Outstanding Info About First Financial Statements After Incorporation

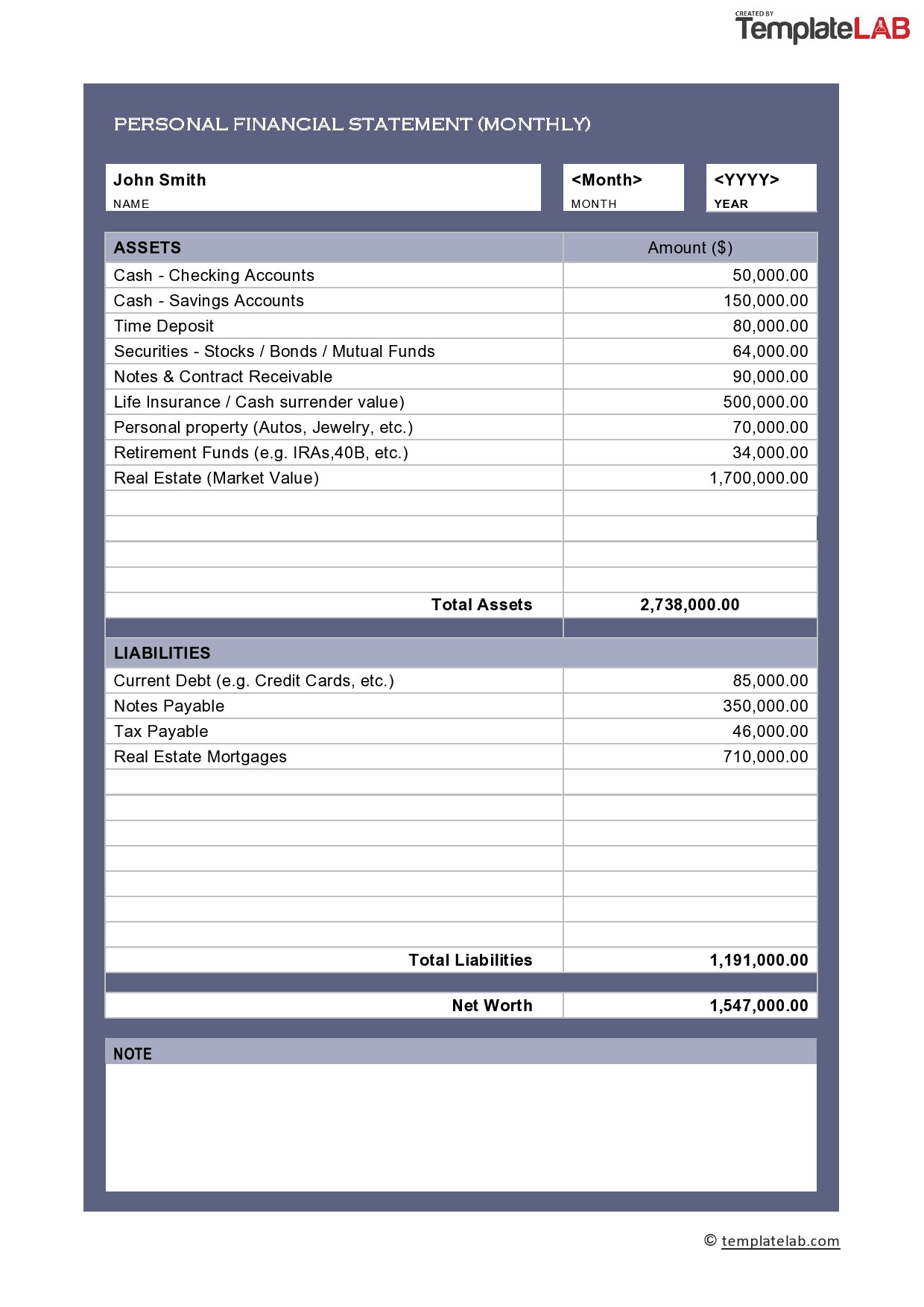

A newly incorporated company, should be held within nine months from the closing of the first financial year.

