Simple Tips About Cash Financial Statement

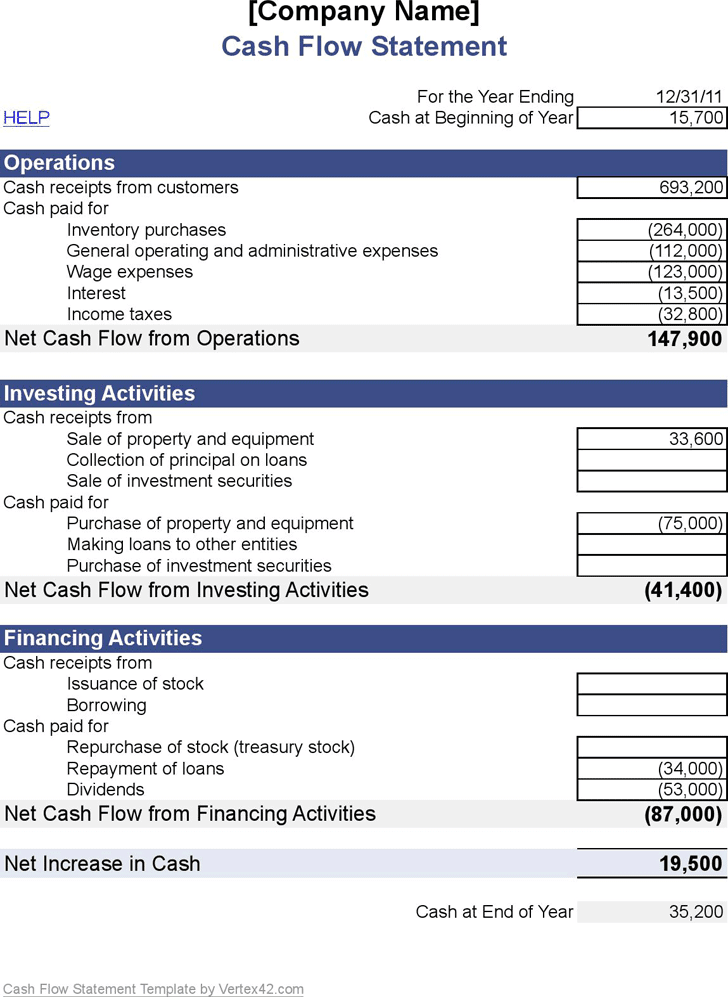

A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period.

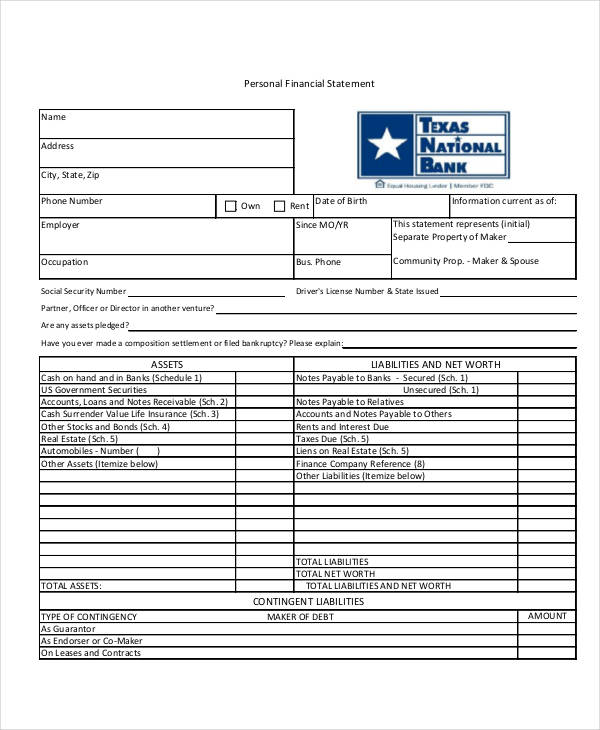

Cash financial statement. These three financial statements are intricately linked to one another. The civil fraud ruling on donald trump, annotated. How to read a balance sheet a balance sheet conveys the “book value” of a company.

