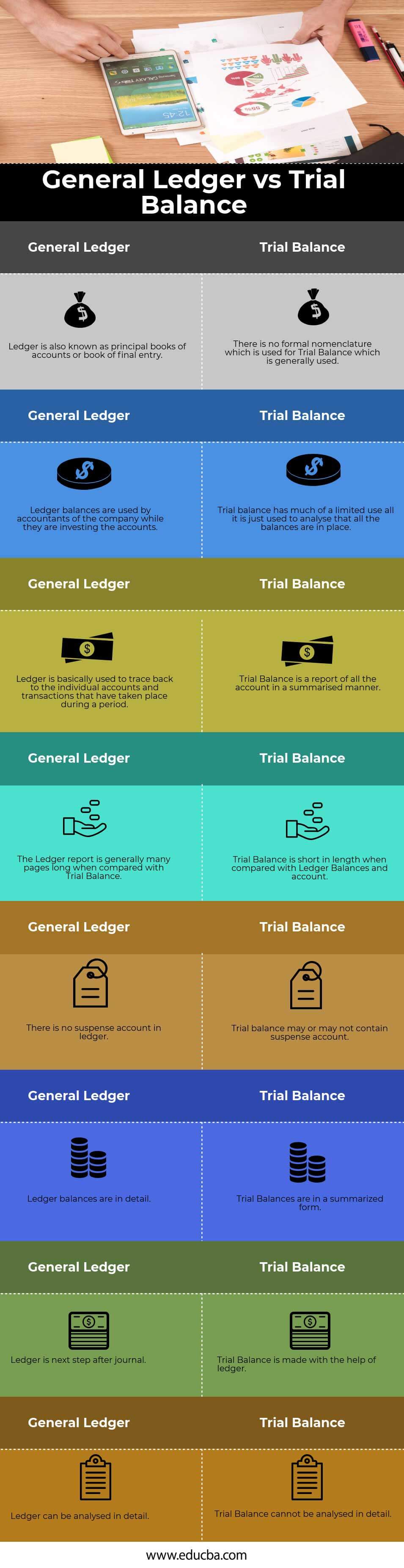

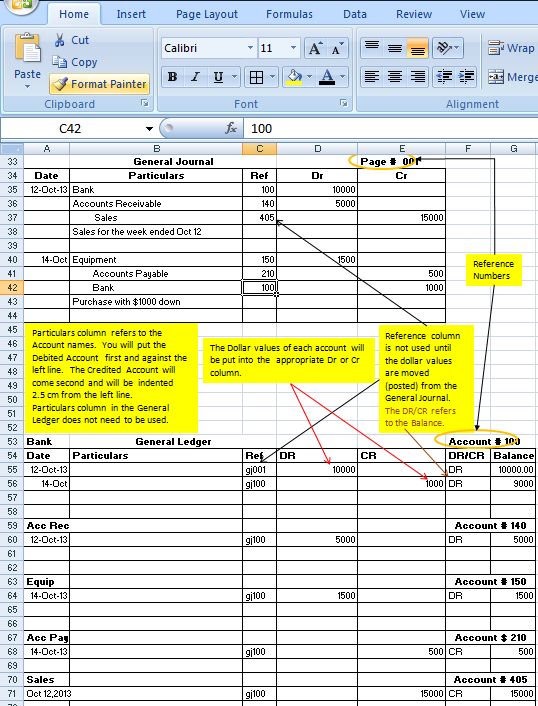

Everything to know about journal and ledger entries Traditionally a ledger was prepared in a physical book with a separate page for each account and a trial balance was derived from these accounts. For example, utility expenses during a period include the payments of four different bills amounting to $ 1,000, $ 3,000, $ 2,500, and $ 1,500, so in the trial balance, single utility expenses account will be shown wi.

