One Of The Best Info About Purchase Of Treasury Stock Statement Cash Flows

A consolidated subsidiary may hold an investment in its parent company's common stock.

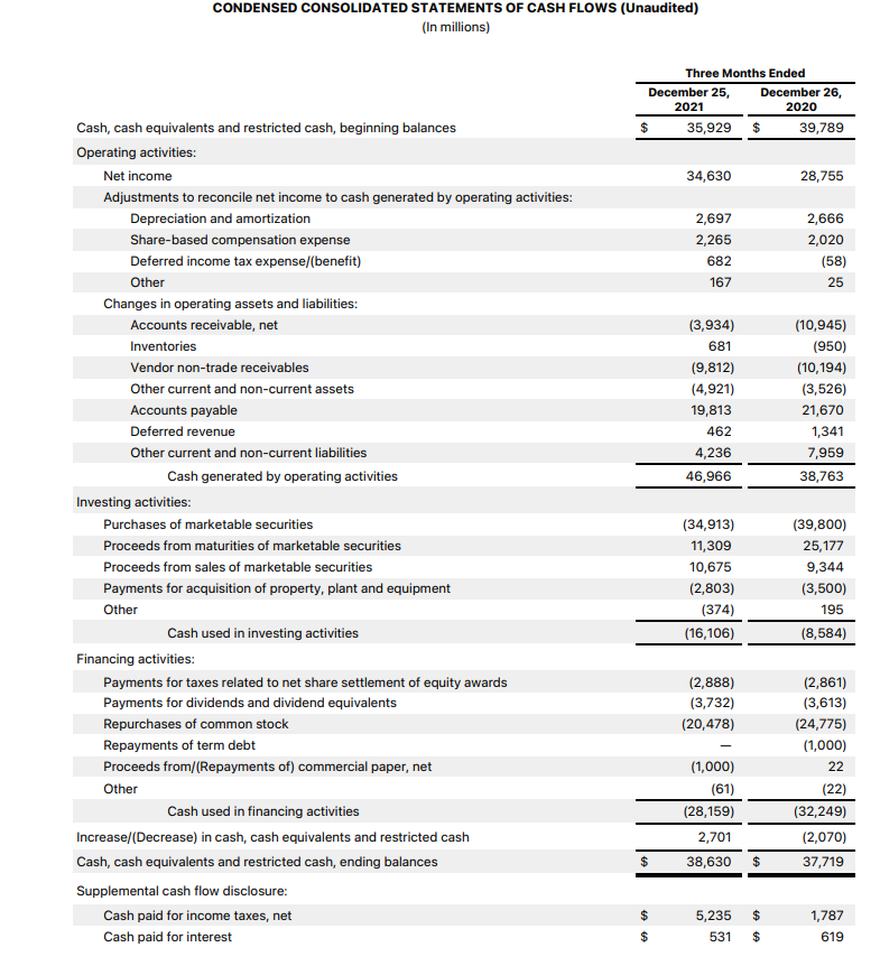

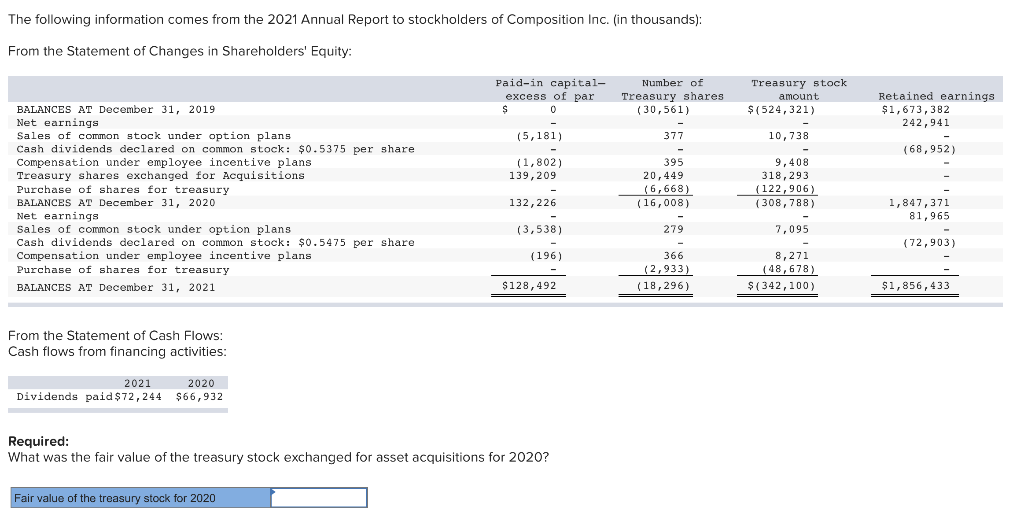

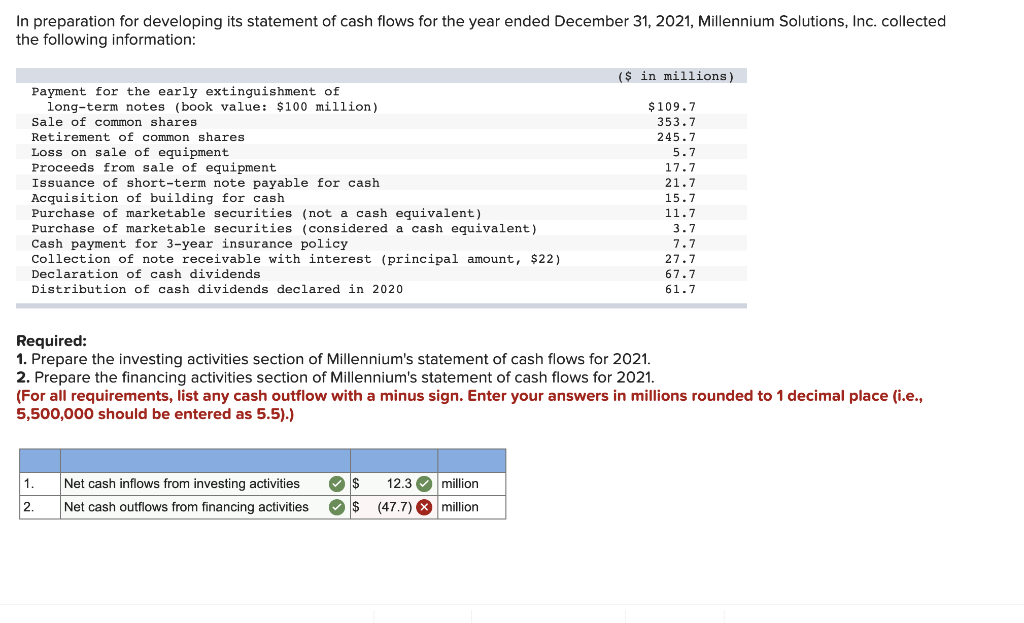

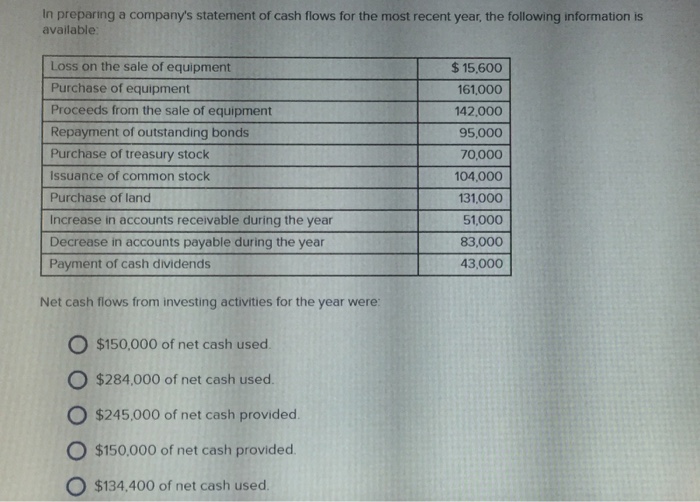

Purchase of treasury stock statement of cash flows. Below is an example from amazon’s 2022 annual report, which breaks down the cash flow generated from operations, investing, and. That stock would now be considered treasury stock since the company. What is cash flow from investing activities?

