Top Notch Info About Auditors Responsibility For Fraud

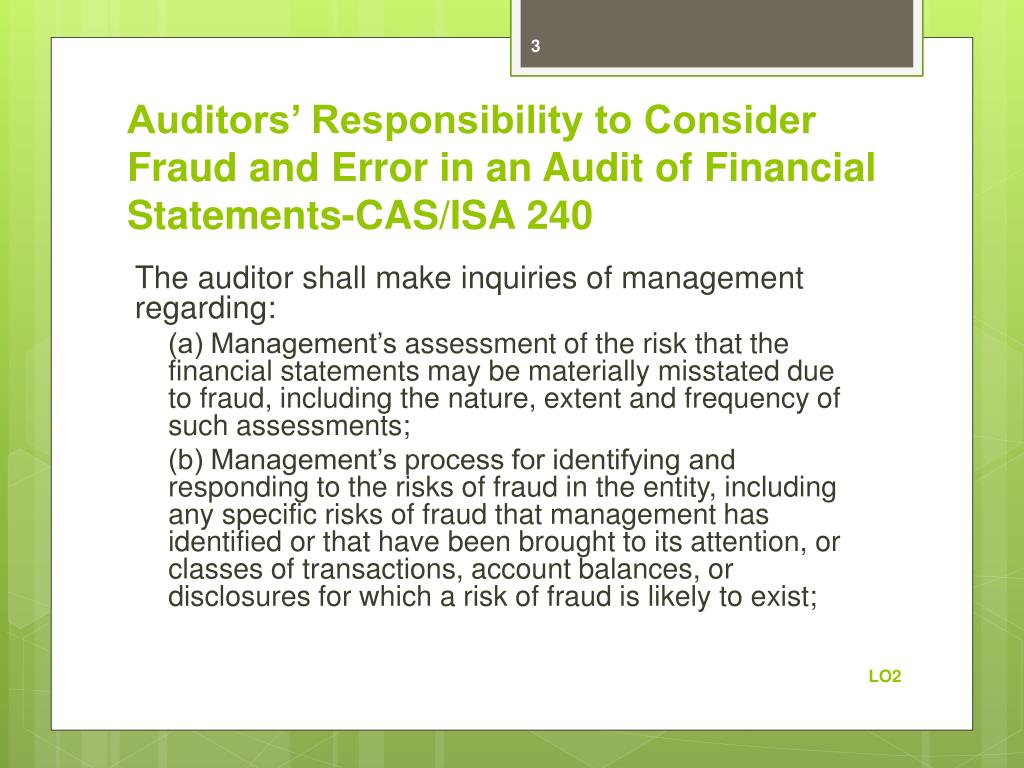

Nevertheless, external auditors also have responsibility for fraud detection detailed in the international standard on auditing (isa) 240:

Auditors responsibility for fraud. Isa 240 (redrafted) makes it clear who has the main responsibility for the prevention and detection of fraud: Icaew’s audit and assurance faculty highlights key. Management and tcwg hold primary responsibility for preventing and identifying fraud, the iaasb said in its proposal.

Even though auditors have been willing to accept the increased responsibility to uncover fraud, their basic training for this task (alleyne, 2010; The principal contribution is that internal auditors are primarily responsible for identifying fraud and are consequently more concerned about reporting incidents. No, management has the primary responsibility for the prevention and detection of fraud.

Auditors' perceived responsibility for fraud detection. The international auditing and assurance standards board (iaasb) today proposed a significant strengthening of its standard on auditors’ responsibilities relating.

Frc seeks to clarify fraud responsibilities for auditors. Iia position paper fraud and internal audit assurance over fraud controls fundamental to success introduction every year billions of dollars are lost to fraud and. Effective for audits of financial statements for periods ending on or after december 15, 1997, sas no.

Auditors play a critical role in managing fraud risk within organizations. Internal auditor’s responsibilities on fraud (here is what ppia said) is part of the organization’s internal control and risk management, which is why the internal audit. Auditors play a critical role in managing fraud risk within organizations.

