Build A Info About Sba Financial Statement How To Put Together A Balance Sheet

Then, write your income statement.

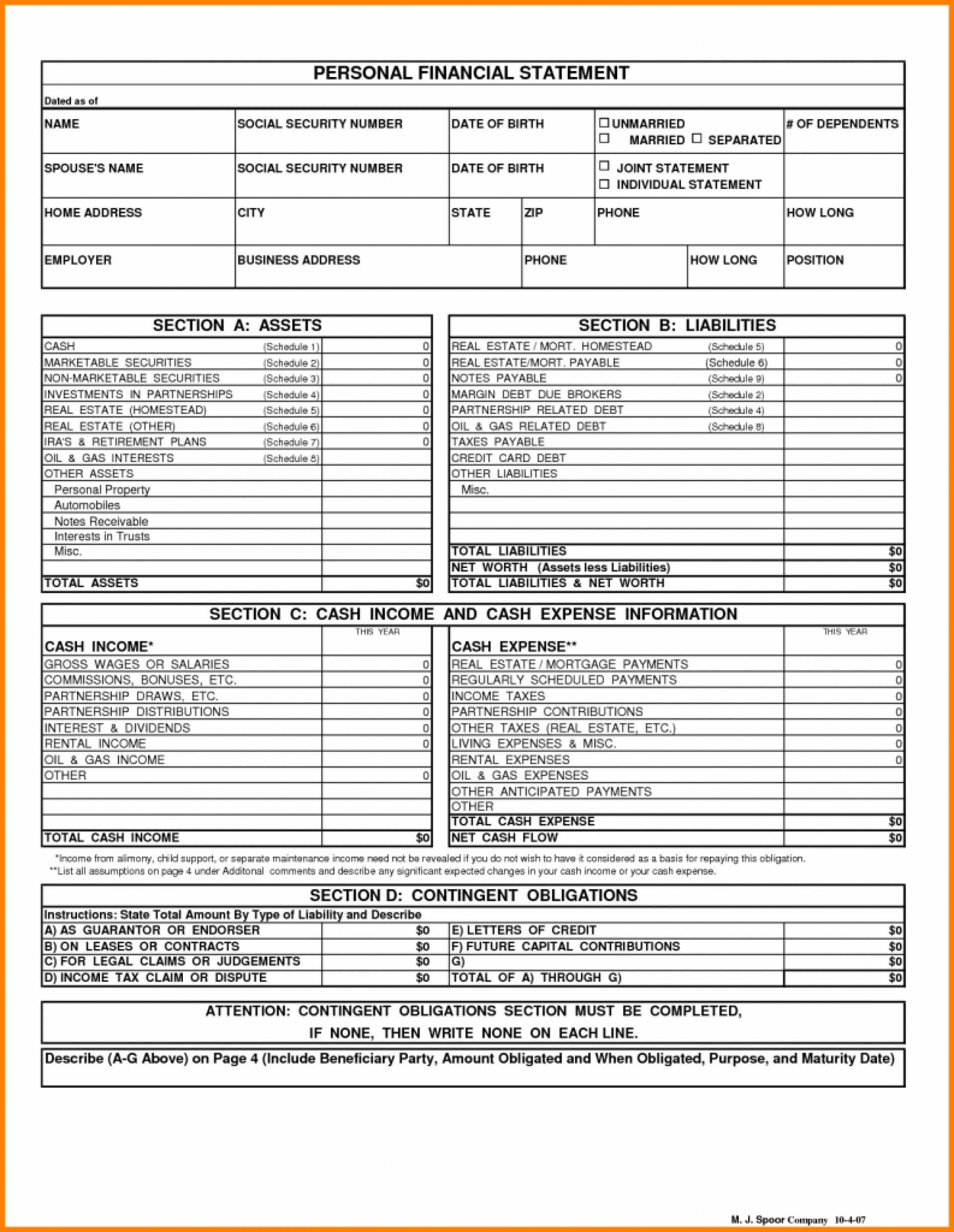

Sba financial statement how to put together a balance sheet. Part 1 setting up your balance sheet download article 1 use the basic accounting equation to make a balance sheets. The balance sheet is easier to prepare than you might think. A blank piece of paper or a new file in your favorite spreadsheet.