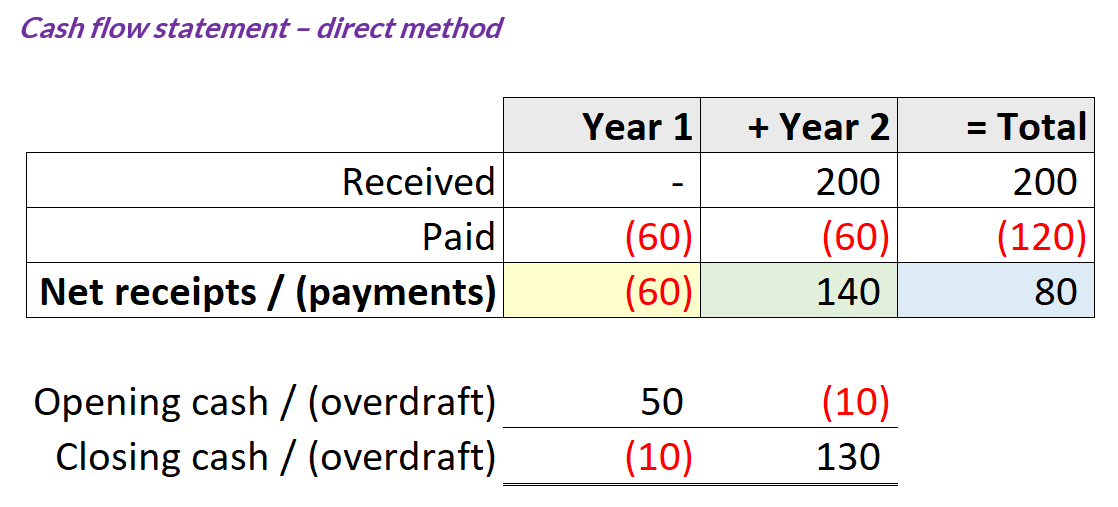

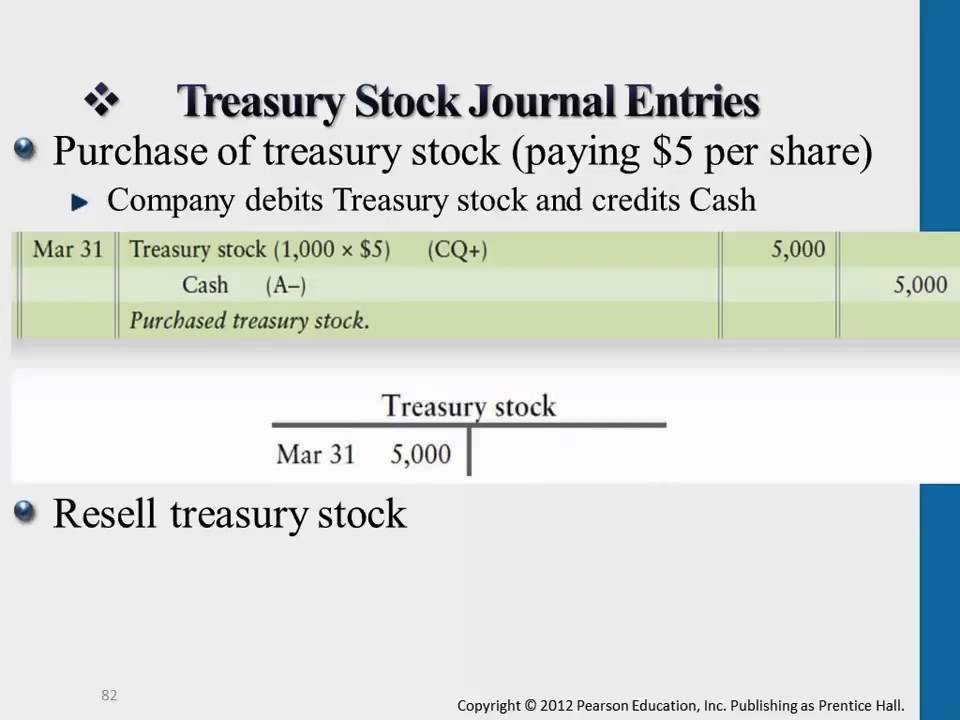

To put it simply, if we receive. Cash outflows for financing activities include payments of cash dividends or other distributions to owners (including cash paid to purchase treasury stock) and. The purchase of treasury stock is the transaction that causes cash flow out of the company.