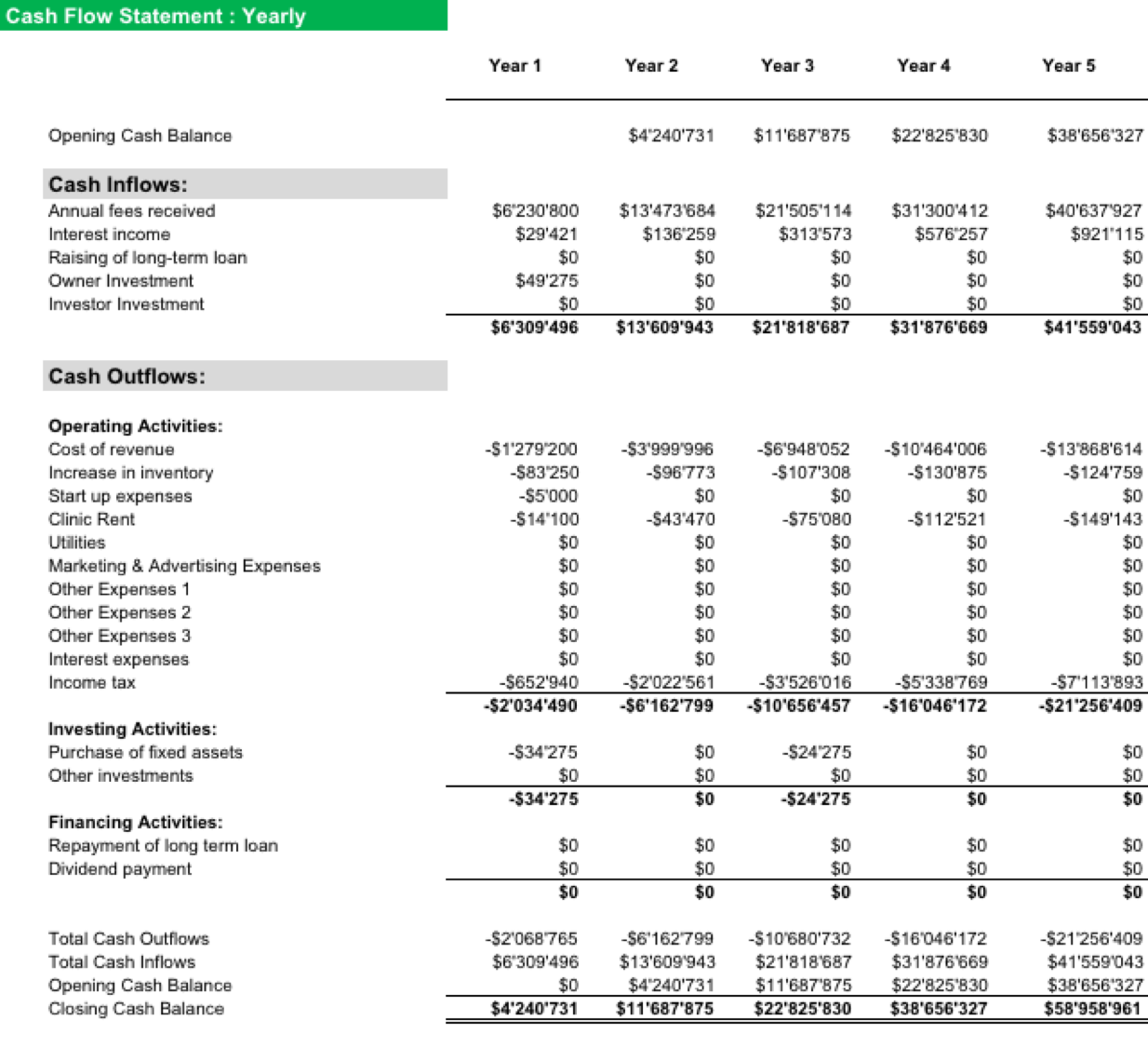

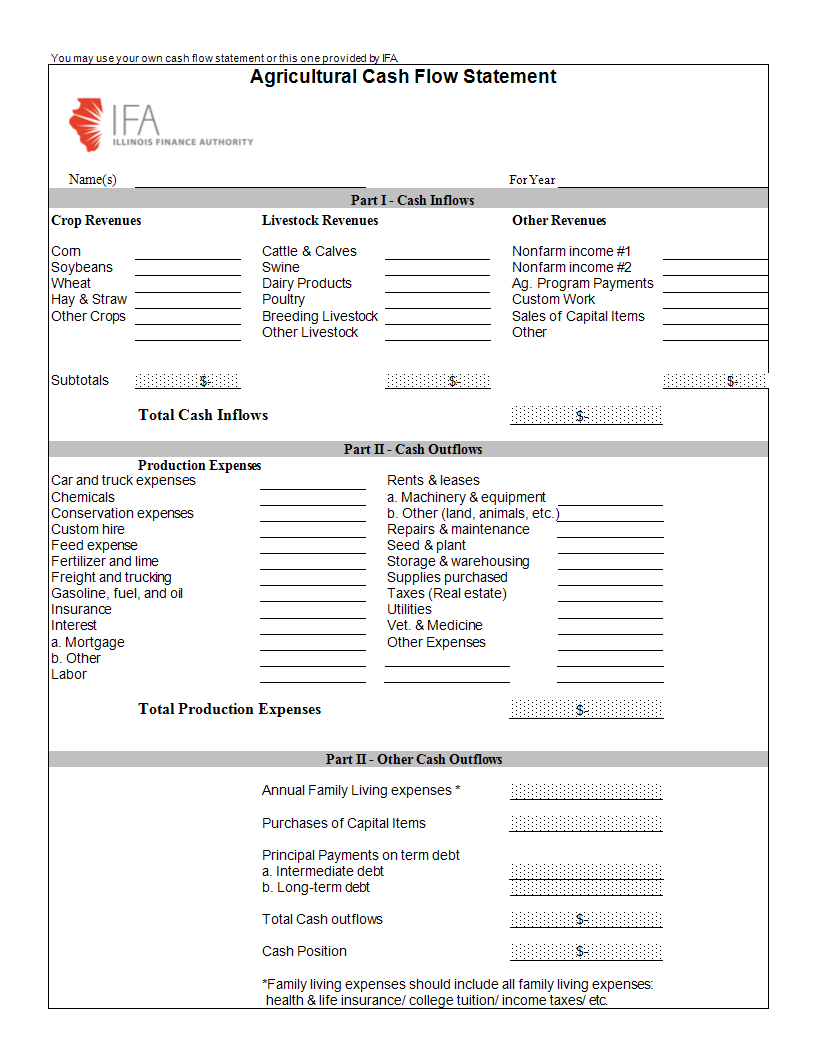

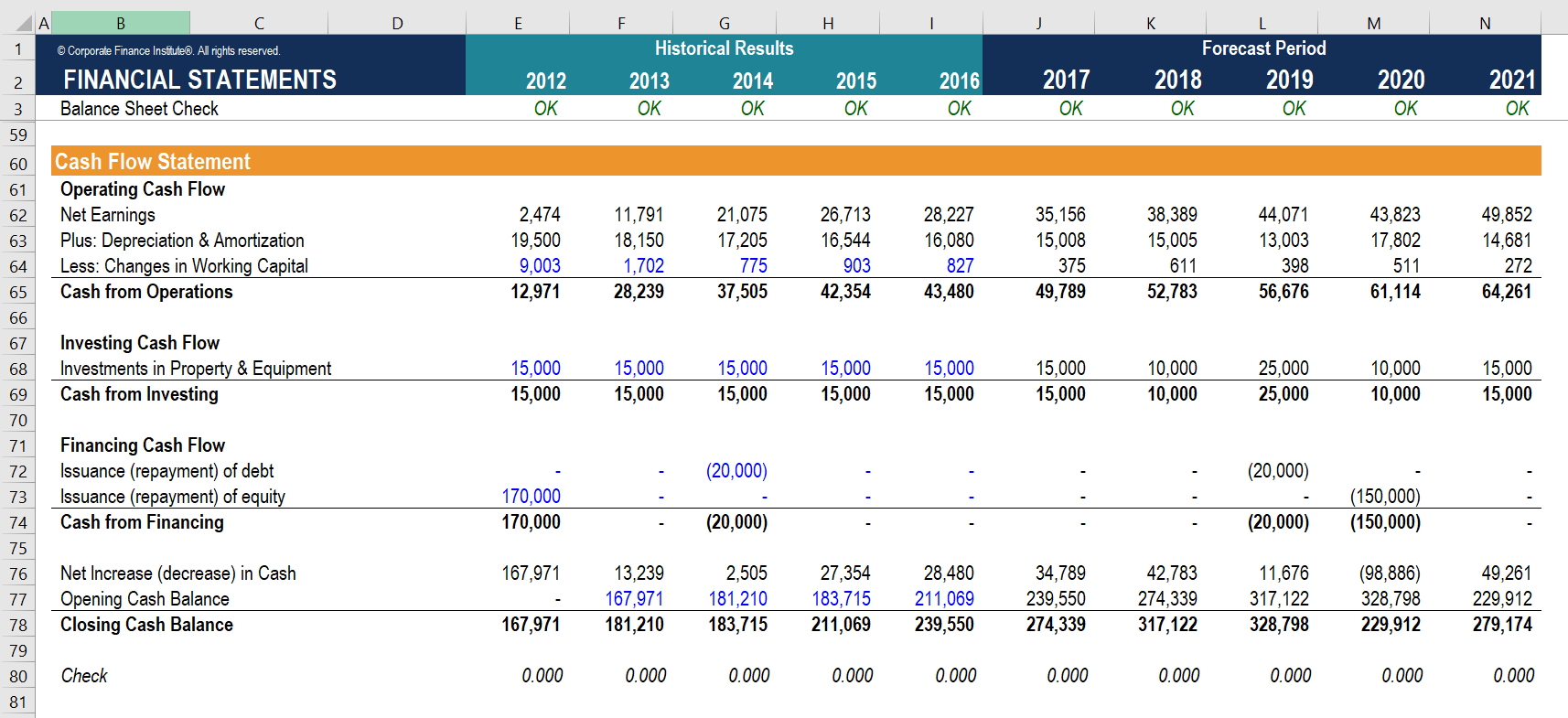

