Have A Tips About A Profit And Loss Account Is Prepared Format Of Balance Sheet

A profit and loss account (p&l) reports the true financial position of the business, i.e.

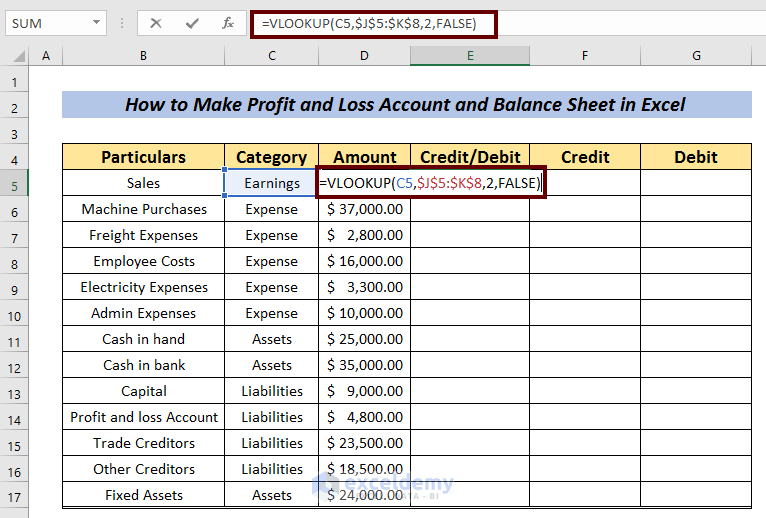

A profit and loss account is prepared format of balance sheet account. What is the difference between profit and loss account and balance sheet? To know the profits/losses earned/incurred by a business, statutory requirements. The profit and loss account.

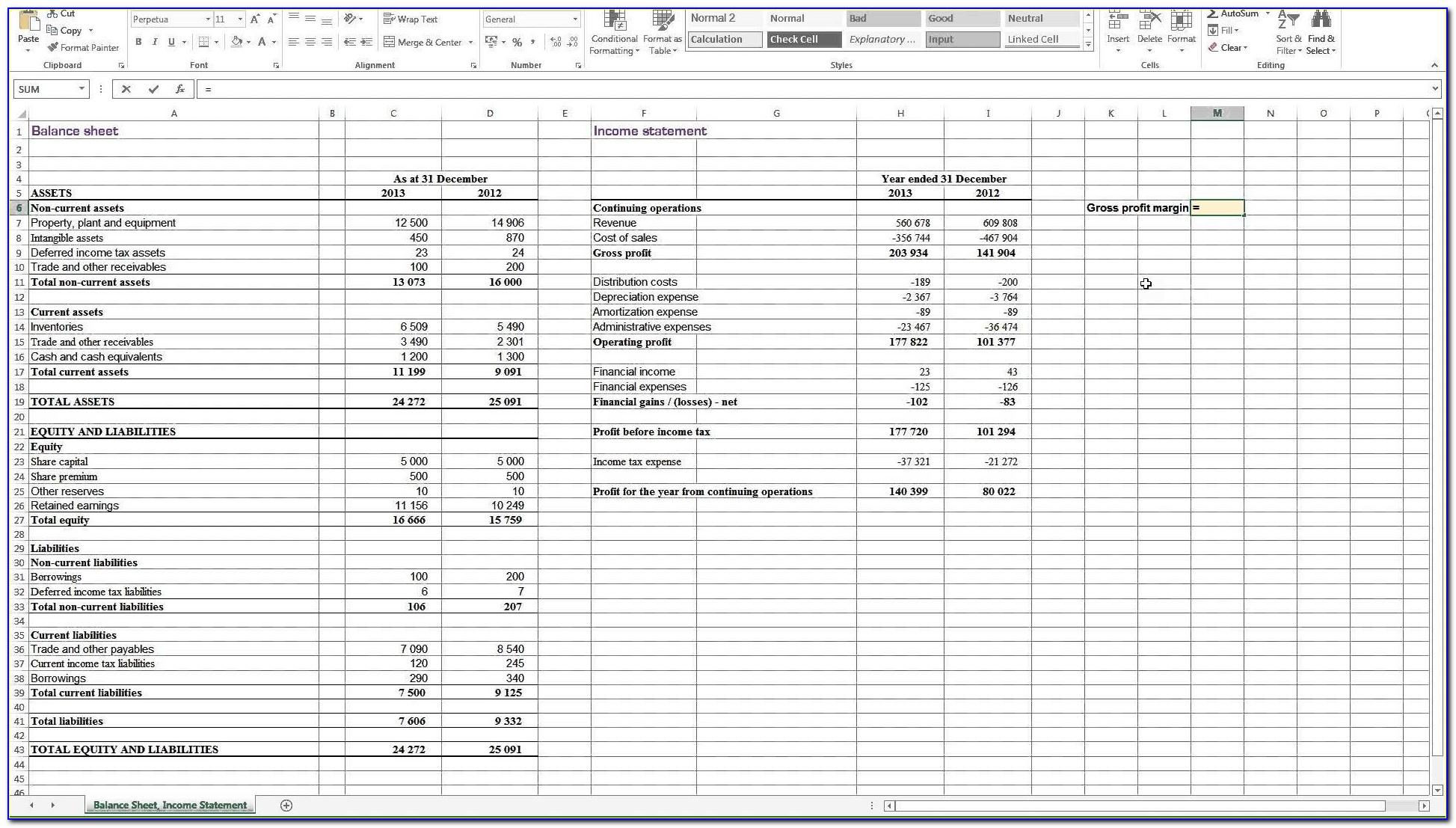

This account is the basis of the balance sheet. The profit and loss account is a depiction of the entity’s revenue and expenses. Relationship between income statement and balance sheet.