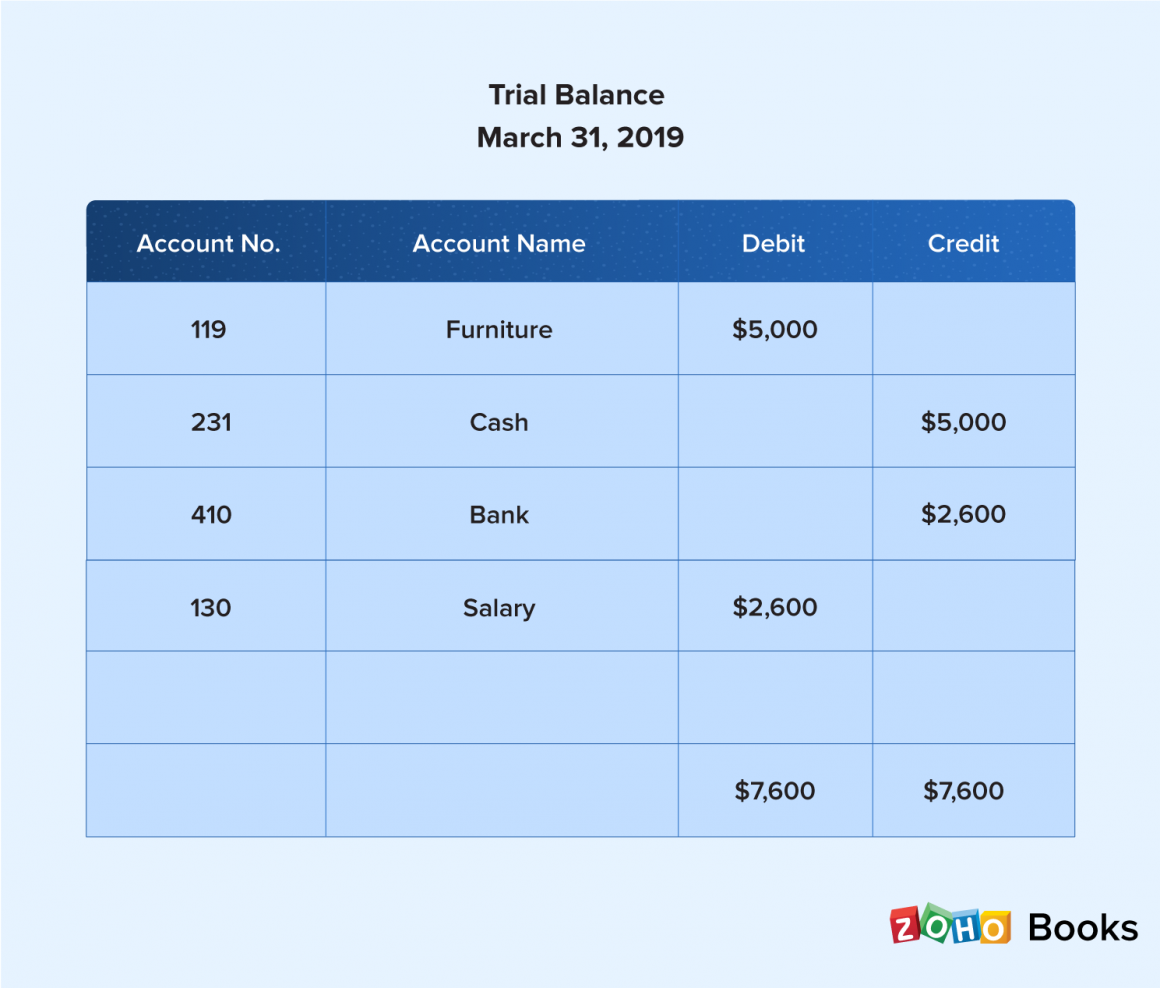

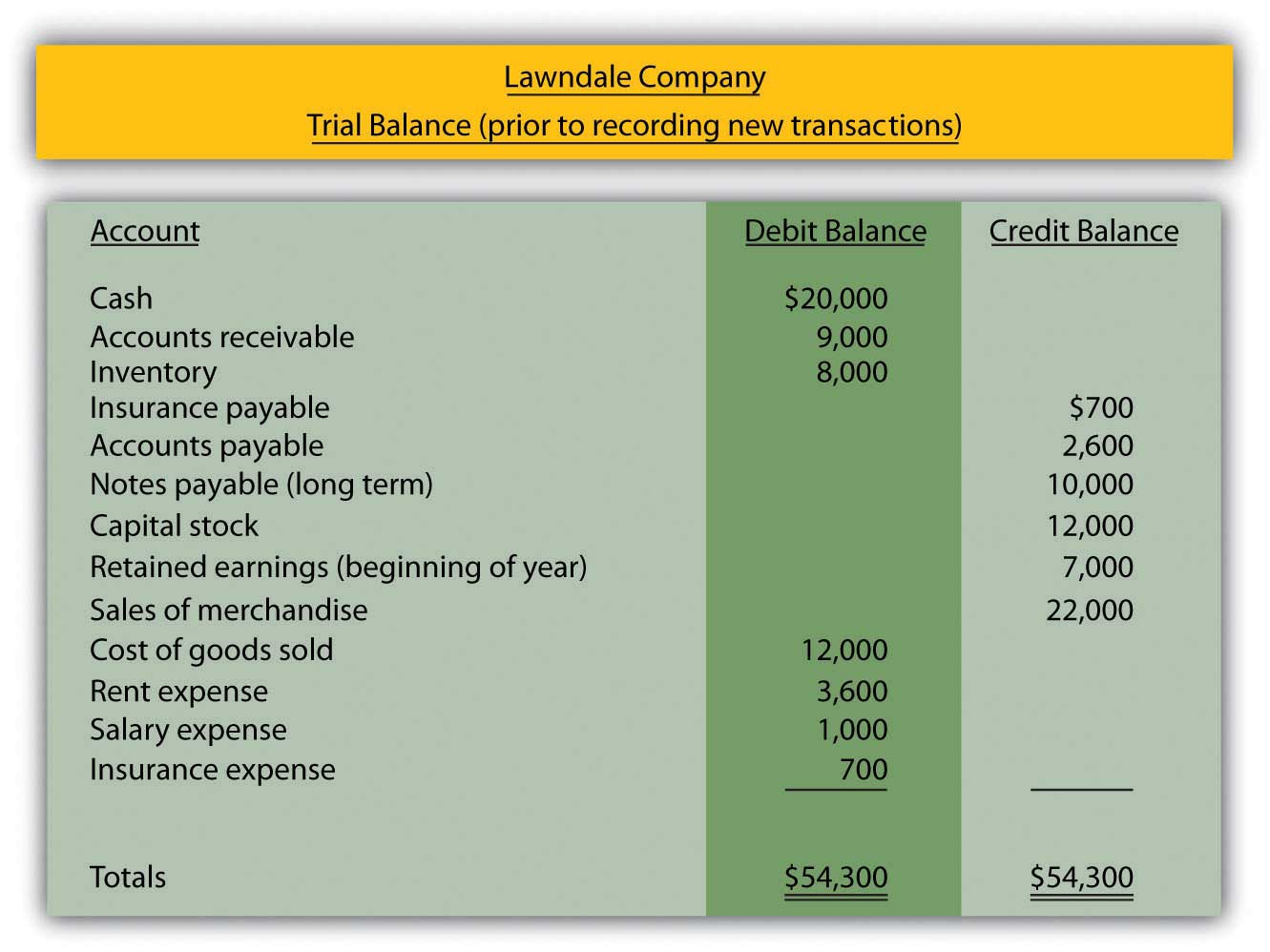

It lists the titles of all the accounts in a business’ general ledger in a column on the left, followed by the debit or credit balance of each account and the totals of the debit and credit columns. A trial balance is a list of all accounts in the general ledger that have nonzero balances. To find any differences between the bank statement and the cash account in the ledger, perform a bank reconciliation.