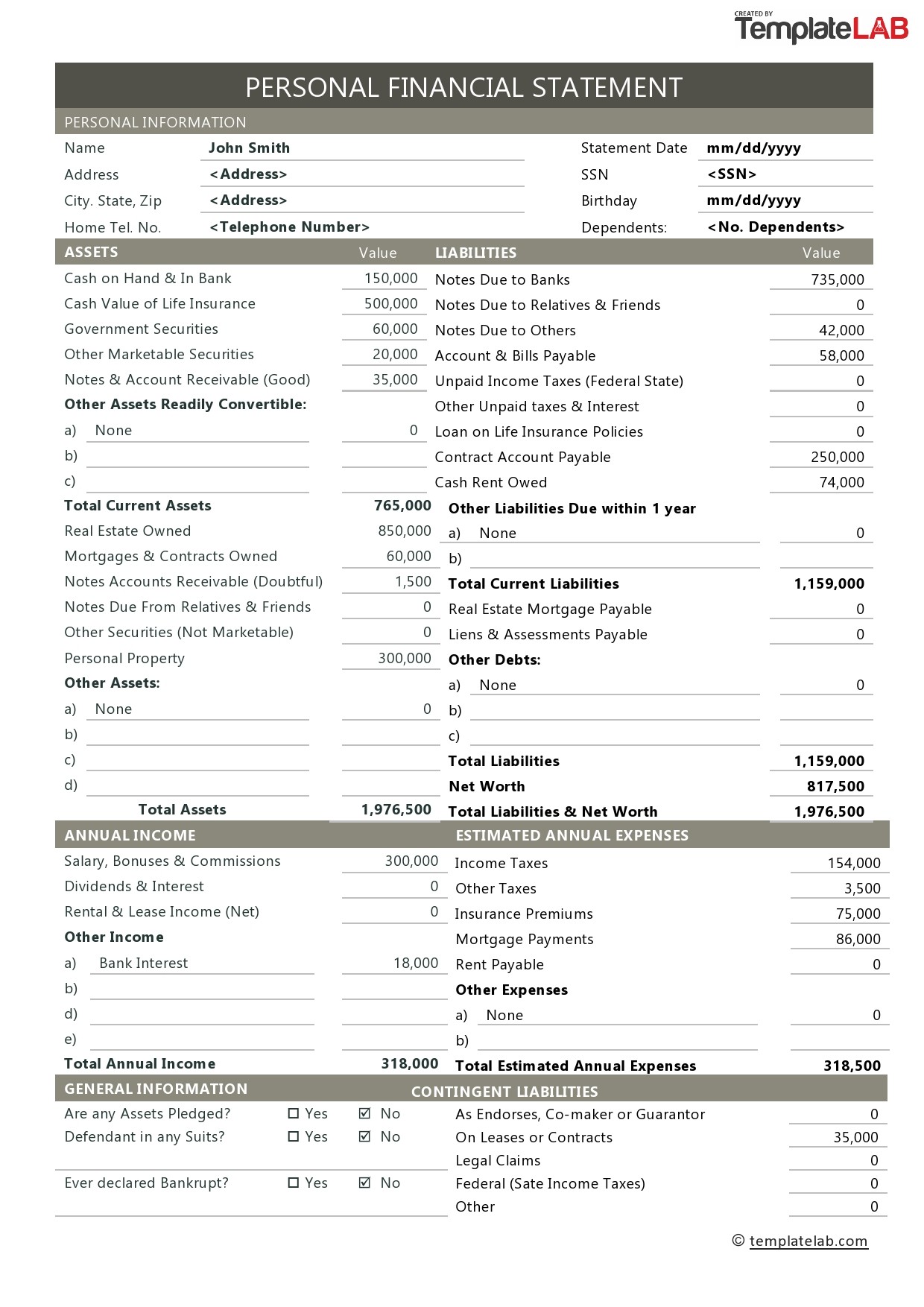

This is assets = liabilities + owner's. The accounting equation format is the basis for the layout of a balance sheet: The 5 simple steps are given below for further clarification.

What you need to make a balance sheet. To make a balance sheet, you’ll need the following: A balance sheet is a financial statement that lists a company’s assets, liabilities and owner's equity to provide an overview of the business’ financials at a.

The amounts on each side of the balance sheet. The balance sheet is one of the three core financial. All four statements are as follows:.

