Casual Info About Impairment Of Investment In Subsidiary Consolidation

A subsidiary is a company that falls under the ownership of another company, known as a parent or holding company.

Impairment of investment in subsidiary in consolidation. Then, the impairment amount is subtracted from the previous goodwill asset listed on the balance sheet, which will now show $15 million to reflect the current market value of the. This approach is also applied where an additional. Investment in an associate, joint venture or subsidiary which is held at cost, the carrying value will be the accumulated cost.

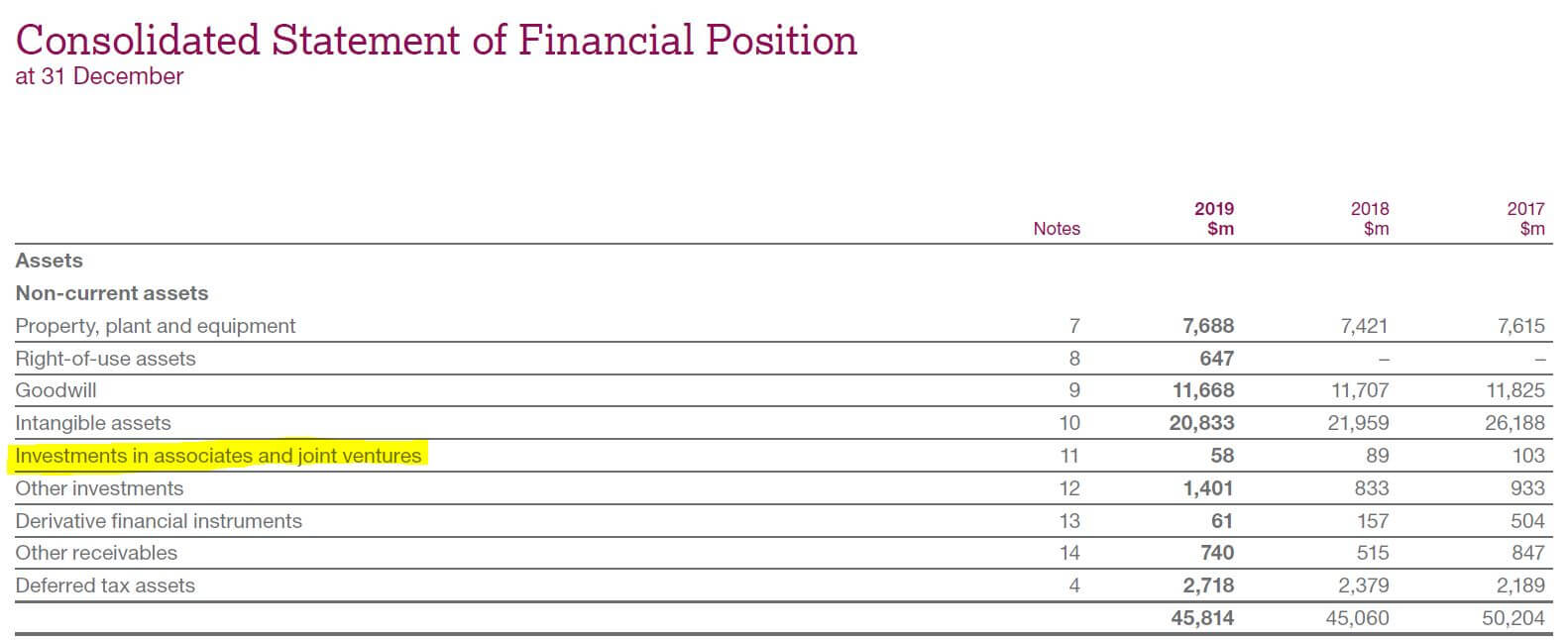

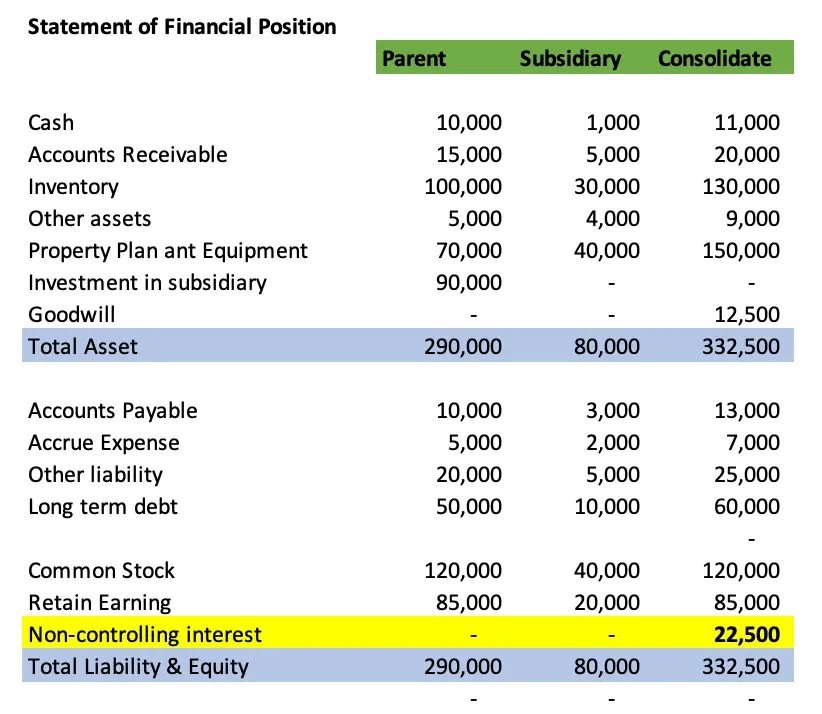

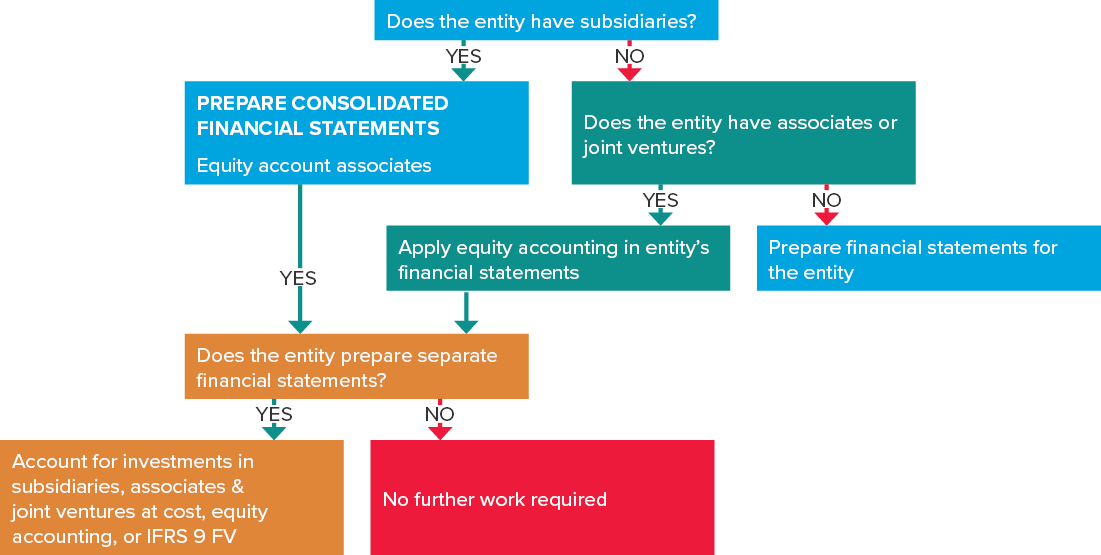