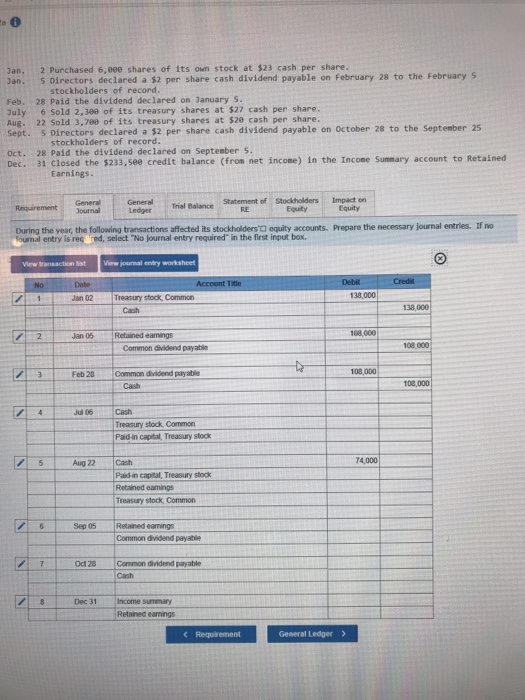

Treasury stock, also known as treasury shares or reacquired stock, refers to previously outstanding stock that has been bought back from stockholders by the. Pensions and other employee benefits. When a company repurchased or reacquires their own common stock, that represents a cash outflow.

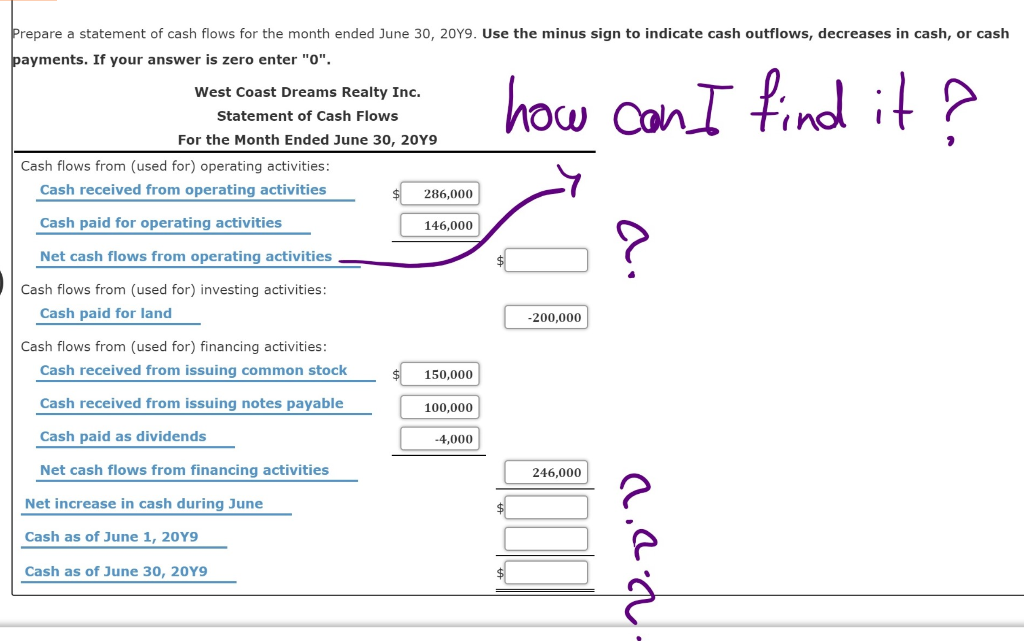

In order to repurchase stock, the company has to make payments to the existing shareholders. Examples of the descriptions and amounts typically reported under cash flows from financing activities include the following: Cash flows from financing activities:

Effect of treasury stock on statement of cash flow: The main purpose of the statement of cash flows is to report on the cash receipts and cash disbursements of an entity during an accounting period. On the cash flow statement, the share repurchase is reflected as a cash outflow (“use” of cash).

