Fantastic Tips About Formula For Cash Flow From Operating Activities

Cash flow from operations formula.

Formula for cash flow from operating activities. Cash payments to and on behalf of employees. Cash flow from operations formula (indirect method) = $170,000 + $0 + 14,500 + $4000 = $188,500. As such, you can calculate cash flow from operating activities using the following formula:

Direct method of operating activities cash flows is one of the two main techniques that may be used to calculate the net cash flow from operating activities in a cash flow statement, the other being indirect method. Another way to determine free cash flow is through other figures on a company’s income statement and balance sheet. Amortization of discount and issuance costs on convertible notes.

Cash flows from investing activities, and. Net loss $ (738) $ (1,331) adjustments to reconcile net loss to net cash provided by (used in) operating activities: It’s important to use data from the same accounting period — otherwise, you risk inaccurate results.

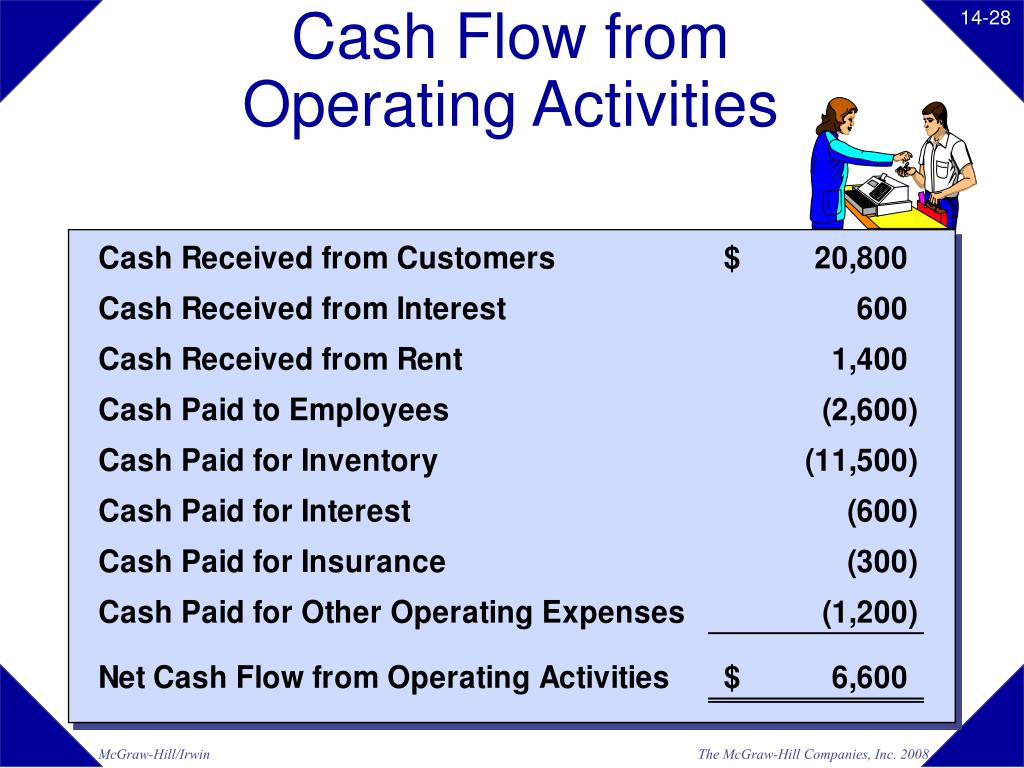

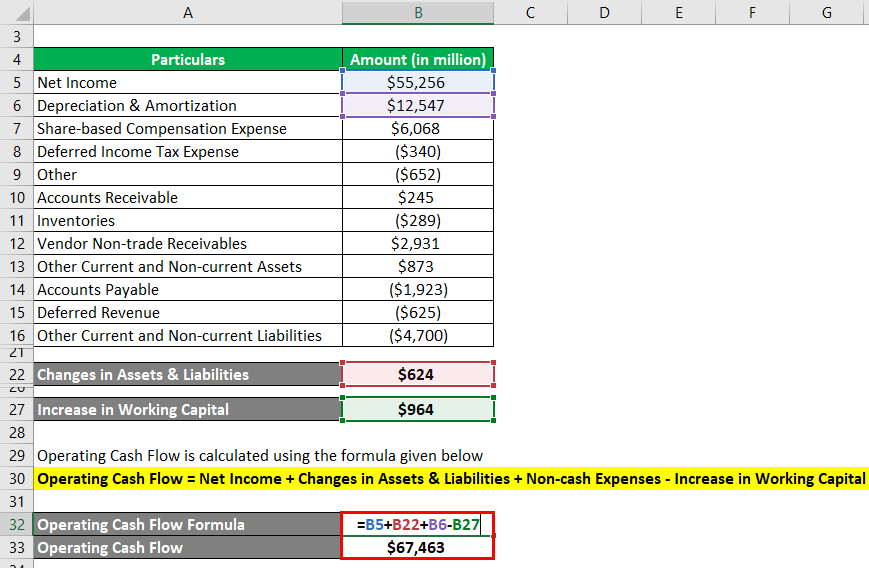

Operating activities, investment activities, and financing activities. A basic operating cash flow formula is as follows: Net cash flow of operating activities = funds from operations + change in working capital.

While the exact formula will be different for every company (depending on the items they have on their income statement and balance sheet), there is a generic cash flow from operations formula that can be used: How to calculate net cash flow from operating activities. The ocf calculation will always include the following three components:

Under the direct method, the information contained in the company's accounting records is used to. $81,750.00 loss on disposal of equipment: Cash flow is calculated using the direct (drawing on income.

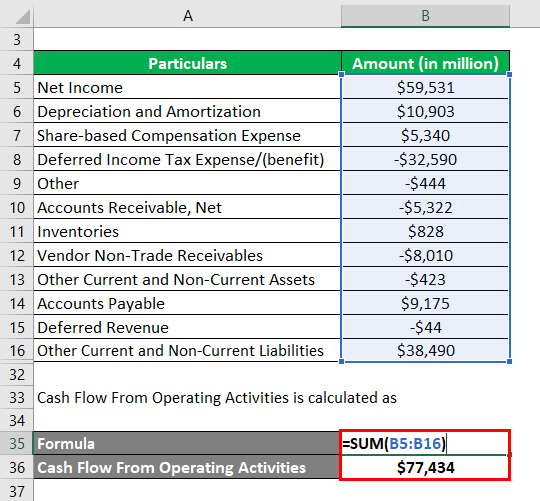

The calculation for ocf using the indirect method uses the following formula: The formula for the indirect method of calculating net operating cash flow is as follow: The first section of a cash flow statement, known as cash flow from operating activities, can be prepared using two different methods known as the direct method and the indirect method.

Cash flow from operating ( cfo) activities is a part of a company's cash flow statement. For instance, you might see an operating. Here we will study the indirect method to calculate cash flows from operating activities.

For the full year, net cash from operating activities was $117.3 million, and free cash flow was $36.5. In indirect method, the net income figure from the. Don’t freak out if they look complicated!

Use the net income figure from the income statement. Cash flows from (for) operating activities: Investopedia / julie bang the formula for the operating cash flow ratio \text {operating cash flow ratio} = \frac {\text {operating cash flow}} {\text {current liabilities}} operating.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)

-Formula.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)