Underrated Ideas Of Info About Which Item Shows A Debit Balance In The Trial

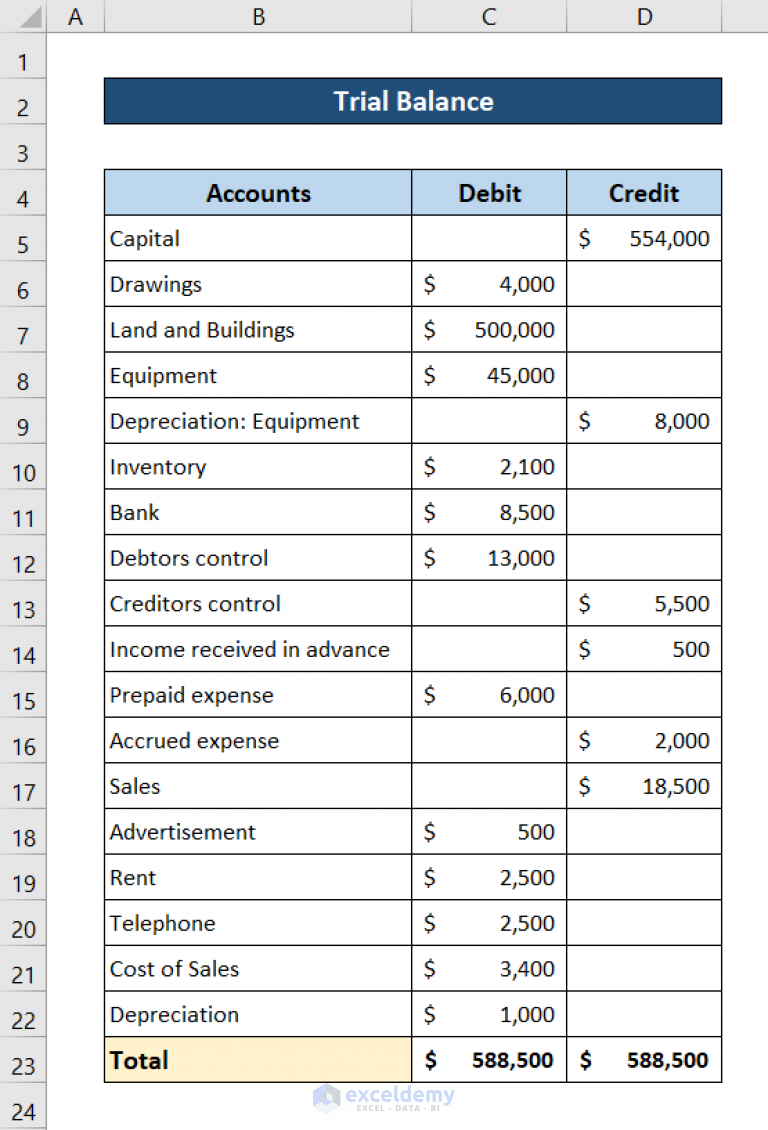

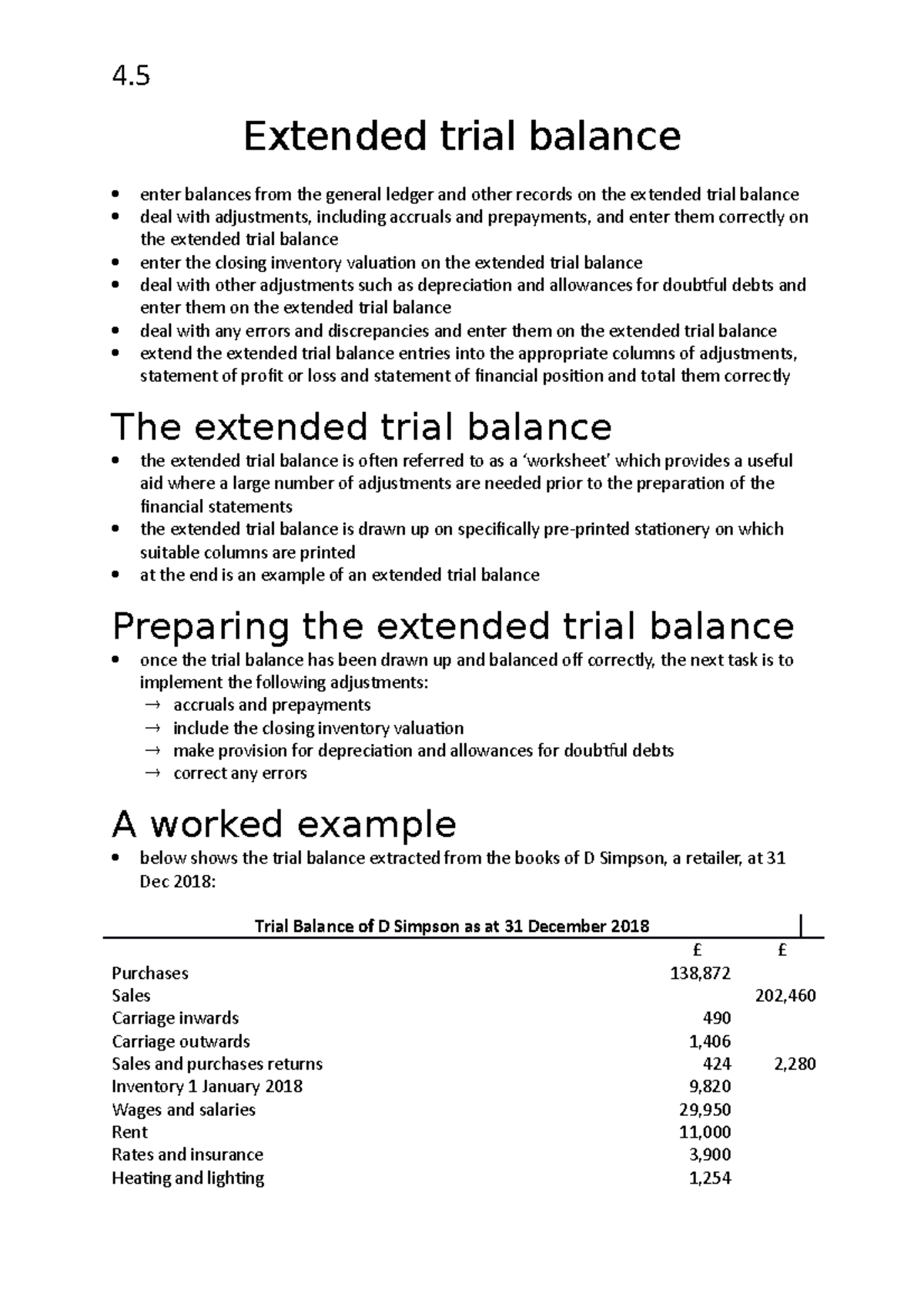

