Breathtaking Info About Interest On Bank Loan In Balance Sheet

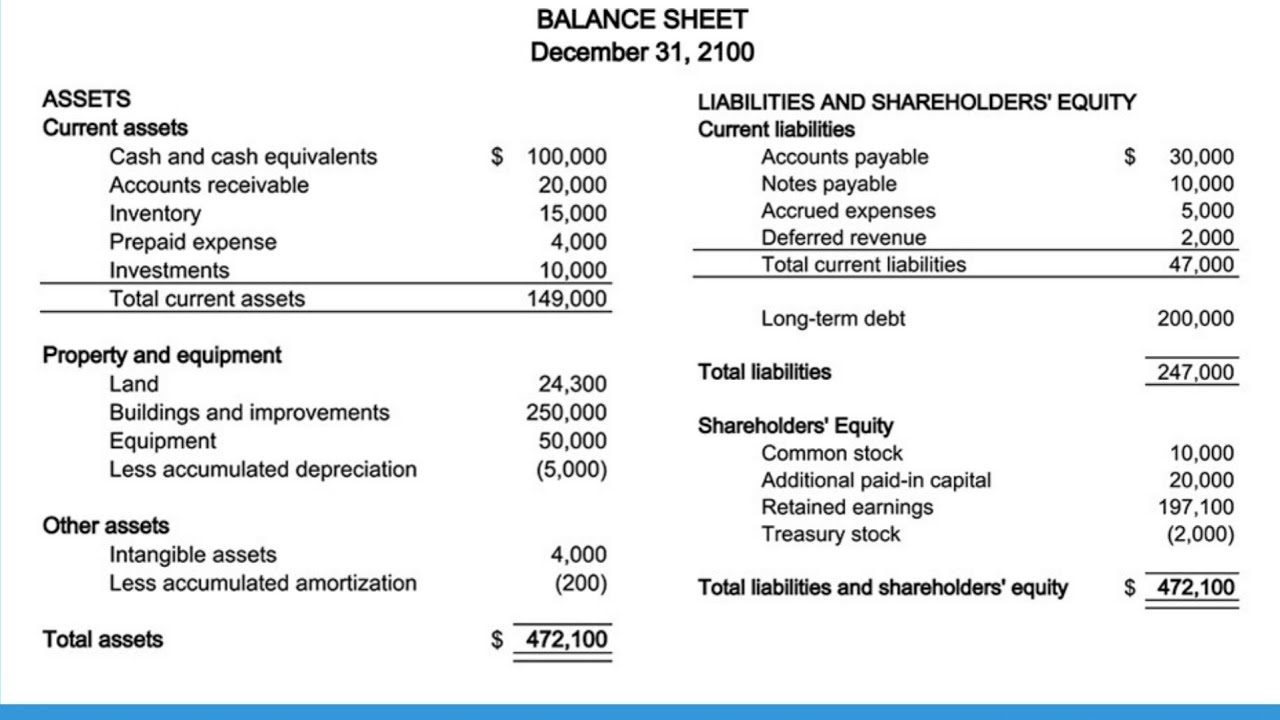

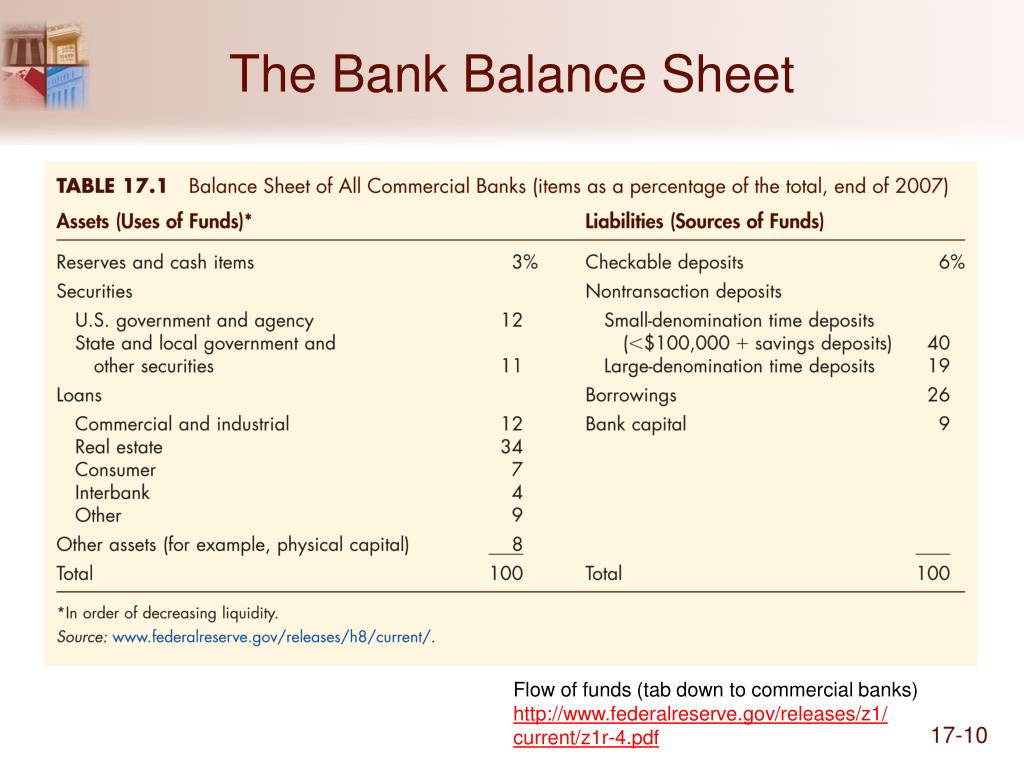

Assets property trading assets loans to customers deposits to the central bank liabilities loans from the central bank deposits from customers trading liabilities misc.

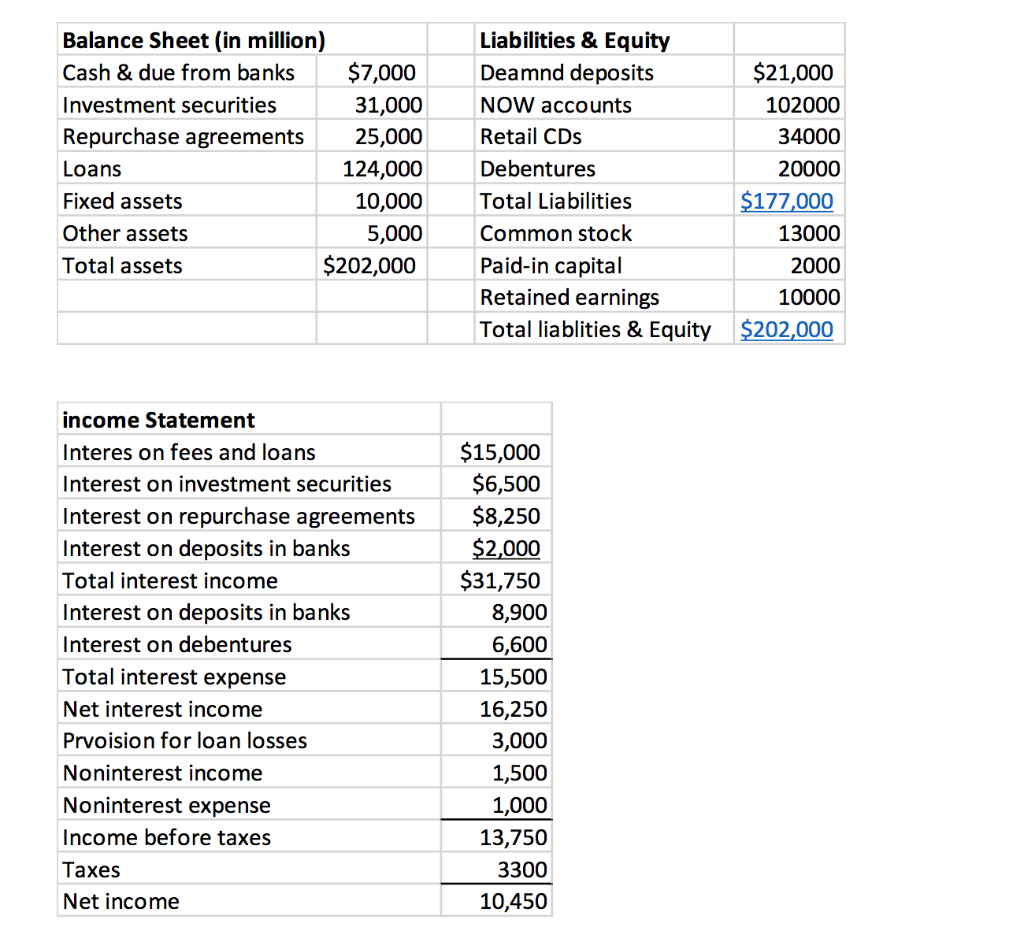

Interest on bank loan in balance sheet. The interest expense for september will be $40 ($1000 x 4%). The typical structure of a balance sheet for a bank is: Net interest income totaled $44.6 billion and is the spread between interest earned.

In such case, two effects will take place: Trump was penalized $355 million, plus millions more in interest, and banned for three years from serving in any top roles at a new. Banks balance sheet explained how to read?

