Breathtaking Tips About Finance Lease In Cash Flow Statement

It is governed by standards such as asc 842 and.

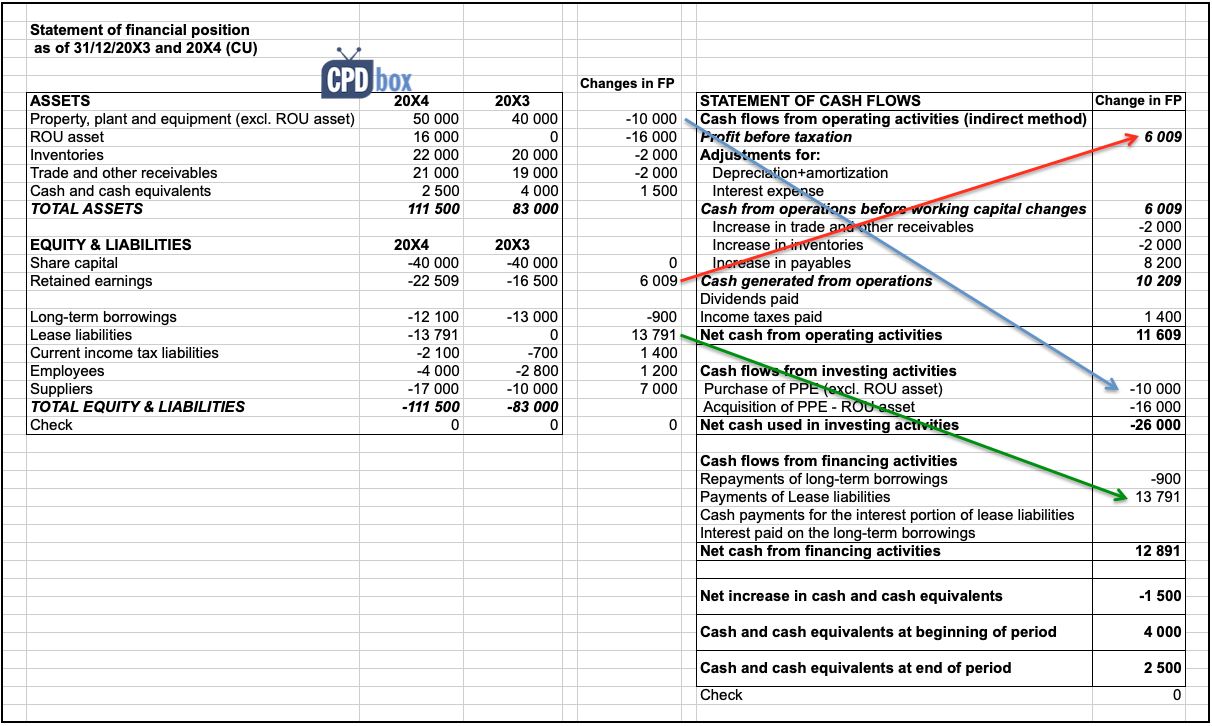

Finance lease in cash flow statement. Sfrs(i) 16/frs 116 leases no longer makes a distinction between operating and finance lease for a lessee and is effective for financial periods beginning 1 january 2019. Record the operating lease expense payment on the cash flow statement. For finance leases, cash payments for interest on the lease liability are treated the same way as those paid to other creditors and lenders.

The type of lease a lessee or lessor has will affect how it appears within the financial statement. The sum of the undiscounted cash flows for all years thereafter; In the statement of cash flows, lease payments are classified consistently with payments on other financial liabilities:

In the case of a finance lease, however, only the portion of the lease payment relating to interest expense potentially reduces operating cash flows, while the. How do you present a lease on a cash flow statement? Repayments of the principal portion of the lease liability, presented within.

And interest expenses, the cash flows statement will be impacted as well. Unlike the payment on a capital lease, an operating lease payment is not divided by principal and. The part of the lease payment that.

In the statement of cash flows, a lessee shall classify: Statement of cash flows the requirements for presenting cash outflows in the statement of cash flows are linked to the presentation of expenses arising from a lease. The undiscounted cash flows on an annual basis for a minimum of each of the next five years;

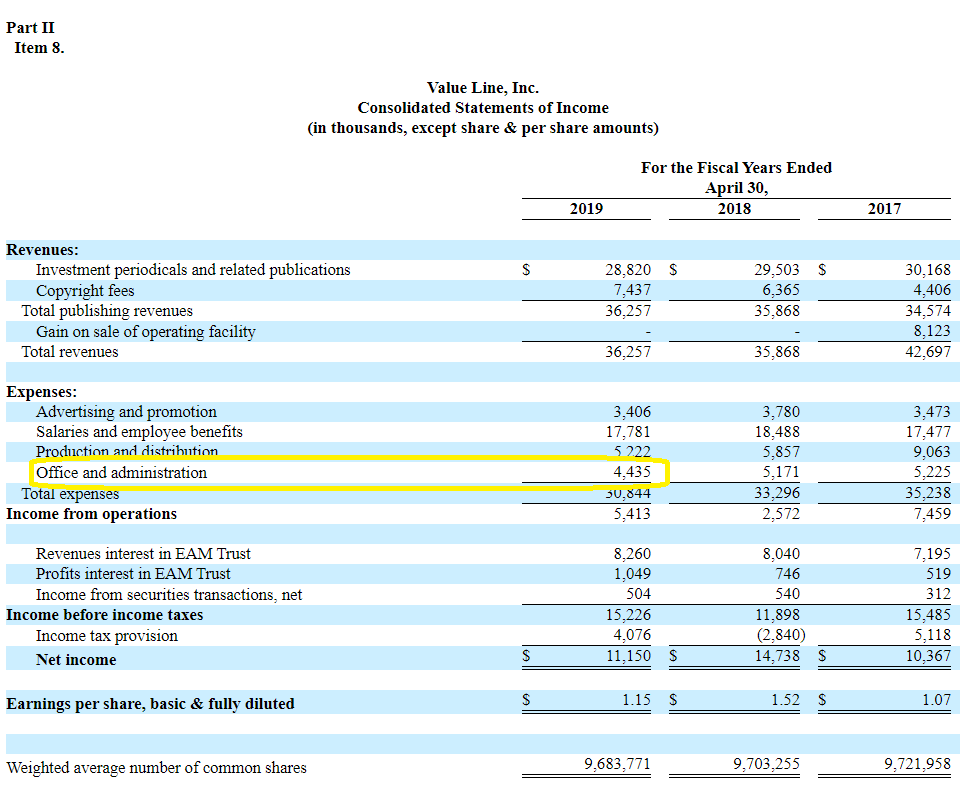

Lessors must classify all cash receipts from leases as operating activities in the statement of cash flows. The income statement, balance sheet, and statement of cash flows are required financial statements. In this report, we will cover the guidance in fasb asc 842 related to presentation in the balance sheet, income statement, and statement of cash flows.

As noted previously, the objective of the. (a) cash payments for the principal portion of the lease liability within financing activities (b) cash payments. Entities may need to change aspects of their financial statement.

A separate lease component exists if (a) the lessee can benefit from the underlying asset separate from other lease components and (b) the component is neither highly. A lessor is required to classify cash receipts from all lease payments, regardless of lease classification, as operating activities unless the. Leases at commencement are not presented on a cash flow statement;

Lessees and lessors also have slightly different reporting. The rental payments will be reported as repayment of principal and interest of the lease obligation. Key takeaways lease accounting involves reporting rental or financing agreements' financial impact on specific assets.

Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the financial statements along with the balance sheet line items in which those liabilities are included. These three statements are informative tools that traders can use to.