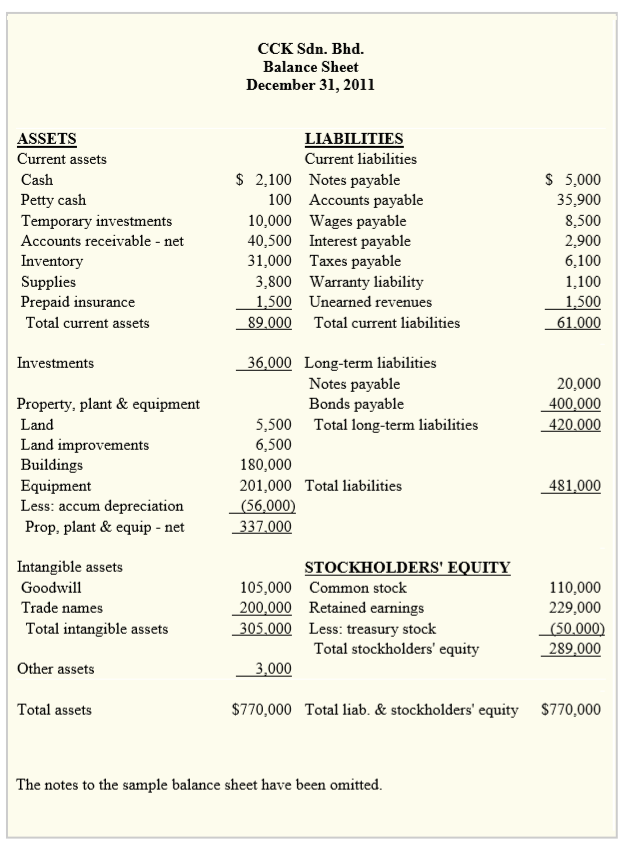

A profit and loss account is prepared to determine the net income(performance result) of an enterprise for the year/period. The balance sheet gives you a snapshot of how much your business owns (its assets) and how much it owes (its liabilities) as at a given point in. Cr expense account (i.e close the respective expense account) the following illustration will help demonstrate how to.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement,. Profit and loss accounts, balance sheets two of the most important financial statements for a business are the profit and loss account, and the balance sheet.

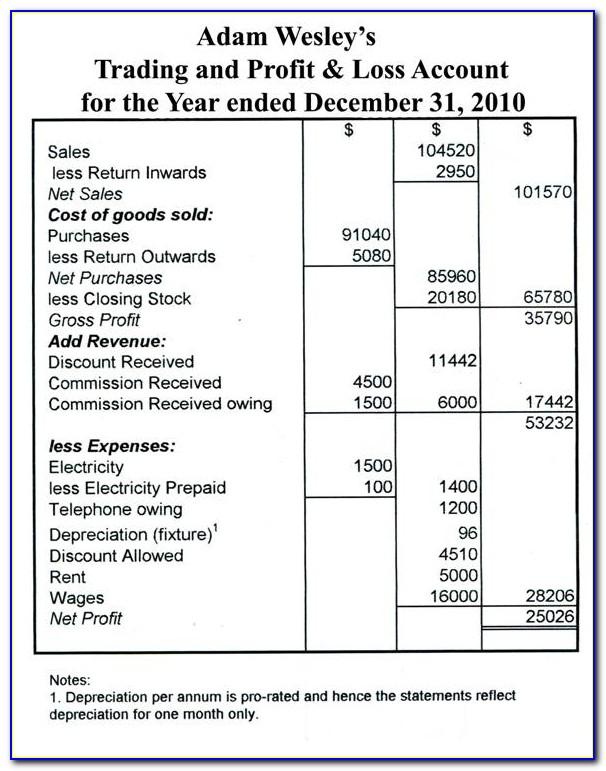

Balancing profit and loss account. Profit and loss account trading account is the first part of this account, and it is used to determine the gross profit that is earned by the business. Profit & loss statement/account is prepared for two main reasons.

A p&l statement provides information. Profit & loss account and balance sheet objectives this chapter will enable the business owner to develop an understanding of: Every company prepares a profit and loss account statement at the end of the year generally, to get the visibility of the income,.

So, in the absence of a profit and. A balance sheet is prepared on the last day of a financial year while the profit and loss account is maintained for the whole accounting period. A balance sheet gives an overview of the assets, equity, and liabilities of the company, but the profit and loss account is a depiction of the entity’s revenue and expenses.

Dr trading account or profit & loss account. This is the most significant information to be reported for decision making. Balance sheet is prepared after creating the p & l account.

The profit and loss account reflects the financial performance of the company by analysing the overall. Once the balances of all the accounts have been transferred from trial balance to p&l account, gross profit/loss transferred. The result of the profit and loss account was transferred to the balance sheet.

A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. The omission can be about interest on capital,. A profit and loss adjustment account format is prepared to record the transactions left while preparing the balance sheet.