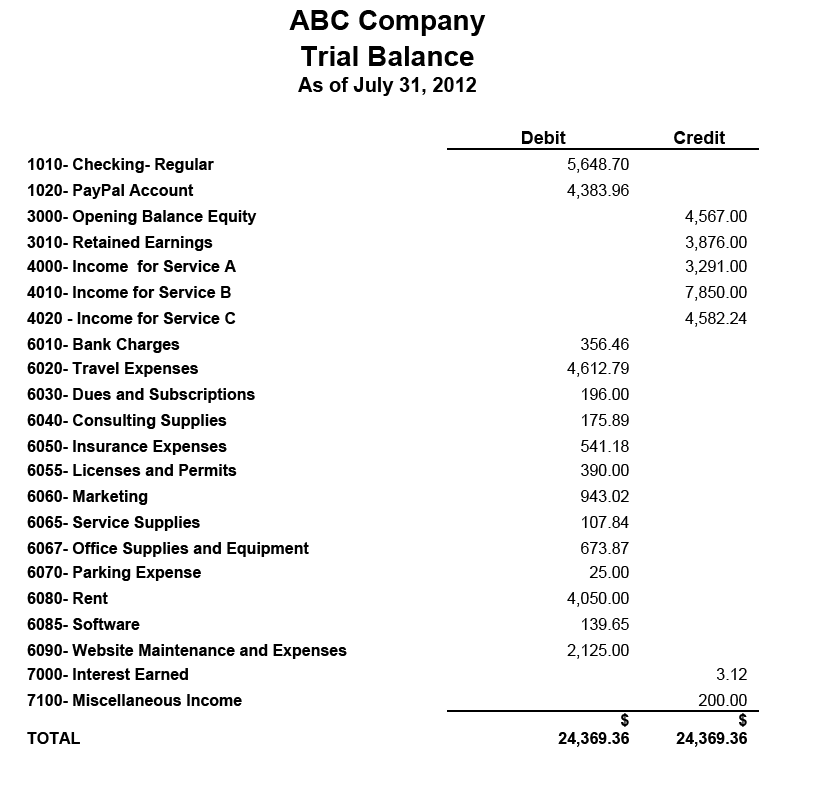

A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that debits equal credits in the recording process.