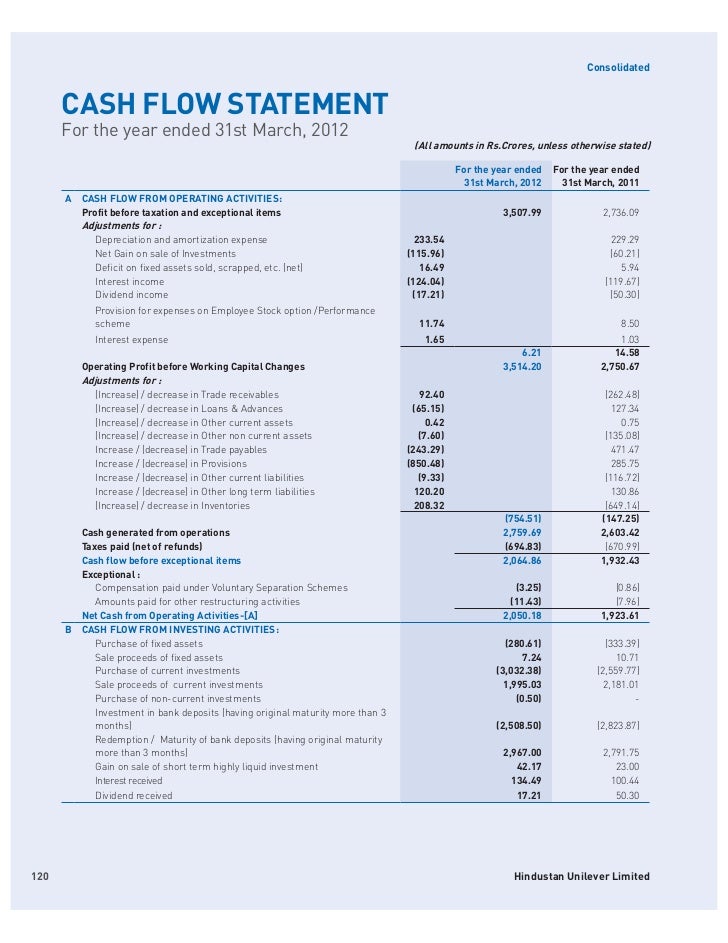

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. Remember, under accrual accounting, transactions are recorded when they occur, not necessarily when cash moves. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