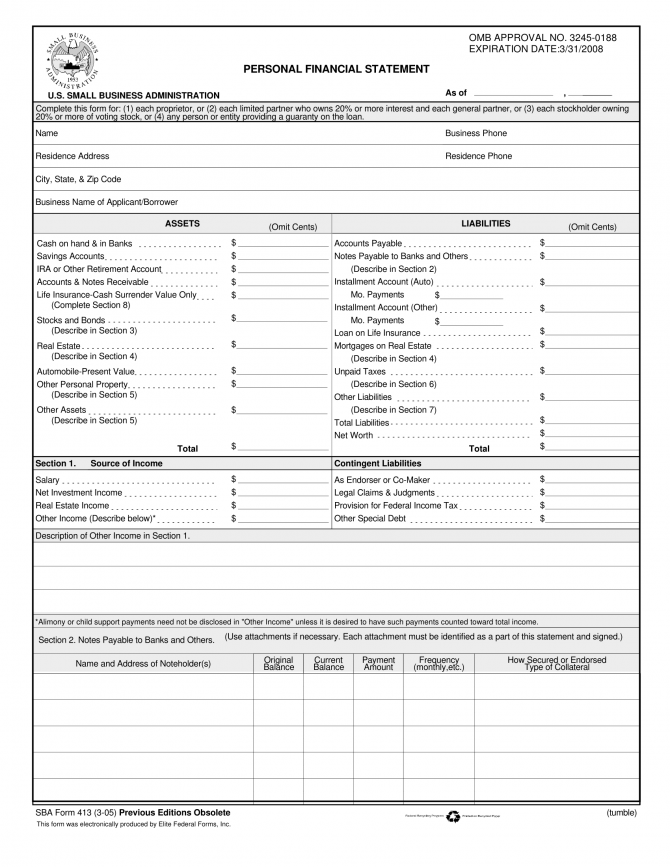

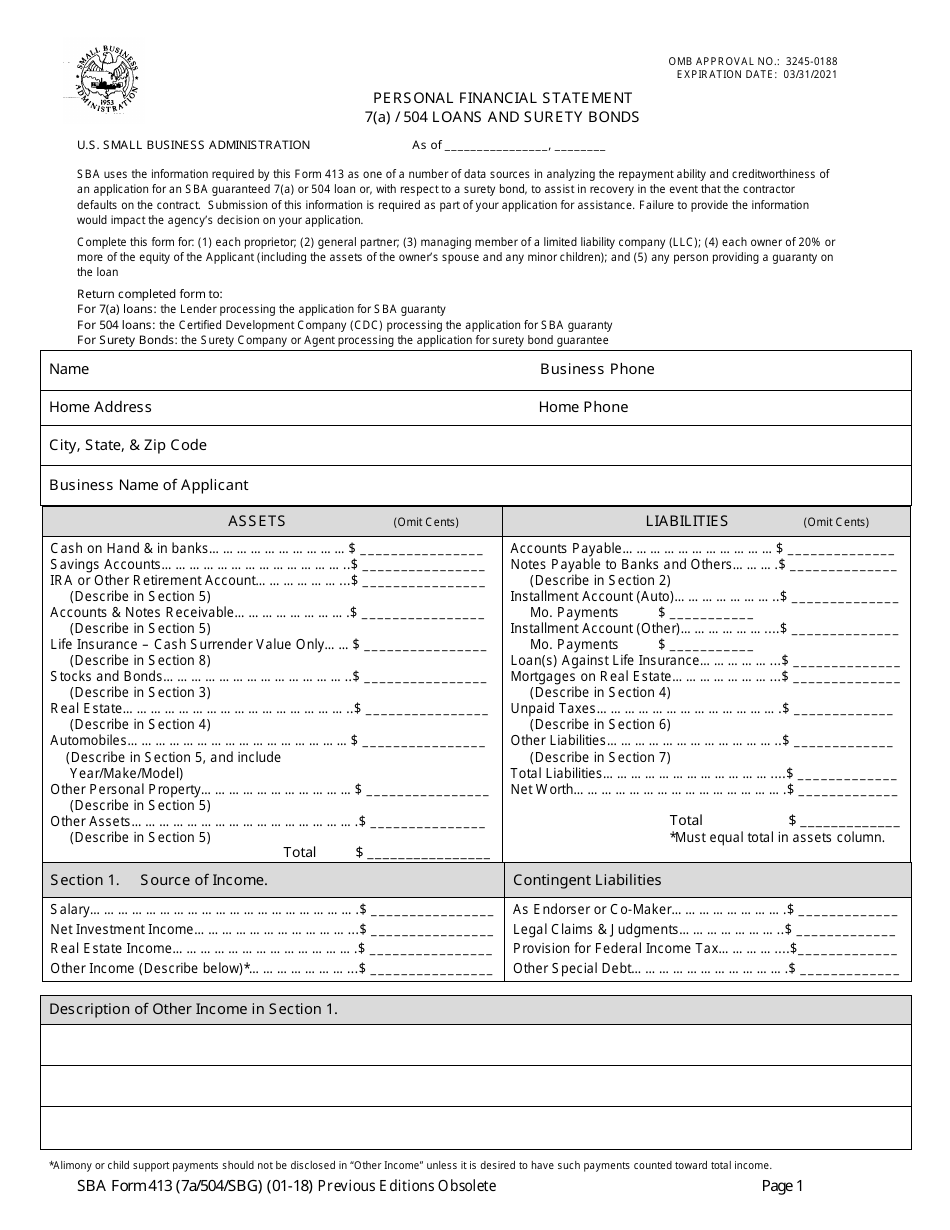

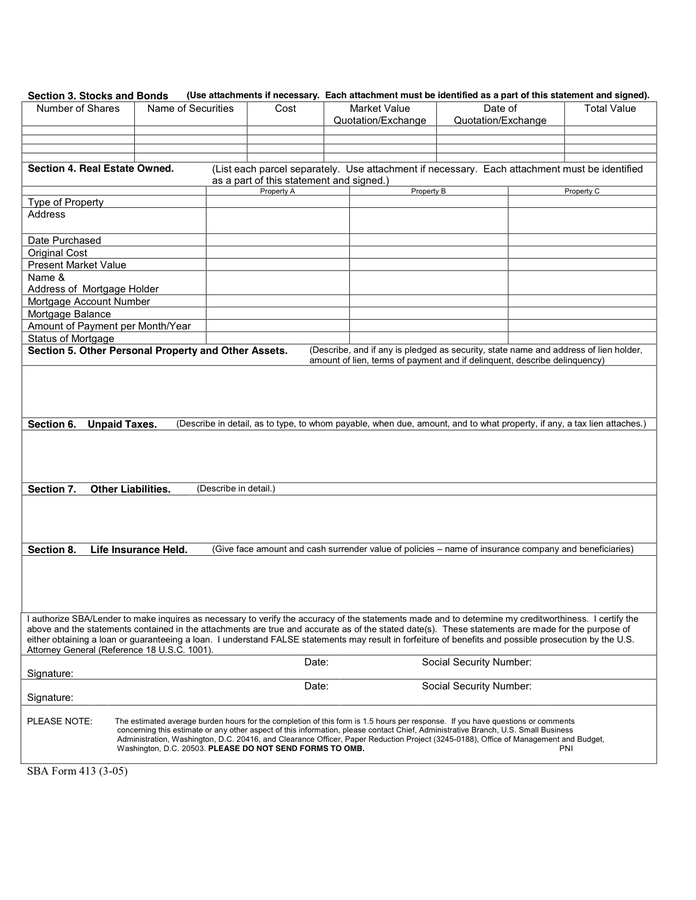

This form is used to assess repayment ability. Key takeaways what is a balance sheet? The goal of a balance sheet is to make sure that your company’s assets are equal to the combination of your liabilities and owners’ equity, i.e., assets = liabilities + equity (net.

Published september 03, 2020 the balance sheet is one of the three most important financial statements for business owners, and includes assets, liabilities and. One of the four most important financial statements that a company produces is the balance sheet. Balance sheets include three sections:

To help you get started with your first balance sheet efficiently, we’ve put together a post on how to prepare a balance sheet. Before you can successfully start preparing a balance sheet, you’ll need to know how to read one. A balance sheet is one of the three common financial statements released by a business.

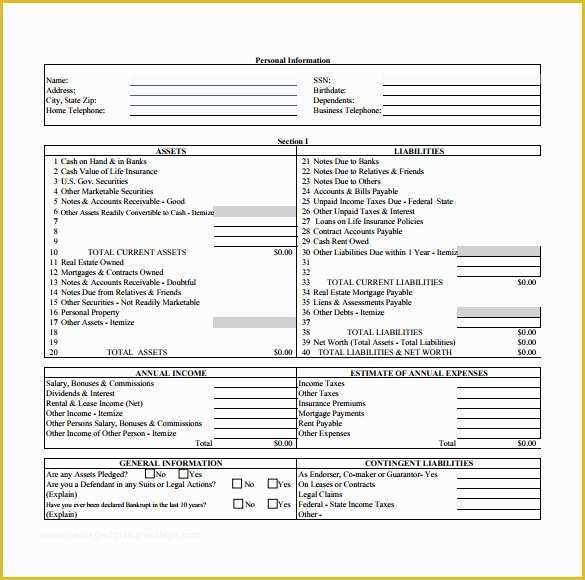

To write a financial statement, start by putting together a balance sheet with details such as your assets and liabilities. Assets are placed on the left side of the balance sheet, while liabilities and equity are placed on the right side. Assets, liabilities, and shareholders’ equity.