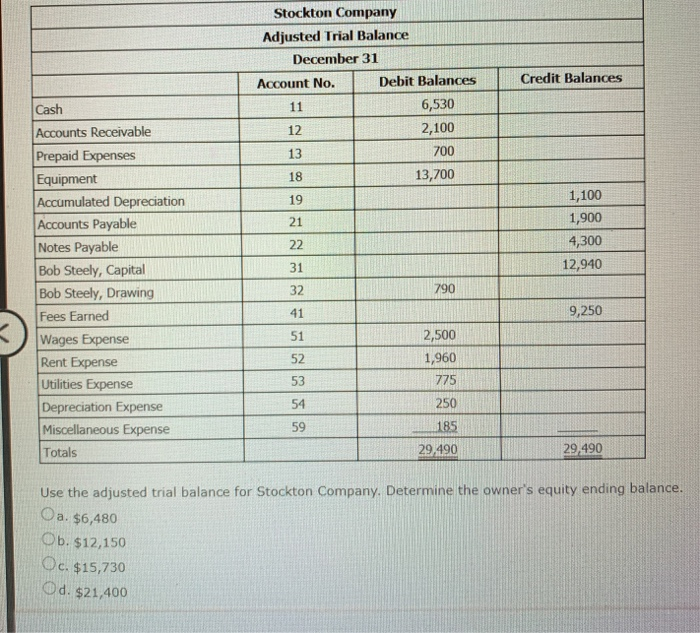

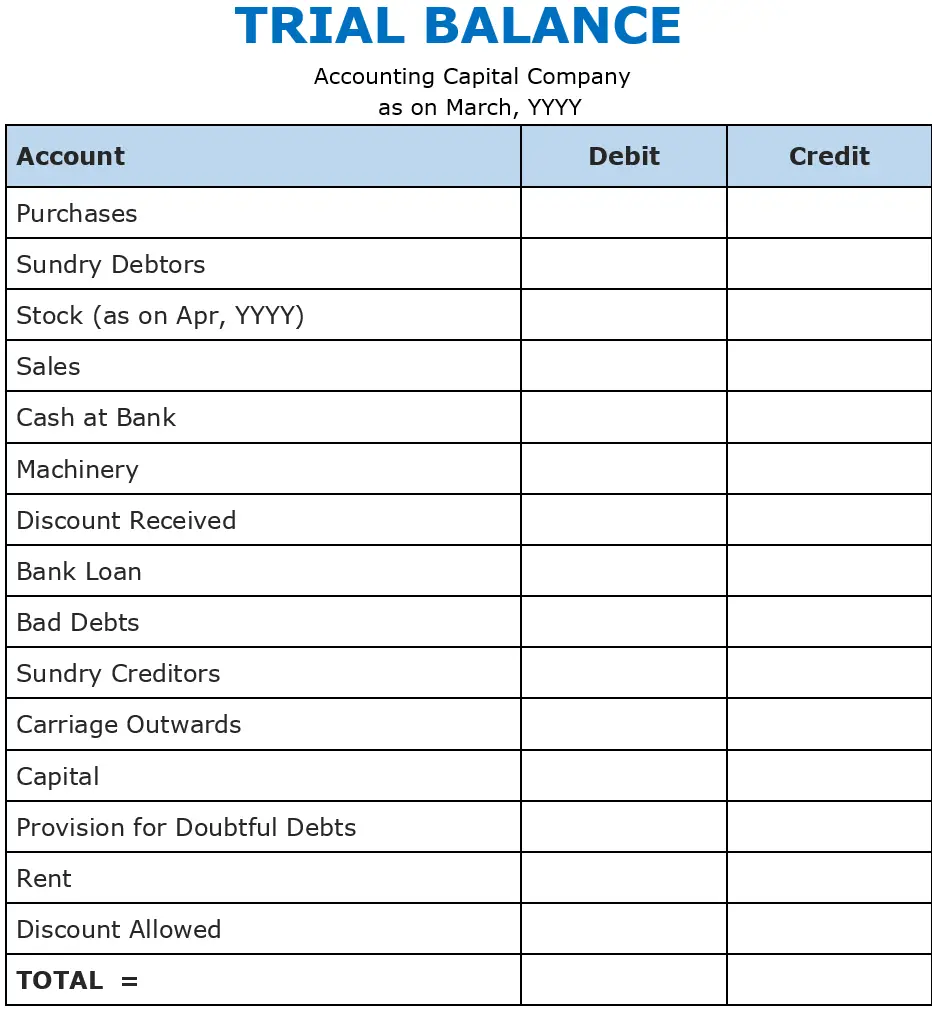

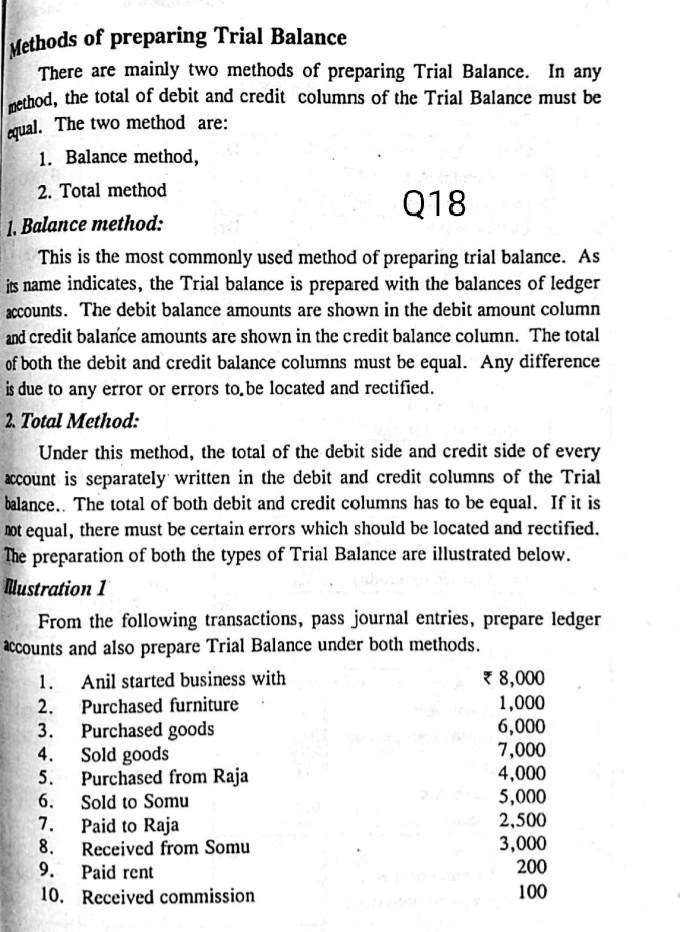

Which item shows a debit balance in the trial balance. The trial balance report lists all balance sheet and income statement summary accounts with account numbers and. A trial balance is not the same as a balance sheet. A trial balance is a conglomerate of or list of debit and credit balances extracted from various accounts in the ledger including cash and bank balances from.

This means that it states the total for each asset, liability, equity,. D excess of income over expenses. Which item is shown on the debit side of a trial balance?