A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. Below is an example of a company’s trial balance: Once information from the ledger is consolidated into the trial balance, it is easy for your accountant to spot imbalances between debits and credits.

Recording transactions in the journal and posting to the ledger It shows the ending balances of all your accounts as they appear on the balance sheet. You must make adjusting entries in the diary and upload them to the ledger in order to correct inaccuracies.

The trial balance shows the opening balance of various accounts. A trial balance can help a company detect some types of errors and make adjustments to the trial balance and accounting ledgers before the books are closed for the accounting period and financial statements are prepared. 2.3 prepare an income statement, statement of.

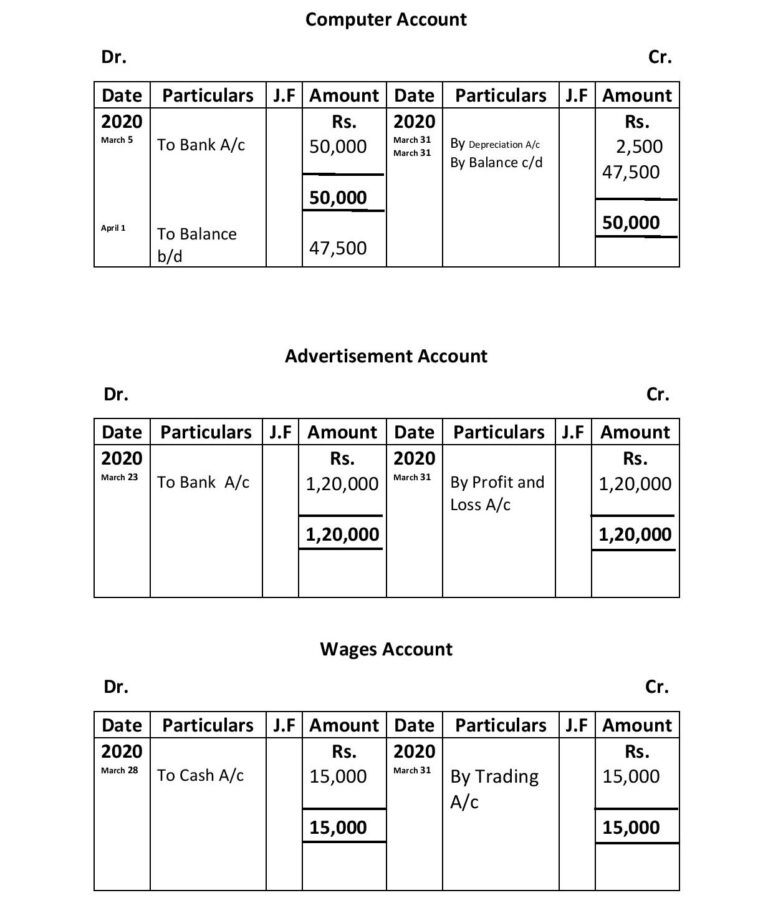

The business started with rs. Trial balance is the report of accounting in which ending balances of the different general ledgers of the company are available; Credited as per the golden rules of accounting.

2.2 define, explain, and provide examples of current and noncurrent assets, current and noncurrent liabilities, equity, revenues, and expenses; Preparing an unadjusted trial balance is the fourth step in the accounting cycle. In this topic, we also cover how to prepare journal, ledger, and trial balance with.

This has been a guide to ledger account examples. The account title should be logical to help the accountant group similar transactions into the same account. For example, a trial balance is given which represents the debit and credit balances, accordingly, i will prepare different ledger accounts to make it simpler.

![Introduction+to+accounting+[Journal+Ledger+&+Trial+balance]+simple](https://i.pinimg.com/originals/f5/74/f8/f574f82198105b4b8132a4ce96729735.jpg)