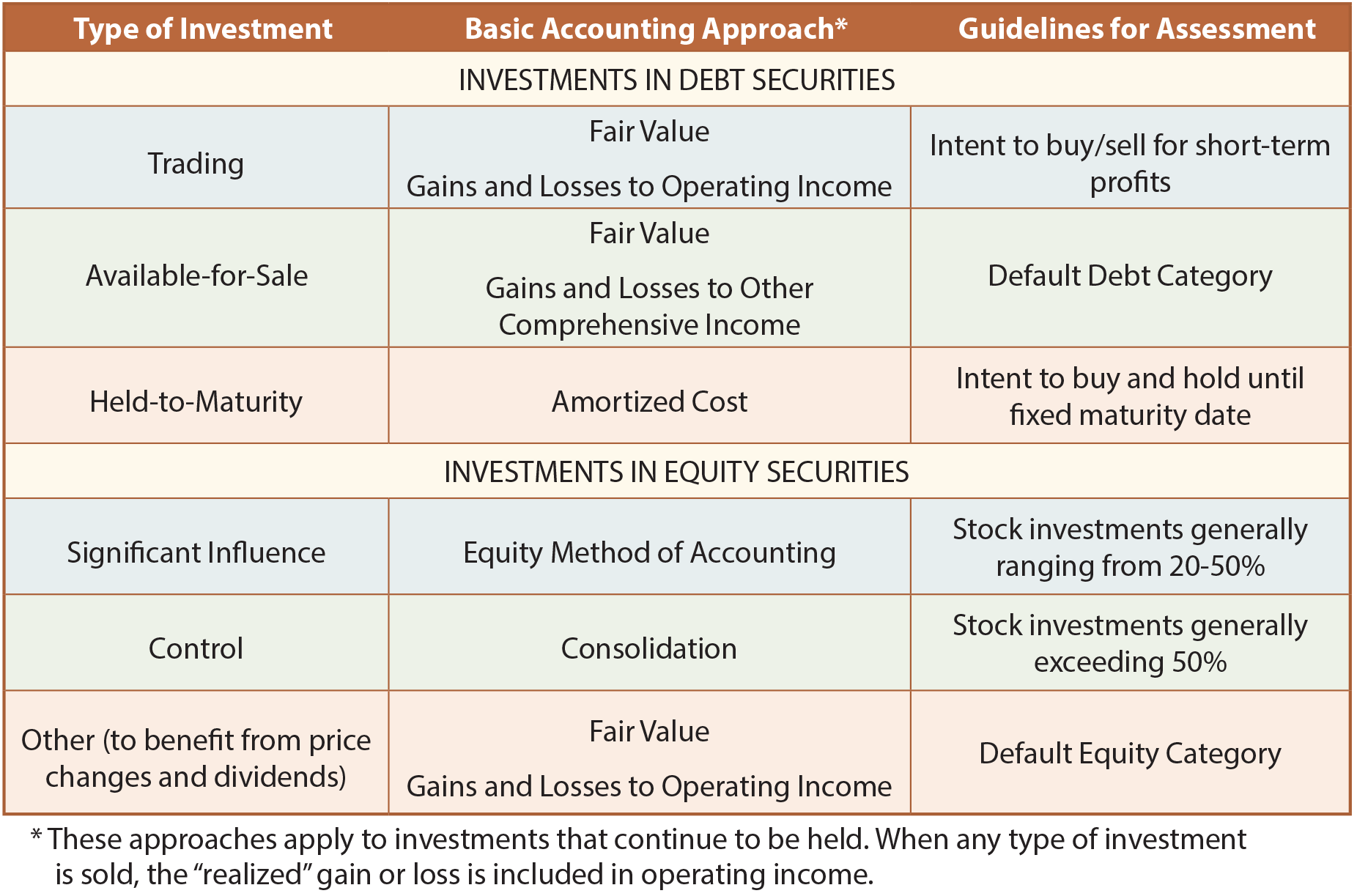

Investments in subsidiaries, joint ventures, and associates. In the consolidated financial statements, company a reflects 100% of the assets and liabilities of subsidiary b and a. We have a case where a holding company has run an impairment test of its subsidiary and found that the present value.

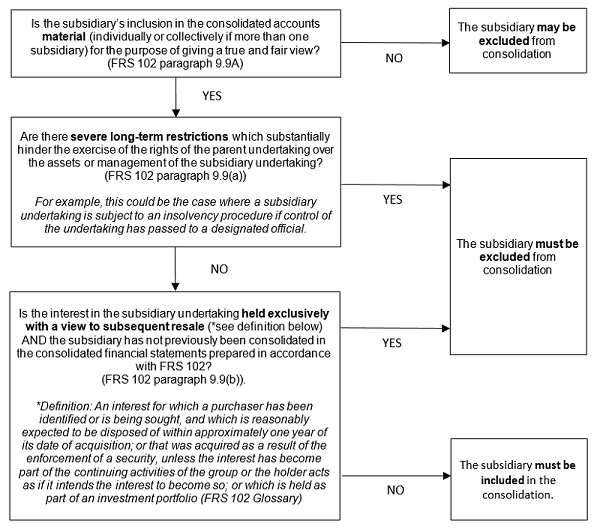

Consolidated financial statements are the financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the. Impairment occurs when a business asset. It also details the available accounting methods for accounting investments in subsidiaries, joint ventures and associates in an entity's separate financial statements, including the.

Deferred tax related to an investment in a subsidiary (ias 12 income taxes)—june 2020. An investor records an impairment charge in earnings when the decline in value below the carrying amount of its equity method investment is determined to be other than. For an investment in a subsidiary, joint venture or associate, the investor recognises a dividend from the investment and evidence is available that:

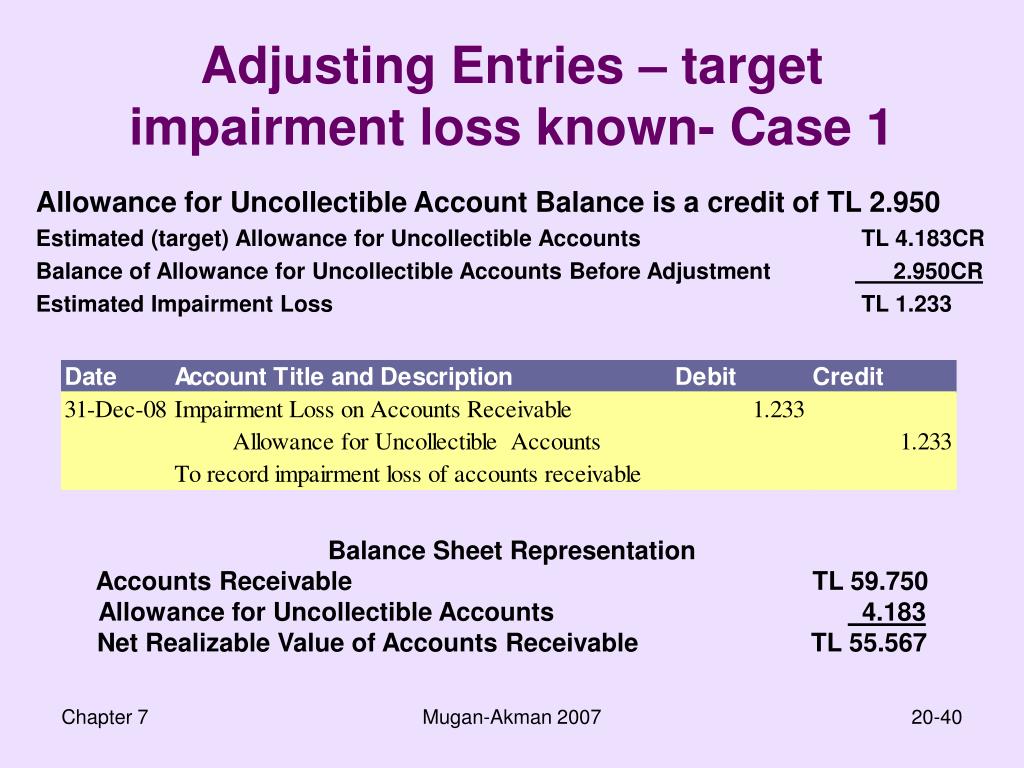

At 12/31/20x1, subsidiary b has net assets of $100. We performed inquiries of management about the current market conditions supporting the evaluation of potential impairment indicators, tested the key assumptions used, and. Ias 27 — impairment of investments in subsidiaries, jointly controlled entities and associates in the separate financial statements of the investor date.

Key definitions [ias 27.4] consolidated financial statements: I'm trying to get my head round how to account for the impairment of an investment within a consolidated group as i haven't come across this situation. Impairment of investment in a subsidiary.

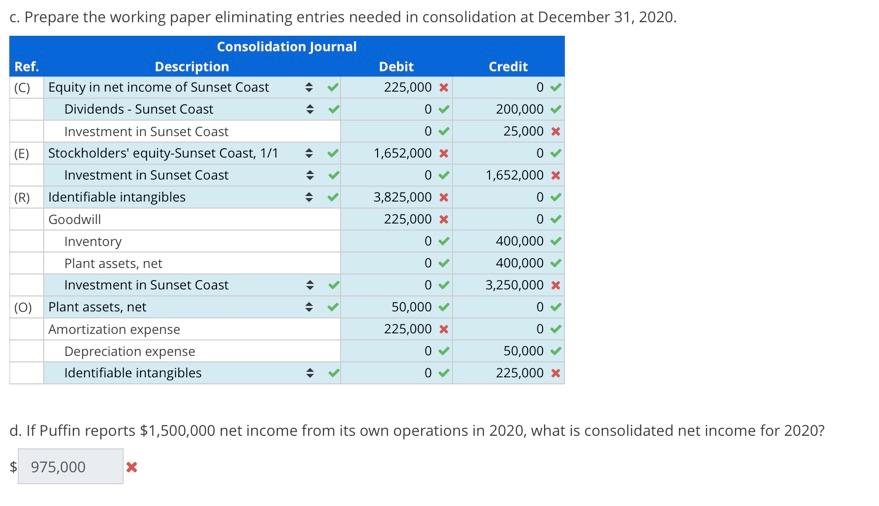

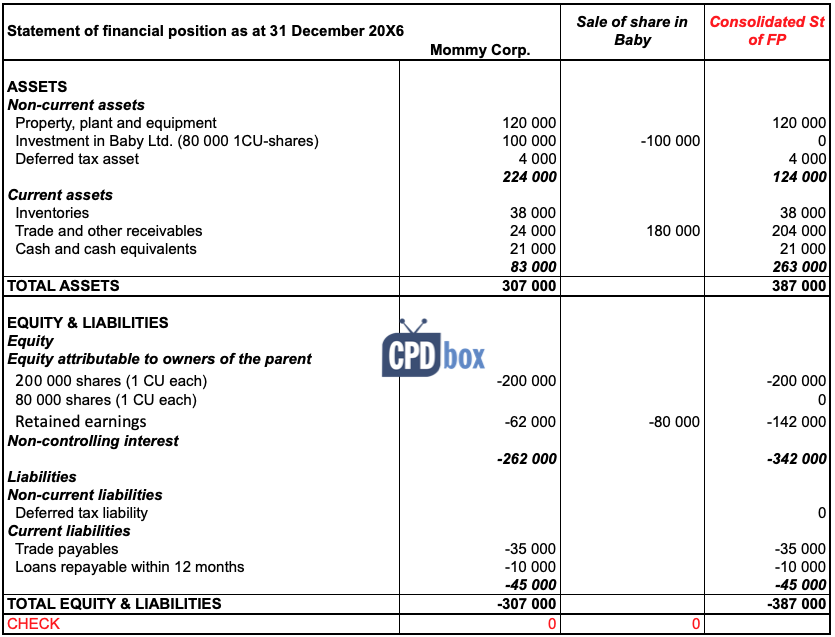

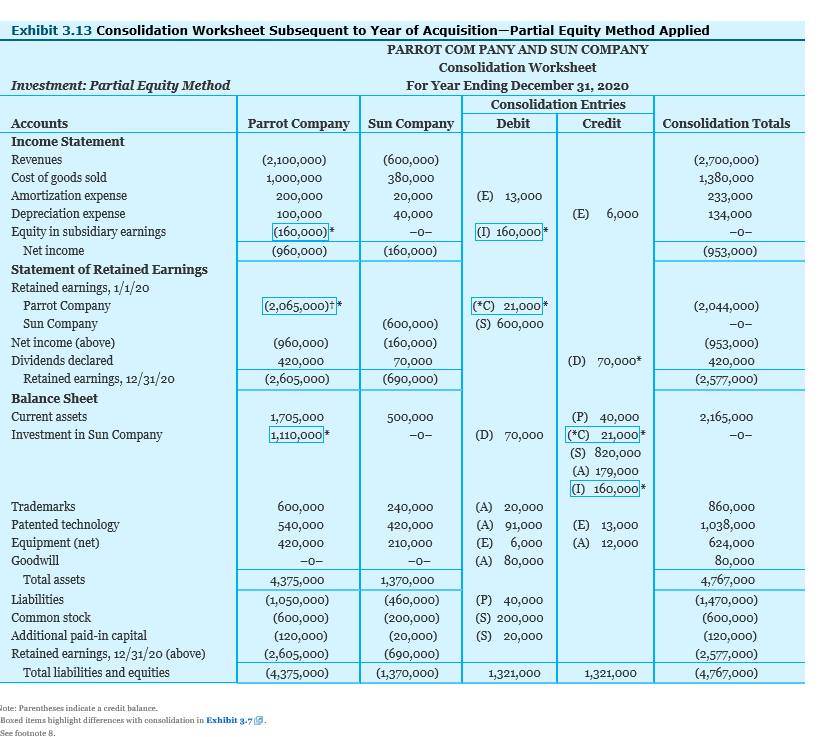

On computation of impairment loss for consolidation purposes, the method shows this way: The impairment of the subsidiary is also reversed at the consolidation level in addition to the usual elimination of subsidiary share capital against the cost of. In the individual financial statements investments in subsidiaries, associates and joint ventures can be carried at either:

The financial statements of a group presented as those of a single economic entity. Consolidated financial