Fabulous Info About Three Types Of Cash Flow Activities

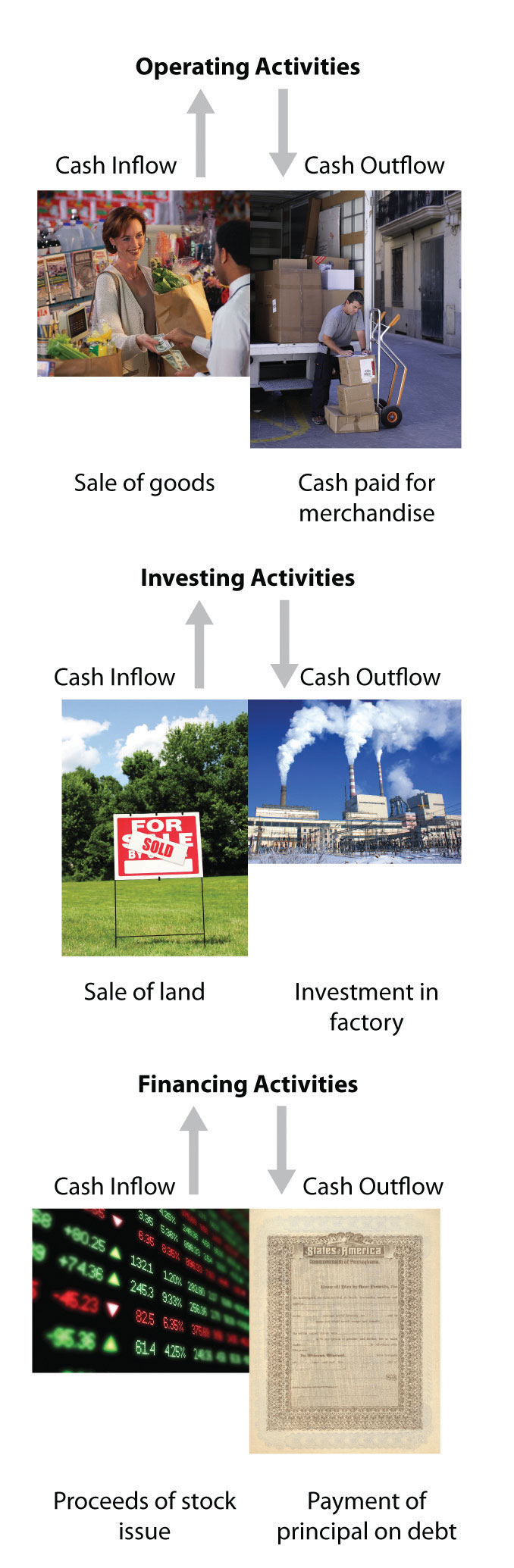

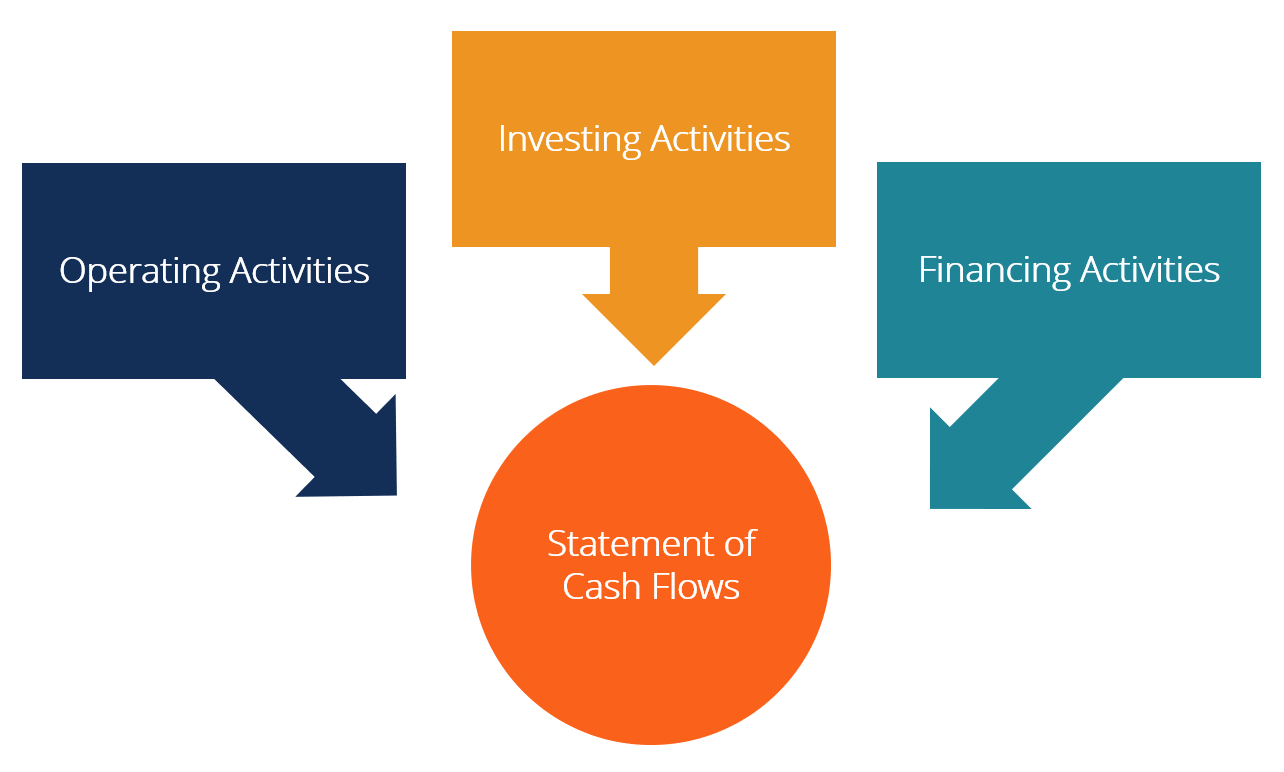

The cash flow statement is divided into three sections—cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