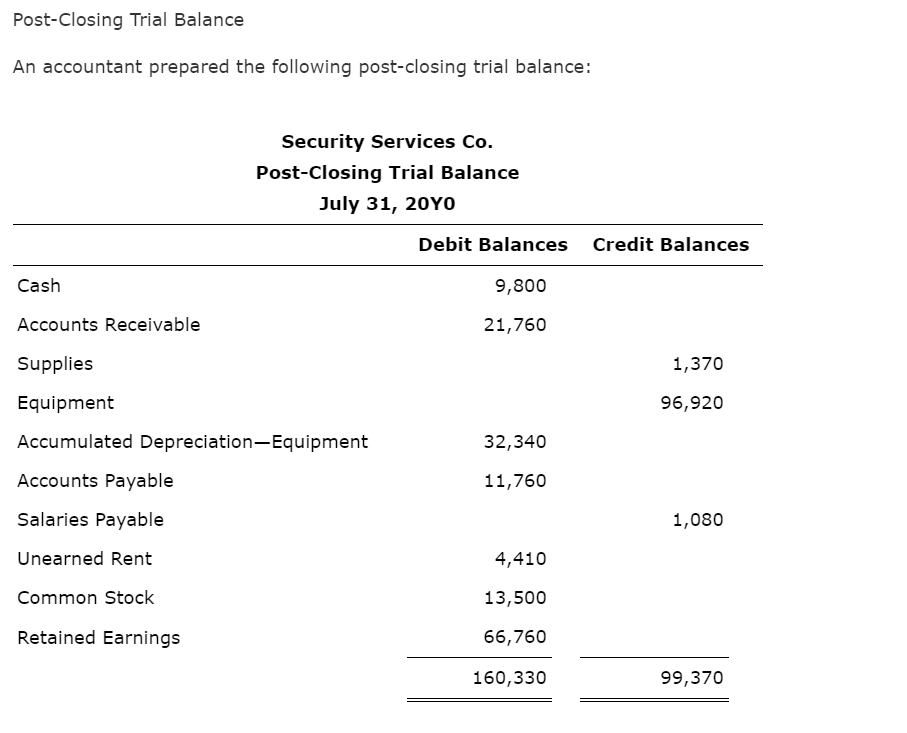

This statement comprises two columns:. Which item shows a debit balance in the trial balance ? The trial balance is recorded under debit and credit columns, while a balance sheet ideally displays total assets, liabilities, and stockholders' equity.

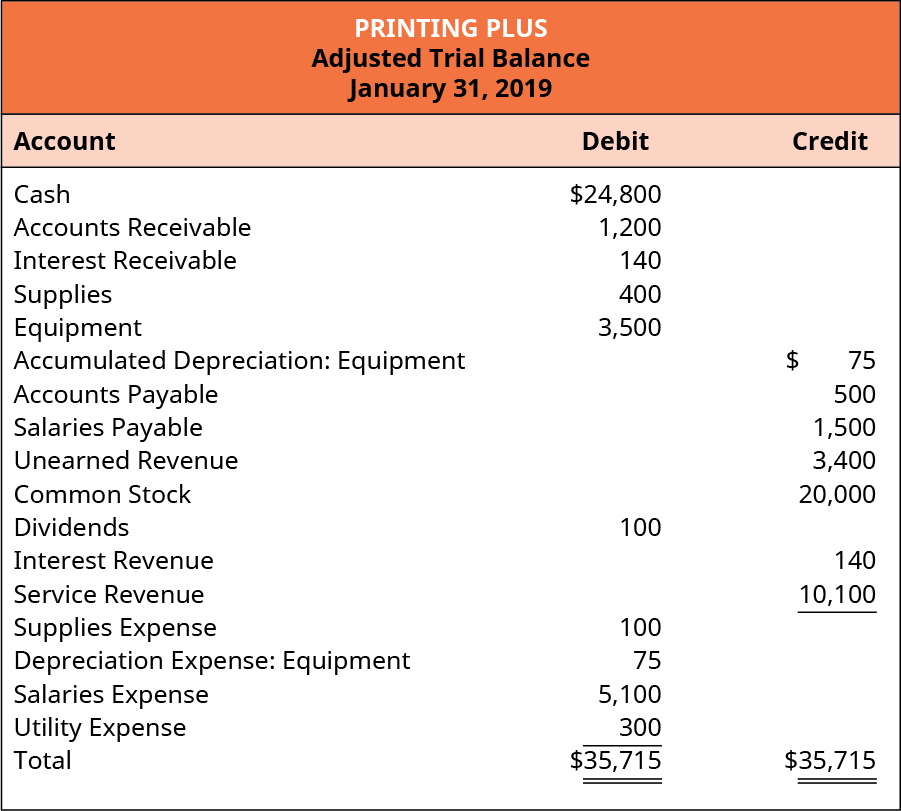

The trial balance is a list of all the accounts a company uses with the balances in debit and credit columns. Interest receivable did not exist in the trial balance information, so the balance in the adjustment column of $140 is transferred over to the adjusted trial balance column. The trial balance is a summation of or list of credit and debit balances drawn from the many ledger accounts like the bank balance, cash book etc.

The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains, and losses. The trial balance is an accounting report that lists the ending balance in each general ledger account. In other words, a trial balance shows a summary of how much cash, accounts receivable, supplies, and all other accounts the company has after the posting.

The trial balance report lists all balance sheet and income statement summary accounts with account numbers and. Accounting articles trial balance trial balance a vital auditing technique used to ensure whether the total debit equals the total credit in the general ledger. Items that appear on the debit side of the trial balance generally, assets and expenses have a positive balance so they are placed on the debit side of the trial balance.

If we go back and look at the trial balance for printing plus, we see that the trial balance shows debits and credits equal to $34,000. Accounts receivable ($1,200), supplies ($500), equipment ($3,500), dividends ($100), salaries expense ($3,600), and utility expense ($300) also have debit final balances in. An asset and expense increases when it is debited and vice versa

Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. There are three types of trial balances:

![[Solved] Complete the Adjusted Trial Balance as of SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2022/08/6308c2ad12be1_5086308c2acbfd1b.jpg)