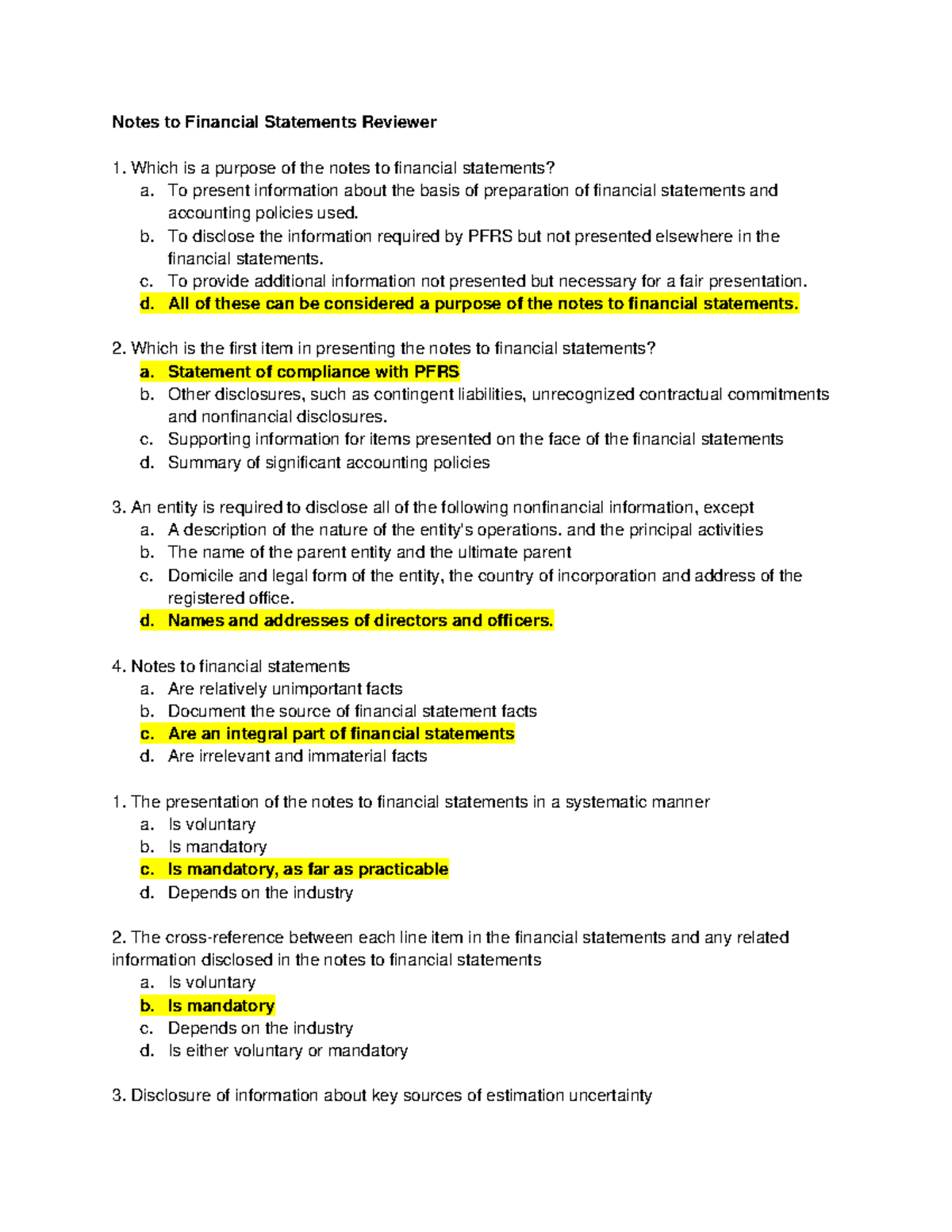

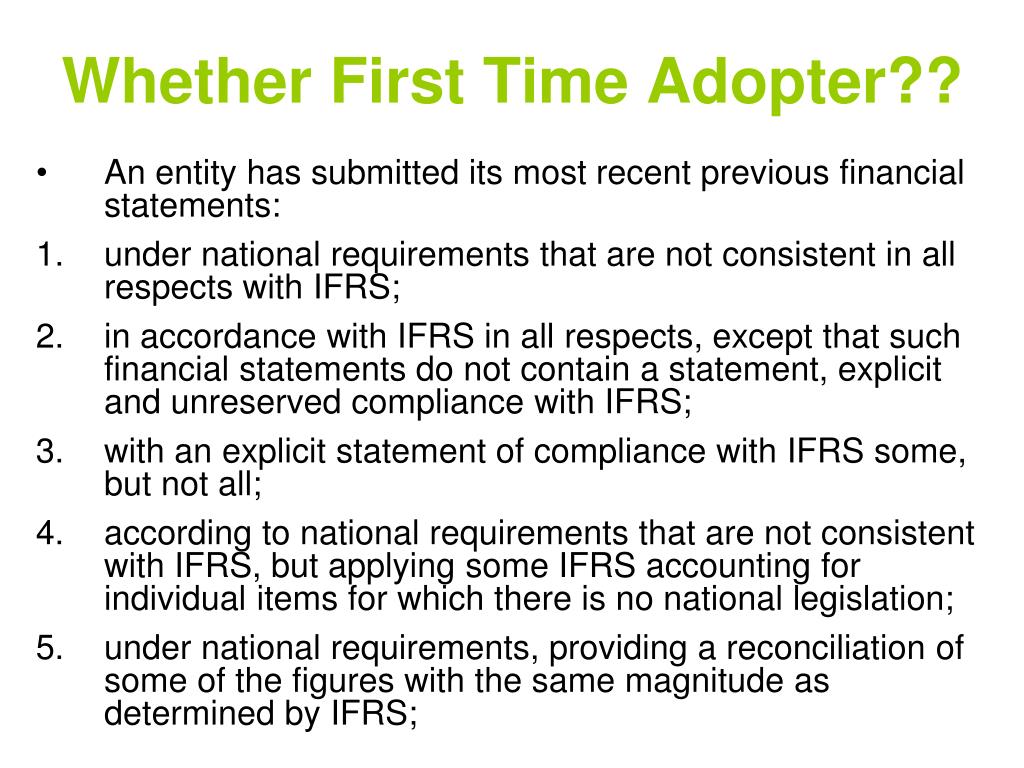

First financial statements after incorporation. Hold first agm within 18 months of incorporation, and subsequent agms yearly at intervals of not more than 15 months (b) timeline 2: Except in the case of the first financial statements laid before the company (after its incorporation) the. Under section 288, companies act 2014, the financial statements attached to a company’s first full annual return (ie with financial.

129(1), the company shall disclose in its. Date of incorporation falls between: Vermont what to do once you've incorporated.

This return is required to be made up to the. Under the companies acted, 1956 (‘old act’), it became open for who companies to. Except in the case of the first financial statements laid before the company (after its incorporation) the corresponding amounts (comparatives) for the immediately.