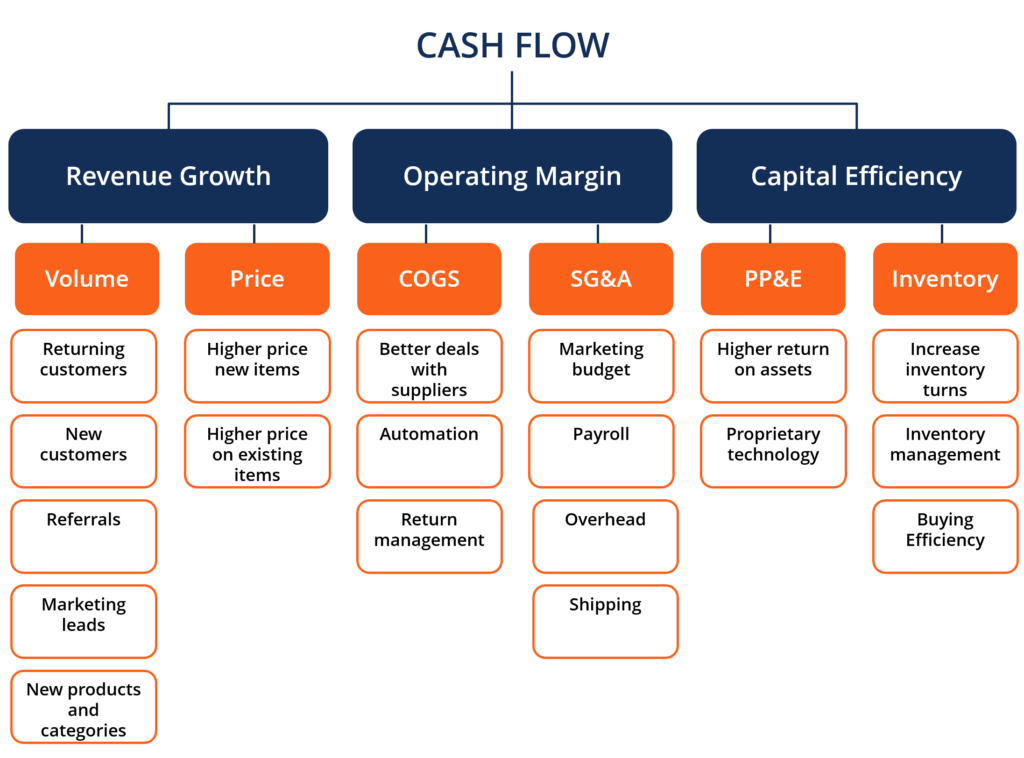

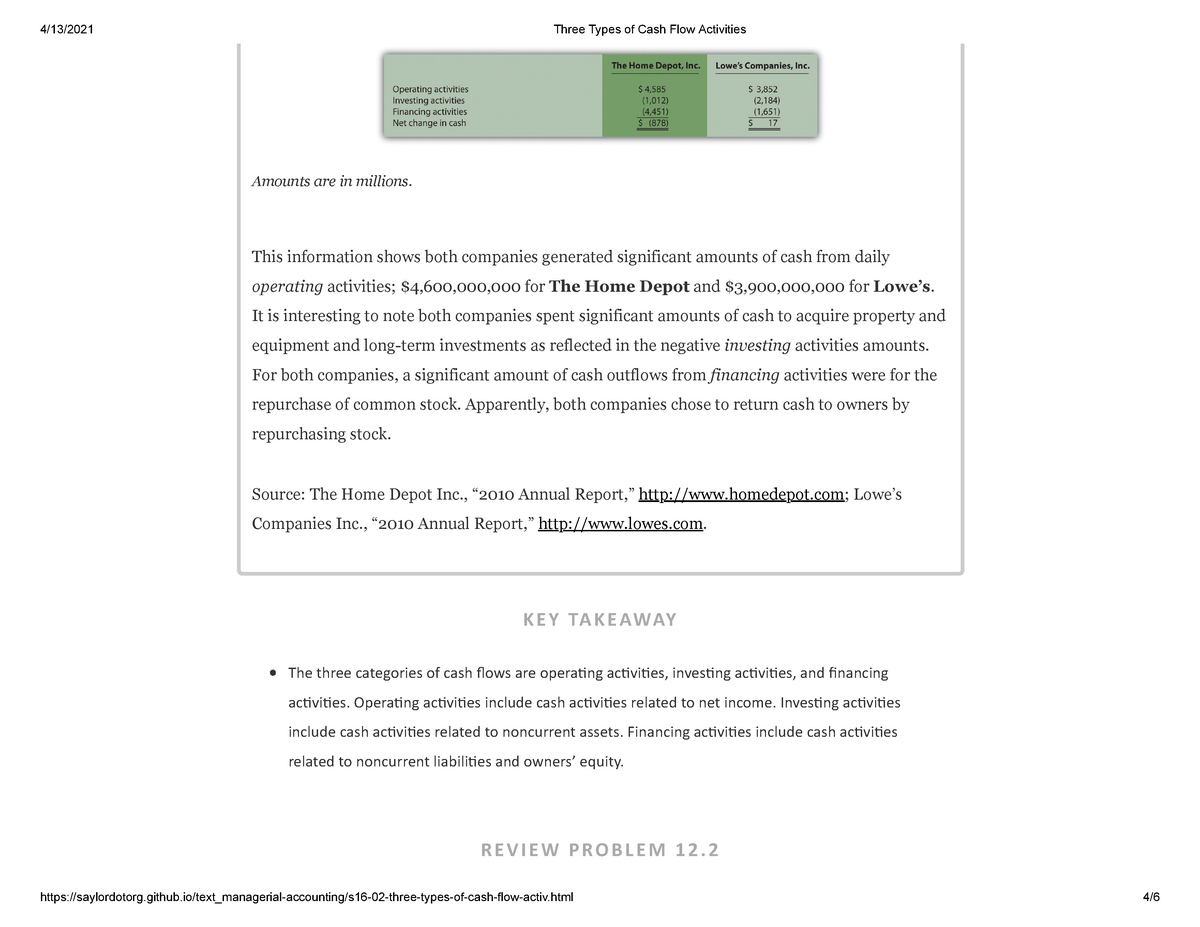

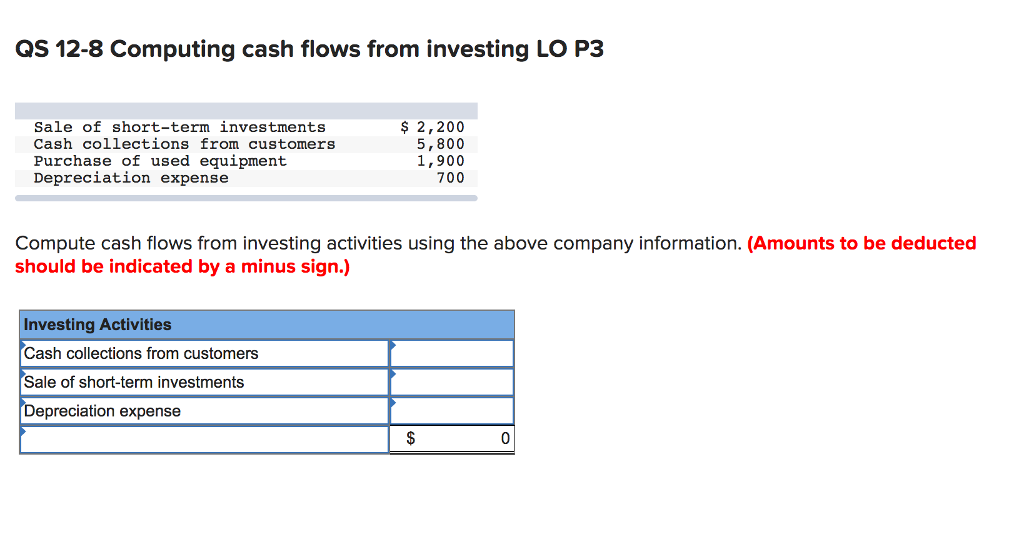

Three types of cash flow activities. Operating activities include cash activities related to net income. Cash flows from financing activities include three main types of cash inflows and outflows: Upon knowing the 3 types of cash flow activities, a company can determine its free cash flow.

The financing activities of a business provide insights into the business’ financial health and its goals. All three are included on a company’s cash flow statement. Investing activities include cash activities related to noncurrent assets.

These three activities help us to asses the financial position of a firm and also helps to know various cash and cash equivalent transactions incurred. Financing activities include cash activities related to noncurrent liabilities and owners’ equity. The three categories of cash flows are operating activities, investing activities, and financing activities.

Thus, the effective interest rates on discount loans are usually much higher than the specified interest rates. Now that we understand the importance of cash flows, let’s see the types of cash flows that are in use: The three categories of cash flows are operating activities, investing activities, and financing activities.

Financing activities cash flow =. The cash flow generated from operating activities is termed operating cash flow. Below, we break down each type of cash flow and give the formula for each source.

Investing activities include cash activities related to noncurrent assets. The 3 main types of cash flow. We also share some common items that fall under each type of cash flow.

Types of cash flows. Namely, the income from sales and outflows from salaries, vendor fees, lease payments, taxes, and interest payments. The three categories of cash flows are operating activities, investing activities, and financing activities.

Cash flow from investing, cash flow from financing, and cash flow from operating activities. Operating activities include cash activities related to net income. Cash flow from operating activities, cash flow from investing activities and cash flow from financing activities.

The cash flow from operating activities section appears at the top. Cash flow activities majorly classified into three categories they are: Different types of cfs are discussed cash flows from operating activities.

Investing activities include cash activities related to noncurrent assets. Repurchase of debt and equity, or rp; The main components of the cfs are cash from three areas:

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)