Simple Tips About Business Accounting Balance Sheet

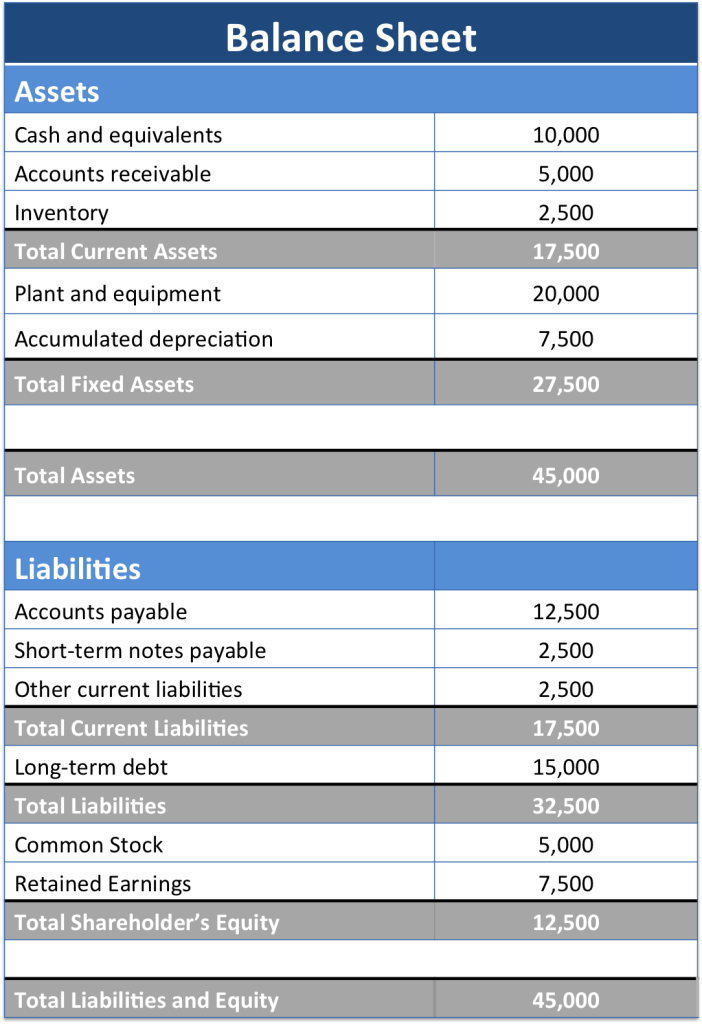

It compares what is owed (liabilities) with what is owned (assets) to demonstrate equity and the financial health of a business.

Business accounting balance sheet. In the united states, firms need to maintain a balance sheet for every year they operate. Keeping the balance sheet balanced. Under fasb accounting standard asc 805, business combinations,.

It follows the accounting equation: How to pass gst receivable journal entry in the books of accounts. So let’s look closer at what each term means:

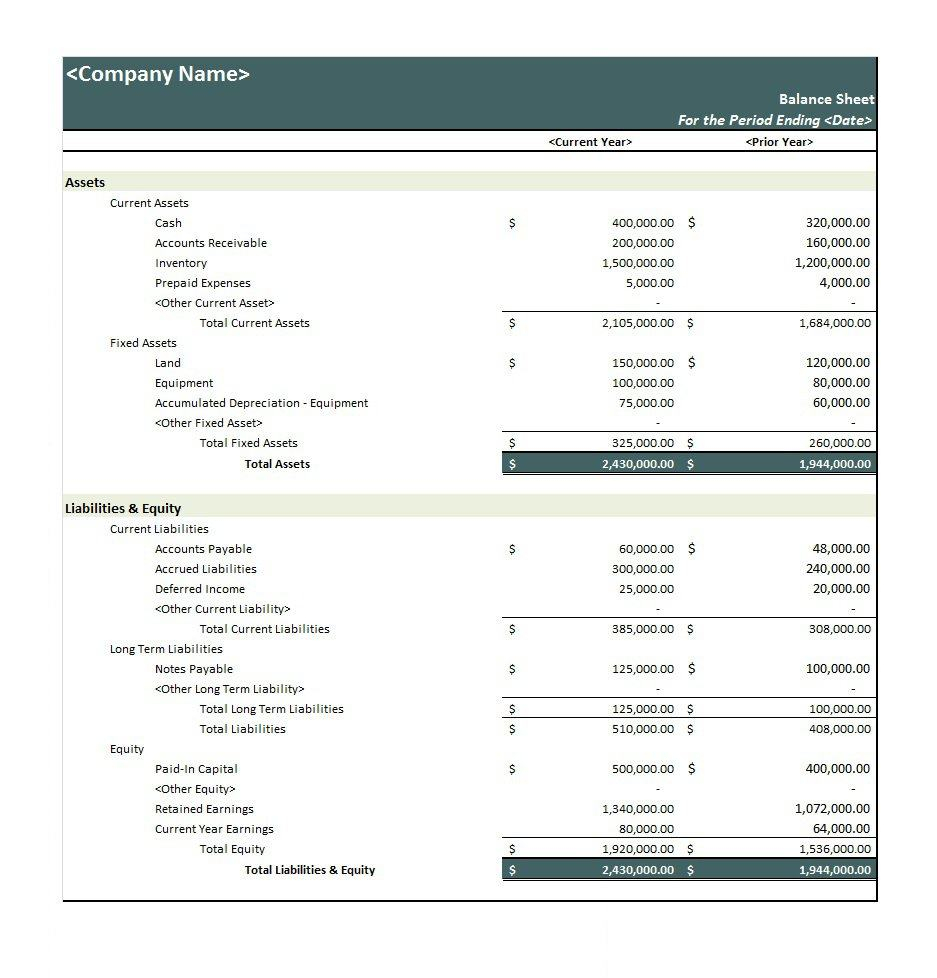

A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date. Vertically, the column on the left lists the assets of the company. A balance sheet provides a summary of a business at a given point in time.

B l premium. The other side shows the business’ liabilities and shareholders’ equity. Close the balance sheet report.

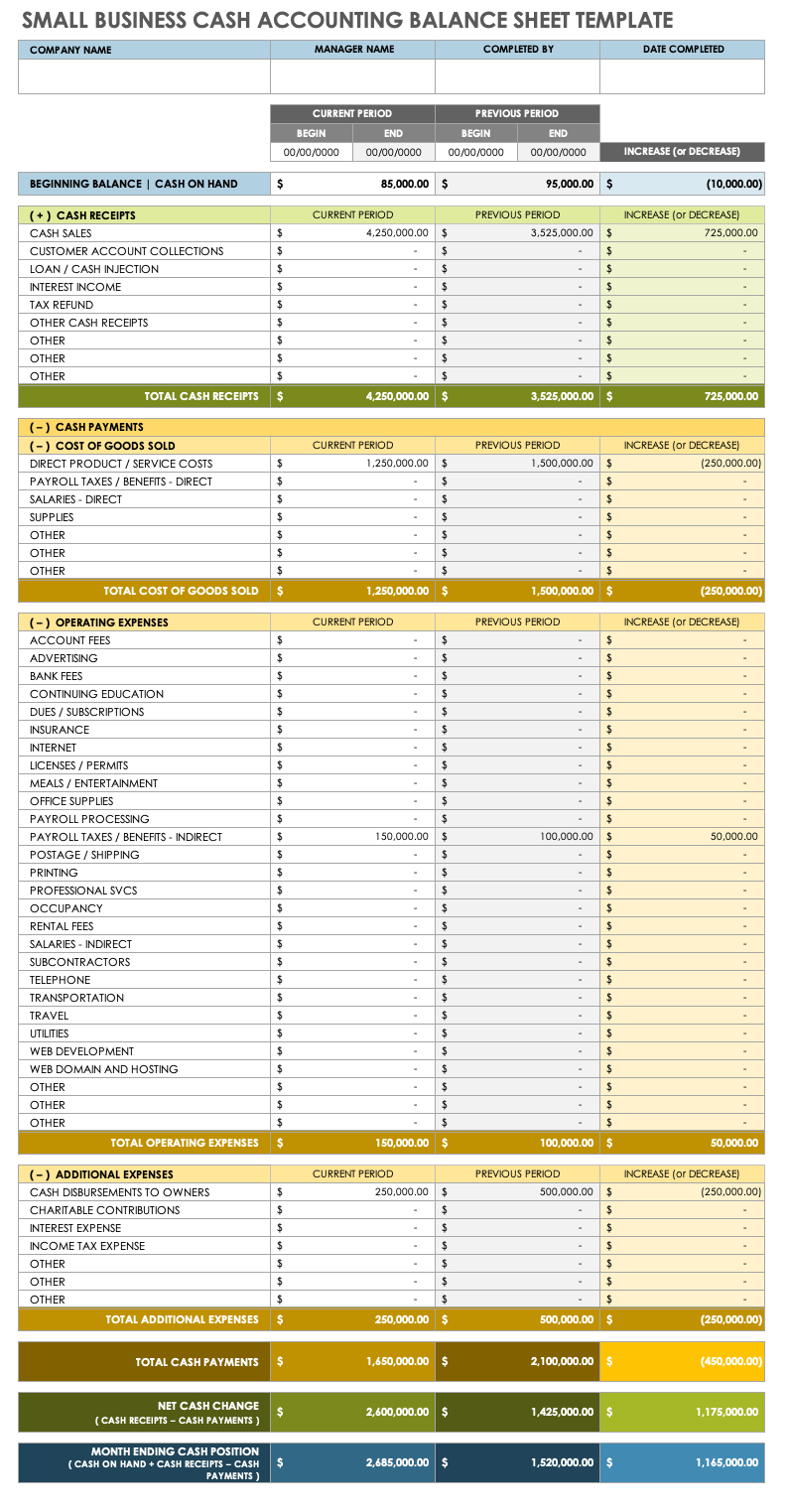

The balance sheet summarizes your business's financial status as of a certain date. Use our template to set up a balance sheet and understand your business's financial health. A balance sheet shows your business assets (what you own) and liabilities (what you owe) on a particular date.

Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date. 210 balance sheet. A balance sheet is one of the key financial statements used for accounting and it’s divided into two sides.

Your total assets and total liabilities are reflected in the balance field. The ability to read and understand a balance sheet is a crucial skill for anyone involved in business, but it’s one that many people lack. As a result, these forms assess a business's health, what it owes, and what it owns.

Why you need a balance sheet the balance sheet provides a picture of the financial health of a business at a given moment in time. Assets = liabilities + equity. Open both transaction detail and inventory valuation reports.

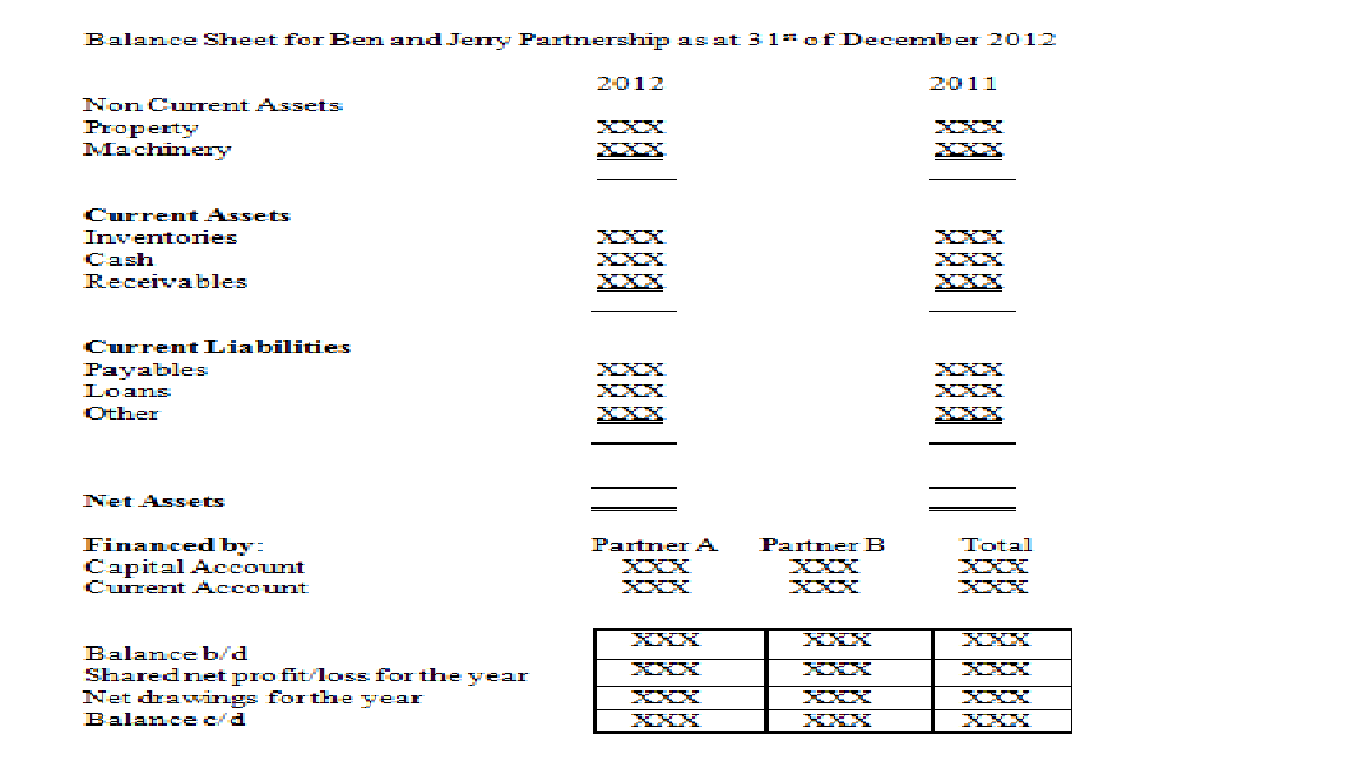

A balance sheet includes a summary of a business’s assets, liabilities, and capital. A small business balance sheet consists of two vertical columns or horizontal sections. In a sole proprietorship, a single capital account comes, while a partnership business maintains a separate capital account for each partner.

Learn what a balance sheet should include and how to create your own. Assets = liabilities + shareholders’ equity Determine the reporting date and period.

![[Download 31+] 24+ Template For Business Balance Sheet Png cdr](https://i.pinimg.com/originals/c0/07/87/c007874d944e867f5b9514d6afa7b863.png)

![Making Sense of Your Balance Sheet [Infographic] Learn accounting](https://i.pinimg.com/originals/f7/0d/ec/f70dec3a63cbcc1511efabd76241ea3c.jpg)