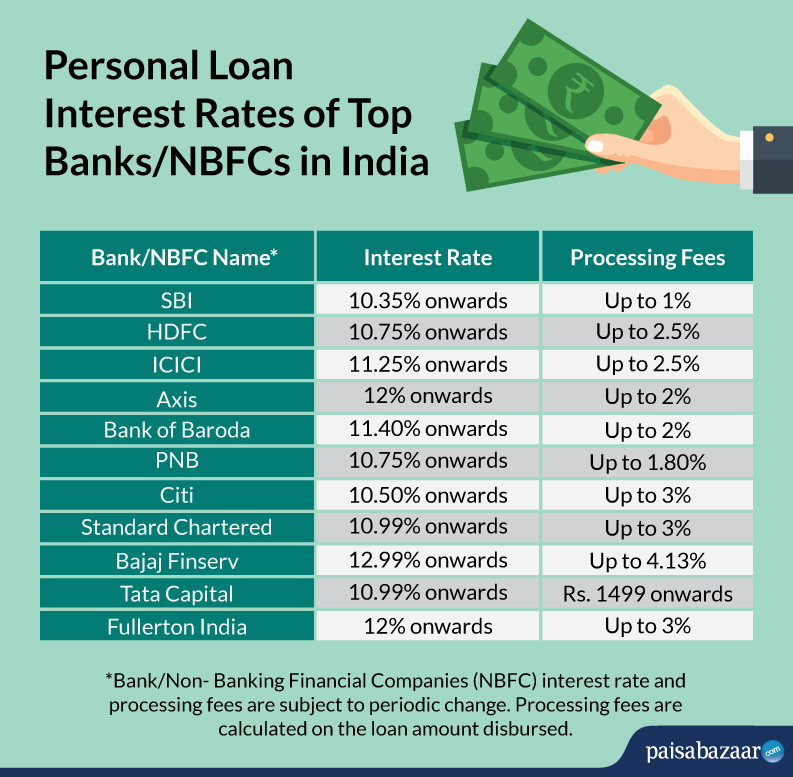

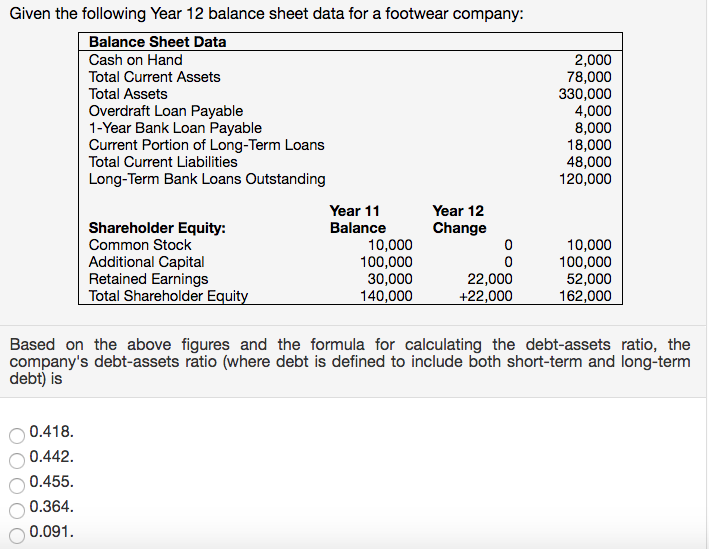

Average balance of debt x interest rate. The hdfc bank ceo suggested it was understandable why the. Therefore, the interest appears on the income statement and reduces a company's net income.