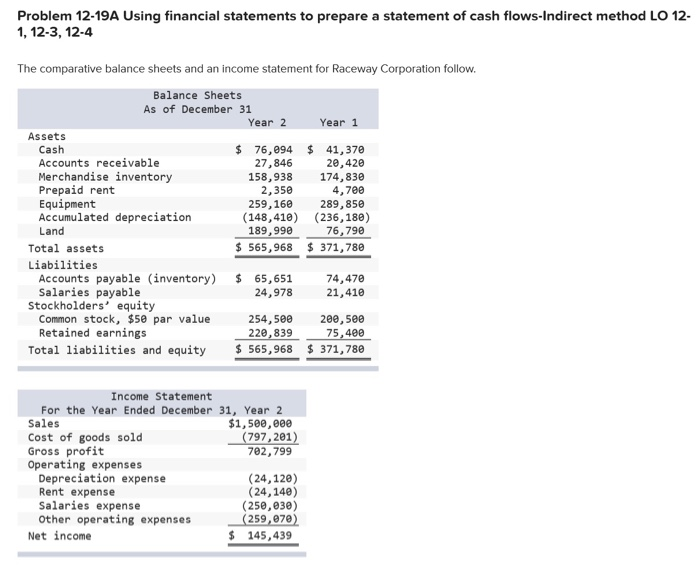

Investing activities include any sources and uses of cash from a company's investments in its. The information in the completed analysis can be used to prepare the statement of cash flows shown in figure 11.5. Guide to analyzing financial statements for financial analysts over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more.

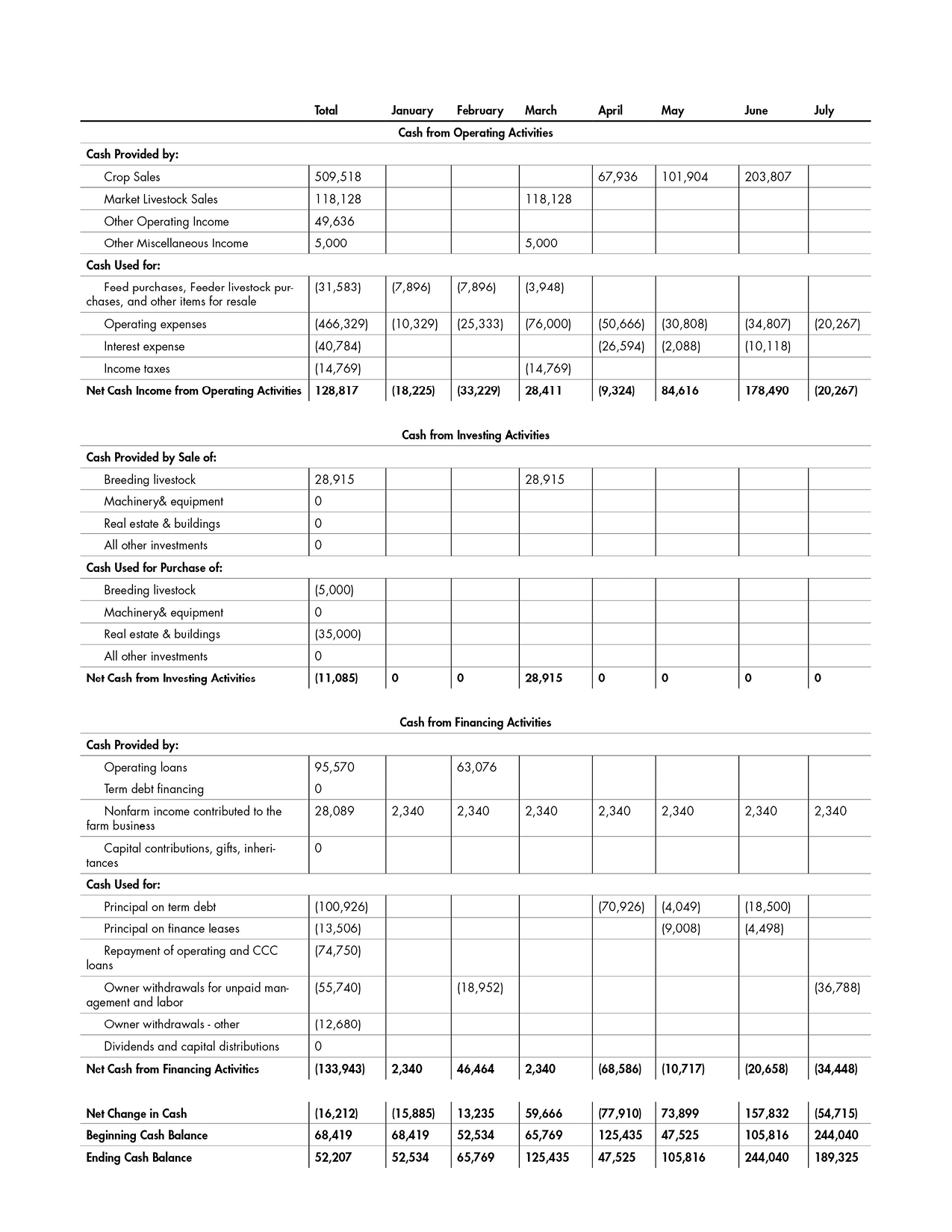

Operating activities investing activities financing activities operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses. The cash flow statement is linked to the income statement by net profit or net loss, which is usually the first line item of a cash flow statement, used to calculate cash flow from. Transaction is 100% stock consideration.

Analyzing these three financial statements is one of the key steps when creating a financial model. A company's cash flow can be categorized as cash flows from operations, investing, and. Capital one to acquire discover.