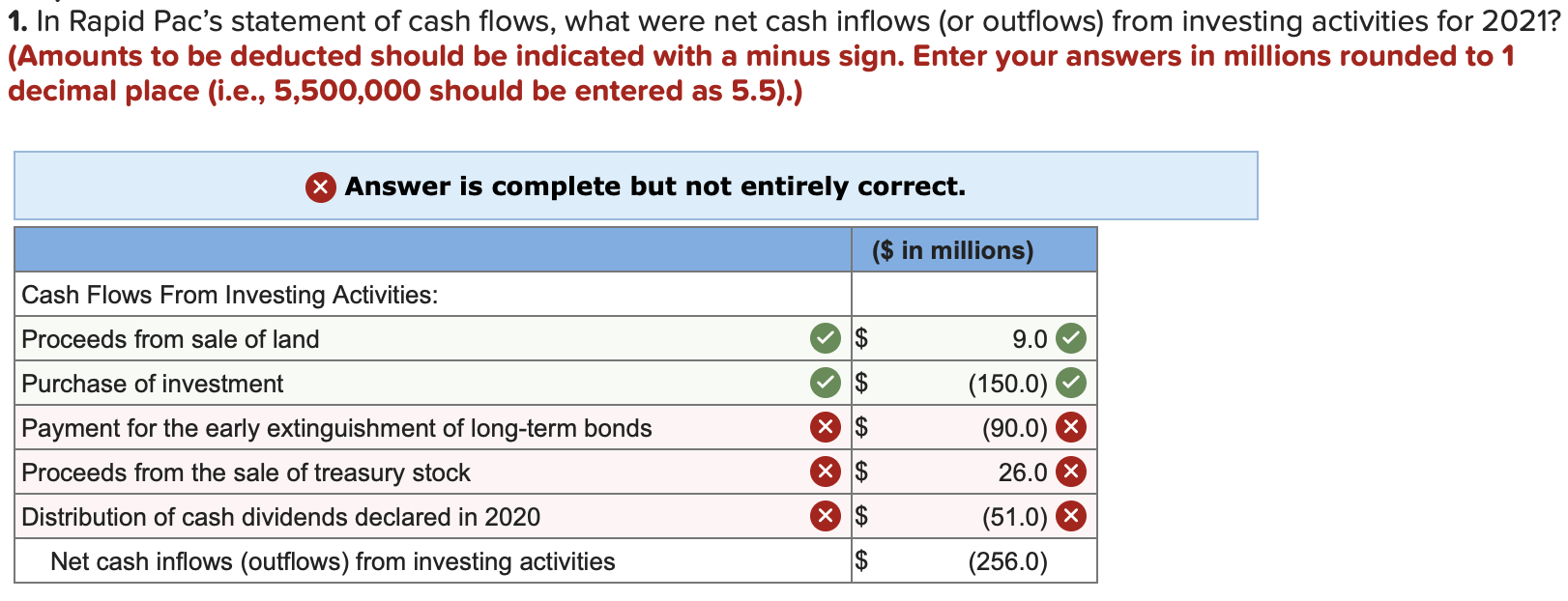

Cash inflow in the cash flows from financing activities section cash outflow in the. Where does the purchase of treasury stock go on the cash flow statement? After a repurchase, the journal entries are a debit to treasury.

The company needs to spend cash to acquire its own shares back. Statement of cash flows example. Supplemental disclosures for each of the following items, indicate which part will be affected.

In the statement of cash flows, inflows and outflows of cash from buying and selling available for sale securities are considered: Cash flow from financing activities (cff) is a section of a company’s cash flow statement, which shows the net flows of cash used to fund the company. Cash flows from investing and financing are prepared the same way under the direct and indirect methods for the statement of cash flows.

On the statement of cash flows, the purchase of treasury stock for cash is an example of: A) operating activities b) financing.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)