One Of The Best Tips About Car Rental Profit And Loss Statement

The single step profit and loss statement formula is:

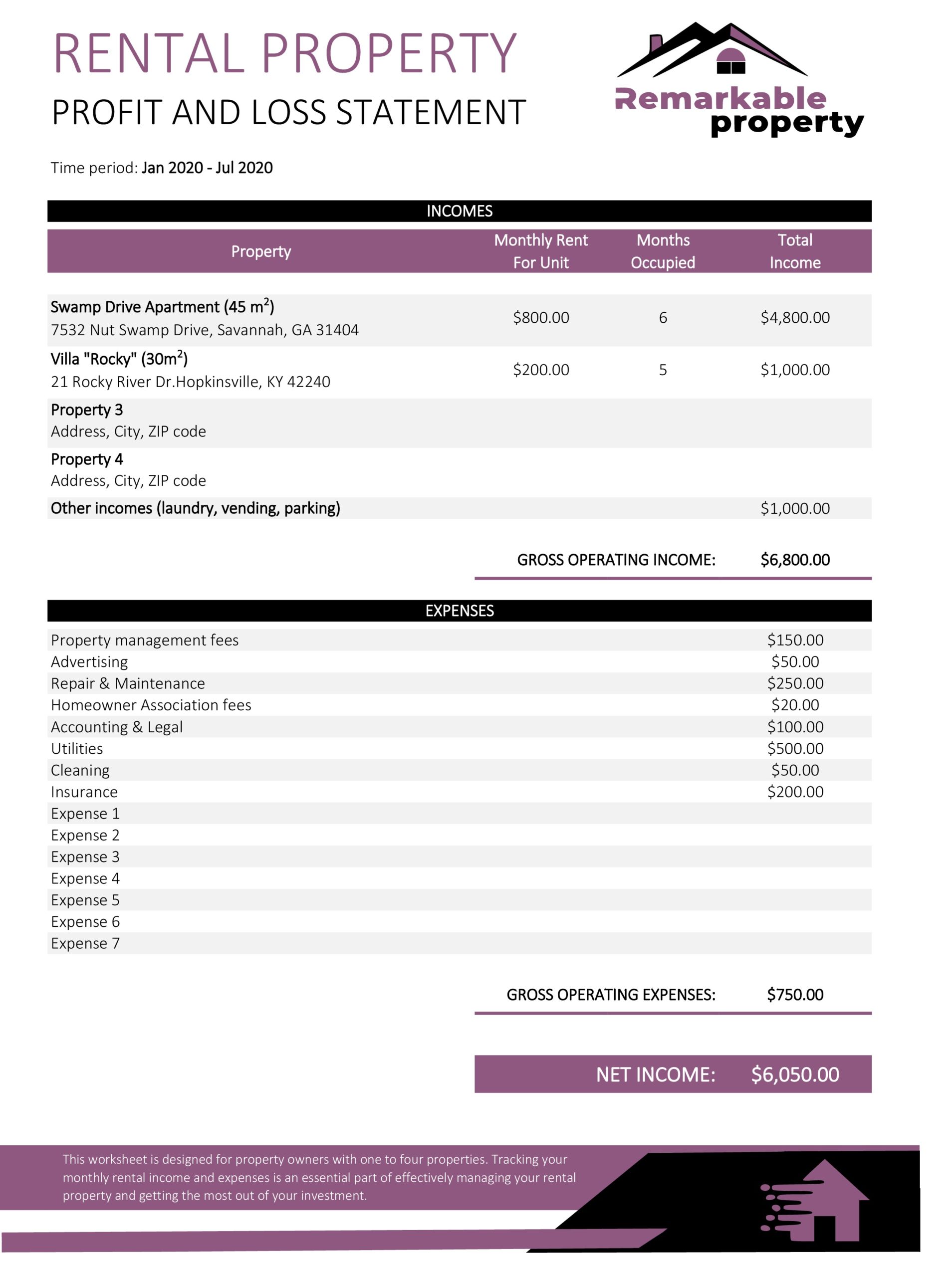

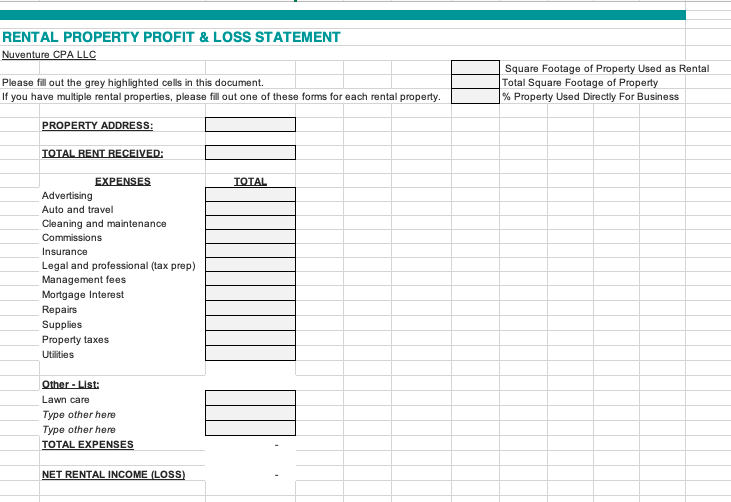

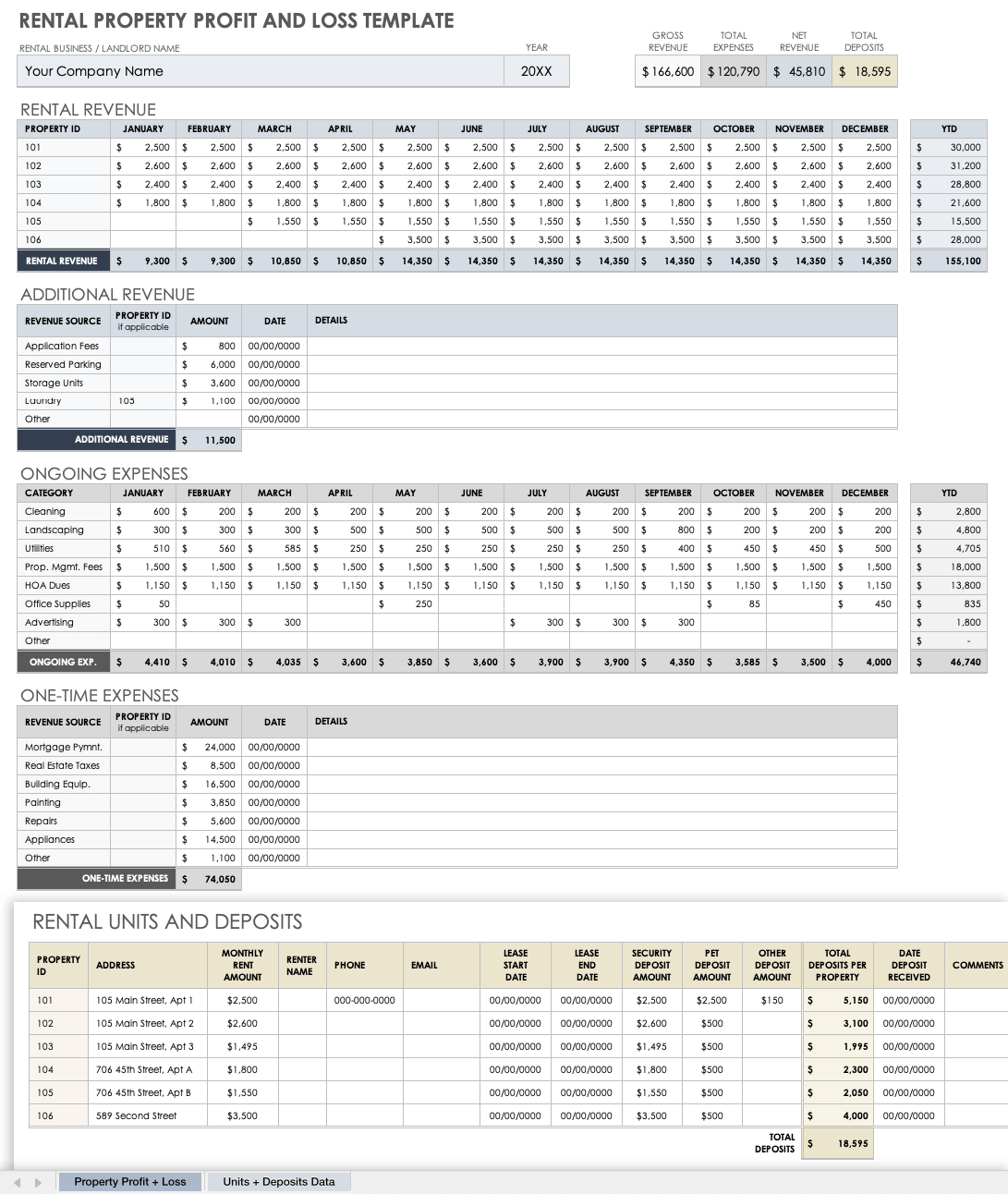

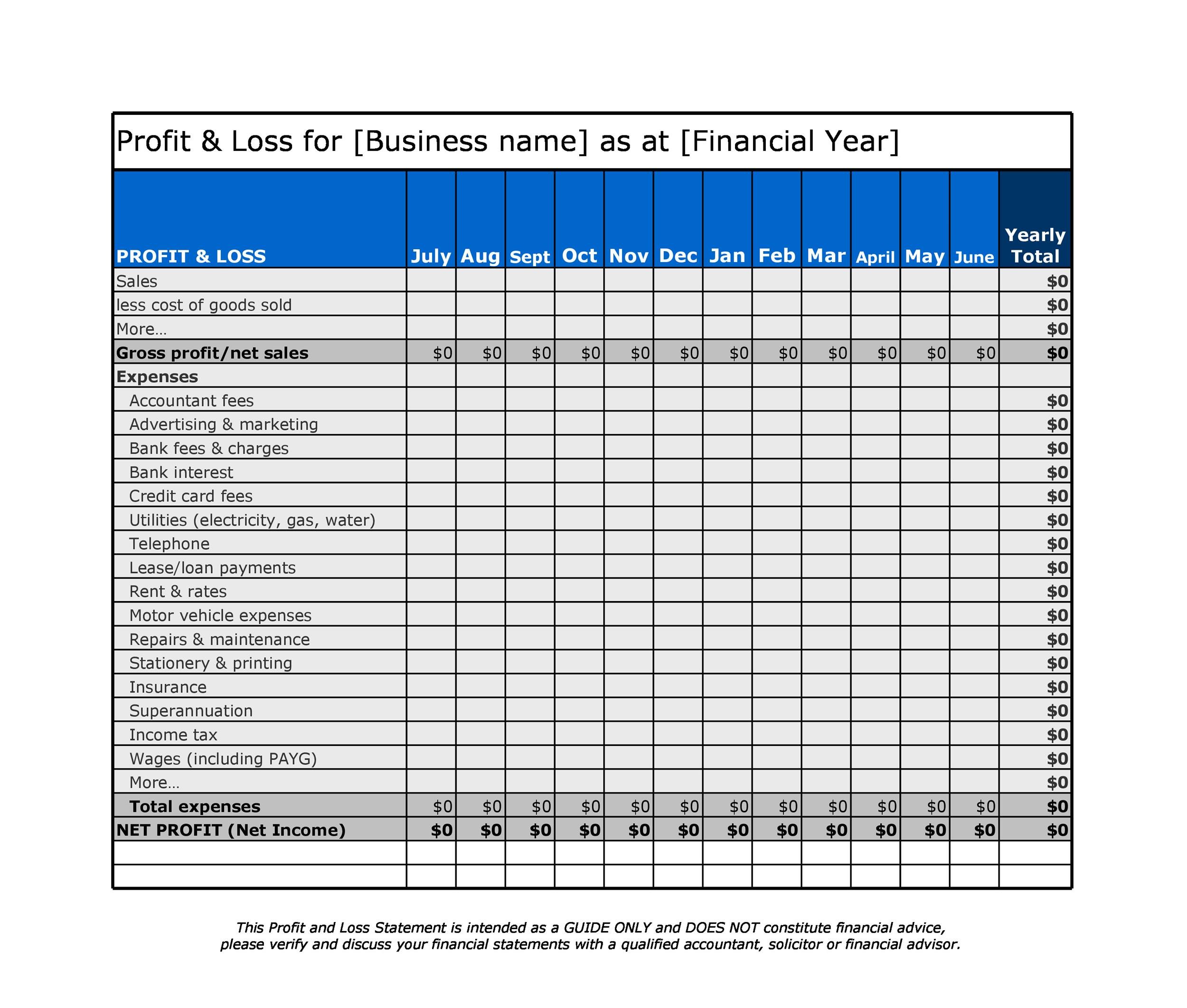

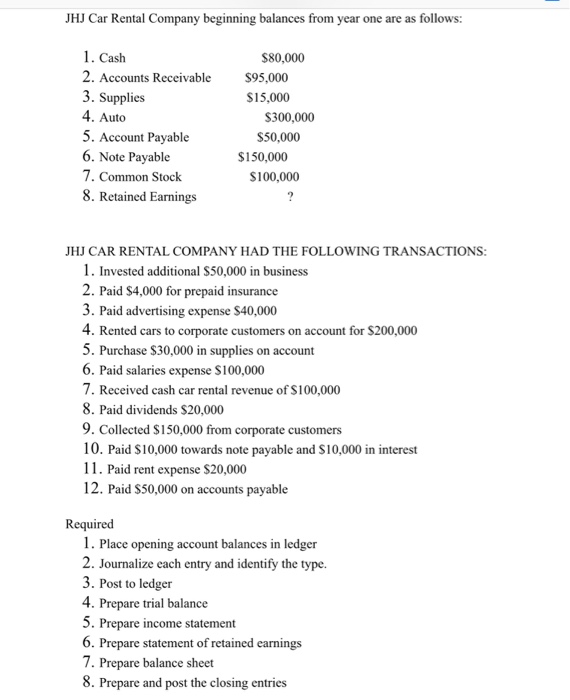

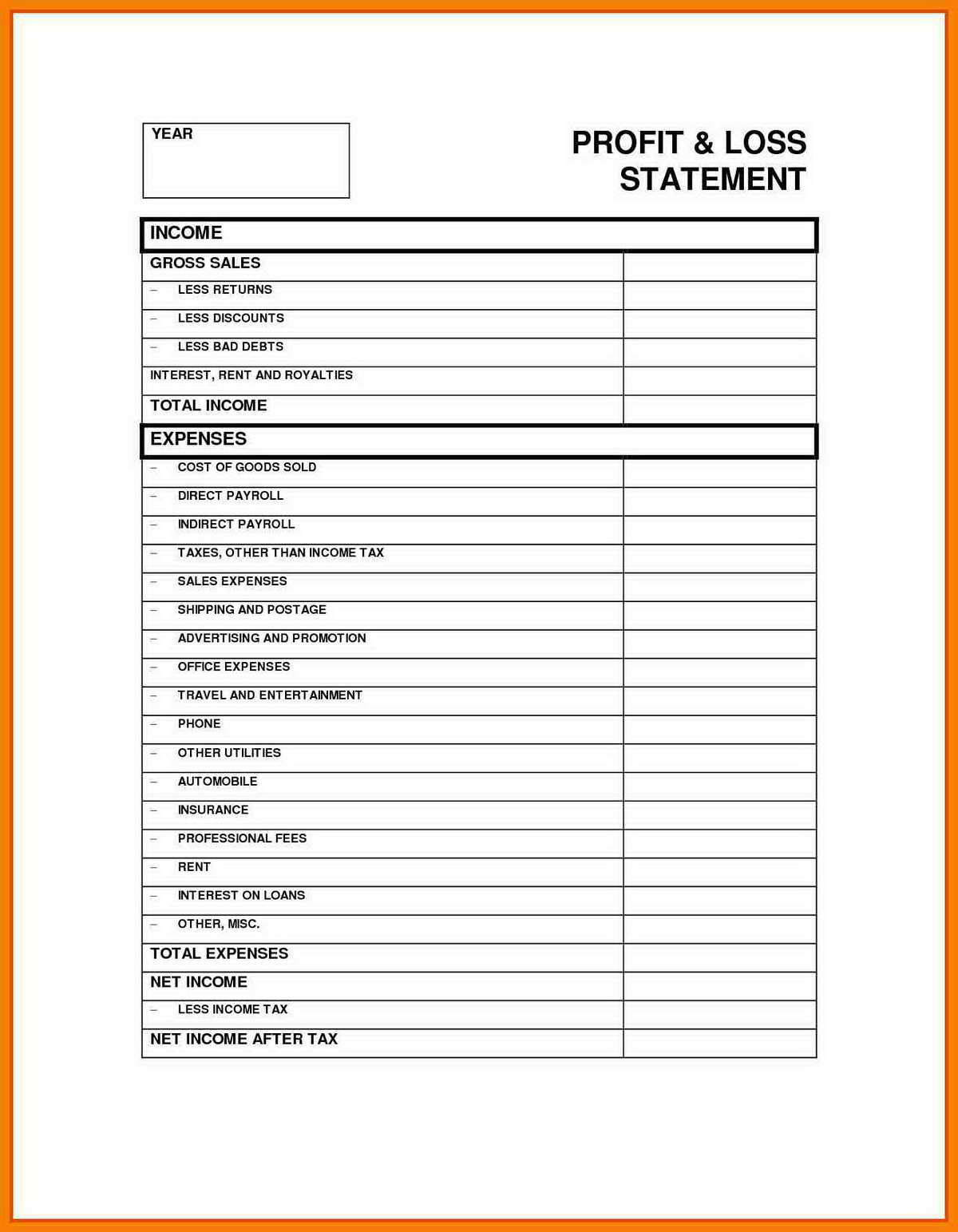

Car rental profit and loss statement. If you use estimated costs,. A rental property profit and loss statement is divided into three sections: Revenue, expenses, and net income.