statements and accounting for investments in subsidiaries, which had originally been issued by the international accounting standards committee in april. The carrying amount of the investment in the separate financial statements exceeds the carrying amount in the consolidated financial statements of the investee’s.

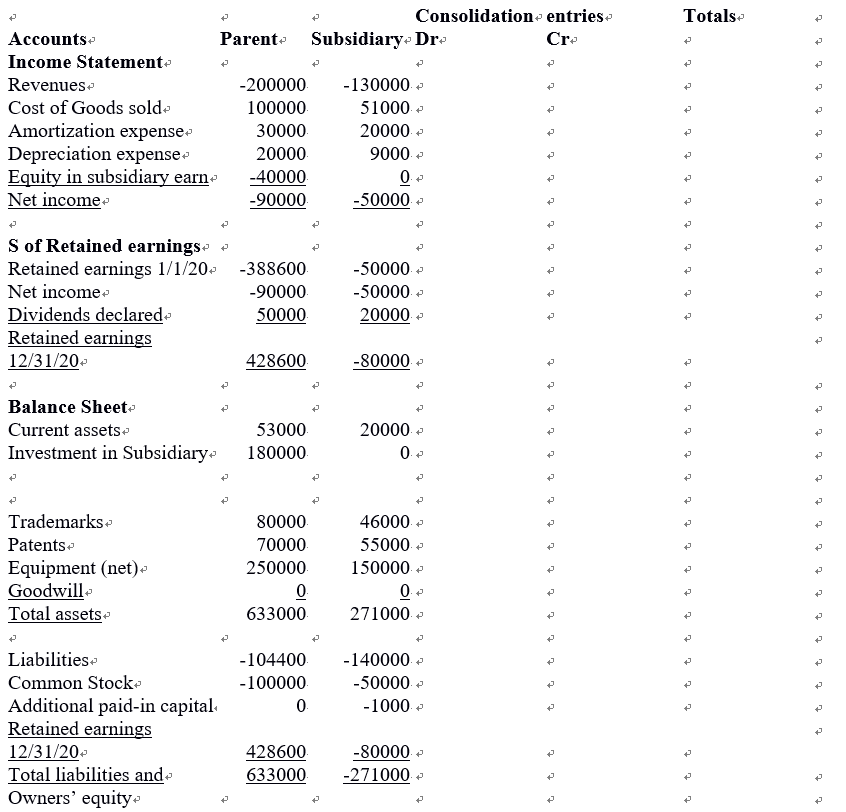

For a company to become a parent company, it is crucial to. The committee received a request about how an entity, in its consolidated. The consolidation method records ‘investment in subsidiary’ in the parent company’s balances as an asset in the balance sheet.