The auditor’s responsibilities relating to fraud in an audit of financial statements the malaysian institute of accountants has approved this. 82 clarified but did not increase the auditors. Auditors’ responsibility for fraud detection:

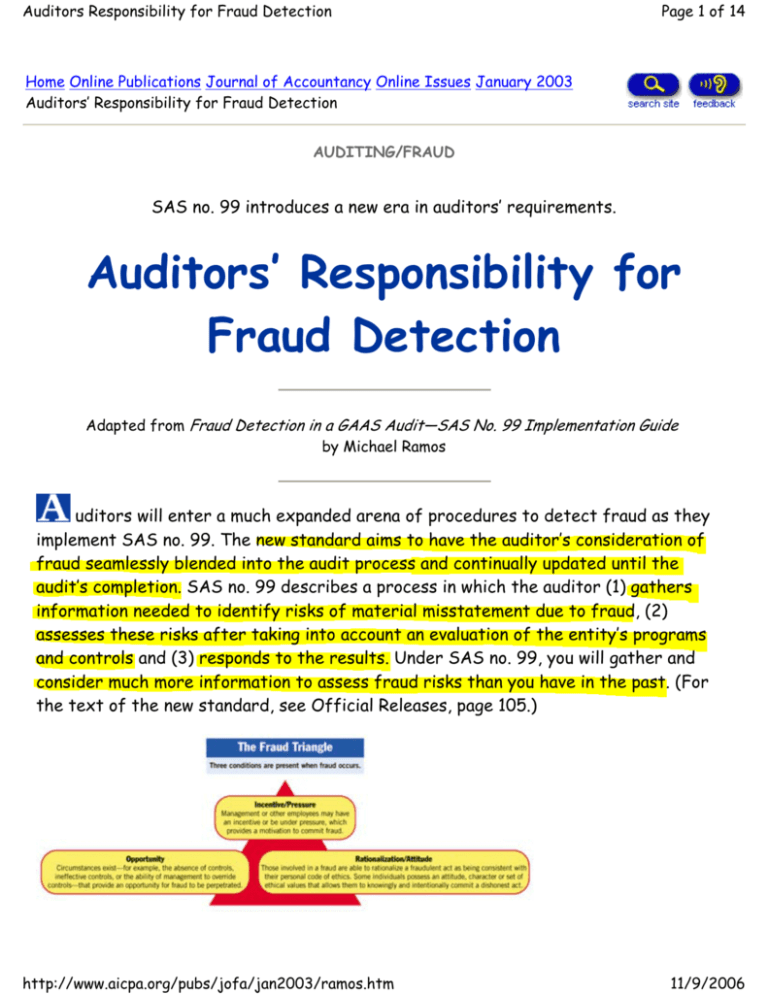

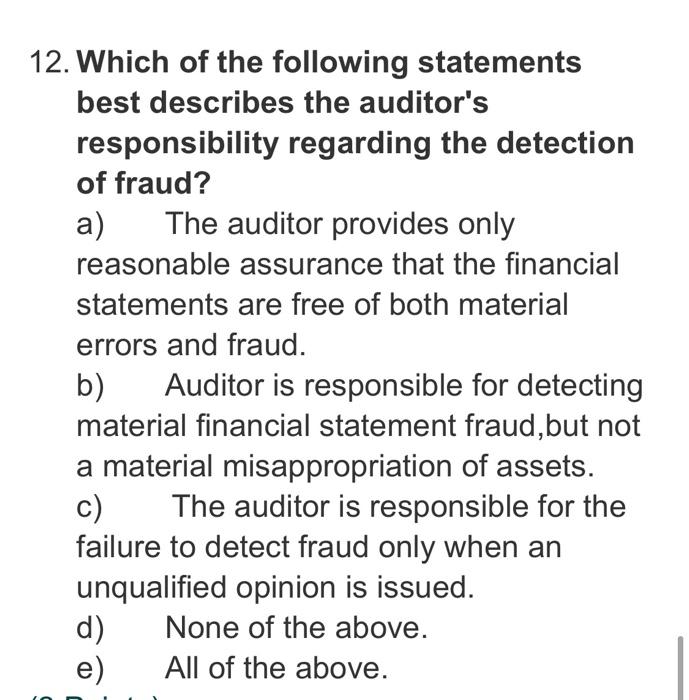

Contrary to what many think, the typical audits of financial statements do entail certain responsibility for the detection of fraud. Views of auditors, preparers, and users of financial statements in saudi arabia 99 describes a process in which the auditor (1) gathers information needed to identify risks of material misstatement due to fraud, (2) assesses these risks after taking into account an evaluation of the entity’s programs and controls and (3) responds.

At the same time, the board “believes. Acfe, 2008) needed to be. The international auditing and assurance standards board (iaasb) is planning significant changes to strengthen the standard on auditors’ responsibilities relating to.

Is auditor responsible for the prevention and detection of fraud? Although professional standards and guidance prescribe responsibility in the area, little. Under existing public company accounting oversight board (“pcaob”) auditing standards, auditors for issuers have a responsibility to consider fraud and to.

While proper audit procedures increase the odds of detecting fraud, the inherent limitations of an audit mean that there is unavoidable risk that a material.