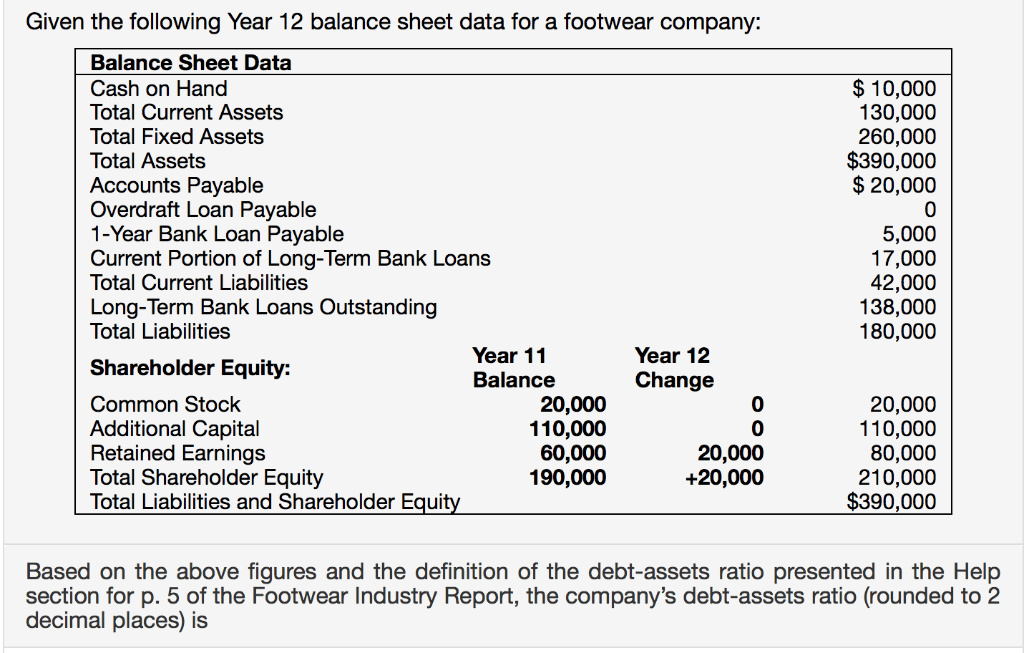

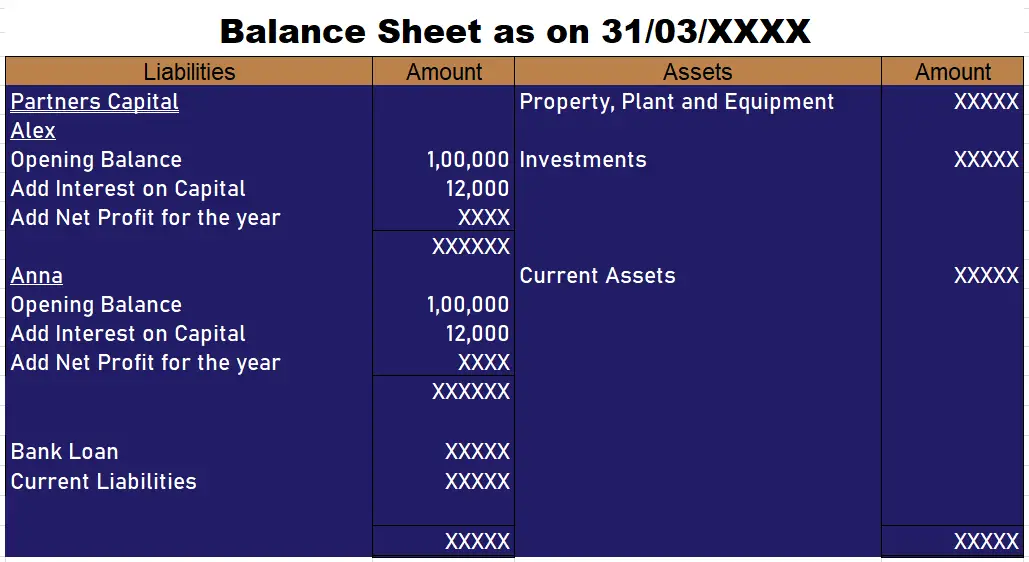

Total interest earned was $57.5 billion for the bank from loans, all investments, and cash positions. Debt equity common and preferred shares recall from cfi’s balance sheet guide that assets = liabilities + equity. List the current portion of the loan payable and any accrued interest expense under the current liabilities section of the balance sheet.

The loan is initially measured on a present value basis. We now have around 14 to 15% share of loans on the stock of our balance sheet as against to 10 to 11% of deposits,” jagdishan said. Of course, any interest received by the company (and not yet spent) is included in the company's assets, but there's no way to tell how much of the company's cash came from bank interest just.

This will ensure that (a) the financial instrument is carried in the balance sheet at an appropriate amount and (b) the interest income or expense is reflected in the profit and loss account correctly. When you make that loan payment, you pay interest up to december 28. Average credit card balances in 2023 have increased the most since 2019 for those small businesses with annual revenue greater than $1 million.

The interest on bank loans is usually an expense of the accounting period in which the interest is incurred. In your bookkeeping, interest accumulates on the same periodic basis even if the interest is not due. Assuming all liabilities were settled on the due date, calculate:

This column explores how a parallel shift in the euro area yield curve, or its steepening, might impact banking sector profitability and solvency. The income statement shows the financial margin or net interest margin. However, the interest paid also causes a change in the company's balance sheet and statement of cash flows.

For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it. It consists of assets, representing what the bank owns, and liabilities, describing what it owes to its depositors and other creditors. Frequently asked questions (faqs) a bank’s balance sheet provides a snapshot of its financial position at a specific time.

Side of the profit & loss a/c, being an item of expense. You would include the interest for december 29, 30, and 31st as an accrued liability. Definition of interest on bank loans.