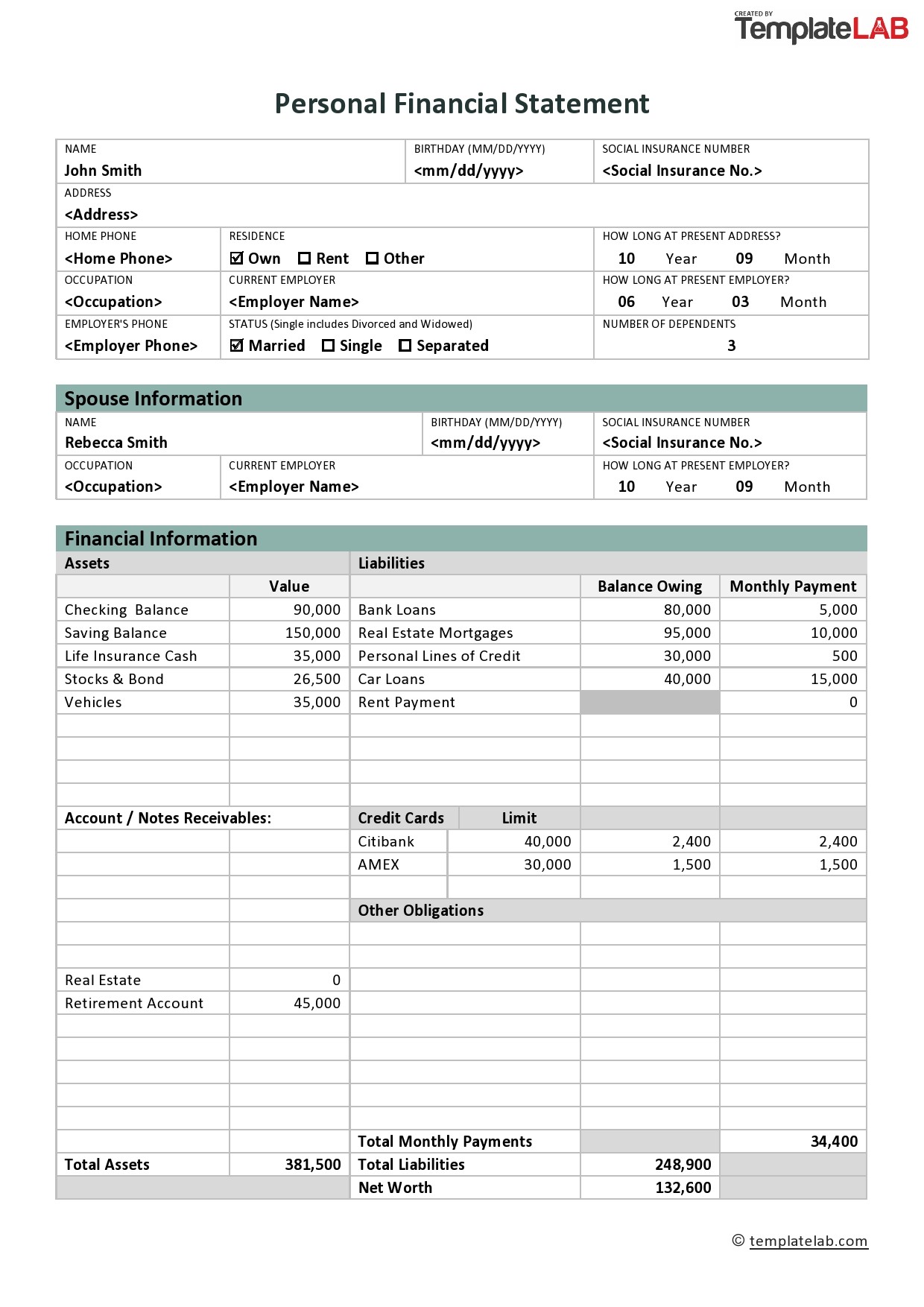

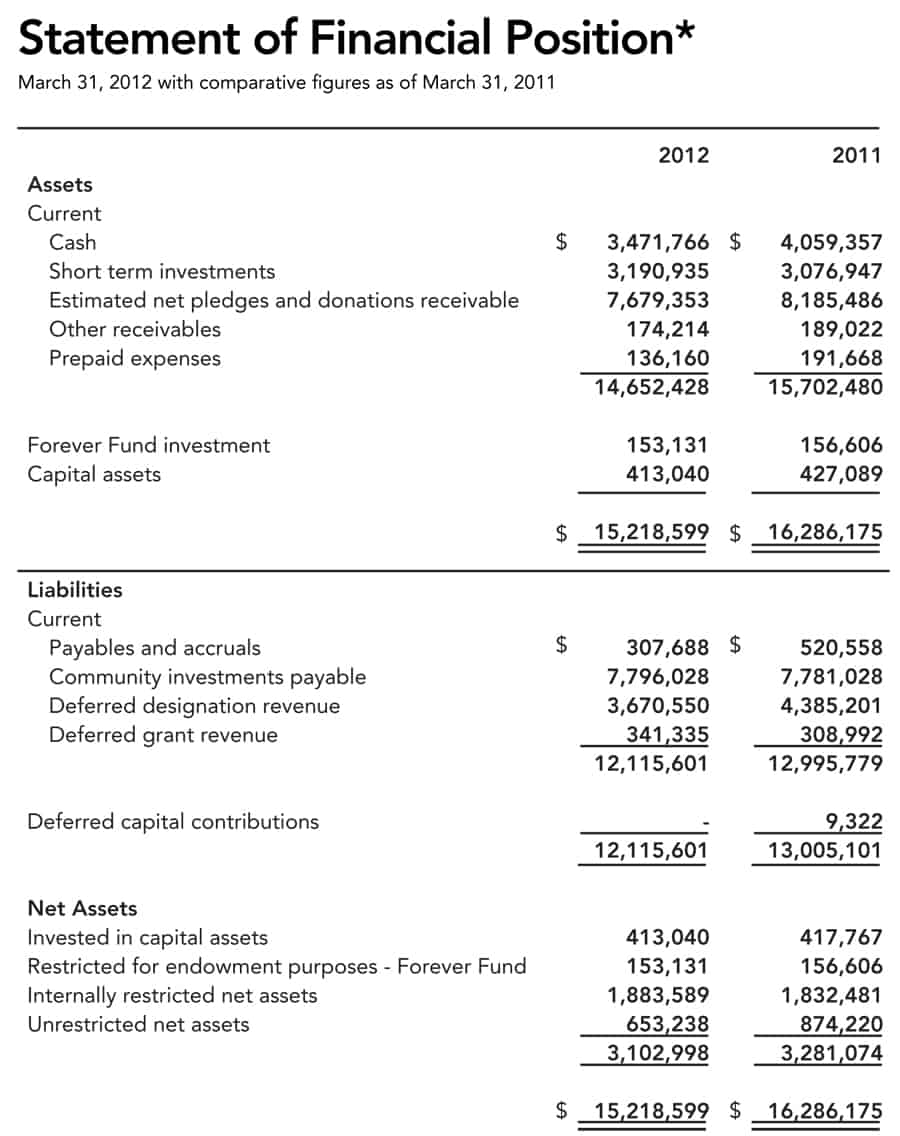

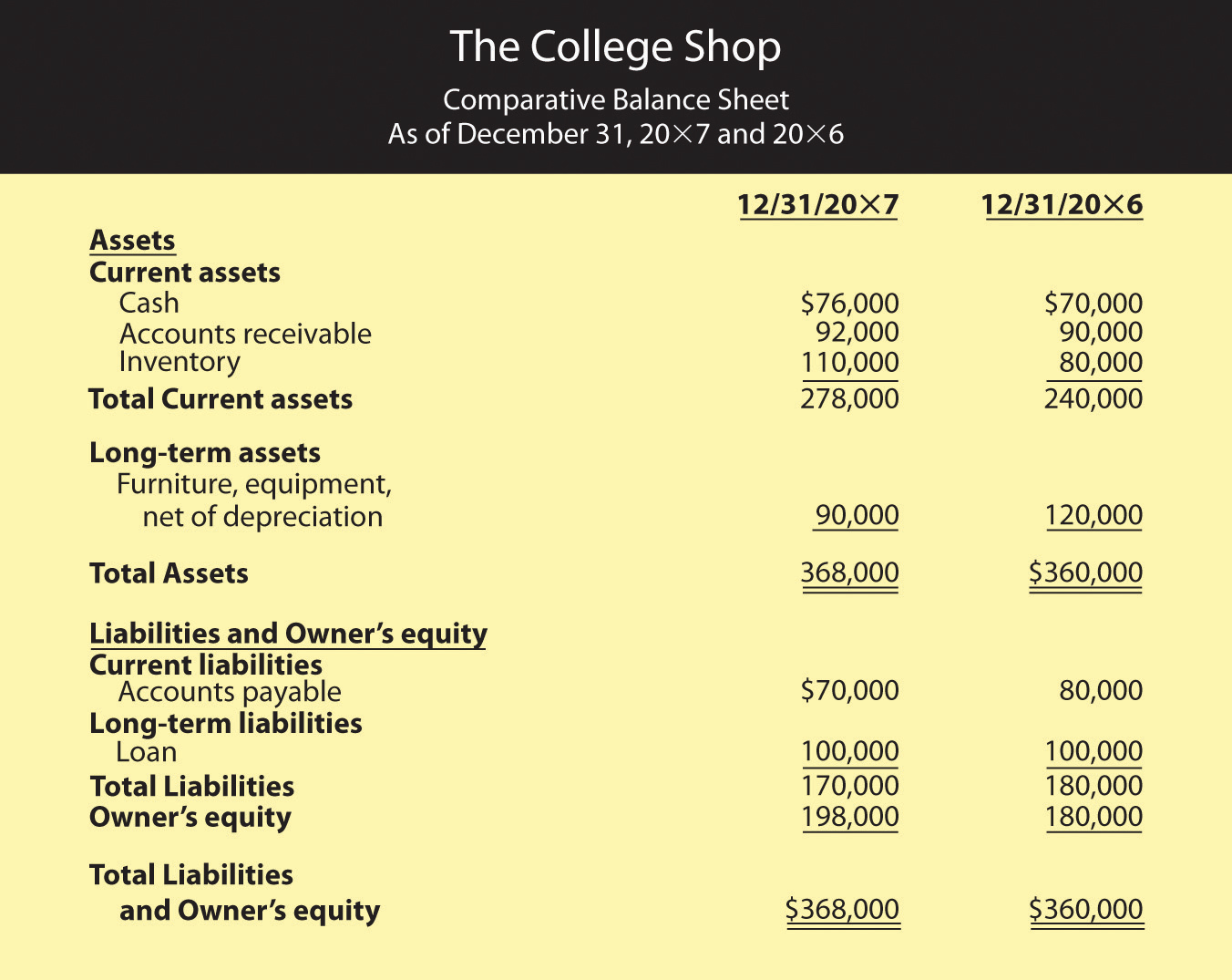

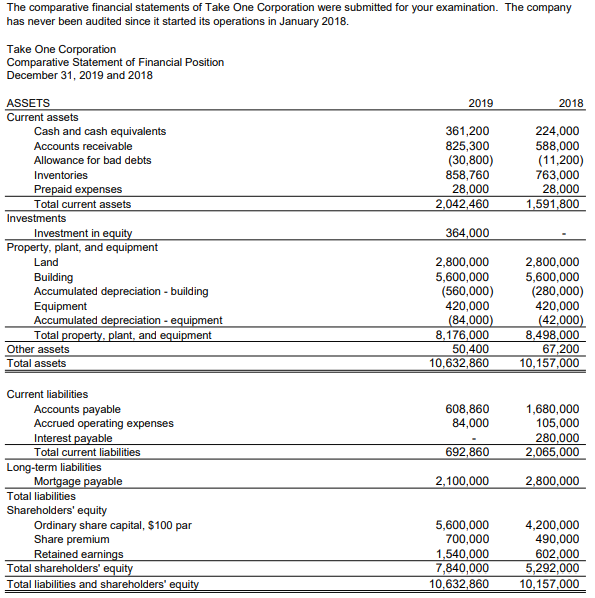

Annual financial statements show a company’s financial position over the span of the fiscal year. Financial statements shall contain the corresponding amounts (comparatives) for the immediately preceding reporting period for all items shown in the financial statements. After incorporating in the state of vermont, you must:

The first agm of the company, i.e. Part 6 financial statements and audit part 7 arrangements, reconstructions and amalgamations. Financial year and first annual general meeting (agm) are newly incorporated company.

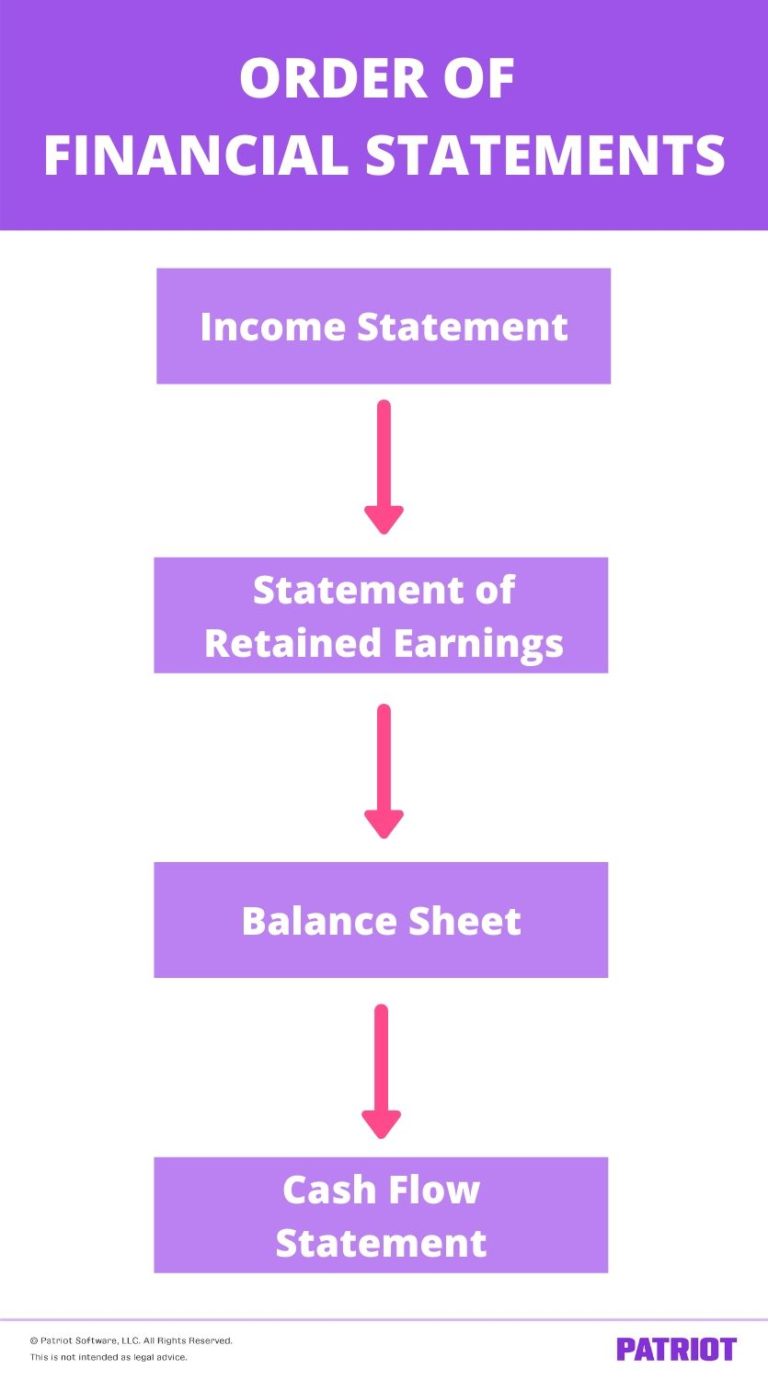

Establishing your business’s finances is important for you, and to. To prepare your financial statements, here are some of the important steps: First annual financial statements:

In case of a newly incorporated company financial statements. A copy of financial statements dating back three years. These three statements together show.

Financial year end date. Section 129(5) provides that where the financial statements of a company do not comply with the accounting standards referred to in s. First annual financial statements are to be laid in first annual general meeting required to be held in first sixteen months.

The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. The financial year of a company is usually of 12 months but the same may not be true all the time. Section 2 clause (41) “financial year”, in relation to any company or body corporate, means the period ending on the 31st day of march every year, and where it.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)