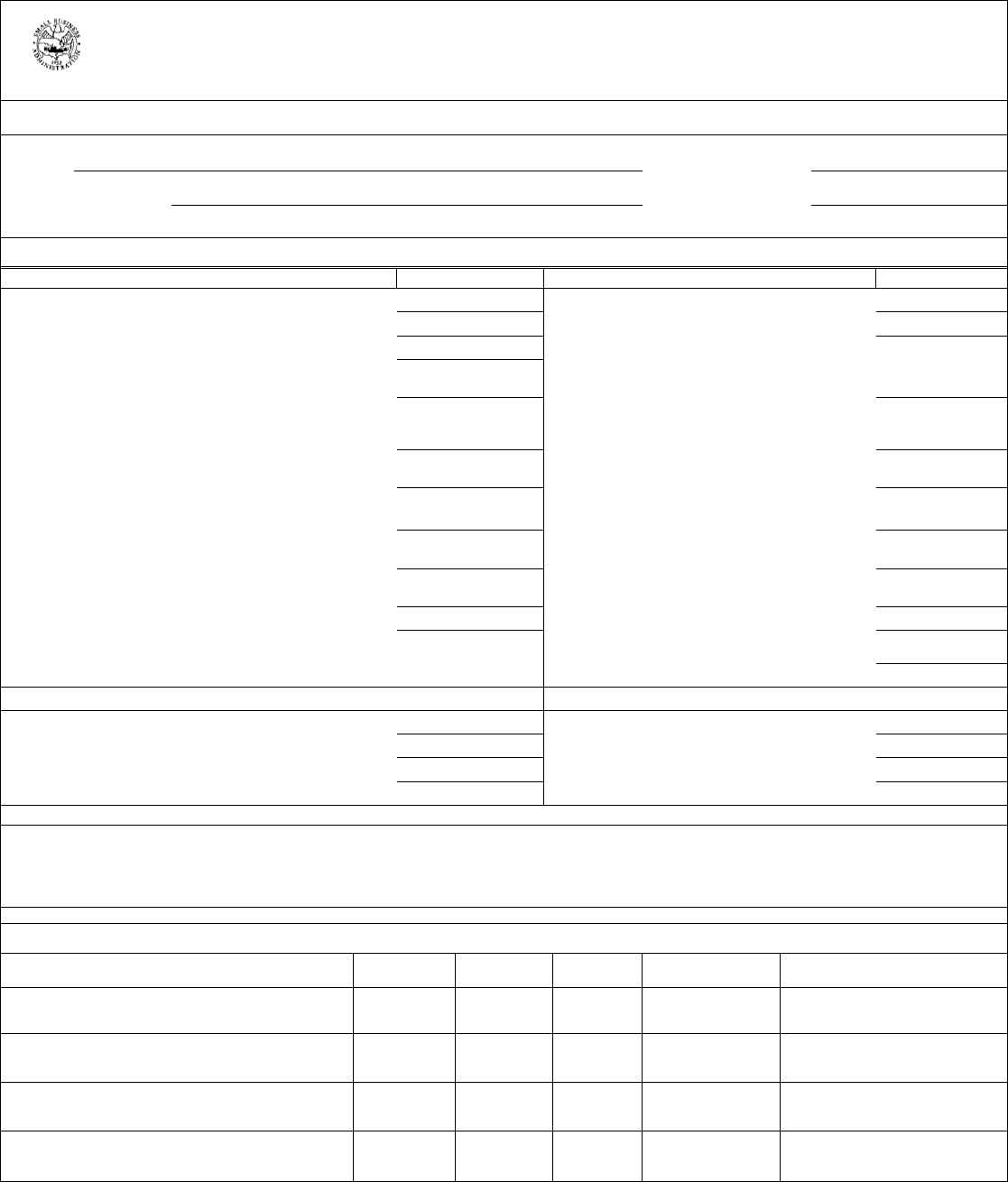

This is referred to as the accounting equation. We’ve also included definitions and. Include complete financial statements balance sheet income statement and reconciliation of net worth for the last three years plus a current interim financial statement not more.

Balance sheets start by listing your assets, followed by your liabilities. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.