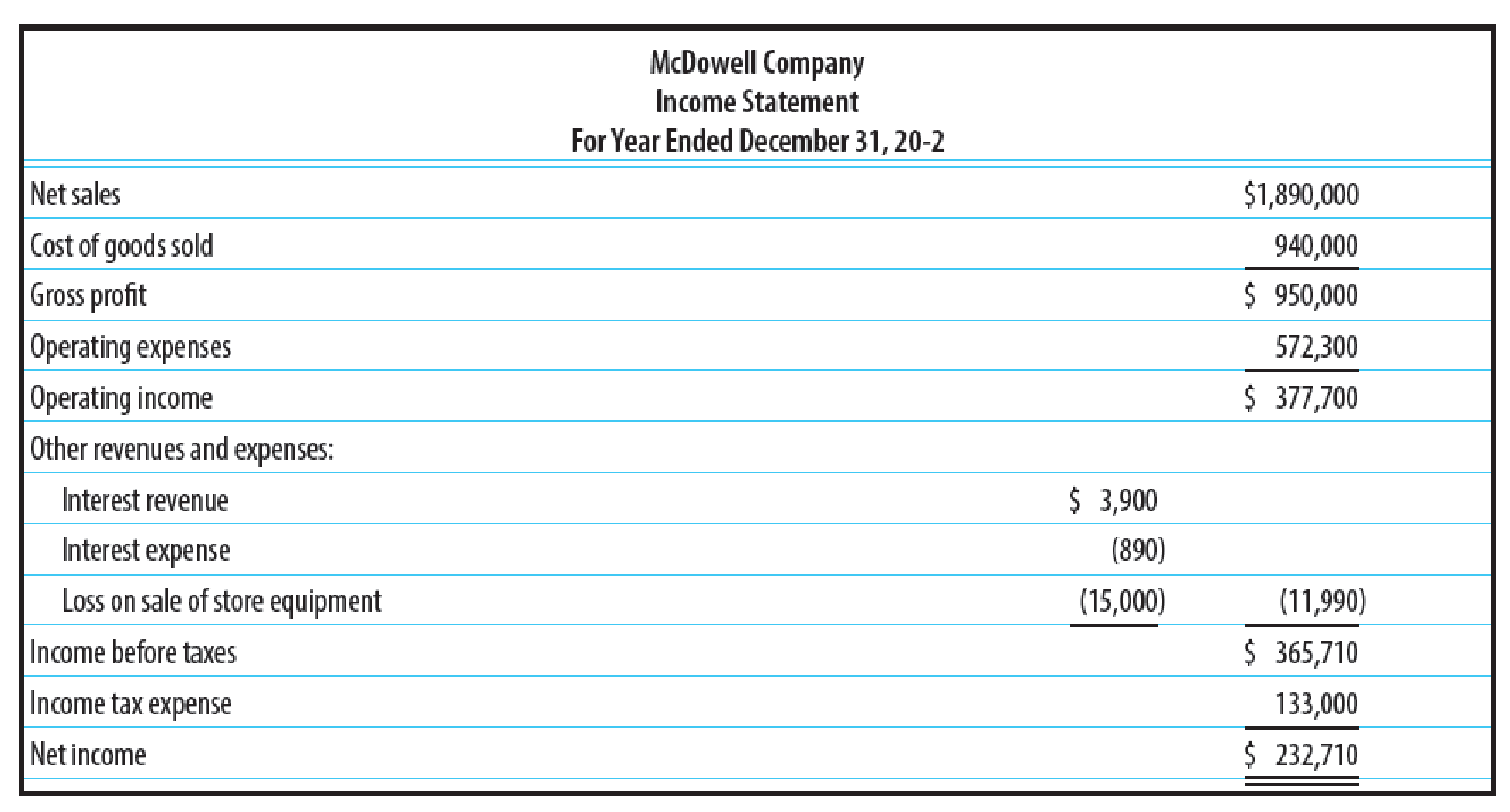

Each example of the financial statement states the topic, the relevant reasons, and additional comments as needed. Financial statement presentation financing transactions health care entities ifrs and us gaap: Income from operations of $652 million;

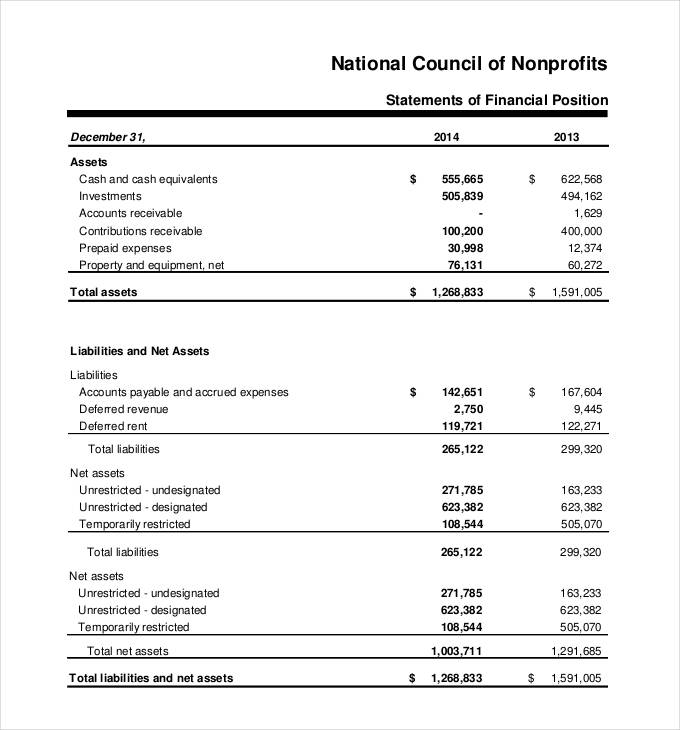

Cash flow statement operating activities. While income statements are excellent for showing you how much money you’ve spent and earned, they don’t necessarily tell you how much cash you have on hand for a specific period of time. It shows its assets, liabilities, and owners’ equity (essentially, what it owes, owns, and the amount invested by shareholders).

Balance sheet balance sheet read more. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. Trump was penalized $355 million plus interest and banned for three years from serving in any top roles at a new york.

The cash flow statement is a financial statement that reports a company's sources and use of cash over time. It allows you to see what resources it has available and how they were financed as of a specific date. Taking into account the profit and cash generation in 2023, as well as the expected strength of future cash flows, subject to shareholder approval at the agm on 7 may 2024, temenos intends to pay a dividend of chf1.20 per share in 2024.

A statement of cash flows is a financial statement that depicts all cash inflows and outflows from a company’s operations, investments, and financing activities in a specified period. Record adjusted ebitda margin fourth. Figure 11.5 statement of cash flows for example corporation.

![40 Petty Cash Log Templates & Forms [Excel, PDF, Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/08/petty-cash-log-07.jpg?w=790)