This is one of the most helpful reports. Realized profits and loss. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was.

Net operating loss ($80,431) ($80,431) $0: It shows your revenues and then subtracts your costs to. Gross income gross income on a.

43 profit and loss statement templates & examples. Profit and loss statement form (su580) use this form if you are a sole trader, subcontractor or a partner in a partnership that has started new employment or a. Writing a car rental business plan is a crucial step toward.

Get the detailed quarterly/annual income statement for hertz global holdings, inc. Certainly, let's delve into the concept of a car rental profit and loss statement. in the realm of finance, this statement serves as a crucial tool for car rental. It helps business owners understand their financial performance and make.

A profit and loss statement template, sometimes referred to as a p&l template or income statement, is a financial. What is a profit and loss statement? Your financial statements include your.

Net income ($80,431) $83,568 : Find out the revenue, expenses and profit or loss over the last fiscal year. The p&l statement reveals the company's realized profits or losses for the specified period of time by comparing total revenues to.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. An accurate profit and loss (p&l) statement is crucial for the success of any car rental business. 2022 a profit and loss statement summarizes your rental income, expenses, and net operating income over the specified time period.

For each year, you need to fill in actual or forecasted figures against each of the below items. Your financial statements include your income statement, balance sheet and cash flow statements. A p&l statement compares company revenue against expenses to.

An income statement is more commonly called a profit and loss statement or p&l. Gross income, operating expenses, and net operating income or noi: The rental property profit and loss statement template creates a detailed reporting and summary of your income and expenses from four distinct categories: